Monroe County Ny Taxes

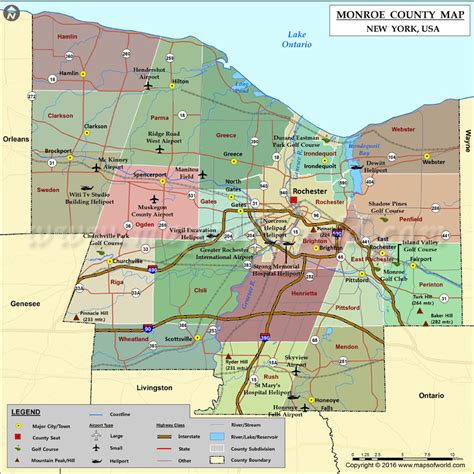

Monroe County, located in the beautiful state of New York, is a vibrant and diverse community with a rich history and a thriving economy. However, when it comes to taxes, understanding the various assessments and rates can be crucial for residents and businesses alike. This comprehensive guide will delve into the intricacies of Monroe County's tax system, shedding light on the different types of taxes, assessment processes, and how they impact the local economy.

Understanding the Tax Landscape in Monroe County

Monroe County’s tax structure is designed to support the county’s infrastructure, services, and overall development. It plays a vital role in funding essential public services, such as education, public safety, healthcare, and local government operations. The tax system in Monroe County is multifaceted, encompassing various types of taxes, each serving a specific purpose.

Property Taxes: A Key Component

Property taxes are a significant revenue source for Monroe County. The county’s real property tax system assesses taxes based on the value of properties, including residential homes, commercial buildings, and land. The assessment process involves determining the fair market value of each property, which is then used to calculate the tax liability.

One unique aspect of Monroe County’s property tax system is the star exemption, which offers a reduction in taxable value for eligible homeowners. This exemption, known as the School Tax Relief (STAR) Program, provides relief to homeowners, especially those with limited incomes or specific circumstances. However, it’s important to note that the STAR exemption does not apply to all properties, and certain conditions must be met to qualify.

The property tax rates in Monroe County are determined by the taxing jurisdictions, which include the county itself, cities, towns, villages, and school districts. Each of these entities sets its own tax rate, leading to varying tax liabilities for property owners. For instance, a homeowner in the city of Rochester may have a different tax rate compared to someone residing in a nearby town.

| Taxing Jurisdiction | Tax Rate (2023) |

|---|---|

| Monroe County | 3.75% |

| City of Rochester | 4.50% |

| Town of Penfield | 2.25% |

| Village of Pittsford | 1.80% |

| School District XYZ | 1.65% |

It's worth noting that property tax rates can change annually, depending on the budgetary needs and fiscal decisions made by the respective taxing authorities. Therefore, it's essential for property owners to stay informed about any changes that may impact their tax liabilities.

Sales and Use Taxes: Impacting Businesses and Consumers

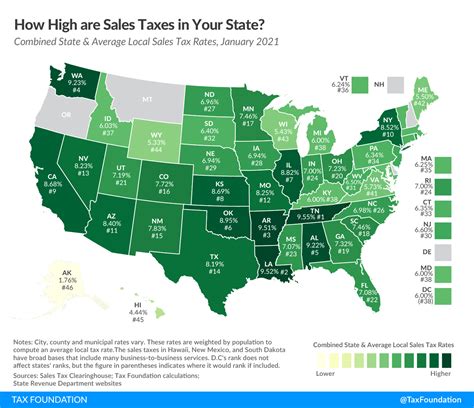

Monroe County, like other areas in New York State, imposes sales and use taxes on various transactions. Sales tax is applicable to the sale of tangible goods and certain services, while use tax is levied on the storage, use, or consumption of goods purchased outside the county but brought into Monroe County for use.

The sales and use tax rates in Monroe County are comprised of several components, including the state sales tax rate and local sales tax rates. As of the latest information, the state sales tax rate in New York is 4%, while Monroe County imposes an additional local sales tax of 3%, resulting in a combined sales tax rate of 7% for most transactions within the county.

It's important to note that certain goods and services are exempt from sales tax, such as prescription medications, most groceries, and certain educational services. Additionally, there are specific tax rates for certain items, such as clothing and footwear, which have a reduced sales tax rate of 4% in Monroe County.

Businesses operating within Monroe County are responsible for collecting and remitting sales taxes to the appropriate taxing authorities. Failure to comply with sales tax regulations can result in penalties and legal consequences. Therefore, it's crucial for businesses to stay informed about sales tax laws and requirements to ensure compliance.

Other Taxes and Fees

In addition to property and sales taxes, Monroe County levies various other taxes and fees to support specific initiatives and services. These include:

- Real Property Transfer Tax: This tax is imposed on the transfer of ownership of real property within the county. The tax rate is typically a percentage of the purchase price or assessed value of the property.

- Mortgage Recording Tax: When a mortgage is recorded in Monroe County, a tax is levied on the principal amount of the mortgage. The tax rate varies depending on the type of mortgage and the jurisdiction.

- Hotel/Motel Occupancy Tax: A tax is applied to the rent charged for hotel and motel rooms within the county. This tax contributes to the funding of tourism-related initiatives and promotions.

- Motor Vehicle Taxes: Monroe County imposes taxes on the registration and sale of motor vehicles. These taxes help fund transportation infrastructure and related services.

Tax Assessment Process and Appeals

The tax assessment process in Monroe County involves a thorough evaluation of properties to determine their fair market value. This process is crucial for ensuring that property owners pay their fair share of taxes based on the value of their properties.

Property assessments are conducted periodically, typically every few years, to account for changes in property values due to market fluctuations, improvements, or other factors. The assessed value of a property is then used to calculate the property tax liability.

If a property owner believes that their assessment is inaccurate or unfair, they have the right to appeal the assessment. The Monroe County Board of Assessment Review (BAR) provides a platform for property owners to challenge their assessments. The BAR is an independent body that reviews assessment appeals and makes decisions based on the evidence presented.

To initiate an assessment appeal, property owners must submit a formal Notice of Petition within a specified timeframe, usually within a few months after receiving their assessment notice. The Notice of Petition should include detailed reasons for the appeal and any supporting documentation, such as recent sales of comparable properties or professional appraisals.

Once the appeal is filed, the BAR schedules a hearing where the property owner can present their case. It's important for property owners to gather compelling evidence and be prepared to defend their position. The BAR's decision is final, but if a property owner is still dissatisfied, they can pursue further legal avenues, such as filing a Small Claims Assessment Review (SCAR) petition or appealing to the New York State Supreme Court.

Impact on the Local Economy

The tax system in Monroe County plays a crucial role in shaping the local economy. The revenue generated from taxes funds essential public services, infrastructure projects, and community development initiatives. It contributes to the overall prosperity and well-being of the county’s residents.

For businesses, the tax landscape in Monroe County can influence their decision-making processes. The sales tax rate, for instance, can impact consumer spending patterns and business operations. Additionally, the property tax rates can affect a business’s operational costs and their ability to expand or invest in the local community.

On the other hand, the tax incentives and exemptions offered by Monroe County can attract businesses and stimulate economic growth. The STAR exemption for homeowners, for example, can make the county more appealing to potential residents, leading to a more robust housing market and a stronger local economy.

Overall, the tax system in Monroe County is a complex but essential framework that supports the county's growth, development, and sustainability. Understanding the various taxes, assessment processes, and their impact is crucial for residents, businesses, and community stakeholders alike.

How often are property assessments conducted in Monroe County?

+Property assessments in Monroe County are conducted every 3 years. However, if there are significant changes to a property, such as improvements or renovations, the assessment may be updated more frequently.

Are there any tax incentives for renewable energy projects in Monroe County?

+Yes, Monroe County offers tax incentives for renewable energy projects. The Real Property Tax Law provides for an exemption from the real property tax on renewable energy systems. This exemption can significantly reduce the tax burden for businesses and individuals investing in renewable energy technologies.

How can I estimate my property tax liability in Monroe County?

+To estimate your property tax liability, you can use the Monroe County Tax Assessor’s Tax Calculator. This online tool allows you to input your property’s assessed value and the applicable tax rates to estimate your annual tax liability. It’s a convenient way to get a rough estimate before receiving your official tax bill.