Mon County Tax

Welcome to an in-depth exploration of the Mon County Tax system, a topic that impacts every resident and business owner in Monongalia County, West Virginia. In this comprehensive guide, we will delve into the intricacies of the county's tax structure, its historical context, and its implications for the local economy. By understanding the Mon County Tax system, we can navigate its complexities and make informed decisions about our financial obligations and investments.

Understanding the Mon County Tax System

The Mon County Tax system is a comprehensive framework designed to generate revenue for the local government, fund essential services, and maintain the county’s infrastructure. It encompasses a range of taxes, each serving a specific purpose and contributing to the overall fiscal health of the county.

Property Taxes: The Backbone of Mon County’s Revenue

Property taxes form the backbone of Mon County’s tax revenue. Every property owner in the county is subject to this tax, which is calculated based on the assessed value of their real estate. The county’s assessor’s office is responsible for determining the fair market value of properties, ensuring equity and fairness in the tax system.

Here’s a breakdown of the property tax structure in Mon County:

- Real Property Tax: Applicable to all real estate, including residential, commercial, and industrial properties.

- Personal Property Tax: Levied on tangible personal property, such as vehicles, boats, and certain business assets.

- Mobile Home Tax: A separate tax category for mobile homes, which are assessed based on their value and location.

The county utilizes a tax rate system, where the assessed value of a property is multiplied by the applicable tax rate to determine the tax liability. These rates are set annually by the county commission and are subject to change based on budgetary requirements and economic factors.

| Property Type | Tax Rate (as of 2023) |

|---|---|

| Residential | $0.85 per $100 of assessed value |

| Commercial | $1.15 per $100 of assessed value |

| Industrial | $1.50 per $100 of assessed value |

| Mobile Homes | $1.30 per $100 of assessed value |

| Personal Property | $0.50 per $100 of assessed value |

It's important to note that these rates may be subject to change in future years, so property owners should stay informed about any adjustments. The county's tax office provides resources and tools to assist taxpayers in understanding their obligations and calculating their tax liabilities accurately.

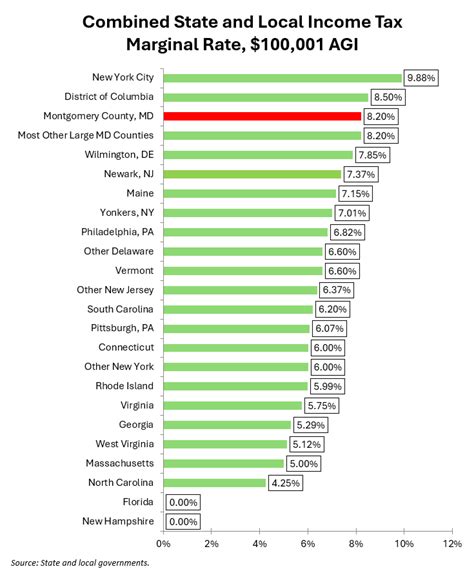

Income Taxes: A Vital Source of Revenue

In addition to property taxes, Mon County also imposes income taxes on individuals and businesses operating within its borders. This tax contributes significantly to the county’s overall revenue stream and is a crucial component of its fiscal policy.

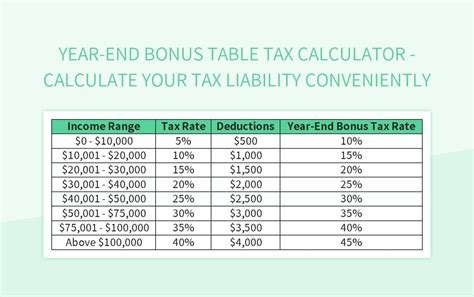

The county’s income tax structure is designed to be progressive, meaning that higher incomes are taxed at higher rates. This approach aims to ensure a fair distribution of the tax burden and promote economic equity.

Here’s an overview of the income tax categories and rates in Mon County:

- Individual Income Tax: Applicable to residents earning income from various sources, including wages, salaries, investments, and business activities.

- Corporate Income Tax: Levied on businesses incorporated in Mon County, regardless of where they conduct their operations.

- Pass-Through Entity Tax: A tax on income generated by partnerships, limited liability companies (LLCs), and S corporations.

The income tax rates are determined by the county commission and are subject to periodic adjustments to align with economic conditions and revenue needs. As of 2023, the income tax rates in Mon County are as follows:

| Income Tax Category | Tax Rate |

|---|---|

| Individual Income Tax | 3.5% of taxable income |

| Corporate Income Tax | 5.5% of taxable income |

| Pass-Through Entity Tax | 3.0% of taxable income |

It's worth noting that Mon County's income tax rates are relatively competitive compared to neighboring counties, making it an attractive location for businesses and individuals seeking a balanced tax environment.

Other Tax Categories: Sales and Excise Taxes

Mon County, like many other counties, also collects sales and excise taxes to generate revenue. These taxes are imposed on specific goods and services, with the proceeds going towards funding various county initiatives and services.

The sales tax is a consumption tax applied to the purchase of tangible goods and certain services. The rate varies depending on the type of item being purchased and the location of the sale. Mon County’s sales tax rate is 6%, which is applied on top of the state sales tax rate of 6%, resulting in a combined rate of 12% for most goods and services.

Excise taxes, on the other hand, are levied on specific goods and activities, such as gasoline, tobacco products, and certain recreational activities. These taxes are typically included in the price of the item or activity and are designed to generate revenue for specific purposes, such as infrastructure development or public safety initiatives.

The Impact of Mon County Taxes on the Local Economy

The tax system in Mon County plays a crucial role in shaping the local economy. It influences investment decisions, business growth, and the overall financial health of the community. Let’s explore some key aspects of the impact of Mon County taxes on the economy.

Attracting Businesses and Investment

Mon County’s tax structure, particularly its income tax rates, is a significant factor in attracting businesses and investors to the area. Competitive tax rates can encourage businesses to establish operations in the county, creating job opportunities and driving economic growth.

Additionally, the county’s focus on maintaining a balanced tax environment, with a mix of property, income, and consumption taxes, provides stability and predictability for businesses. This stability is essential for long-term planning and investment decisions.

For example, consider the case of TechSolutions Inc., a technology startup that recently expanded its operations to Mon County. The company’s decision was influenced by the county’s attractive tax rates, which allowed them to allocate more resources towards research and development, ultimately benefiting the local economy through job creation and innovation.

Funding Essential Services and Infrastructure

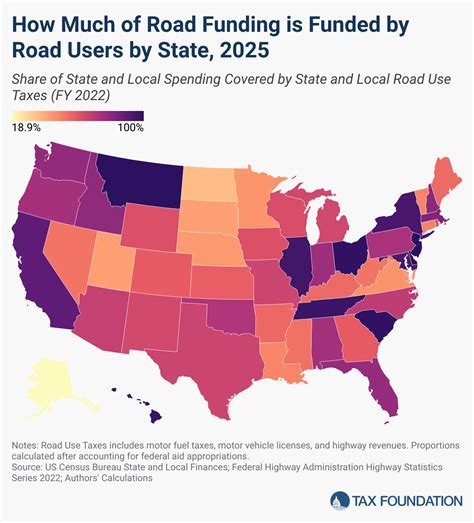

The revenue generated from Mon County taxes is vital for funding essential services and maintaining the county’s infrastructure. These funds support vital areas such as education, public safety, healthcare, and transportation.

For instance, property taxes contribute significantly to the funding of the county’s public school system. The tax revenue is used to hire teachers, maintain school facilities, and provide resources for students, ensuring a high-quality education for the community’s youth.

Similarly, income taxes play a crucial role in funding public safety initiatives, such as law enforcement, emergency services, and fire protection. These services are essential for maintaining a safe and secure environment, which is a key factor in attracting businesses and residents.

Promoting Economic Development and Growth

Mon County’s tax system is designed to promote economic development and encourage growth. The county actively seeks to create an environment that fosters entrepreneurship, innovation, and investment.

One way the county achieves this is by offering tax incentives and abatements to businesses that meet certain criteria. These incentives can include reduced tax rates, tax credits, or exemptions for a specific period. By providing these incentives, the county aims to attract new businesses, stimulate job creation, and diversify the local economy.

Furthermore, the county utilizes tax revenue to invest in infrastructure projects, such as road improvements, public transportation, and utility upgrades. These investments enhance the quality of life for residents and create a more attractive business environment, making Mon County an appealing location for companies looking to expand.

Navigating the Mon County Tax System

Understanding and navigating the Mon County Tax system can be complex, especially for new residents and businesses. However, the county provides a range of resources and support to assist taxpayers in complying with their obligations.

Tax Assessment and Appeals

The county’s assessor’s office is responsible for accurately assessing the value of properties for tax purposes. Property owners have the right to review their assessment and, if necessary, file an appeal if they believe the assessed value is inaccurate or unfair.

The appeals process provides an opportunity for taxpayers to present evidence and arguments to support their case. It is a crucial mechanism for ensuring fairness and equity in the tax system.

Tax Payment Options and Deadlines

Mon County offers various payment options for taxpayers to settle their tax liabilities. These options include online payments, direct debit, and traditional methods such as checks or money orders. The county provides a user-friendly online portal for taxpayers to manage their accounts and make payments conveniently.

It’s important for taxpayers to be aware of the payment deadlines to avoid penalties and interest charges. The county typically has specific due dates for property taxes, income taxes, and other tax categories. Failure to meet these deadlines can result in additional costs and complications.

Tax Exemptions and Credits

Mon County offers a range of tax exemptions and credits to eligible taxpayers. These provisions aim to provide relief and support to specific groups, such as senior citizens, veterans, and low-income individuals.

For example, the county provides a Homestead Exemption for homeowners aged 65 and above, which reduces the taxable value of their property. This exemption helps alleviate the financial burden on seniors, allowing them to stay in their homes and maintain their quality of life.

Additionally, the county offers various tax credits for energy-efficient improvements, renewable energy installations, and other environmentally conscious initiatives. These credits encourage residents and businesses to adopt sustainable practices, contributing to a greener and more resilient community.

Future Outlook and Implications

As Mon County continues to evolve and adapt to changing economic and demographic trends, the tax system will play a pivotal role in shaping its future. Let’s explore some potential implications and considerations for the county’s tax landscape.

Economic Growth and Revenue Needs

As the county experiences economic growth, the demand for public services and infrastructure development is likely to increase. This growth may lead to a higher demand for tax revenue to fund these initiatives.

To accommodate these needs, the county may consider adjusting tax rates or exploring new revenue streams. For instance, the county could explore the implementation of a tourism tax or a hotel occupancy tax to generate additional revenue from the growing hospitality industry.

Population Dynamics and Tax Base

Changes in population demographics, such as an aging population or shifts in migration patterns, can impact the tax base and revenue streams. A declining population, for example, may result in a decrease in property tax revenue, as there are fewer taxpayers contributing to the system.

To address these challenges, the county may need to implement strategies to attract and retain residents, such as offering incentives for homeownership or investing in amenities and infrastructure that cater to diverse age groups.

Environmental Sustainability and Green Initiatives

With growing concerns about environmental sustainability, Mon County may explore ways to incorporate green initiatives into its tax system. This could include expanding tax credits for renewable energy projects, encouraging energy-efficient practices, and promoting sustainable development.

By incentivizing environmentally friendly behaviors, the county can contribute to a greener future while also attracting businesses and individuals who prioritize sustainability.

Technological Advancements and Tax Administration

The rapid advancement of technology is transforming the way taxes are administered and collected. Mon County can leverage these advancements to streamline tax processes, improve efficiency, and enhance taxpayer experience.

For instance, the county could implement digital tax filing and payment systems, offering taxpayers a convenient and secure way to manage their obligations. Additionally, the use of data analytics and artificial intelligence can assist in identifying potential tax evasion and improving the accuracy of tax assessments.

Conclusion: A Balanced and Progressive Tax System

The Mon County Tax system is a well-structured and balanced framework that serves the needs of the local community. It generates revenue to fund essential services, promote economic development, and maintain the county’s infrastructure.

By understanding the intricacies of the tax system and staying informed about changes and updates, residents and businesses can navigate their obligations effectively. The county’s commitment to transparency, fairness, and economic growth ensures a stable and prosperous future for Monongalia County.

What are the due dates for Mon County property tax payments?

+

Property taxes in Mon County are due in two installments. The first installment is typically due on July 1st, and the second installment is due on December 1st. Failure to pay by the due date may result in penalties and interest charges.

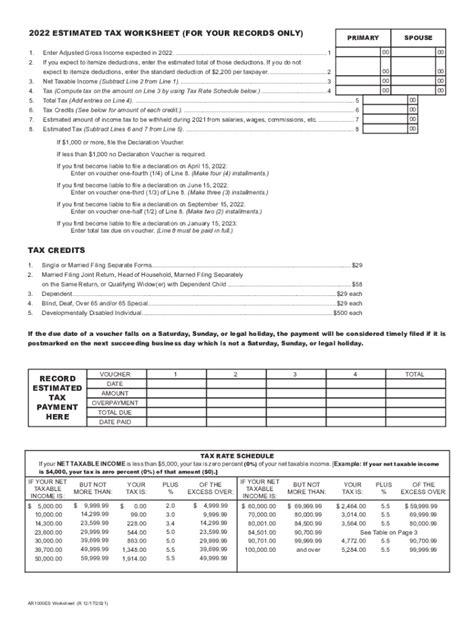

How can I estimate my Mon County income tax liability?

+

To estimate your income tax liability in Mon County, you can use the county’s online tax estimator tool. This tool takes into account your income, deductions, and tax credits to provide an estimate of your tax obligation. You can find the estimator on the county’s official website.

Are there any tax incentives for businesses in Mon County?

+

Yes, Mon County offers a range of tax incentives to attract and support businesses. These incentives include tax abatements, tax credits for job creation, and reduced tax rates for certain industries. The county’s economic development office provides detailed information on these incentives and can assist businesses in navigating the application process.

How does Mon County ensure fairness in its tax assessment process?

+

Mon County employs a professional and independent assessor’s office to ensure fairness and accuracy in the tax assessment process. The assessor’s office utilizes standardized valuation methods and regularly conducts field inspections to verify property values. Property owners have the right to appeal their assessments if they believe there are discrepancies.