Mn Real Estate Tax Refund

In Minnesota, the topic of real estate tax refunds is of significant interest, especially for homeowners and investors. The state offers a unique program that provides financial relief to eligible property owners, helping them manage their tax obligations. This comprehensive guide aims to delve into the intricacies of the Mn Real Estate Tax Refund, shedding light on its benefits, eligibility criteria, application process, and its broader impact on the state's real estate landscape.

Understanding the Mn Real Estate Tax Refund

The Mn Real Estate Tax Refund, officially known as the Property Tax Refund program, is a vital component of Minnesota’s tax system. It is designed to offer relief to homeowners, renters, and even some business property owners who meet specific criteria. This program has been in place for decades, serving as a safety net for many Minnesotans facing financial challenges due to high property taxes.

Program Overview

The Property Tax Refund program operates under the Minnesota Department of Revenue. It provides refunds on property taxes paid based on a homeowner’s or renter’s income and the characteristics of the property they own or occupy. The refund can be substantial, often amounting to hundreds of dollars, depending on the circumstances.

| Refund Eligibility Criteria | Details |

|---|---|

| Income Level | The program primarily targets homeowners and renters with limited income. Eligibility is determined by comparing the property owner's or renter's income to the state's median income. |

| Property Value | The program considers the assessed value of the property. Homes or rental units with higher values may be eligible for lower refunds. |

| Property Type | The program covers both residential and commercial properties. However, there are specific eligibility rules for each category. |

| Occupancy | Homeowners must occupy the property as their primary residence. Renters must have a lease agreement and reside in the property. |

Benefits and Impact

The Mn Real Estate Tax Refund program has a profound impact on the state’s real estate market and its residents. Here’s a closer look at its benefits:

- Financial Relief: For eligible homeowners and renters, the refund provides a significant financial boost, reducing the burden of property taxes. This can be especially crucial for those on fixed incomes or facing economic hardships.

- Stability and Affordability: By offering tax relief, the program helps maintain housing affordability in Minnesota. It ensures that residents can continue to live in their homes without being priced out due to rising property values and subsequent tax increases.

- Community Development: The program's focus on income-eligible households encourages community stability. It prevents the concentration of low-income households in certain areas, promoting a more diverse and integrated community.

- Economic Stimulus: Refunds can be spent on various necessities, boosting local economies. This circulates money within communities, supporting local businesses and job creation.

Eligibility and Application Process

Understanding the eligibility criteria and application process is crucial for those seeking the Mn Real Estate Tax Refund. Here’s a detailed breakdown:

Eligibility Criteria

The Property Tax Refund program has specific eligibility requirements that must be met to qualify for a refund. These criteria are designed to target those most in need of financial assistance with their property taxes.

| Eligibility Criteria | Details |

|---|---|

| Income | Homeowners and renters must meet income thresholds. These thresholds vary based on household size and the number of dependents. For instance, a single homeowner with no dependents may have a lower income threshold compared to a family with multiple dependents. |

| Property Ownership | Homeowners must own and occupy their property as their primary residence. This means that vacation homes or investment properties are not eligible for the refund. |

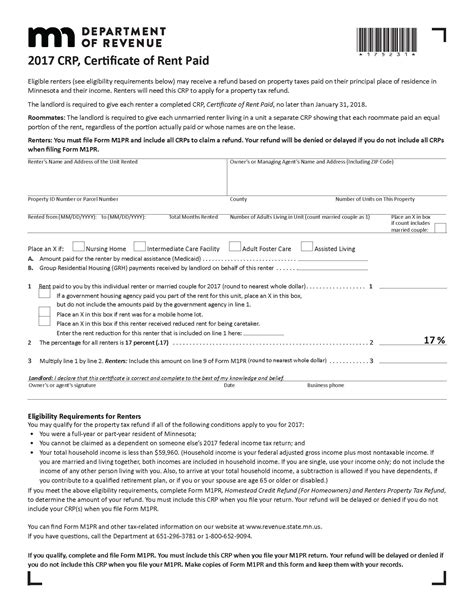

| Renter Status | Renters must have a valid lease agreement and occupy the property as their primary residence. They must also provide proof of rent payments and meet the same income criteria as homeowners. |

| Property Value | The assessed value of the property plays a role in determining eligibility. Properties with higher values may have lower refund amounts or may not be eligible at all. This is to ensure that the program targets those with genuine financial need. |

| Timely Payment | To be eligible, property taxes must be paid on time. Late payments or delinquent accounts can impact eligibility and refund amounts. |

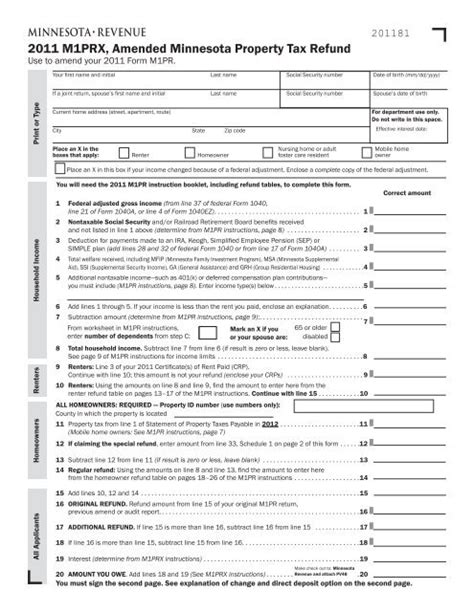

Application Process

Applying for the Mn Real Estate Tax Refund involves several steps to ensure a smooth and accurate process. Here’s a step-by-step guide:

- Gather Required Documents: Before starting the application, collect necessary documents such as:

- Proof of income (e.g., tax returns, pay stubs)

- Property tax statements

- Lease agreement (for renters)

- Proof of residence (e.g., utility bills)

- Choose Application Method: The Property Tax Refund program offers multiple application methods to cater to different preferences and capabilities:

- Online Application: The most convenient option, allowing applicants to complete the process digitally. The Minnesota Department of Revenue's website provides a user-friendly platform for online applications.

- Paper Application: For those who prefer traditional methods, paper applications can be downloaded from the Department of Revenue's website and mailed in with supporting documents.

- Assistance Programs: Community organizations and local government offices often provide assistance with the application process, especially for those who may face language or technological barriers.

- Complete the Application: Whether online or on paper, carefully fill out all sections of the application. Ensure that all information is accurate and up-to-date. Incomplete or inaccurate applications can lead to delays or disqualification.

- Submit the Application: After completion, submit the application and supporting documents. For online applications, this is a simple click of a button. For paper applications, mail the package to the address provided on the form.

- Wait for Processing: Once submitted, the Department of Revenue will process the application. This typically takes several weeks, so patience is key. Applicants can check the status of their application online or by contacting the Department.

- Receive Refund: If approved, the refund will be issued. Refunds can be sent via check or direct deposit, depending on the applicant's preference.

Impact on Real Estate Market

The Mn Real Estate Tax Refund program has a significant impact on the state’s real estate market, influencing both buyers and sellers in various ways. Understanding these impacts is crucial for those navigating the market.

Homebuyer Benefits

For homebuyers, the Property Tax Refund program offers several advantages:

- Affordability: The refund helps make homeownership more affordable, especially for first-time buyers or those on tighter budgets. It reduces the overall cost of owning a home, making it a more feasible option.

- Stability: The program encourages long-term homeownership by providing financial stability. Buyers can plan their finances more effectively, knowing that they may be eligible for a refund each year.

- Location Flexibility: With the refund, buyers have more flexibility in choosing a location. They are not limited to specific areas based on tax rates alone, as the refund can offset higher taxes in certain neighborhoods.

- Investment Opportunity: For investors, the program can make buying rental properties more attractive. The refund can help offset the cost of owning multiple properties, making it a more lucrative investment.

Seller Considerations

Sellers, too, should be aware of the implications of the Property Tax Refund program:

- Buyer Appeal: Homes in areas with higher property taxes but also higher refund potential may be more appealing to buyers. Sellers can highlight this benefit to attract a wider range of interested parties.

- Negotiation Tool: In negotiations, sellers can emphasize the availability of the refund as an added value. This can be especially useful when dealing with buyers who are concerned about high property taxes.

- Marketability: Properties in areas with a strong history of refund eligibility can be marketed as more affordable options. This can increase interest and potentially speed up the selling process.

Future Implications and Considerations

As with any program, the Mn Real Estate Tax Refund has ongoing implications and considerations that affect its future direction and impact.

Program Sustainability

One of the primary considerations for the Property Tax Refund program is its sustainability. The program relies on state funding, and its future depends on the state’s financial health and priorities. Budget constraints or changes in political leadership could impact the program’s funding and eligibility criteria.

Income Threshold Adjustments

To ensure the program remains relevant and effective, income thresholds must be periodically reviewed and adjusted. This is crucial to keep up with inflation and changes in the cost of living. Failure to adjust these thresholds could result in the program becoming less accessible to those who need it most.

Technological Advances

The program has embraced technological advancements, such as online applications, to improve efficiency and accessibility. However, ongoing investment in technology is necessary to keep up with evolving digital trends and ensure the program remains user-friendly and accessible to all eligible participants.

Community Engagement

Community engagement is vital for the success and awareness of the program. The Department of Revenue should continue to collaborate with community organizations and local governments to educate residents about the program and assist those who may face barriers in accessing it.

Conclusion

The Mn Real Estate Tax Refund, or Property Tax Refund program, is a vital component of Minnesota’s tax system, providing much-needed relief to homeowners, renters, and investors. Its impact on the state’s real estate market is significant, promoting affordability, stability, and community development. Understanding the program’s intricacies, eligibility criteria, and application process is crucial for those seeking to benefit from this financial relief.

As Minnesota continues to evolve, the Property Tax Refund program will play a pivotal role in shaping the state's real estate landscape, ensuring that homeownership and rental opportunities remain accessible to a diverse range of residents. By staying informed and engaged, individuals can make the most of this program and contribute to a thriving, equitable real estate market.

How often can I apply for the Mn Real Estate Tax Refund?

+You can apply annually for the Property Tax Refund program. The application period typically opens in early spring and closes in late summer or early fall. It’s essential to check the Minnesota Department of Revenue’s website for the exact dates each year.

What happens if I miss the application deadline?

+If you miss the application deadline, you may still be able to apply, but you will need to contact the Department of Revenue directly to discuss your options. In some cases, late applications may be accepted, but there is no guarantee.

Can I receive a refund if I own multiple properties?

+Yes, you can receive a refund for each eligible property you own. However, the refund amount may vary based on the characteristics of each property and your income level.