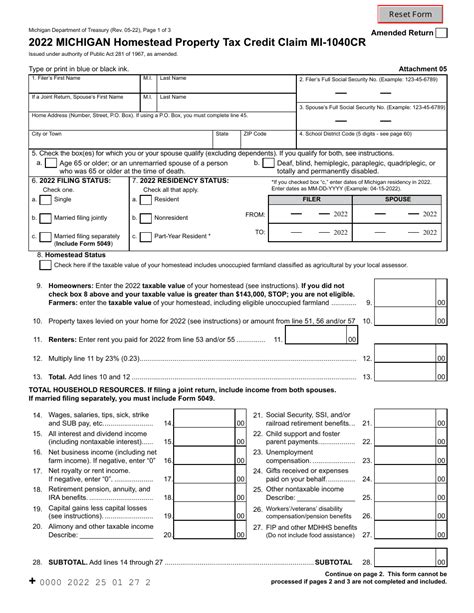

Michigan Tax Form 1040Cr 2025

Welcome to a comprehensive guide on the Michigan Tax Form 1040Cr, a crucial document for residents of the Wolverine State when it comes to claiming tax credits. This form is an essential tool for taxpayers to maximize their refunds and minimize their tax liabilities. In this article, we will delve into the intricacies of Form 1040Cr, its purpose, and how it can benefit Michigan taxpayers. As we navigate through the various sections, we'll uncover the specific tax credits available, the eligibility criteria, and the step-by-step process of claiming these credits.

Understanding the Purpose of Form 1040Cr

Form 1040Cr, officially known as the “Michigan Income Tax Credit Claim,” is a vital component of the Michigan tax system. It serves as a means for taxpayers to claim various tax credits offered by the state government, which can significantly reduce the overall tax burden. These credits are designed to provide relief to taxpayers in specific circumstances and promote economic growth in targeted areas.

The Michigan Department of Treasury introduces tax credits as an incentive for taxpayers to invest in certain areas of the state's economy, support local businesses, and encourage specific behaviors that align with the state's goals. By offering these credits, the government aims to stimulate economic activity and provide financial benefits to eligible taxpayers.

Eligibility and Targeted Credits

Not all taxpayers are eligible for the same tax credits. Michigan has designed its tax credit system to cater to various segments of the population and different economic activities. Some credits are aimed at individuals and families, while others are tailored for businesses and specific industries.

| Credit Name | Eligibility Criteria |

|---|---|

| Low Income Tax Credit | Available to taxpayers with adjusted gross income below a certain threshold. The credit amount varies based on filing status and number of dependents. |

| Senior Citizens' Property Tax Credit | Eligible for senior citizens aged 65 and above with limited income and assets. The credit helps offset property taxes. |

| Business Investment Tax Credit | Businesses investing in designated economic development zones or engaging in specific research and development activities can claim this credit. |

| Homestead Property Tax Credit | Homeowners with principal residences in Michigan can claim this credit to reduce their property tax burden. |

| Child and Dependent Care Tax Credit | Taxpayers with childcare expenses for eligible dependents may qualify for this credit, providing relief for working families. |

Navigating Form 1040Cr: A Step-by-Step Guide

Completing Form 1040Cr can be a straightforward process if you have the right guidance. Here’s a step-by-step breakdown to help you navigate this crucial tax form:

Step 1: Determine Eligibility

Before you begin, ensure you meet the eligibility criteria for the tax credits you intend to claim. Review the official guidelines provided by the Michigan Department of Treasury to understand the specific requirements for each credit.

Step 2: Gather Necessary Documents

Collect all the required documents and information to support your tax credit claims. This may include:

- Proof of income (e.g., W-2 forms, 1099s)

- Property tax bills or receipts

- Childcare expense records

- Business investment documentation

- Any other supporting documents as specified by the tax guidelines.

Step 3: Download and Review the Form

Access the official Form 1040Cr from the Michigan Department of Treasury’s website. Familiarize yourself with the sections and the specific credits you wish to claim. Pay close attention to the instructions and ensure you understand the requirements.

Step 4: Complete the Form

Fill out the form accurately and honestly. Provide all the necessary details, including your personal information, tax identification numbers, and the specific credits you’re claiming. Calculate the credit amounts based on the guidelines provided.

Step 5: Attach Supporting Documentation

Attach all the supporting documents to your Form 1040Cr. Ensure that each document is clearly labeled and corresponds to the relevant credit section. This step is crucial to validate your claims and avoid potential audits.

Step 6: Sign and Submit

Review your completed form and supporting documents for accuracy. Sign the form, ensuring that your signature is legible. Submit your Form 1040Cr along with the supporting documents to the Michigan Department of Treasury before the deadline. You can do this electronically or by mail, depending on your preference and the department’s guidelines.

Maximizing Your Tax Credits: Tips and Strategies

To make the most of your tax credits, consider the following tips and strategies:

- Stay Informed: Keep yourself updated with the latest tax guidelines and changes in credit eligibility. The Michigan Department of Treasury regularly publishes updates and announcements.

- Explore All Credits: Don't limit yourself to just one credit. Review all the available credits to identify those for which you may be eligible. Some credits may have specific requirements, so ensure you meet them.

- Organize Your Records: Maintain a well-organized system for your financial and tax-related documents. This will make it easier to gather the necessary information when it's time to file your taxes.

- Seek Professional Advice: If you're unsure about your eligibility or have complex tax situations, consider consulting a tax professional. They can provide tailored advice and ensure you're maximizing your tax benefits.

- Plan for the Future: Some tax credits require planning. For instance, if you're considering a business investment, understand the criteria for the Business Investment Tax Credit to ensure you're eligible when the time comes.

Looking Ahead: Future of Michigan Tax Credits

The Michigan tax credit landscape is subject to change, driven by the state’s economic goals and policy priorities. As the state continues to evolve, so too will its tax credit programs. Staying informed about these changes is essential for taxpayers to ensure they continue to benefit from the available credits.

The Michigan Department of Treasury regularly assesses the effectiveness of its tax credits and may introduce new initiatives or modify existing ones. Taxpayers should stay tuned to official announcements and updates to stay ahead of any changes that may impact their tax strategies.

Additionally, as the state works towards economic recovery and growth, new tax incentives may be introduced to stimulate specific sectors or promote certain behaviors. Staying engaged with the state's tax policies can help taxpayers position themselves to take advantage of these opportunities.

What happens if I’m eligible for multiple tax credits on Form 1040Cr?

+You can claim multiple tax credits on Form 1040Cr as long as you meet the eligibility criteria for each. Simply calculate the credit amount for each applicable credit and include them in the appropriate sections of the form. Ensure you have the necessary supporting documentation for each credit.

Are there any income limits for claiming tax credits on Form 1040Cr?

+Yes, most tax credits have income limits. For instance, the Low Income Tax Credit has specific thresholds based on filing status and number of dependents. It’s important to review the eligibility criteria for each credit to determine if you meet the income requirements.

Can I claim tax credits if I’m a part-year resident of Michigan?

+The eligibility for tax credits may vary for part-year residents. Some credits, like the Homestead Property Tax Credit, may have specific requirements for the length of residency. It’s crucial to review the guidelines for each credit to understand if you qualify as a part-year resident.

Is there a deadline for submitting Form 1040Cr?

+Yes, there is a deadline for submitting Form 1040Cr. Typically, it aligns with the standard tax filing deadline, which is April 15th. However, it’s essential to check the official guidelines for any changes or extensions. Late filings may result in penalties and interest.