Michigan Income Tax Rate

The Michigan income tax system is an important aspect of the state's financial landscape, influencing both individual taxpayers and businesses. Understanding the intricacies of Michigan's tax rates and their implications is crucial for anyone navigating the state's financial ecosystem.

Unraveling Michigan’s Income Tax Rates

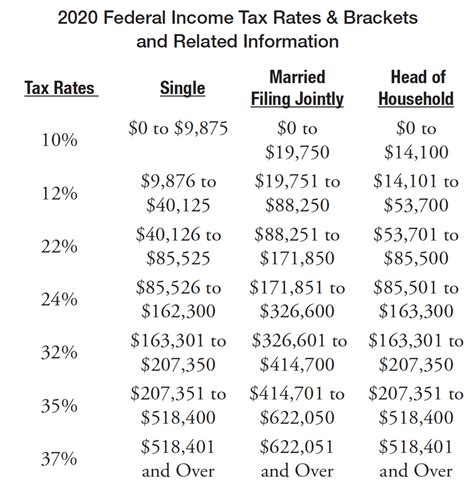

The income tax landscape in Michigan is defined by a single, flat tax rate applied to personal income. This rate is a cornerstone of Michigan’s tax policy, providing a straightforward approach to taxation. As of the most recent updates, the state income tax rate stands at 4.25%, a percentage that applies uniformly to all income brackets.

This flat tax structure stands in contrast to the progressive tax systems employed by some other states, where tax rates increase as income levels rise. Michigan's approach, by keeping the tax rate consistent across income levels, simplifies the tax filing process for residents and businesses.

A Historical Perspective

The evolution of Michigan’s income tax rates offers an insightful glimpse into the state’s fiscal policies. In the 1960s, the state introduced an income tax rate of 3.4%, marking a significant step towards a more equitable tax system. Over the years, this rate has fluctuated, reaching a high of 6.35% in the early 1990s and dipping to 3.9% in 2011. The current rate of 4.25% was established in 2013 and has remained stable since.

These historical variations in tax rates often reflect the state's economic climate and its revenue needs. For instance, the increase in the early 1990s could be linked to economic challenges, while the decrease in 2011 might be attributed to a strategic move to stimulate economic growth.

Impact on Taxpayers and Businesses

Michigan’s flat income tax rate has both advantages and potential drawbacks for taxpayers. On the positive side, it simplifies tax calculations and ensures fairness, as all taxpayers, regardless of income level, contribute at the same rate. However, critics argue that this structure might not adequately consider the ability-to-pay principle, as higher-income earners pay the same rate as lower-income individuals.

For businesses, the flat tax rate provides a stable and predictable tax environment, which can be beneficial for long-term financial planning. However, the absence of a progressive tax system means that larger corporations, which often contribute significantly to state revenues, pay at the same rate as smaller businesses.

| Income Tax Rate | Years in Effect |

|---|---|

| 3.4% | 1960s |

| 6.35% | Early 1990s |

| 3.9% | 2011 |

| 4.25% | 2013 - Present |

Comparative Analysis with Other States

When compared to other states, Michigan’s income tax rate positions it in the middle range. Several states, such as Pennsylvania and Massachusetts, have higher tax rates, while states like Florida and Texas have no income tax at all. This variability in tax rates across states often influences business decisions and individual migration patterns.

For instance, a business considering expansion might opt for a state with no income tax to reduce its tax burden. Conversely, states with higher tax rates might offer other incentives, such as better infrastructure or a skilled workforce, to attract businesses and compensate for the higher tax rate.

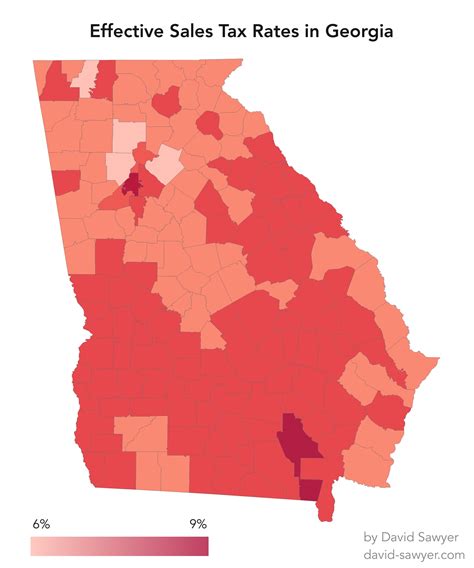

The Role of Local Taxes

It’s important to note that Michigan, like many other states, also has local taxes, which can vary significantly across counties and municipalities. These local taxes, often in the form of sales taxes or property taxes, can add to the overall tax burden for both individuals and businesses.

For instance, while the state income tax rate is 4.25%, local income tax rates can range from 0% to 2%, depending on the location. These local variations can significantly impact the total tax liability of individuals and businesses, making it essential to consider both state and local taxes when evaluating the tax landscape.

Implications for Michigan’s Economy

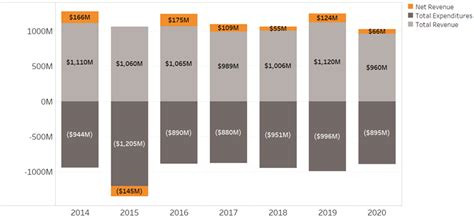

The income tax rate has profound implications for Michigan’s economy and its residents. A stable and predictable tax rate can foster economic growth by encouraging business investment and consumer spending. On the other hand, a high tax rate can deter businesses and individuals from locating in the state.

Moreover, the income tax revenue generated is a significant source of funding for essential state services, such as education, healthcare, and infrastructure development. A balanced tax system ensures that the state can meet its financial obligations while also providing incentives for economic growth.

Potential Future Adjustments

Looking ahead, Michigan’s income tax rate could be subject to adjustments to meet changing economic conditions and revenue needs. For instance, during economic downturns, the state might consider temporary tax rate increases to boost revenue. Conversely, to stimulate economic growth, the state could opt for tax rate reductions, especially for certain sectors or income levels.

The state's decision-making on tax rates is often influenced by a delicate balance of economic considerations, political ideologies, and the public's acceptance of tax policies. As such, any future changes to the income tax rate are likely to be carefully considered and strategically implemented.

What is the current Michigan income tax rate for individuals and businesses?

+As of the most recent updates, the Michigan income tax rate for both individuals and businesses stands at 4.25%.

How does Michigan’s flat tax rate compare to other states’ tax systems?

+Michigan’s flat tax rate of 4.25% places it in the middle range compared to other states. While some states have higher rates, others, like Florida and Texas, have no income tax.

Are there any local taxes in Michigan that can impact my tax liability?

+Yes, Michigan has local taxes, including local income taxes, which can vary significantly across counties and municipalities. These local taxes can range from 0% to 2%, adding to your overall tax burden.

How does Michigan’s income tax rate affect its economy and residents?

+A stable and predictable income tax rate, like Michigan’s 4.25%, can foster economic growth by encouraging business investment and consumer spending. Conversely, a high tax rate can deter businesses and individuals from locating in the state.