Miami Dade County Fl Tax Collector

Welcome to a comprehensive exploration of the Miami-Dade County Tax Collector's Office, a vital entity in one of the most dynamic counties in the United States. This office plays a crucial role in the financial landscape of Miami-Dade County, Florida, offering a range of services that impact residents, businesses, and the overall economic health of the region.

With a diverse range of responsibilities, from vehicle registration to tax collection and more, the Miami-Dade County Tax Collector's Office serves as a critical hub for various administrative and financial activities. In this article, we delve into the workings of this essential department, uncovering its history, services, and impact on the community.

A Historical Perspective: The Evolution of the Miami-Dade County Tax Collector's Office

The story of the Miami-Dade County Tax Collector's Office is intertwined with the rich history of South Florida. Established with the aim of efficiently managing the county's tax system, this office has evolved significantly over the years to meet the changing needs of its diverse population.

Miami-Dade County, known for its vibrant culture, stunning beaches, and dynamic business environment, has witnessed rapid growth since its inception. The Tax Collector's Office has played a pivotal role in facilitating this growth by providing efficient and accessible tax-related services. Its journey, marked by innovation and adaptation, reflects the region's transformation into a global economic powerhouse.

Initially, the office focused primarily on collecting property taxes, a crucial revenue stream for local governments. As the county expanded and diversified, so did the responsibilities of the Tax Collector's Office. Today, it stands as a comprehensive administrative center, offering a wide array of services to residents and businesses alike.

Key Milestones in the Office's Evolution

- Early 20th Century: The office's inception, marked by the establishment of a centralized tax collection system, aimed to streamline revenue collection and improve financial management.

- Post-WWII Era: With the post-war boom and the rise of tourism, the office expanded its services to cater to a growing population, including offering vehicle registration and titling services.

- 1980s: A period of technological advancement saw the office implementing computerization, enhancing efficiency and accuracy in tax record-keeping and collection.

- Recent Years: Focus on digital transformation with the launch of an online platform, enabling residents to access a wide range of services remotely, from tax payment to vehicle registration renewal.

Through these milestones, the Miami-Dade County Tax Collector's Office has not only adapted to changing times but has also driven innovation in local government services, setting a benchmark for other counties across the nation.

Services Offered by the Miami-Dade County Tax Collector's Office

The Miami-Dade County Tax Collector's Office is a multifaceted entity, offering a wide array of services that cater to the diverse needs of the county's residents and businesses. Here's an in-depth look at the key services provided by this essential department:

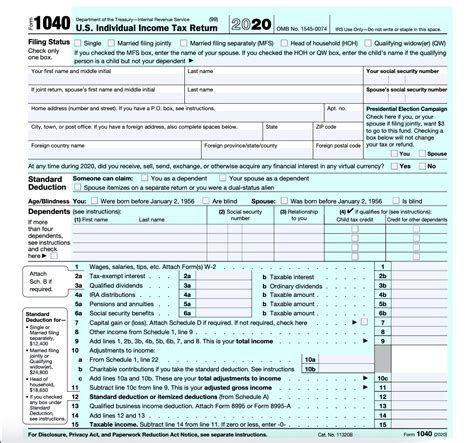

Tax Collection and Payment

At the heart of the Tax Collector's Office is the critical function of tax collection. This includes:

- Property Taxes: The office manages the collection of property taxes, a significant revenue source for the county. Residents can pay their taxes online, by mail, or in person at designated locations.

- Sales Taxes: Sales tax collection is another vital responsibility. The office ensures compliance with sales tax regulations, providing support to businesses and facilitating timely tax payments.

- Other Taxes: From business taxes to special assessments, the office handles a range of tax types, offering a comprehensive tax management service to the county's diverse taxpayer base.

The office also provides tax payment plans and assistance programs to support taxpayers facing financial difficulties. These initiatives aim to foster a fair and equitable tax system, ensuring that all residents can meet their tax obligations.

Vehicle Registration and Titling

The Tax Collector's Office is the go-to place for vehicle-related services in Miami-Dade County. Here's what they offer:

- Vehicle Registration: Residents can register their vehicles at the office, a process that involves providing necessary documentation, paying fees, and obtaining license plates and registration stickers.

- Title Transfers: For those buying or selling a vehicle, the office facilitates title transfers, ensuring a smooth and legal transaction. This service includes processing the necessary paperwork and updating records.

- Renewal Services: Vehicle registration renewal is a crucial service, ensuring that residents stay compliant with the law. The office provides convenient renewal options, including online renewal for added convenience.

Additionally, the office offers veteran-specific plates, handicap parking permits, and boat registration services, catering to the diverse needs of the county's vehicle owners.

Business Services

The Miami-Dade County Tax Collector's Office provides a range of business-oriented services, supporting the county's vibrant business community:

- Business Tax Receipts: Also known as occupational licenses, these receipts are mandatory for most businesses operating in the county. The office assists businesses in obtaining and renewing these licenses, ensuring compliance with local regulations.

- Business Support: The office offers guidance and support to businesses, providing resources and information on tax obligations, permits, and other regulatory requirements.

- Online Business Services: Recognizing the importance of digital accessibility, the office has launched an online platform, enabling businesses to manage their tax and license obligations remotely, enhancing efficiency and convenience.

Through these services, the Tax Collector's Office plays a crucial role in fostering a business-friendly environment, supporting economic growth and development in Miami-Dade County.

Other Services

Beyond the core services, the Miami-Dade County Tax Collector's Office offers a range of additional services to benefit the community:

- Property Appraisals: The office provides property appraisal services, helping residents understand the assessed value of their properties, which is crucial for tax calculation and planning.

- E-Check Services: To promote environmental sustainability, the office offers E-Check services, facilitating the testing and certification of vehicle emissions, a critical aspect of Miami-Dade County's green initiatives.

- Notary Services: Residents can avail of notary services at the office, a convenient and reliable way to get documents notarized, often required for various legal processes.

- Hunting and Fishing Licenses: For outdoor enthusiasts, the office provides hunting and fishing licenses, ensuring compliance with wildlife conservation regulations and contributing to the state's conservation efforts.

These additional services showcase the Tax Collector's Office's commitment to serving the diverse needs of Miami-Dade County residents, going beyond tax collection and administrative duties.

Impact and Contributions of the Miami-Dade County Tax Collector's Office

The Miami-Dade County Tax Collector's Office is not just a government department; it's a vital pillar of the community, impacting the lives of residents and the overall health of the county in numerous ways. Here's a deeper look at its contributions:

Economic Impact

The office plays a pivotal role in the county's economic ecosystem, serving as a key revenue generator and a facilitator of economic activities. By efficiently collecting taxes, the office ensures the county has the financial resources needed for essential services and infrastructure development.

Furthermore, the Tax Collector's Office's support for businesses, through services like business tax receipt issuance and online business platforms, contributes to the county's economic growth and job creation. Its commitment to accessibility and efficiency makes it easier for businesses to operate and thrive in Miami-Dade County.

Community Engagement and Support

Beyond its administrative duties, the Tax Collector's Office actively engages with the community, offering support and assistance to residents. This includes:

- Financial Aid Programs: Recognizing that financial difficulties can affect anyone, the office provides tax relief programs and payment plans, ensuring that residents can meet their tax obligations without undue hardship.

- Educational Initiatives: Through workshops and online resources, the office educates residents about tax laws, property appraisals, and other relevant topics, empowering them to make informed decisions and navigate the tax system effectively.

- Community Partnerships: The office collaborates with various community organizations and charities, supporting their initiatives and leveraging its resources to benefit the wider community.

By fostering a culture of community support and engagement, the Tax Collector's Office strengthens the social fabric of Miami-Dade County, making it a more resilient and cohesive community.

Technological Innovation and Accessibility

The Miami-Dade County Tax Collector's Office has been at the forefront of technological innovation, continuously enhancing its services to meet the evolving needs of residents and businesses. The launch of its online platform is a prime example, providing a user-friendly interface for a range of services, from tax payment to vehicle registration renewal.

This commitment to digital transformation has improved accessibility, especially for those with limited mobility or busy schedules. It also enhances efficiency, reducing wait times and streamlining processes, thereby improving overall customer satisfaction.

The office's embrace of technology positions Miami-Dade County as a leader in digital governance, setting a high standard for other counties to follow.

Future Prospects and Innovations

As we look ahead, the Miami-Dade County Tax Collector's Office is poised for further growth and innovation, driven by a commitment to excellence and a desire to serve the community better. Here's a glimpse into its future prospects:

Expanding Digital Services

The office is likely to continue its focus on digital transformation, aiming to make more services available online. This includes exploring blockchain technology for secure and transparent tax records, as well as developing mobile apps for even greater accessibility.

By leveraging digital tools, the office can enhance efficiency, reduce costs, and provide a more personalized experience to residents and businesses, fostering greater trust and engagement.

Enhanced Customer Experience

With a deep understanding of the community's needs, the Tax Collector's Office is dedicated to improving customer experience. This involves streamlining processes, reducing wait times, and providing clear and concise information to make interactions with the office more pleasant and productive.

The office is also likely to invest in staff training and development, ensuring that its employees are equipped with the skills and knowledge to deliver exceptional service. This commitment to staff development will, in turn, enhance the overall customer experience.

Sustainable Initiatives

In line with the county's sustainability goals, the Tax Collector's Office is expected to expand its green initiatives. This may include promoting electric vehicle adoption through incentives and facilitating the registration process for these vehicles. Additionally, the office could explore partnerships with environmental organizations to further its sustainability efforts.

By embracing sustainability, the office not only contributes to the county's environmental goals but also sets an example for other government departments, encouraging a culture of eco-consciousness.

Community Collaboration and Outreach

Looking forward, the Tax Collector's Office aims to deepen its community engagement, collaborating with local businesses, schools, and community groups to provide educational programs and support initiatives. This includes hosting workshops on financial literacy and tax planning, especially for underserved communities.

Through these outreach efforts, the office can build stronger relationships with the community, fostering trust and understanding, and ensuring that its services remain relevant and beneficial to all residents.

Conclusion: A Vital Pillar of Miami-Dade County

The Miami-Dade County Tax Collector's Office is more than just a tax collection entity; it's a dynamic and responsive department, dedicated to serving the community and driving positive change. Through its diverse services, technological innovations, and community engagement, the office plays a crucial role in the economic, social, and environmental health of Miami-Dade County.

As it continues to evolve and adapt to the changing needs of the community, the Tax Collector's Office remains a vital pillar of Miami-Dade County, contributing to its growth, prosperity, and overall well-being.

What are the office hours for the Miami-Dade County Tax Collector’s Office?

+

The Miami-Dade County Tax Collector’s Office typically operates from Monday to Friday, with specific hours depending on the location. While most offices open at 8:30 AM, some may open earlier or later. It’s recommended to check the official website or contact the office directly for the most up-to-date information on opening hours.

How can I renew my vehicle registration online?

+

To renew your vehicle registration online, you can visit the official website of the Miami-Dade County Tax Collector’s Office. There, you’ll find a dedicated section for online vehicle registration renewal. You’ll need to provide your vehicle information and make the payment online to complete the process.

Are there any discounts or exemptions for property taxes in Miami-Dade County?

+

Yes, Miami-Dade County offers various tax discounts and exemptions. These include the Homestead Exemption, which reduces taxable property value for homeowners, and the Disabled Veterans Exemption, which provides tax relief for qualifying veterans. Other exemptions are also available for senior citizens and surviving spouses. It’s advisable to consult with the Tax Collector’s Office or a tax professional to determine eligibility.

Can I make tax payments in person at the Tax Collector’s Office?

+

Absolutely! The Miami-Dade County Tax Collector’s Office accepts tax payments in person at its various locations. You can visit the office during business hours, bring your payment, and make the transaction in person. It’s recommended to bring the correct amount and any necessary documentation to expedite the process.

How does the Tax Collector’s Office support local businesses?

+

The Tax Collector’s Office provides several support services for local businesses. This includes issuing business tax receipts (occupational licenses), which are mandatory for most businesses operating in the county. The office also offers guidance on tax obligations, permits, and other regulatory requirements, ensuring businesses can operate smoothly and efficiently.