Miami Dade Property Tax Information

Welcome to an in-depth exploration of property taxes in Miami-Dade County, a topic of great interest to both current and prospective residents of this vibrant region. As a thriving metropolitan hub, Miami-Dade County boasts a diverse real estate market, ranging from luxurious beachfront properties to cozy suburban homes and bustling commercial spaces. Understanding the intricacies of property taxes is essential for making informed decisions, whether you're a homeowner, investor, or simply curious about the financial landscape of this dynamic community.

The Fundamentals of Miami-Dade Property Taxes

Property taxes in Miami-Dade County are an integral part of the local economy, contributing significantly to the funding of essential public services, including schools, emergency services, and infrastructure development. These taxes are determined by a combination of factors, primarily the assessed value of the property and the millage rate, which is set annually by the county and various taxing authorities.

The property tax system in Miami-Dade County is designed to ensure fairness and transparency. The process begins with an assessment of the property's value, conducted by the Miami-Dade Property Appraiser's Office. This office is responsible for appraising all properties within the county, considering factors such as location, size, improvements, and market trends. The assessed value serves as the basis for calculating the property tax liability.

Assessed Value and Millage Rates

The assessed value of a property is not necessarily equal to its market value. Instead, it is determined through a complex process that takes into account the property’s specific characteristics and the prevailing real estate market conditions. The millage rate, on the other hand, is the tax rate per 1,000 of the assessed value. It is expressed in mills, where one mill is equivalent to 1 for every $1,000 of assessed value.

| Taxing Authority | 2023 Millage Rate |

|---|---|

| General County | 5.7580 |

| Municipal Services | 2.2953 |

| Schools | 6.4788 |

| Fire Services | 2.1000 |

| Water Control | 0.4367 |

| Drainage | 0.4300 |

These millage rates are subject to change annually, and they can vary based on the specific location within the county. For instance, properties within incorporated areas may have additional millage rates for municipal services, while those in unincorporated areas may have different rates for fire and water control.

Tax Exemptions and Discounts

Miami-Dade County offers various tax exemptions and discounts to eligible homeowners. These incentives are designed to ease the tax burden for certain groups and promote homeownership. Some of the notable exemptions and discounts include:

- Homestead Exemption: Provides a significant reduction in taxable value for primary residences. This exemption is available to homeowners who reside in their properties as their permanent residence.

- Senior Exemption: Offers an additional reduction in taxable value for homeowners who are 65 years or older and meet certain income requirements.

- Low-Income Senior Discount: Provides a discount on property taxes for seniors with limited income.

- Military Discounts: Offers reduced tax rates for active-duty military personnel and veterans.

Understanding Your Property Tax Bill

A property tax bill, or “TRIM Notice” (Truth in Millage), is a comprehensive document that details the calculation of your property taxes. It provides a breakdown of the assessed value, the applicable millage rates, and the resulting tax liability. Understanding your TRIM Notice is crucial for ensuring accuracy and identifying any potential errors or discrepancies.

Key Components of a TRIM Notice

- Property Information: This section provides details about your property, including the address, legal description, and parcel number.

- Assessed Value: Here, you’ll find the assessed value of your property, which is the basis for calculating your tax liability.

- Millage Rates: This section lists the millage rates applicable to your property, broken down by taxing authority.

- Taxable Value: The taxable value is calculated by subtracting any applicable exemptions or discounts from the assessed value.

- Tax Amount: This is the total amount of property taxes you owe for the year, calculated by multiplying the taxable value by the sum of the millage rates.

- Payment Information: Your TRIM Notice will also provide details on how and when to make your property tax payments.

Reviewing and Challenging Your Assessment

If you believe your property’s assessed value is inaccurate, you have the right to challenge it. The Miami-Dade Property Appraiser’s Office provides a formal process for appealing assessments. This process typically involves submitting evidence, such as recent sales of similar properties or professional appraisals, to support your claim.

It's essential to act promptly if you intend to appeal your assessment. The deadline for filing an appeal is usually several months after the TRIM Notice is issued. Consult the Miami-Dade Property Appraiser's Office or a tax professional for specific deadlines and guidance on the appeal process.

Property Tax Payment Options and Due Dates

Property taxes in Miami-Dade County are typically due in two installments. The first installment is due in November, and the second installment is due in March of the following year. However, homeowners have several payment options to choose from, including online payment, mail-in payment, and in-person payment at designated locations.

Online payment is the most convenient option, allowing homeowners to pay their taxes quickly and securely from the comfort of their homes. The Miami-Dade County Tax Collector's Office provides an online payment portal where taxpayers can make payments using a credit or debit card, or even set up automatic payments from their bank accounts.

For those who prefer traditional methods, mail-in payments are also an option. Homeowners can send a check or money order along with the payment coupon from their TRIM Notice to the Tax Collector's Office. It's crucial to ensure that the payment is received by the due date to avoid late fees and penalties.

In-person payments can be made at designated locations, such as the Tax Collector's Office or certain government centers. This option is particularly useful for those who prefer face-to-face transactions or need assistance with their payments.

Late Payment Penalties and Interest

Failure to pay property taxes by the due date can result in late fees and interest charges. Miami-Dade County imposes a late fee of 3% of the unpaid taxes for each month the payment is late, up to a maximum of 18% per year. Additionally, interest accrues on the unpaid taxes at a rate of 1.5% per month until the taxes are paid in full.

To avoid these penalties, it's crucial to stay informed about payment due dates and take advantage of the various payment options available. Homeowners can also set up reminders or automatic payments to ensure timely payment and avoid unnecessary financial burdens.

Property Tax Relief Programs

Miami-Dade County recognizes the importance of providing relief to homeowners facing financial challenges. As such, the county offers several property tax relief programs to assist eligible homeowners in managing their tax obligations.

Circuit Breaker Program

The Circuit Breaker Program is designed to provide relief to low-income homeowners by reducing their property taxes. To be eligible, homeowners must meet certain income and asset limits, and their property must be their primary residence. The program offers a refund of a portion of the property taxes paid, providing much-needed financial relief.

Homestead Exemption

As mentioned earlier, the Homestead Exemption is a significant tax benefit for homeowners who reside in their properties as their permanent residence. This exemption reduces the taxable value of the property, resulting in lower property taxes. It’s an essential tool for making homeownership more affordable and accessible.

Other Relief Programs

Miami-Dade County also offers other relief programs, such as the Low-Income Senior Discount and the Disability Exemption. These programs aim to assist vulnerable populations by providing tax relief based on specific criteria, such as age, income, or disability status. Homeowners who believe they may be eligible for these programs should contact the Miami-Dade Property Appraiser’s Office for more information.

Future Outlook and Potential Changes

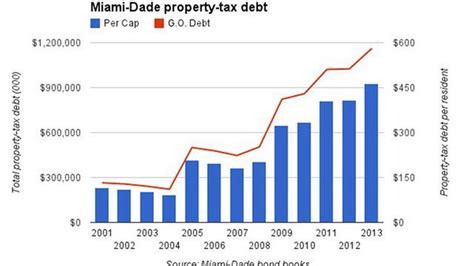

The property tax landscape in Miami-Dade County is subject to change, influenced by various factors such as economic trends, population growth, and legislative decisions. While it’s challenging to predict specific changes, certain trends and potential developments can be anticipated.

Economic Factors

The local economy plays a significant role in shaping property tax policies. A thriving economy with strong real estate market growth may lead to increased property values, resulting in higher tax assessments. Conversely, economic downturns can lead to decreased property values and potentially lower tax assessments.

Population Growth and Development

Miami-Dade County’s population continues to grow, and this growth can impact property taxes in several ways. As the population increases, the demand for public services also rises, potentially leading to higher millage rates to fund these services. Additionally, new development projects can affect property values and tax assessments in specific areas.

Legislative Changes

Legislative decisions at the state and local levels can have a significant impact on property taxes. Changes in tax laws, such as the introduction of new exemptions or adjustments to existing ones, can directly affect homeowners. It’s crucial for homeowners to stay informed about any proposed or enacted legislative changes that may impact their property tax obligations.

Technology and Efficiency

Advancements in technology are also likely to play a role in the future of property taxes. The Miami-Dade Property Appraiser’s Office and other relevant departments may adopt new technologies to enhance the accuracy and efficiency of property assessments and tax collection processes. These improvements could lead to more streamlined and transparent systems, benefiting both taxpayers and the county.

How can I estimate my property taxes before purchasing a home in Miami-Dade County?

+

To estimate your property taxes before purchasing a home, you can use the Miami-Dade County Tax Estimator tool available on the Tax Collector’s Office website. This tool allows you to input the property’s address and assessed value to calculate an estimated tax amount. Keep in mind that this estimate is based on current millage rates and may not reflect any potential changes in the future.

What happens if I don’t receive my TRIM Notice or lose it?

+

If you haven’t received your TRIM Notice or have lost it, you can request a duplicate copy from the Miami-Dade Property Appraiser’s Office. Simply contact their office and provide your property information, and they will mail you a replacement notice.

Can I make partial payments for my property taxes?

+

Yes, Miami-Dade County allows homeowners to make partial payments for their property taxes. However, it’s important to note that partial payments may not stop late fees and interest from accruing on the remaining balance. To avoid penalties, it’s best to pay the full amount by the due date.

How often are property values reassessed in Miami-Dade County?

+

Property values in Miami-Dade County are reassessed every year. The Miami-Dade Property Appraiser’s Office conducts annual assessments to ensure that property values accurately reflect the current real estate market conditions.

Are there any online resources to help me understand my property tax bill?

+

Yes, the Miami-Dade County Tax Collector’s Office provides a comprehensive guide to understanding your property tax bill on their website. This guide explains each section of the TRIM Notice in detail, making it easier for homeowners to decipher their tax obligations.