Los Angeles District Tax Rate

The tax landscape in Los Angeles is a complex interplay of various factors, from property taxes to sales taxes, and income taxes. Understanding these rates is crucial for both residents and businesses, as it impacts financial planning and overall economic health. In this article, we delve into the specifics of the Los Angeles District Tax Rate, exploring the different types of taxes, their current rates, and how they affect the city's economic ecosystem.

Unraveling the Los Angeles Tax Structure

Los Angeles, being a bustling metropolis, boasts a diverse tax system that caters to its diverse population and industries. This section provides an in-depth breakdown of the key taxes in the region.

Property Taxes: A Pillar of Local Revenue

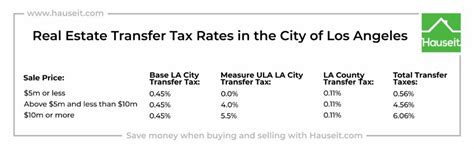

Property taxes in Los Angeles are a significant revenue source for the city and its surrounding areas. These taxes are determined by the assessed value of properties, with rates varying based on location and property type. The current average property tax rate in Los Angeles County stands at approximately 1.08%, which is applied to the assessed value of the property. However, it’s important to note that this rate can fluctuate slightly depending on the specific city or area within the county.

For instance, in the city of Los Angeles itself, the property tax rate is slightly lower, averaging around 0.84% of the assessed value. This rate, known as the "Secure Property Tax Rate," is a crucial component of the city's budget, funding essential services like public safety, infrastructure, and education.

| Property Tax Rate | Assessed Value |

|---|---|

| Los Angeles County Average | 1.08% |

| City of Los Angeles | 0.84% |

It's worth highlighting that property taxes in Los Angeles, like many other jurisdictions, are subject to propositions and ballot measures that can impact tax rates. For instance, Proposition 13, a landmark tax reform initiative, limits property tax increases to a maximum of 2% per year unless there's a change in ownership.

Sales and Use Taxes: Funding Public Services

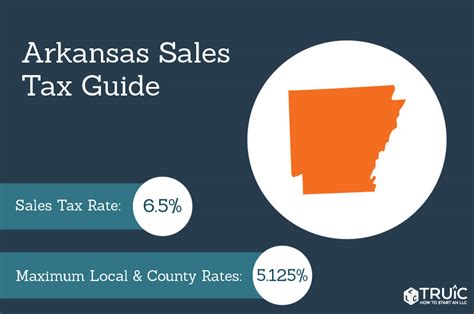

Sales and use taxes are another critical component of Los Angeles’ tax structure. These taxes are levied on the sale of goods and services, as well as on the storage, use, or consumption of tangible personal property in the city. The city’s sales tax rate is composed of several layers, including state, county, city, and district taxes.

Currently, the combined sales tax rate in Los Angeles is approximately 10.25%, which includes:

- California State Sales Tax: 7.25%

- Los Angeles County Sales Tax: 0.25%

- City of Los Angeles Sales Tax: 0.5%

- Los Angeles Unified School District Sales Tax: 2.25%

It's important to note that sales tax rates can vary depending on the specific city or district within Los Angeles County. For example, the sales tax rate in Santa Monica is slightly higher at 11.25%, with an additional 0.5% tax dedicated to funding transportation projects.

Sales and use taxes play a pivotal role in funding public services, including education, transportation, and healthcare. The revenue generated from these taxes helps maintain the city's infrastructure, support local businesses, and provide essential services to residents.

Income Taxes: Individual and Corporate Contributions

Income taxes in Los Angeles are a crucial aspect of the city’s tax landscape, contributing significantly to its economic sustainability. These taxes are levied on both individual and corporate income, with rates varying based on income brackets and tax laws.

For individual income taxes, Los Angeles follows the state's tax structure, which has a progressive rate system. The current state income tax rates range from 1% to 12.3%, depending on taxable income. Additionally, the city of Los Angeles imposes its own income tax, which is set at 1% for all residents.

Corporate income taxes, on the other hand, are slightly more complex. The state of California imposes a corporate income tax rate of 8.84%, while the city of Los Angeles has a separate corporate tax rate of 0.6%. These taxes are crucial for funding public services and infrastructure development, ensuring the city's economic stability and growth.

Economic Impact and Tax Incentives

The tax structure in Los Angeles not only funds essential services but also plays a pivotal role in shaping the city’s economic landscape. This section explores the economic implications of the district tax rate and how it influences business decisions and growth.

Attracting Businesses and Investors

Los Angeles’ tax rates, while competitive, can be a significant factor in attracting businesses and investors to the region. The city’s diverse tax structure, which includes property, sales, and income taxes, provides a stable revenue stream for local governments and essential services. This stability is attractive to businesses, as it ensures a consistent tax environment for long-term planning.

Moreover, Los Angeles offers various tax incentives and credits to encourage business growth and investment. For instance, the city provides tax credits for hiring local residents, investing in research and development, and expanding operations. These incentives can significantly reduce the tax burden for businesses, making Los Angeles an appealing location for startups and established companies alike.

The presence of major industries like entertainment, technology, and healthcare also contributes to the city's economic appeal. These industries, coupled with a talented workforce and a robust infrastructure, make Los Angeles a desirable hub for businesses seeking expansion or relocation.

Supporting Local Communities and Small Businesses

The tax revenue generated in Los Angeles plays a crucial role in supporting local communities and small businesses. Property taxes, in particular, are a significant source of funding for local services, such as schools, public safety, and infrastructure maintenance. This ensures that communities have access to essential resources and services, fostering a sense of stability and growth.

Additionally, sales and use taxes contribute to the development of local businesses. These taxes provide revenue for local governments to invest in economic development initiatives, such as business incubation programs, small business grants, and infrastructure improvements. By supporting local businesses, the city fosters a vibrant and diverse economic ecosystem, benefiting both residents and visitors.

Tax Relief and Assistance Programs

Los Angeles recognizes the importance of tax relief and assistance programs in supporting its residents and businesses. The city offers a range of initiatives to ease the tax burden on low-income individuals, seniors, and small businesses.

For example, the Property Tax Postponement Program allows eligible seniors and disabled individuals to postpone the payment of their property taxes until their home is sold, providing much-needed financial relief. Similarly, the Small Business Tax Relief Program offers reduced tax rates and simplified tax structures for eligible small businesses, helping them thrive and contribute to the local economy.

These programs not only provide immediate financial relief but also promote long-term economic stability and growth. By supporting individuals and businesses during challenging times, Los Angeles ensures a resilient and thriving community.

Conclusion: Navigating the Los Angeles Tax Landscape

Understanding the Los Angeles District Tax Rate is crucial for anyone navigating the city’s complex economic ecosystem. From property taxes to sales and income taxes, each component plays a vital role in funding essential services, supporting local businesses, and driving economic growth.

As we've explored, the tax structure in Los Angeles is designed to balance the needs of residents, businesses, and the city's overall economic health. While the rates may seem complex, they are essential in maintaining the city's infrastructure, providing quality public services, and fostering a thriving business environment.

By staying informed about the tax landscape, individuals and businesses can make informed financial decisions, contributing to the continued success and prosperity of Los Angeles.

¿Qué pasa si no puedo pagar mis impuestos de propiedad en Los Ángeles a tiempo?

+

Si enfrenta dificultades para pagar sus impuestos de propiedad en Los Ángeles, existen programas de alivio fiscal que pueden ayudar. Por ejemplo, el Programa de Postergación de Impuestos sobre la Propiedad permite a las personas mayores y discapacitadas posponer el pago de sus impuestos hasta que se venda su casa. Es importante ponerse en contacto con la oficina de impuestos local para obtener más información y asistencia.

¿Hay exenciones o deducciones de impuestos para propietarios de viviendas en Los Ángeles?

+

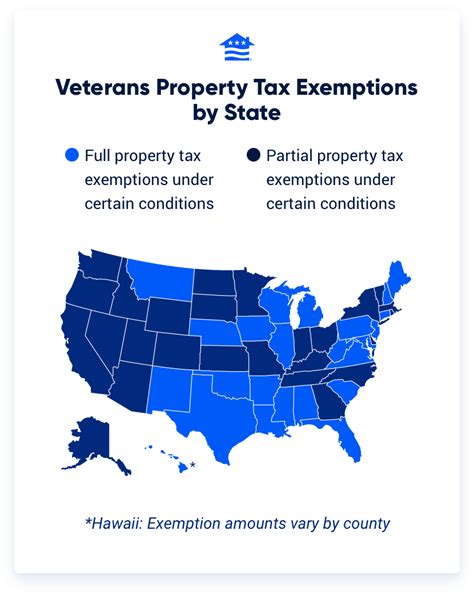

Sí, Los Ángeles ofrece varias exenciones y deducciones de impuestos para propietarios de viviendas. Por ejemplo, la Exención de Impuestos sobre la Propiedad para Veteranos discapacitados exime a los veteranos discapacitados de pagar impuestos sobre la propiedad. Además, existen deducciones para propietarios de viviendas que realizan mejoras energéticas en sus hogares. Es recomendable consultar con un asesor fiscal para obtener más detalles sobre estas oportunidades.

¿Cómo afectan los impuestos a la economía local de Los Ángeles?

+

Los impuestos son una fuente importante de ingresos para la ciudad y el condado de Los Ángeles. Estos ingresos se utilizan para financiar servicios públicos, como educación, seguridad pública y mantenimiento de infraestructura. Además, los impuestos también influyen en las decisiones de inversión y crecimiento de las empresas, ya que pueden afectar la rentabilidad y la competitividad.