Laurens County Sc Taxes

Welcome to an in-depth exploration of Laurens County, South Carolina, a region with a rich history and a unique tax structure that impacts its residents and businesses. In this comprehensive guide, we will delve into the intricacies of Laurens County's tax system, providing valuable insights for homeowners, investors, and those curious about the financial landscape of this vibrant county.

Understanding Laurens County’s Tax Ecosystem

Situated in the Upstate region of South Carolina, Laurens County boasts a diverse economy and a thriving community. The tax system in this county is designed to support its growth while ensuring the necessary revenue for public services. Let’s unravel the key components and considerations of Laurens County’s taxes.

Property Taxes: A Core Component

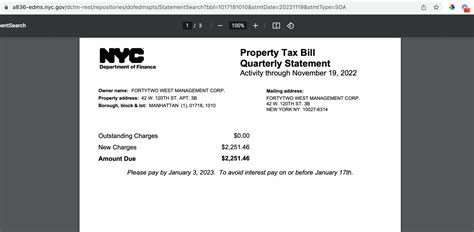

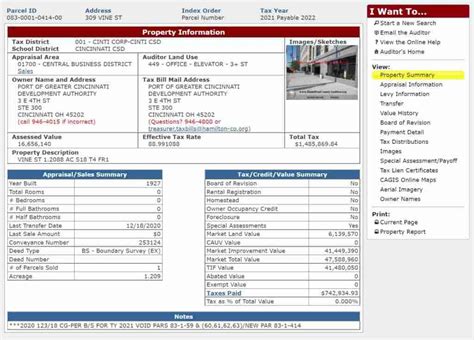

Property taxes are a significant aspect of Laurens County’s tax landscape. These taxes are levied on real estate properties within the county, including residential homes, commercial establishments, and agricultural lands. The property tax system plays a crucial role in funding essential services such as education, infrastructure development, and public safety.

| Taxable Property Types | Assessment Rates |

|---|---|

| Residential Properties | 6% of Fair Market Value |

| Commercial Properties | 6% of Fair Market Value |

| Agricultural Lands | 4% of Fair Market Value |

The assessment rate for each property type is set by the Laurens County Assessor's Office, which determines the fair market value of properties based on various factors. Property owners can appeal their assessed values if they believe they are inaccurate or unfair.

Personal Property Taxes: Vehicles and More

In addition to real estate, Laurens County also imposes taxes on personal property. This includes vehicles, boats, and other tangible assets owned by individuals or businesses. These taxes contribute to the county’s revenue and are an essential part of its tax ecosystem.

| Personal Property Type | Tax Rate |

|---|---|

| Vehicles | 1% of Vehicle Value |

| Boats | 0.5% of Boat Value |

| Other Personal Property | Varies by Asset Type |

The tax rates for personal property can vary depending on the specific asset and its value. Laurens County provides guidelines and resources to help property owners calculate and understand their personal property tax obligations.

Sales and Use Taxes: Consumer Impact

Like many other counties, Laurens County collects sales tax on retail transactions and use tax on goods purchased outside the county but used within its borders. These taxes are an essential revenue source for the county and can impact the purchasing decisions of residents and visitors.

| Tax Type | Rate |

|---|---|

| Sales Tax | 6% (State) + 1% (County) |

| Use Tax | Varies by Item and Purchase Location |

The sales tax rate in Laurens County is comprised of a state-level tax and an additional county-level tax. The use tax, on the other hand, can vary depending on the item and where it was purchased. Understanding these rates is crucial for businesses and consumers alike.

Business Taxes: Supporting the Local Economy

Laurens County offers a supportive environment for businesses, which is reflected in its tax structure. Various business taxes are in place to contribute to the county’s revenue and infrastructure development.

- Business License Tax: Businesses operating within Laurens County are required to obtain a business license and pay an annual tax based on their gross receipts.

- Accommodations Tax: A tax is imposed on short-term accommodations, such as hotels and vacation rentals, to support tourism-related initiatives and services.

- Meals and Beverage Tax: Restaurants and food service establishments contribute to the county's revenue through this tax, which is applied to the sale of prepared meals and beverages.

The county's tax incentives and programs aim to encourage economic growth and business development, making it an attractive location for entrepreneurs and investors.

Tax Relief Programs: Supporting Residents

Laurens County recognizes the importance of supporting its residents, especially those facing financial challenges. Various tax relief programs are in place to assist homeowners and businesses in need.

- Homestead Exemption: Eligible homeowners can apply for a homestead exemption, which reduces the taxable value of their primary residence, providing a valuable tax relief measure.

- Senior Citizen Tax Relief: Laurens County offers tax relief to senior citizens based on income and property value, ensuring that older residents can continue to thrive within the community.

- Agricultural Conservation Tax Relief: To encourage agricultural practices, the county provides tax relief for landowners who maintain their properties for agricultural purposes.

Performance Analysis and Future Implications

Laurens County’s tax structure has proven effective in supporting its public services and economic development. The diverse range of taxes ensures a stable revenue stream, allowing the county to invest in infrastructure, education, and community initiatives.

As the county continues to grow and evolve, its tax system will play a pivotal role in shaping its future. Here are some key considerations and potential implications:

- Economic Growth and Business Attraction: The county's business-friendly tax environment is expected to attract new businesses and investments, further diversifying the local economy.

- Infrastructure Development: Continued investment in infrastructure, such as roads, schools, and public facilities, will be supported by a stable tax base, enhancing the quality of life for residents.

- Community Engagement: The county's commitment to tax relief programs fosters a sense of community and support, encouraging residents to actively participate in local initiatives and events.

- Sustainable Practices: With an emphasis on agricultural tax relief, Laurens County is positioned to promote sustainable land use and support local farming practices, contributing to environmental stewardship.

Conclusion: A Thriving Community, Powered by Effective Taxation

In conclusion, Laurens County’s tax system is a well-crafted mechanism that supports its vibrant community and thriving economy. From property taxes to business incentives and tax relief programs, every aspect is designed to contribute to the county’s growth and well-being.

As residents, investors, and stakeholders, understanding the intricacies of Laurens County's tax landscape empowers us to make informed decisions and actively participate in the county's future. Whether you're a homeowner, a business owner, or simply curious about the financial health of this vibrant region, this guide provides a comprehensive insight into the world of Laurens County SC Taxes.

What is the deadline for paying property taxes in Laurens County, SC?

+

Property taxes in Laurens County are due by January 15th of each year. If you miss the deadline, you may be subject to penalties and interest.

Are there any tax incentives for new businesses in Laurens County?

+

Yes, Laurens County offers various tax incentives to attract new businesses. These incentives can include tax credits, abatements, and grants, depending on the nature of the business and its impact on the local economy.

How can I appeal my property assessment if I believe it is inaccurate?

+

If you disagree with your property assessment, you have the right to appeal. The process involves submitting an appeal to the Laurens County Assessor’s Office, providing evidence to support your claim, and attending a hearing if necessary. It’s advisable to seek professional guidance for a successful appeal.