Ira Tax Deduction Income Limit

Welcome to this in-depth exploration of the Ira Tax Deduction Income Limit, a crucial aspect of financial planning and retirement savings. Understanding this limit is essential for individuals aiming to maximize their retirement funds while enjoying the tax benefits offered by Individual Retirement Accounts (IRAs). This article aims to provide a comprehensive guide, shedding light on the complexities of the income limit, its impact on tax deductions, and the strategies one can employ to navigate this landscape effectively.

Understanding the Ira Tax Deduction Income Limit

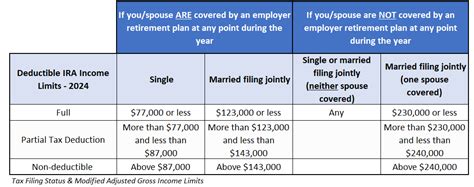

The Ira Tax Deduction Income Limit is a threshold set by the Internal Revenue Service (IRS) that determines the eligibility for tax deductions on contributions made to a Traditional IRA. It’s a critical component of retirement planning, as it directly influences the tax advantages individuals can reap from their retirement savings.

The income limit is not a static figure; it varies annually and is influenced by a combination of factors, including filing status, age, and participation in workplace retirement plans. This dynamic nature adds a layer of complexity to retirement planning, necessitating a nuanced understanding of the rules and regulations.

Income Limit Variations

The income limit is not a one-size-fits-all parameter. For instance, in 2023, the IRS set the income limit for single taxpayers participating in workplace retirement plans at 68,000</strong>, while for those not participating, the limit was <strong>78,000. These limits are significantly different for married couples filing jointly, with the participating limit set at 109,000</strong> and the non-participating limit at <strong>198,000.

| Filing Status | Participating in Workplace Retirement Plan | Not Participating in Workplace Retirement Plan |

|---|---|---|

| Single | $68,000 | $78,000 |

| Married Filing Jointly | $109,000 | $198,000 |

These variations in income limits highlight the importance of personalized financial planning. The decision to contribute to a Traditional IRA, and the subsequent tax benefits, can be significantly impacted by one's marital status, employment benefits, and other financial factors.

Maximizing Tax Deductions within the Income Limit

Within the constraints of the income limit, there are strategies individuals can employ to maximize their tax deductions and, consequently, their retirement savings. Understanding these strategies can empower individuals to make informed decisions about their financial future.

Strategic IRA Contributions

One of the key strategies involves making the most of the income limit by timing your IRA contributions. For those nearing the income limit, contributing earlier in the year can help ensure that the full deduction is available. This strategy is particularly relevant for individuals whose income fluctuates throughout the year or those who anticipate a significant income increase in the future.

Furthermore, individuals can also consider adjusting their income through various tax-efficient strategies. This could involve optimizing investment gains, timing the sale of assets, or utilizing tax-loss harvesting techniques. By reducing taxable income, individuals can potentially maintain their eligibility for the full IRA tax deduction, even if their income is close to the limit.

The Role of Spousal IRAs

Spousal IRAs offer a unique opportunity to maximize tax deductions, especially for couples where one spouse has a higher income and the other has little or no earned income. By contributing to a Traditional IRA on behalf of the lower-income spouse, the couple can potentially qualify for a tax deduction, even if the higher-income spouse’s income exceeds the income limit.

This strategy can be particularly beneficial for couples where one spouse stays at home or has a significantly lower income due to part-time work or other circumstances. It allows the couple to effectively increase their retirement savings while enjoying the tax advantages of Traditional IRAs.

Navigating Income Limits for Maximum Benefits

While the income limit is a critical consideration, it’s not the sole factor in determining the success of your retirement savings plan. Other variables, such as investment strategy, contribution limits, and the potential for catch-up contributions, also play a significant role.

Exploring Other Retirement Accounts

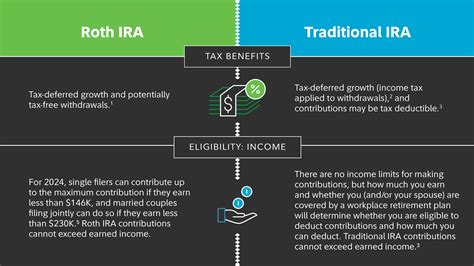

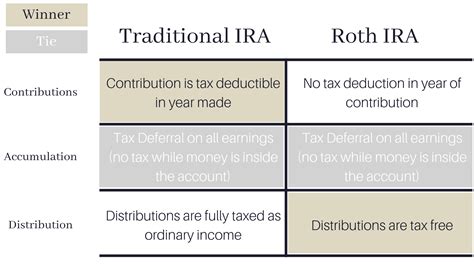

For individuals whose income exceeds the income limit, or who simply prefer a different retirement savings vehicle, there are alternative options to consider. Roth IRAs, for instance, do not have income limits for contributions, making them an attractive option for certain individuals. Additionally, employer-sponsored plans like 401(k)s and 403(b)s offer tax advantages and can be a significant component of a comprehensive retirement plan.

However, it's essential to understand the nuances of these alternative accounts. Roth IRAs, for example, do not offer an immediate tax deduction on contributions, but the growth and withdrawals are generally tax-free, offering a different set of advantages.

The Impact of Catch-Up Contributions

For individuals over the age of 50, the IRS allows for catch-up contributions, which are additional contributions to retirement accounts beyond the standard limits. This provision is particularly beneficial for those aiming to maximize their retirement savings in the lead-up to retirement.

Catch-up contributions can be a powerful tool to boost retirement savings, especially when combined with strategic IRA contributions within the income limit. However, it's important to note that catch-up contributions are subject to specific rules and limits, and they do not impact the income limit for tax deductions.

Future Implications and Planning

The landscape of retirement savings and tax deductions is ever-evolving. As the IRS continues to update its guidelines and income limits, it’s crucial for individuals to stay informed and adapt their financial strategies accordingly.

Staying Informed for Long-Term Planning

Long-term financial planning requires a proactive approach. Individuals should make it a habit to review and understand the annual updates to income limits and contribution rules. This ensures that their retirement savings strategy remains aligned with the current regulations, minimizing the risk of missed opportunities or unexpected tax liabilities.

Furthermore, staying informed about potential changes in tax laws can provide an edge in financial planning. While predicting legislative changes is challenging, being aware of proposed reforms or ongoing discussions can help individuals make more strategic decisions about their retirement savings and investments.

The Role of Financial Advisors

For individuals seeking expert guidance, financial advisors can provide invaluable support in navigating the complexities of retirement planning. A financial advisor can offer personalized advice, taking into account an individual’s unique financial situation, goals, and risk tolerance. They can also provide ongoing support, ensuring that an individual’s retirement plan remains robust and responsive to changing circumstances.

Financial advisors can help individuals optimize their retirement savings by recommending strategies tailored to their specific income and financial goals. This could involve a combination of IRA contributions, employer-sponsored plans, and other investment vehicles, all designed to maximize tax benefits and retirement savings.

Conclusion

Understanding and navigating the Ira Tax Deduction Income Limit is a critical component of effective retirement planning. By staying informed about the annual income limits and contribution rules, individuals can make strategic decisions to maximize their tax deductions and retirement savings.

This comprehensive guide has shed light on the complexities of the income limit, offering insights into strategic IRA contributions, the role of spousal IRAs, and the potential of catch-up contributions. Additionally, it has highlighted the importance of exploring alternative retirement accounts and the value of staying informed about future changes in tax laws.

As you embark on your journey towards a secure financial future, remember that knowledge is power. By staying informed and adapting your strategies, you can make the most of the tax benefits offered by IRAs and other retirement savings vehicles. Here's to a well-planned and secure retirement!

Can I still contribute to a Traditional IRA if my income exceeds the income limit?

+Yes, you can still contribute to a Traditional IRA, but you may not be eligible for a tax deduction on those contributions. However, the growth on your investments within the IRA will still benefit from tax-deferred growth.

Are there any strategies to maintain eligibility for the full IRA tax deduction if my income is close to the limit?

+Yes, you can consider optimizing your income through tax-efficient strategies, such as timing the sale of assets or utilizing tax-loss harvesting techniques. Additionally, contributing earlier in the year can help ensure you qualify for the full deduction if your income fluctuates.

What is the difference between a Traditional IRA and a Roth IRA, and which is better for me?

+A Traditional IRA offers an immediate tax deduction on contributions, while a Roth IRA does not. However, Roth IRA withdrawals in retirement are generally tax-free, whereas Traditional IRA withdrawals are taxed. The choice between the two depends on your current tax bracket and retirement income expectations.