Sales Tax New York

Sales tax in New York is a complex system that varies across the state and applies to a wide range of goods and services. Understanding the nuances of this tax is crucial for both consumers and businesses alike. In this comprehensive guide, we delve into the specifics of New York's sales tax, exploring its rates, applicability, exemptions, and the impact it has on the state's economy.

New York’s Sales Tax Structure

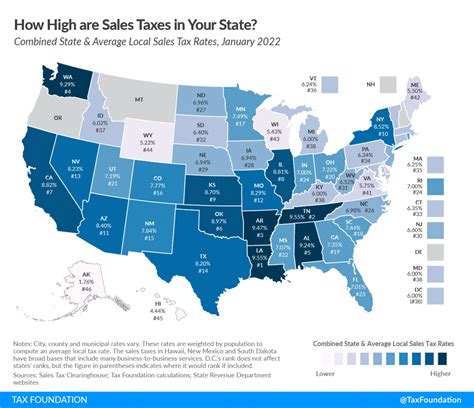

The sales tax in New York is a combined state and local tax, meaning that the total tax rate applied to a transaction consists of both state and local components. This unique structure results in varying tax rates across different regions within the state.

The statewide sales tax rate in New York is set at 4%. This rate is applied uniformly across the state and forms the base for the total sales tax. However, it is important to note that local governments, including counties, cities, and special districts, are authorized to levy additional sales taxes, which can significantly increase the total tax burden.

Local Sales Tax Rates

The local sales tax rates in New York vary widely, ranging from 0% to 4.75%. These rates are determined by the local governing bodies and can be influenced by factors such as the need for additional revenue for local services, infrastructure development, or specific initiatives.

| County | City | Total Sales Tax Rate |

|---|---|---|

| Albany | Albany | 8.0% |

| Monroe | Rochester | 8.75% |

| Nassau | Nassau | 8.625% |

| Suffolk | Suffolk | 8.625% |

| Westchester | Westchester | 8.375% |

Applicability of Sales Tax

The sales tax in New York is applicable to a wide range of transactions, encompassing both tangible and certain intangible goods and services. Understanding the scope of sales tax applicability is crucial for businesses to ensure compliance and for consumers to be aware of their tax obligations.

Tangible Personal Property

Sales tax is primarily levied on the sale of tangible personal property, which includes items such as:

- Clothing and footwear

- Electronics and appliances

- Furniture and home furnishings

- Jewelry and accessories

- Books, magazines, and newspapers

- Sporting goods and recreational equipment

- Automotive parts and accessories

Services and Intangible Goods

In addition to tangible goods, New York imposes sales tax on certain services and intangible goods. These include:

- Telecommunications services

- Internet access services

- Cable and satellite television services

- Public utility services (electricity, gas, water)

- Hotel and lodging services

- Admission fees for entertainment events (movies, concerts)

- Certain professional services (legal, accounting)

Sales Tax Exemptions

While sales tax is broadly applicable, New York does offer exemptions for certain goods and services. These exemptions are designed to alleviate the tax burden on specific industries, promote economic development, or support social causes.

Food and Beverage Exemptions

One notable exemption in New York is the sales tax on unprepared food, including:

- Fresh fruits and vegetables

- Meat, poultry, and seafood

- Dairy products

- Bread and other staple foods

However, it's important to note that prepared food, such as meals in restaurants or delis, is subject to sales tax.

Clothing and Shoe Exemptions

New York also provides sales tax exemptions for clothing and footwear under certain conditions. Items that cost $110 or less per article are exempt from sales tax. This exemption is particularly beneficial for low-income individuals and families.

Agricultural and Manufacturing Exemptions

Sales tax is generally not applicable to the sale of agricultural products and certain manufacturing inputs. This exemption aims to support the state’s agricultural industry and promote manufacturing activities.

Impact on the Economy

The sales tax in New York plays a significant role in the state’s economy, serving as a substantial source of revenue for both the state and local governments. The revenue generated from sales tax is used to fund various public services, infrastructure projects, and social programs.

Revenue Generation

In the fiscal year 2021-2022, New York collected $18.1 billion in sales and use taxes, accounting for approximately 14.3% of the state’s total revenue. This substantial revenue stream allows the state to invest in critical areas such as education, healthcare, transportation, and public safety.

Economic Development and Job Creation

The sales tax structure in New York also serves as an incentive for economic development and job creation. Local governments can utilize their authority to impose additional sales taxes to fund specific initiatives, such as infrastructure improvements, which can attract businesses and create employment opportunities.

Consumer Behavior and Spending Patterns

The varying sales tax rates across different regions can influence consumer behavior and spending patterns. In areas with higher sales tax rates, consumers may be more inclined to shop online or in neighboring regions with lower tax rates. Understanding these dynamics is crucial for businesses to optimize their pricing strategies and customer engagement.

Compliance and Reporting

Ensuring compliance with New York’s sales tax regulations is a critical responsibility for businesses operating within the state. Failure to comply can result in penalties, interest, and legal consequences.

Registration and Collection

Businesses are required to register for a sales tax permit with the New York State Department of Taxation and Finance if they meet certain criteria, such as having a physical presence in the state or exceeding a specific sales threshold. Once registered, businesses must collect the appropriate sales tax from customers and remit it to the state on a regular basis.

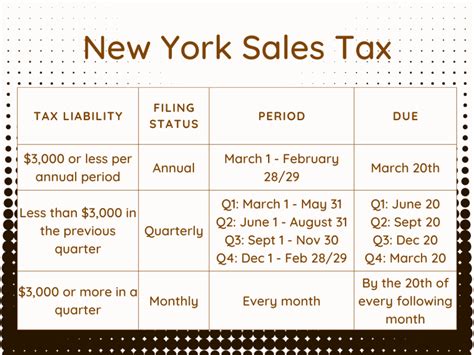

Sales Tax Returns and Remittance

Businesses are obligated to file sales tax returns periodically, typically on a monthly, quarterly, or annual basis, depending on their sales volume. These returns detail the total sales, applicable tax rates, and the amount of tax collected. The sales tax remitted must be paid to the state by the due date to avoid penalties.

Audit and Enforcement

The New York State Department of Taxation and Finance conducts audits to ensure compliance with sales tax regulations. During an audit, businesses must provide detailed records and documentation to support their sales tax reporting. Non-compliance can result in audits, fines, and legal actions.

Future Implications and Trends

The sales tax landscape in New York is subject to ongoing changes and developments. Understanding these trends is crucial for businesses and consumers to stay informed and adapt to evolving tax regulations.

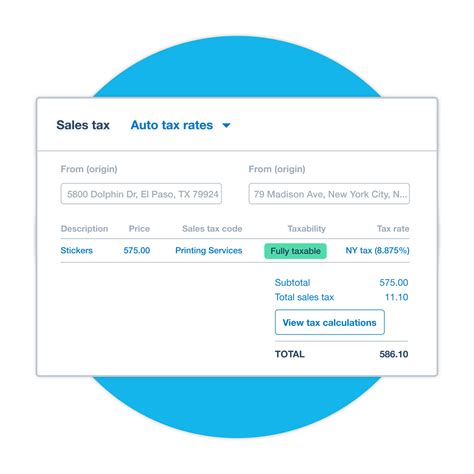

Online Sales Tax

With the growth of e-commerce, the collection of sales tax on online transactions has become a significant focus for state governments. New York has implemented measures to ensure that online retailers collect and remit sales tax, even if they do not have a physical presence in the state. This trend is expected to continue, with further efforts to streamline online sales tax collection.

Sales Tax Simplification

There have been ongoing discussions and proposals to simplify the sales tax system in New York. Some of these proposals aim to standardize the tax rates across the state or streamline the registration and reporting processes for businesses. While these initiatives may face challenges, they could significantly impact the administrative burden on businesses and the overall tax structure.

Environmental and Social Initiatives

New York has been at the forefront of environmental and social initiatives. In recent years, there have been proposals to introduce sales tax exemptions or reduced rates for environmentally friendly products or services. Additionally, discussions around sales tax reforms have considered the impact on low-income communities and the potential for targeted exemptions or relief measures.

How often do sales tax rates change in New York?

+Sales tax rates in New York can change periodically, typically as a result of legislative actions or local government decisions. While the statewide rate has remained stable, local tax rates may fluctuate based on local needs and initiatives. It’s important for businesses and consumers to stay updated on any changes to ensure compliance and accurate tax calculations.

Are there any sales tax holidays in New York?

+Yes, New York has implemented sales tax holidays in the past, typically for specific periods during the year. These holidays often apply to certain categories of goods, such as clothing, school supplies, or energy-efficient appliances. Sales tax holidays can provide significant savings for consumers and encourage spending. It’s important to check the official state website for any upcoming sales tax holidays and their applicable dates and restrictions.

How does New York handle sales tax for online purchases?

+New York has implemented measures to collect sales tax on online purchases, even if the retailer does not have a physical presence in the state. This is in line with the federal Wayfair decision, which allows states to require out-of-state sellers to collect and remit sales tax. Online retailers are obligated to collect the appropriate sales tax based on the buyer’s shipping address and remit it to the state.