Income Tax Rate In Wisconsin

Income tax rates are an essential aspect of personal finance and tax planning, and understanding the tax landscape in your state can be crucial for financial decision-making. In Wisconsin, income tax rates play a significant role in the state's economy and the financial lives of its residents. Let's delve into the intricacies of Wisconsin's income tax system, exploring its structure, rates, and how it impacts individuals and businesses.

Understanding Wisconsin’s Income Tax Structure

Wisconsin operates on a progressive income tax system, which means that higher incomes are taxed at higher rates. This progressive nature ensures that individuals with higher earning capabilities contribute a larger proportion of their income to the state’s revenue. The state’s income tax rates are categorized into brackets, and the applicable rate depends on the taxpayer’s income level.

| Income Bracket (Single Filers) | Tax Rate |

|---|---|

| $0 - $10,750 | 3.62% |

| $10,751 - $17,499 | 4.62% |

| $17,500 - $35,000 | 5.62% |

| $35,001 - $75,000 | 6.27% |

| $75,001 - $117,000 | 6.88% |

| $117,001 - $262,000 | 7.65% |

| $262,001 and above | 7.72% |

For married couples filing jointly, the income brackets and tax rates are adjusted accordingly. It's important to note that these rates are subject to change and may vary based on legislative decisions and economic conditions.

Tax Credits and Deductions

Wisconsin offers a range of tax credits and deductions to ease the tax burden on individuals and families. These incentives aim to support low-income earners, promote education, and encourage specific behaviors. Some notable tax credits include the Earned Income Tax Credit, Child and Dependent Care Credit, and the Property Tax Credit.

Additionally, Wisconsin allows itemized deductions, which can further reduce taxable income. These deductions can include expenses for medical care, charitable contributions, mortgage interest, and state and local taxes.

Impact on Individuals and Businesses

Wisconsin’s income tax rates have a direct impact on the financial decisions and planning of its residents. For individuals, understanding the tax brackets and potential deductions can influence how they manage their income and investments. Higher earners, in particular, may need to strategize their financial plans to optimize their tax liabilities.

Businesses operating in Wisconsin also navigate the state's tax landscape. The income tax rates, combined with other business taxes and incentives, can influence a company's decision to establish or expand its operations in the state. Wisconsin offers various tax credits and incentives to attract businesses, particularly those in high-growth sectors like technology and manufacturing.

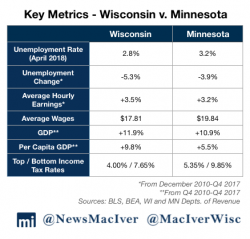

Comparison with Other States

When comparing Wisconsin’s income tax rates to those of other states, it’s evident that Wisconsin’s rates are relatively moderate. Some states have no income tax at all, while others have higher rates, especially for top earners. This variation in tax policies across states can lead to tax migration, where individuals and businesses consider relocating to states with more favorable tax environments.

| State | Top Income Tax Rate |

|---|---|

| California | 13.3% |

| New York | 8.82% |

| Florida | 0% (No income tax) |

| Texas | 0% (No income tax) |

| Illinois | 4.95% |

| Minnesota | 9.85% |

| Wisconsin | 7.72% |

Future Outlook and Tax Policy

The future of Wisconsin’s income tax rates is intertwined with the state’s economic and political landscape. As the state’s economy evolves, so too may its tax policies. Economic growth and changing demographics can influence the need for tax reform, potentially impacting the rates and brackets. Additionally, political dynamics and public opinion play a crucial role in shaping tax legislation.

Potential Tax Reform

Proposed tax reforms in Wisconsin often center around flattening the tax rate or introducing a single-rate tax system. While these proposals aim to simplify the tax structure, they may also shift the tax burden. Lower-income earners could face higher effective tax rates, while higher-income earners might see a reduction in their tax liabilities.

It's important to monitor these discussions, as they can have significant implications for taxpayers. Understanding the potential outcomes of tax reform is crucial for financial planning and decision-making.

Conclusion

Wisconsin’s income tax rates are a key component of the state’s fiscal policy, impacting the lives of its residents and the operations of businesses. Understanding the progressive nature of the tax system, along with the available credits and deductions, is essential for effective tax planning. As Wisconsin’s economic and political landscape evolves, so too will its tax policies, making it imperative for individuals and businesses to stay informed and adapt their financial strategies accordingly.

What is the income tax rate for Wisconsin residents?

+Wisconsin’s income tax rates are progressive, ranging from 3.62% to 7.72% based on income brackets. These rates are subject to change and are applied differently for single filers and married couples filing jointly.

Are there any tax credits or deductions available in Wisconsin?

+Yes, Wisconsin offers various tax credits, including the Earned Income Tax Credit, Child and Dependent Care Credit, and Property Tax Credit. Additionally, itemized deductions are allowed for expenses like medical care, charitable contributions, and mortgage interest.

How do Wisconsin’s income tax rates compare to other states?

+Wisconsin’s income tax rates are relatively moderate compared to some states. While some states have no income tax, others have higher rates. California, for example, has a top income tax rate of 13.3%, while Florida and Texas have no income tax.

What impact do income tax rates have on businesses in Wisconsin?

+Income tax rates, along with other business taxes and incentives, can influence a company’s decision to operate in Wisconsin. The state offers tax credits and incentives to attract businesses, especially in high-growth sectors.

Are there any proposed tax reforms in Wisconsin?

+Yes, proposed tax reforms in Wisconsin often involve flattening the tax rate or introducing a single-rate system. These reforms aim to simplify the tax structure but may also shift the tax burden, impacting taxpayers differently.