Car Sales Tax In Utah

Understanding the intricacies of car sales tax is crucial when making a vehicle purchase, especially when navigating the unique tax landscape of each state. In Utah, the sales tax on cars is an essential consideration for both residents and those planning to relocate to the Beehive State. This comprehensive guide will delve into the specifics of car sales tax in Utah, providing an in-depth analysis of the rates, exemptions, and strategies to ensure a smooth and cost-effective transaction.

The Landscape of Car Sales Tax in Utah

Utah’s sales tax system is governed by a combination of state and local laws, which can result in varying tax rates depending on the location of the purchase. The state sales tax in Utah stands at 4.70%, which is applied uniformly across the state. However, this is just the beginning of the story; local municipalities have the authority to levy additional sales taxes, often referred to as “local option taxes.”

These local option taxes can significantly impact the overall sales tax rate on car purchases. For instance, in Salt Lake City, a 1.75% local option tax is applied, bringing the total sales tax rate to 6.45%. In contrast, rural areas like Emery County have a lower local option tax of 0.5%, resulting in a total sales tax rate of 5.20%. This variability underscores the importance of understanding the specific tax rate in your area before finalizing a car purchase.

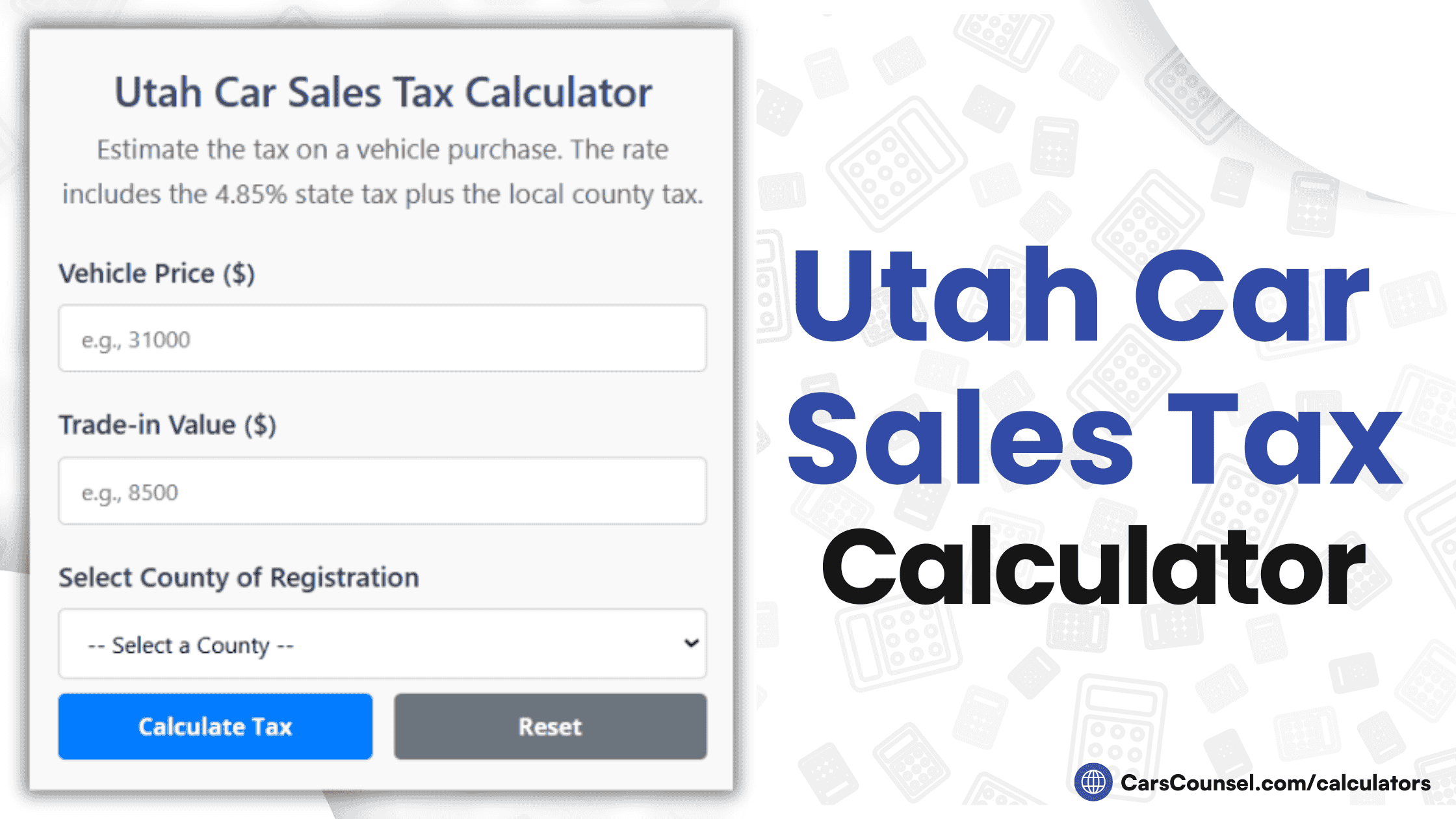

The Calculation Process

Calculating the sales tax on a car purchase in Utah involves a straightforward formula. Start by multiplying the purchase price of the vehicle by the applicable sales tax rate. For instance, if you’re purchasing a car in Salt Lake City, you would multiply the purchase price by 0.0645 (or 6.45% as a decimal) to determine the sales tax amount.

| Location | State Sales Tax | Local Option Tax | Total Sales Tax Rate |

|---|---|---|---|

| Salt Lake City | 4.70% | 1.75% | 6.45% |

| Emery County | 4.70% | 0.5% | 5.20% |

| Utah County | 4.70% | 1.5% | 6.20% |

Let's illustrate this with an example. If you're buying a car priced at $25,000 in Salt Lake City, the sales tax calculation would be: $25,000 x 0.0645 = $1,612.50. This means you would owe $1,612.50 in sales tax on top of the purchase price.

Exemptions and Special Considerations

Utah, like many states, offers certain exemptions and special considerations when it comes to car sales tax. One notable exemption is for vehicles purchased from a private seller. If you’re buying a car from an individual rather than a dealership, you may not be subject to the standard sales tax rate. However, it’s crucial to consult with a tax professional to ensure compliance with all relevant laws and regulations.

Additionally, Utah provides a sales tax exemption for certain disabled individuals. If you qualify for the disability tax exemption, you may be eligible to purchase a vehicle without paying sales tax. This exemption is designed to provide financial relief to those with specific disabilities, making car ownership more accessible.

Strategies for Minimizing Car Sales Tax

While the sales tax on cars in Utah is a mandatory expense, there are strategies you can employ to minimize the impact on your wallet. Here are some effective approaches:

Shop Around for the Best Deal

Utah’s diverse sales tax landscape presents an opportunity to save by shopping around. If you’re flexible with your location, consider purchasing your vehicle in an area with a lower sales tax rate. For example, buying a car in Emery County, with its 5.20% total sales tax rate, could save you money compared to Salt Lake City’s 6.45% rate.

Consider Lease vs. Buy

Leasing a car can be a tax-efficient alternative to purchasing. When you lease a vehicle, the sales tax is typically calculated based on the monthly lease payments rather than the full purchase price. This can result in a lower upfront tax cost. However, it’s important to carefully evaluate the total cost of leasing versus buying over the long term.

Utilize Tax Credits and Incentives

Utah, like many states, offers various tax credits and incentives to promote the purchase of energy-efficient vehicles. These incentives can significantly reduce the overall cost of your car purchase. Stay informed about the latest tax credits and incentives available, as they can provide substantial savings.

Timing Your Purchase

The timing of your car purchase can also influence the sales tax you pay. Certain periods, like tax-free weekends or end-of-year sales, may offer opportunities to save on sales tax. Additionally, keeping an eye on the local tax calendar can help you identify periods when local option taxes may be temporarily reduced or waived.

The Impact of Car Sales Tax on the Utah Economy

The sales tax on cars plays a significant role in Utah’s economy, contributing to the state’s revenue stream. In the fiscal year 2022, vehicle sales taxes generated over $240 million for the state, a substantial portion of its total revenue. This revenue is allocated towards various public services, infrastructure development, and community initiatives.

However, the sales tax on cars also influences consumer behavior. The variability in tax rates across the state can lead to "tax shopping," where consumers choose to purchase vehicles in areas with lower tax rates. This phenomenon can impact local economies, with some regions experiencing a boost in car sales revenue while others may see a decline.

Future Trends and Considerations

Looking ahead, several factors could influence the future of car sales tax in Utah. The increasing popularity of electric vehicles (EVs) and the potential for federal and state incentives for EV purchases may shift the tax landscape. Additionally, the ongoing debate surrounding the fairness of sales tax systems, particularly in relation to online sales, could lead to legislative changes that impact car sales tax.

Staying informed about these trends and potential changes is essential for both consumers and businesses operating in Utah's automotive industry. It's a dynamic landscape that requires a proactive approach to ensure compliance and optimize financial outcomes.

Conclusion

Understanding and navigating the car sales tax system in Utah is a critical aspect of making an informed vehicle purchase. By familiarizing yourself with the state and local tax rates, exemptions, and strategies for minimizing costs, you can ensure a more financially sound decision. Remember, staying informed and consulting with tax professionals can make all the difference in ensuring a smooth and cost-effective transaction.

What is the current sales tax rate for cars in Utah?

+

The state sales tax rate in Utah is 4.70%, but local option taxes can vary, resulting in a total sales tax rate ranging from 5.20% to 6.45% depending on the location.

Are there any exemptions for car sales tax in Utah?

+

Yes, Utah offers exemptions for private sales and certain disabled individuals. However, it’s crucial to consult with a tax professional to ensure eligibility and compliance.

How can I minimize the sales tax on my car purchase in Utah?

+

Strategies to minimize sales tax include shopping around for the best deal, considering leasing vs. buying, utilizing tax credits and incentives, and timing your purchase to take advantage of tax-free periods or reduced tax rates.

What is the impact of car sales tax on Utah’s economy?

+

Car sales tax generates substantial revenue for Utah, contributing over $240 million in the fiscal year 2022. This revenue supports public services and infrastructure development. However, it also influences consumer behavior and local economies due to tax shopping.

What future trends might impact car sales tax in Utah?

+

Future trends include potential incentives for electric vehicle purchases and ongoing debates about the fairness of sales tax systems, particularly in relation to online sales. These factors could lead to legislative changes impacting car sales tax.