Canadian Company Tax Rate

When doing business in Canada, understanding the tax landscape is crucial. Canada has a progressive tax system, which means that the tax rate applied to a company's income depends on the level of income. This system aims to ensure fairness and contribute to the country's revenue. Let's delve into the specifics of the Canadian company tax rate, exploring its structure, applicable rates, and how it compares to other jurisdictions.

Canadian Company Tax Structure

Canada’s corporate tax system operates on a territorial basis, which means that the tax rate is primarily determined by the location of the company’s activities and the specific tax jurisdiction within the country. The federal government sets the base corporate tax rate, and each province and territory can apply additional tax rates, resulting in varying tax burdens across the nation.

The corporate tax structure in Canada is designed to encourage investment and economic growth. It offers several tax incentives and deductions to promote innovation, research and development, and job creation. These incentives vary depending on the industry, region, and the nature of the business activities.

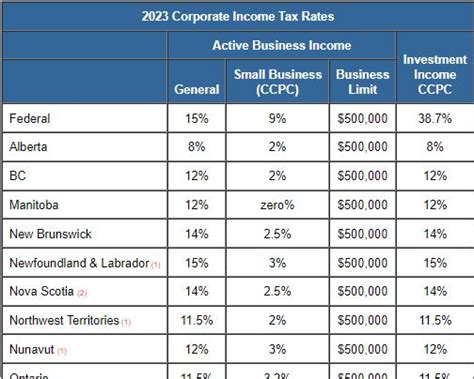

Federal Corporate Tax Rate

The federal government in Canada imposes a general corporate tax rate of 15% on active business income. This rate applies to most Canadian-controlled private corporations (CCPCs) and other corporate entities. CCPCs are companies where Canadian residents own a controlling interest, and they benefit from a lower tax rate compared to foreign-controlled corporations.

For non-CCPCs, the federal corporate tax rate is 27.5%, which is applied to passive income and income from certain specified investments. Passive income refers to revenue derived from sources such as interest, dividends, and capital gains, rather than active business operations.

Provincial and Territorial Corporate Tax Rates

In addition to the federal corporate tax rate, companies operating in Canada must also consider the provincial and territorial tax rates. These rates can vary significantly across the country, with some provinces offering lower tax rates to attract businesses and stimulate economic development.

| Province/Territory | Corporate Tax Rate |

|---|---|

| Alberta | 12% |

| British Columbia | 12% |

| Manitoba | 12% |

| New Brunswick | 14% |

| Newfoundland and Labrador | 15% |

| Northwest Territories | 12% |

| Nova Scotia | 16% |

| Nunavut | 11% |

| Ontario | 11.5% |

| Prince Edward Island | 16% |

| Quebec | 11.58% |

| Saskatchewan | 12% |

| Yukon | 12% |

It's important to note that these tax rates are subject to change, and companies should refer to the official tax regulations and guidelines provided by the Canada Revenue Agency (CRA) and the respective provincial and territorial tax authorities for the most up-to-date information.

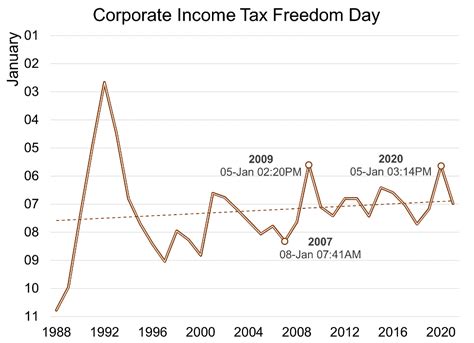

Comparing Canadian Corporate Tax Rates

When assessing the Canadian corporate tax rate, it is beneficial to compare it to other countries to understand its competitiveness and attractiveness for businesses. Here’s a comparison with a few prominent jurisdictions:

United States

The US federal corporate tax rate is 21%, which is higher than Canada’s federal rate of 15% for CCPCs. However, it’s worth noting that the US has a more complex tax system with varying state-level tax rates. Some states offer lower tax rates to compete for businesses, while others have higher rates. On average, the combined federal and state corporate tax rates in the US are comparable to those in Canada.

United Kingdom

The UK has a corporate tax rate of 19%, which is slightly lower than Canada’s federal rate. The UK’s tax system is relatively straightforward, with a single rate applicable to all companies. However, the UK offers various tax incentives and allowances, similar to Canada, to promote investment and economic growth.

Germany

Germany’s corporate tax rate stands at 15%, which is identical to Canada’s federal rate for CCPCs. The German tax system is known for its simplicity and transparency, with a single rate applicable to all corporate entities. Germany also provides a range of tax incentives and deductions to support businesses, especially in research and development.

Australia

Australia has a corporate tax rate of 30%, which is higher than Canada’s federal rate. The Australian tax system is relatively complex, with different rates applicable to small and large businesses. However, Australia offers various tax concessions and incentives to promote investment and entrepreneurship.

Tax Incentives and Deductions in Canada

Canada’s corporate tax system is designed to support businesses and promote economic growth. As such, it offers a range of tax incentives and deductions that can significantly reduce a company’s tax burden. Here are some notable examples:

Small Business Deduction

The Small Business Deduction is a key tax incentive in Canada. It allows eligible CCPCs to reduce their taxable income by up to $500,000, resulting in a lower effective tax rate. This deduction aims to support small and medium-sized enterprises and encourage entrepreneurship.

Research and Development (R&D) Tax Credits

Canada provides generous tax credits for companies engaged in research and development activities. The Scientific Research and Experimental Development (SR&ED) program offers tax incentives to encourage innovation and technological advancement. Companies can claim a 35% refundable tax credit on eligible R&D expenses, providing a significant boost to their bottom line.

Investment Tax Credits

Canada offers investment tax credits to promote investment in certain industries and activities. These credits can be claimed for investments in manufacturing and processing, film and video production, renewable energy, and more. The credits can reduce the tax burden on companies and encourage investment in specific sectors.

Conclusion: Navigating the Canadian Corporate Tax Landscape

Understanding the Canadian company tax rate is essential for businesses operating in the country. With a progressive tax system and varying rates across provinces and territories, companies must stay informed about the tax regulations and incentives available to them. By leveraging the tax structure and incentives effectively, businesses can optimize their tax obligations and contribute to Canada’s economic growth.

What is the general corporate tax rate in Canada for Canadian-controlled private corporations (CCPCs)?

+The general corporate tax rate for CCPCs in Canada is 15% on active business income.

How does Canada’s corporate tax system compare to other countries?

+Canada’s corporate tax rate is generally competitive, with some provinces offering lower rates to attract businesses. However, it’s important to consider the overall tax burden, including provincial and territorial rates, when comparing jurisdictions.

What tax incentives are available for companies in Canada?

+Canada offers a range of tax incentives, including the Small Business Deduction, Research and Development (R&D) tax credits, and investment tax credits for specific industries. These incentives aim to support businesses and promote economic growth.