Income Tax Rate For Michigan

The state of Michigan, located in the Great Lakes region of the United States, has a progressive income tax system. This means that the tax rate an individual pays is determined by their taxable income, with higher income brackets being subject to higher tax rates. Understanding Michigan's income tax structure is crucial for residents and businesses operating within the state, as it directly impacts their financial planning and tax obligations.

Income Tax Rates in Michigan

As of my last update in January 2023, Michigan imposes a flat income tax rate of 4.25% on all taxable income. This rate is applied to both individuals and businesses, including sole proprietors, partnerships, and corporations. The state’s income tax is relatively straightforward compared to some other states with more complex tax structures.

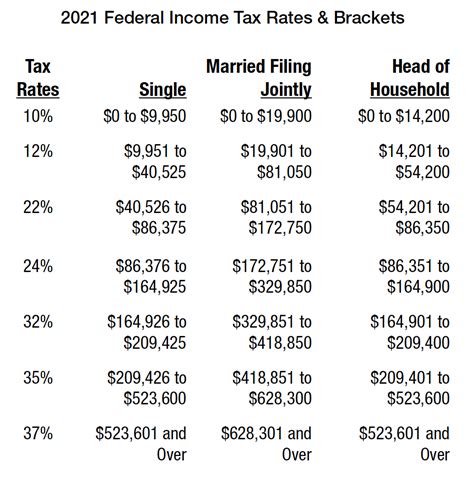

It's important to note that Michigan's income tax rate is separate from federal income tax, which is determined by the Internal Revenue Service (IRS) and can vary based on an individual's tax filing status, deductions, and credits.

Historical Perspective

Michigan’s income tax rate has evolved over the years. Prior to 1967, the state did not have an income tax. The introduction of the income tax in Michigan aimed to provide a more stable and reliable source of revenue for the state government, which was previously heavily reliant on property taxes.

Since its inception, the income tax rate has undergone several changes. In 1993, the rate was raised to 4.6% to help fund education initiatives. However, in 2011, the rate was reduced to the current flat rate of 4.25%, aiming to provide tax relief and stimulate economic growth.

| Tax Rate History | Period |

|---|---|

| No Income Tax | Before 1967 |

| 4.6% | 1993 - 2010 |

| 4.25% | 2011 - Present |

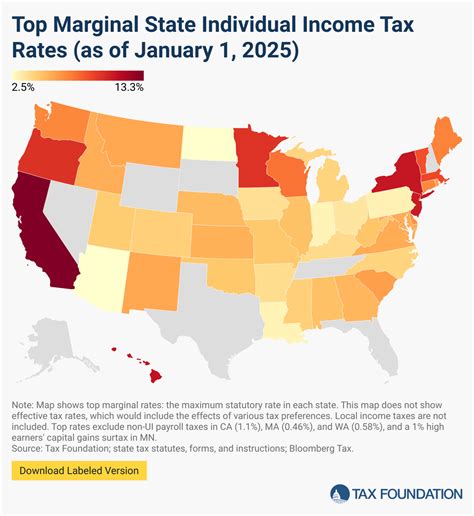

Comparison with Other States

Michigan’s income tax rate of 4.25% is relatively moderate compared to many other states. Some states, like California and New York, have progressive income tax systems with rates ranging from 1% to over 10%, depending on income levels. On the other hand, several states, including Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming, have no income tax at all.

Taxable Income and Deductions

Michigan’s income tax is based on an individual’s or business’s taxable income. Taxable income is calculated by subtracting any allowable deductions and exemptions from an individual’s total income. These deductions can include personal exemptions, standard deductions, and itemized deductions, such as medical expenses, charitable contributions, and certain business expenses.

Common Deductions in Michigan

-

Standard Deduction: Individuals can choose to claim a standard deduction, which is a fixed amount based on their filing status. For the 2022 tax year, the standard deduction amounts were 4,750 for single filers, 9,500 for married filing jointly, and $7,000 for head of household filers.

-

Personal Exemptions: Michigan allows personal exemptions for each dependent claimed on a tax return. However, these exemptions were phased out starting in 2018 due to federal tax reforms. As of 2022, personal exemptions are no longer available in Michigan.

-

Itemized Deductions: Taxpayers have the option to itemize their deductions, listing specific expenses that qualify. Common itemized deductions in Michigan include mortgage interest, property taxes, state and local income taxes, and charitable contributions.

Filing Requirements and Deadlines

Michigan residents and businesses are required to file their income tax returns annually, typically by April 15th, mirroring the federal tax filing deadline. However, if this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers can file their returns electronically or by mail.

Filing Options and Extensions

The Michigan Department of Treasury provides several options for filing income tax returns:

-

Online Filing: Taxpayers can use the Michigan Online Tax System (MiOTS) to file their returns electronically. This system is user-friendly and offers real-time updates on the status of the return.

-

Paper Filing: Individuals and businesses can choose to file their returns on paper by downloading and printing the appropriate forms from the Department of Treasury’s website.

-

Tax Preparation Software: Many tax preparation software programs are available that can assist taxpayers in completing and filing their Michigan income tax returns.

In certain circumstances, taxpayers may request an extension to file their returns. To do so, they must file Form 4868 with the Michigan Department of Treasury before the original filing deadline. An extension allows taxpayers more time to complete their returns but does not extend the deadline for paying any taxes owed.

Tax Credits and Incentives

Michigan offers various tax credits and incentives to individuals and businesses to promote economic growth and support specific industries. These credits can reduce the amount of tax owed or provide refunds.

Common Tax Credits in Michigan

-

Homestead Property Tax Credit: Eligible homeowners in Michigan can receive a credit to offset a portion of their property taxes. This credit is designed to help homeowners with lower incomes.

-

Michigan Business Tax Credit (MBTC): Businesses operating in Michigan may be eligible for this credit, which is based on the amount of Michigan Business Tax paid in a given year.

-

Michigan Economic Growth Authority (MEGA) Tax Credit: This credit is aimed at encouraging businesses to invest in Michigan. It provides a credit against Michigan Business Tax or Michigan Income Tax for eligible businesses that meet certain investment and job creation criteria.

Future Implications and Potential Changes

Michigan’s income tax system is subject to ongoing review and potential changes. Economic conditions, political shifts, and legislative decisions can all influence the tax landscape. While the current flat tax rate of 4.25% has been stable for over a decade, there is no guarantee that it will remain unchanged.

Proposals for tax reform are periodically introduced in the Michigan legislature, which could lead to modifications in the tax structure, rates, or deductions. Additionally, federal tax reforms can indirectly impact state tax systems, as seen with the elimination of personal exemptions in Michigan due to the 2017 Tax Cuts and Jobs Act.

Staying informed about tax changes is crucial for individuals and businesses to ensure compliance and optimize their tax strategies. The Michigan Department of Treasury and local tax professionals can provide the most up-to-date information and guidance on any new developments.

Conclusion

Michigan’s income tax rate of 4.25% offers a relatively simple and moderate tax environment for individuals and businesses. While the state has made efforts to provide tax relief and promote economic growth, the tax system remains subject to potential changes and reforms. Understanding Michigan’s income tax structure, deductions, and credits is essential for effective financial planning and compliance with state tax laws.

What is the income tax rate for Michigan residents?

+

As of my knowledge cutoff in January 2023, Michigan residents pay a flat income tax rate of 4.25% on their taxable income.

Are there any deductions or exemptions available for Michigan taxpayers?

+

Yes, Michigan taxpayers can claim deductions such as the standard deduction, itemized deductions for specific expenses, and personal exemptions (though personal exemptions were phased out starting in 2018). These deductions can reduce taxable income, resulting in a lower tax liability.

When is the deadline for filing Michigan income tax returns?

+

The deadline for filing Michigan income tax returns is typically April 15th, in line with the federal tax filing deadline. If this date falls on a weekend or holiday, the deadline is extended to the next business day.

Are there any tax credits available in Michigan?

+

Yes, Michigan offers various tax credits to individuals and businesses. These include the Homestead Property Tax Credit for homeowners, the Michigan Business Tax Credit for businesses, and the Michigan Economic Growth Authority Tax Credit for businesses that meet certain investment and job creation criteria.

Can I file an extension for my Michigan income tax return?

+

Yes, taxpayers can request an extension to file their Michigan income tax returns by completing and submitting Form 4868 with the Michigan Department of Treasury before the original filing deadline. However, an extension does not extend the deadline for paying any taxes owed.