How to Claim Your il state tax refund Quickly and Easily

Filing for your Illinois state tax refund can often feel like navigating a complex maze, especially for those unfamiliar with the latest procedures and digital tools available. As the state continues to modernize tax processes, understanding how to claim your Illinois tax refund quickly and with minimal hassle becomes essential not only for financial peace of mind but also for optimizing your overall tax experience. This comprehensive guide aims to simplify the process, step-by-step, so you can confidently access your refund, whether you're a first-time filer or a seasoned taxpayer seeking efficiency.

Understanding Illinois State Tax Refunds: An Overview

Before diving into the claiming process, it’s important to understand the foundational elements of Illinois state tax refunds. The Illinois Department of Revenue (IDOR) manages all tax collection and refunds, employing a combination of traditional paper methods and digital platforms. When you overpay your Illinois income taxes — whether through withholding, estimated payments, or credits — you become eligible for a refund of the excess amount.

Key factors influencing the refund timeline include the completeness of your filing, accuracy of provided data, and the chosen submission method. According to recent data from the IDOR, the average processing time for electronic refunds ranges from 2 to 4 weeks, significantly faster than paper submissions, which can take 6 to 8 weeks or longer.

Key Points

- Filing efficiency: Electronic submissions lead to faster refunds.

- Accuracy matters: Correct data minimizes delays caused by processing errors.

- Digital tools: Use official portals and apps for streamlined claiming.

- Monitor status: Stay updated with online tracking features.

- Timely filing: Submit your return before deadlines to avoid penalties and delays.

Step 1: Gather Essential Documents and Information

Starting with solid preparation sets the stage for a smooth claim process. Collect all relevant paperwork, such as your W-2 forms, 1099s, and previous year tax returns. Precise data on your income, withholding, and tax credits is critical for accurate filing. Notable items include:

- W-2s from your employers

- 1099 forms (if applicable)

- Proof of estimated payments or previous refunds

- Social Security number and date of birth

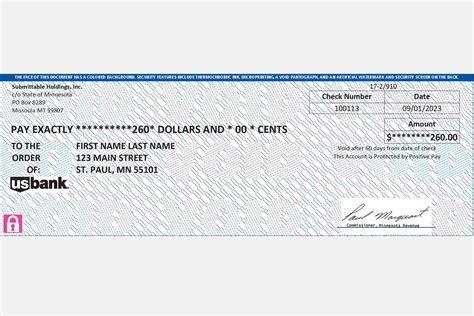

- Bank account information for direct deposit

Having these details at your fingertips reduces errors, accelerates verification, and secures your refund via the fastest payout method—direct deposit.

Step 2: Choose Your Filing Method — Online or Paper

The Illinois Department of Revenue strongly encourages electronic filing, citing efficiency and security as key benefits. You can file your Illinois state tax return through:

Official Illinois e-file System

The IDOR endorses its free or low-cost e-filing portal, accessible via the MyTax Illinois platform. To use this service, register for an account, verify your identity, and follow guided steps. Electronic filing reduces the risk of data entry errors and significantly cuts processing time.

Tax Software and Third-Party Providers

Alternatively, specialized tax software services—such as TurboTax, TaxAct, or H&R Block—support Illinois state returns. These platforms often integrate direct deposit and refund tracking features, enhancing user convenience.

Paper Filing

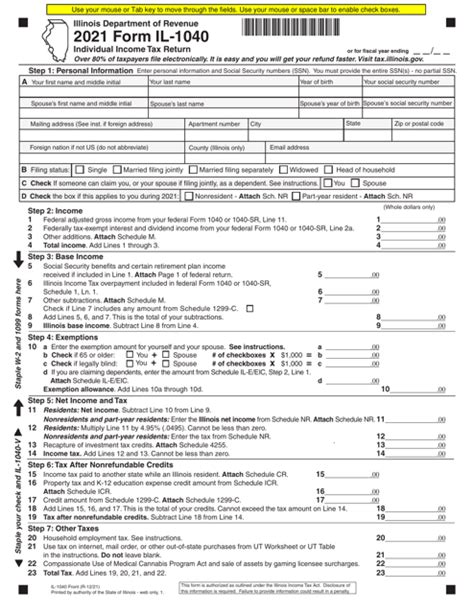

If you prefer traditional methods, download the Illinois Form IL-1040, fill out manually, and mail it to the designated address. Though this method is more time-consuming and susceptible to postal delays, some filers choose it for privacy concerns or familiarity.

Step 3: Complete Your Illinois State Return Accurately

Accurate completion of your tax forms is essential. Use your gathered documents to fill in details precisely, paying extra attention to:

- Filing status: Single, Married Filing Jointly, Head of Household, etc.

- Income calculations: Ensure all income sources are reported correctly.

- Tax credits and deductions: Claim eligible items to reduce liabilities or increase refunds.

- Bank information: Enter accurate routing and account numbers to facilitate direct deposit.

Leverage the validation tools within e-filing portals, which automatically flag common errors, ensuring your submission is complete and precise. The increased accuracy translates into faster processing and minimized rejection or correction cycles.

Step 4: Submit Your Return and Confirm Receipt

Once everything is reviewed, submit your return electronically. You’ll receive an acknowledgment receipt—save or print this confirmation for your records. If mailing, send your documents via certified mail with tracking to ensure delivery confirmation.

Using online submission not only speeds the process but also provides immediate confirmation that your return has been received by the Illinois Department of Revenue. Tracking your submission status via the MyTax Illinois portal is recommended for ongoing updates.

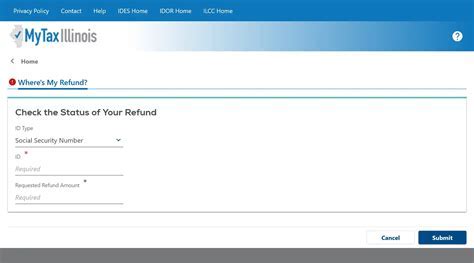

Step 5: Track Your Refund Status Actively

The IDOR provides a dedicated Tool for Refund Status Check, which can be accessed through your online account. Once your return is accepted, you’ll see updates about processing milestones—verification, approval, and disbursement stages.

For refunds via direct deposit, the timeline from acceptance to payout typically ranges between two to four weeks. If delays extend beyond this window, verifying the accuracy of your banking information and contacting the IDOR can help troubleshoot potential issues.

Additional Tips to Expedite Your Illinois Refund

Beyond the primary steps, consider these additional strategies for an expedited refund claim:

- File early: Submit your return as soon as you have all documents ready, before the April deadline.

- Use direct deposit: Opt for electronic funds transfer to get your refund faster.

- Double-check everything: Review all entries thoroughly to prevent rejection or reprocessing delays.

- Monitor your email: Stay alert for correspondence from the IDOR regarding your return status or any required actions.

Addressing Common Challenges and Limitations

Despite the streamlined digital procedures, some filers encounter hurdles such as delayed processing due to incomplete information, errors, or technical glitches. Addressing these efficiently involves:

- Responding promptly to any notices from the IDOR requesting additional information.

- Using customer support avenues provided by the Department and third-party software services.

- Ensuring your bank details are precise, especially if you’ve changed accounts recently, to avoid delays in direct deposit.

While the overall process is designed for speed and ease, understanding the common points of friction allows you to proactively mitigate potential delays, ensuring your refund arrives without unnecessary wait times.

FAQs about Claiming Your Illinois State Tax Refund

How quickly can I expect my Illinois state tax refund after filing?

+Typically, electronic filings are processed within 2 to 4 weeks, with direct deposit refunds arriving sooner. Paper returns may take 6 to 8 weeks or longer.

Can I track my Illinois refund online?

+Yes, through the MyTax Illinois portal, you can view real-time updates on your return’s status and refund processing stages.

What should I do if my refund is delayed beyond the typical processing time?

+If your refund hasn’t arrived within expected timeframes, verify your bank details, check for any correspondence from the IDOR, and contact their support line for assistance.

Is filing electronically secure and reliable?

+Absolutely. The Illinois Department of Revenue employs encryption and secure authentication measures to protect taxpayer data. E-filing is considered both safe and efficient.

What if I made a mistake on my return?

+You can file an amended return using Form IL-1040-X to correct errors. Prompt corrections help avoid delays and ensure accuracy in your refund processing.