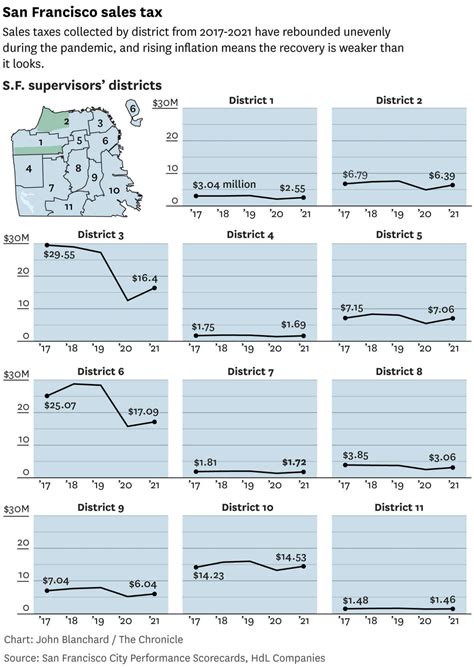

San Fran Sales Tax

Sales tax in San Francisco, California, is an important consideration for both businesses and consumers alike. Understanding the intricacies of this tax can provide valuable insights into the city's economy and its impact on local businesses and residents. As an expert in tax matters, I will delve into the specifics of San Francisco's sales tax, its rates, exemptions, and the implications it has on various industries within the city.

Understanding San Francisco’s Sales Tax Structure

San Francisco, like many other cities in California, operates within a complex sales tax system that consists of various tax rates and regulations. The sales tax in San Francisco is comprised of three primary components: the state sales tax rate, the county-wide sales tax rate, and the city-specific sales tax rate.

State Sales Tax Rate

California’s state sales tax rate is a uniform 7.25% across the state. This rate is set by the state government and applies to most retail transactions, including the sale of goods and certain services. It is a vital source of revenue for the state, funding various public services and infrastructure projects.

County Sales Tax Rate

San Francisco County, like many other counties in California, imposes an additional sales tax rate on top of the state rate. As of the latest available information, the county-wide sales tax rate in San Francisco is set at 1.25%. This additional tax is used to support county-specific initiatives and programs, ensuring the efficient functioning of local government services.

City Sales Tax Rate

San Francisco, as a bustling city with diverse economic activities, has its own unique sales tax rate. The city sales tax rate is currently set at 1.5%, bringing the total combined sales tax rate in San Francisco to 10% (7.25% state rate + 1.25% county rate + 1.5% city rate). This city-specific tax contributes to the city’s budget, allowing for the maintenance of essential services and the development of new initiatives.

It is important to note that while these rates are generally applicable, there may be specific industries or products that are subject to additional taxes or exemptions. For instance, certain food items, prescription drugs, and select services may have different tax rates or be exempt from sales tax altogether. These variations are determined by state and local laws and regulations.

| Tax Component | Rate |

|---|---|

| State Sales Tax | 7.25% |

| County Sales Tax | 1.25% |

| City Sales Tax | 1.5% |

| Total Combined Rate | 10% |

Impact on Local Businesses and Consumers

The sales tax structure in San Francisco has a significant impact on both local businesses and consumers. For businesses, the tax can influence pricing strategies, profit margins, and overall competitiveness in the market. Companies must carefully consider the tax rate when setting their retail prices to remain attractive to customers while maintaining a healthy bottom line.

From a consumer perspective, the sales tax can affect purchasing decisions and overall spending habits. Higher tax rates may discourage certain purchases, especially for discretionary items, as consumers may opt to save money by reducing their spending or shopping in neighboring areas with lower tax rates.

Competitive Pricing Strategies

To remain competitive, businesses in San Francisco often employ various pricing strategies. Some may choose to absorb the sales tax into their retail prices, offering a seamless shopping experience for customers. Others may opt for a more transparent approach, clearly displaying the tax amount on the receipt to educate consumers about the tax contribution they make with each purchase.

Exemptions and Incentives

San Francisco, like other cities, offers certain exemptions and incentives to promote specific industries or encourage particular behaviors. For instance, the city may exempt certain green technologies or sustainable products from sales tax to encourage their adoption. Additionally, there may be incentives for businesses that provide essential services or contribute to the local community in meaningful ways.

Compliance and Administration

Ensuring compliance with the sales tax regulations is a critical aspect of doing business in San Francisco. Businesses must accurately calculate and collect the appropriate sales tax on each transaction, and then remit these funds to the relevant tax authorities on a regular basis. Failure to comply with sales tax regulations can result in significant penalties and legal consequences.

Registration and Reporting

Businesses operating in San Francisco are required to register with the California Department of Tax and Fee Administration (CDTFA) to obtain a seller’s permit. This permit allows businesses to collect and remit sales tax legally. The CDTFA provides resources and guidance to help businesses understand their tax obligations and ensure compliance.

Once registered, businesses must regularly report their sales tax collections and remittances to the CDTFA. The frequency of these reports depends on the business's sales volume and may range from monthly to quarterly filings.

Audits and Enforcement

The CDTFA has the authority to conduct audits of businesses to ensure they are accurately calculating and remitting sales tax. These audits can be complex and time-consuming, requiring businesses to provide detailed records and documentation to support their tax filings. Failure to comply with audit requests can result in penalties and legal action.

Sales Tax Software and Solutions

To simplify the sales tax compliance process, many businesses in San Francisco utilize specialized software and solutions. These tools automate the calculation of sales tax based on the applicable rates and regulations, ensuring accuracy and reducing the risk of errors. Additionally, these solutions can streamline the reporting process, making it easier for businesses to meet their tax obligations.

Future Implications and Potential Changes

The sales tax landscape in San Francisco, like any other tax system, is subject to potential changes and adjustments. These changes can be driven by various factors, including economic conditions, political priorities, and shifts in consumer behavior.

Economic Factors

Economic downturns or recessions can impact the city’s budget and revenue streams, potentially leading to discussions about adjusting the sales tax rate. Similarly, periods of economic growth may provide an opportunity to reduce the tax burden on businesses and consumers, stimulating further economic activity.

Political Considerations

Changes in local or state government can bring new priorities and policies that may influence the sales tax rate. For instance, a new administration may propose adjustments to fund specific initiatives or address emerging social or economic issues. Public opinion and community feedback also play a significant role in shaping the tax landscape.

Consumer Behavior and Technology

Shifts in consumer behavior, such as a preference for online shopping or the adoption of new technologies, can impact the sales tax system. The rise of e-commerce, for example, has prompted discussions about the fair taxation of online transactions and the need for updated regulations to ensure compliance.

Potential Future Scenarios

While it is challenging to predict the exact future of San Francisco’s sales tax, certain scenarios are worth considering. The city may choose to adjust the tax rate to encourage economic growth, support specific industries, or address social issues. Alternatively, the tax system could undergo significant reforms to simplify compliance or adapt to the changing nature of retail transactions.

In conclusion, San Francisco's sales tax structure is a complex yet vital component of the city's economic ecosystem. It influences business strategies, consumer behavior, and the overall financial health of the city. As an expert in tax matters, I believe that a thorough understanding of this system is essential for businesses and consumers alike to navigate the local economy effectively and contribute to the city's prosperity.

What is the purpose of sales tax in San Francisco?

+

Sales tax in San Francisco, as in many other cities, is primarily a source of revenue for the city and county governments. The tax funds essential services, infrastructure projects, and local initiatives. It also contributes to the state’s overall revenue, which is used to support various public programs and services.

Are there any products or services exempt from sales tax in San Francisco?

+

Yes, certain products and services are exempt from sales tax in San Francisco. This includes prescription drugs, certain medical devices, and select services such as legal and professional services. Additionally, certain food items may be exempt or subject to a reduced tax rate.

How often do sales tax rates change in San Francisco?

+

Sales tax rates in San Francisco, as in many other jurisdictions, are subject to periodic reviews and potential adjustments. These changes are typically proposed and approved by local government bodies, such as the city council or county board of supervisors. While there is no set schedule for rate changes, they are generally proposed to address budget needs or economic priorities.