Will County Tax Bill

Property taxes in Will County, Illinois, are an important topic for homeowners and property owners alike. The tax bill, often referred to as the "Will County Tax Bill," is a crucial document that outlines the amount of taxes owed by property owners in the county. In this comprehensive article, we will delve into the intricacies of the Will County Tax Bill, exploring its components, calculation methods, payment options, and the impact it has on the local community.

Understanding the Will County Tax Bill

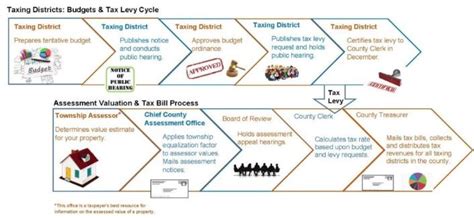

The Will County Tax Bill is an annual assessment sent to property owners, detailing the taxes levied on their real estate holdings. It is an essential part of the county’s revenue generation process, contributing to the funding of essential services and infrastructure development. Let’s break down the key elements of this tax bill and shed light on how it affects residents and businesses.

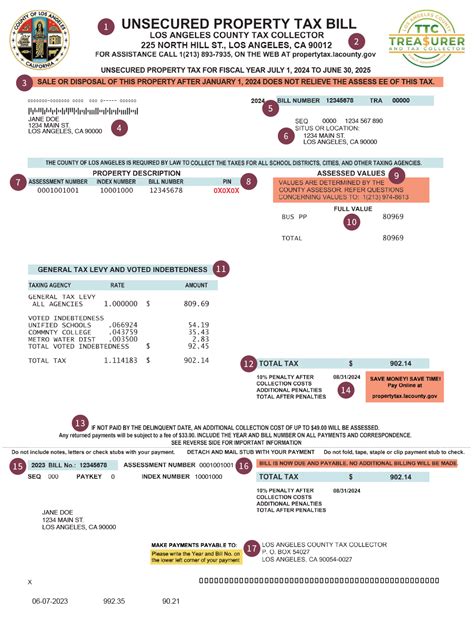

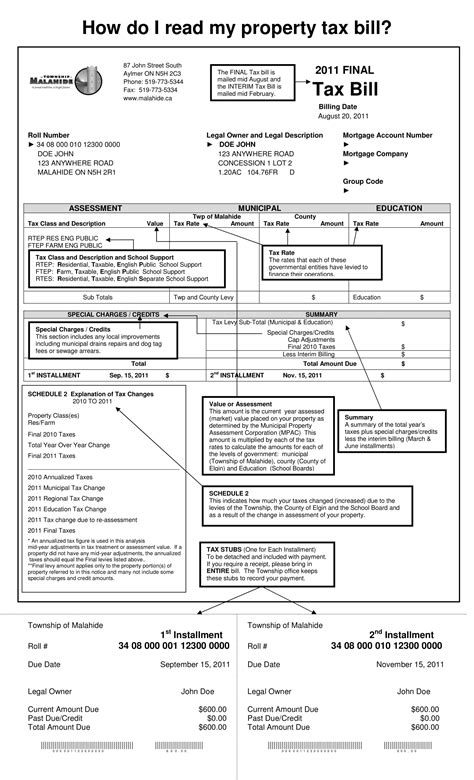

Components of the Tax Bill

The Will County Tax Bill comprises several crucial components that determine the final tax amount. These include:

- Assessed Value: The assessed value of a property is determined by the Will County Assessor's Office. It is an estimate of the property's fair market value and forms the basis for tax calculations.

- Tax Rate: The tax rate is established by various taxing bodies, such as the county, municipalities, school districts, and special purpose districts. It is expressed as a percentage and is applied to the assessed value to calculate the tax liability.

- Tax Exemptions: Certain properties may be eligible for tax exemptions, which reduce the overall tax burden. These exemptions can be based on factors like veteran status, senior citizen discounts, or specific property characteristics.

- Penalties and Fees: Late payments or non-compliance with tax obligations may result in penalties and additional fees. These charges are outlined in the tax bill to ensure transparency and prompt payment.

| Tax Component | Description |

|---|---|

| Assessed Value | Estimated fair market value of the property as determined by the Assessor's Office. |

| Tax Rate | Percentage rate applied to the assessed value, set by various taxing bodies. |

| Tax Exemptions | Reductions in tax liability based on specific criteria, such as veteran or senior status. |

| Penalties and Fees | Charges for late payments or non-compliance with tax regulations. |

Tax Bill Calculation

The calculation of the Will County Tax Bill involves a straightforward process. Here’s a step-by-step breakdown:

- Determine the assessed value of the property. This value is typically based on recent sales of comparable properties and is subject to periodic reassessments.

- Apply the tax rate to the assessed value. The tax rate is a combination of rates set by different taxing authorities, each with its own purpose and funding requirements.

- Subtract any applicable tax exemptions or deductions from the calculated tax amount. These exemptions can significantly reduce the overall tax liability for eligible property owners.

- Add any penalties or fees if the property owner has missed the payment deadline or failed to comply with tax regulations.

Payment Options and Due Dates

Property owners in Will County have several options for paying their tax bills. The county offers convenient methods to ensure timely payments and avoid penalties. Here are the key payment options:

- Online Payment: Property owners can make secure online payments through the Will County Treasurer's website. This option provides a quick and efficient way to settle tax obligations.

- Mail-In Payment: Taxpayers can mail their payments to the designated address, ensuring they reach the Treasurer's Office within the specified timeframe.

- In-Person Payment: For those who prefer a more traditional approach, in-person payments can be made at the Will County Treasurer's Office during regular business hours.

- Automatic Payment Plans: To avoid late fees and ensure timely payments, property owners can enroll in automatic payment plans. This option allows for automatic deductions from a designated bank account on the due date.

It's essential for property owners to be aware of the tax bill due dates to avoid any unnecessary penalties. The Will County Treasurer's Office typically sends out tax bills in two installments, with specific due dates for each. Failure to pay by the due date may result in late fees and additional interest charges.

The Impact of Property Taxes on the Community

Property taxes play a vital role in the development and maintenance of Will County’s infrastructure and services. The revenue generated from these taxes contributes to a wide range of essential initiatives, including:

- Education: A significant portion of property tax revenue is allocated to local school districts, ensuring that students receive the resources and support they need for a quality education.

- Public Safety: Taxes fund police and fire departments, ensuring the safety and security of residents and businesses in the county.

- Infrastructure: Property taxes are invested in maintaining and improving roads, bridges, and other critical infrastructure, making the county more accessible and efficient.

- Social Services: Funds from property taxes support various social services, such as healthcare, senior programs, and assistance for vulnerable populations.

- Economic Development: Tax revenue is used to attract businesses and create job opportunities, fostering economic growth in the community.

Community Engagement and Tax Transparency

Will County recognizes the importance of transparency and community engagement when it comes to property taxes. The county’s website provides a wealth of information, including tax rate calculations, exemption details, and payment options. This transparency ensures that property owners can make informed decisions and actively participate in the tax process.

Additionally, the county organizes community forums and meetings where residents can voice their concerns, ask questions, and provide feedback on tax-related matters. These initiatives foster a sense of community involvement and allow for a more equitable and responsive tax system.

Conclusion: Navigating the Will County Tax Bill

The Will County Tax Bill is a critical document that impacts the financial obligations of property owners in the county. By understanding the components, calculation methods, and payment options, residents and businesses can effectively manage their tax liabilities. Moreover, the revenue generated from property taxes plays a vital role in supporting the community’s infrastructure, education, and overall well-being.

As a property owner in Will County, staying informed and engaged with the tax process is essential. By utilizing the resources provided by the county and staying up-to-date with tax regulations, individuals can ensure compliance and contribute to the growth and prosperity of their community.

When are the tax bills sent out in Will County, Illinois?

+Tax bills in Will County are typically sent out in two installments. The first installment is due in March, while the second installment is due in September. It’s important to note that the specific dates may vary slightly from year to year, so it’s advisable to check the official Will County Treasurer’s website for the most accurate information.

How can I contest the assessed value of my property in Will County?

+If you believe the assessed value of your property is inaccurate, you have the right to appeal. The process involves submitting an appeal to the Will County Board of Review within a specified timeframe. You’ll need to provide evidence and supporting documentation to support your case. It’s recommended to consult with a tax professional or the Board of Review for guidance on the appeal process.

Are there any tax relief programs available for seniors or veterans in Will County?

+Yes, Will County offers various tax relief programs for eligible seniors and veterans. These programs provide reductions in property taxes based on specific criteria. To apply, you’ll need to meet the eligibility requirements and submit the necessary documentation. Contact the Will County Assessor’s Office or the Treasurer’s Office for more information on the available programs and the application process.