Iowa Property Taxes vs. State Income Taxes: Which Is More Cost-Effective

In the complex landscape of fiscal policy, individuals and businesses continuously evaluate the comparative burdens of various tax structures. Iowa, a Midwestern state with a diverse economy ranging from agriculture to manufacturing, exemplifies this ongoing assessment through its blend of property taxes and state income taxes. While often considered in isolation, the intersection and comparative analysis of these two revenue sources reveal nuanced implications for cost-effectiveness, economic mobility, and long-term fiscal sustainability. Indeed, understanding whether Iowa's property taxes or state income taxes impose a greater financial burden requires a meticulous examination of their respective structures, local variations, and broader contextual factors influencing taxpayer behavior and government expenditures.

Dissecting Iowa’s Property Tax System: Structure, Variations, and Economic Impact

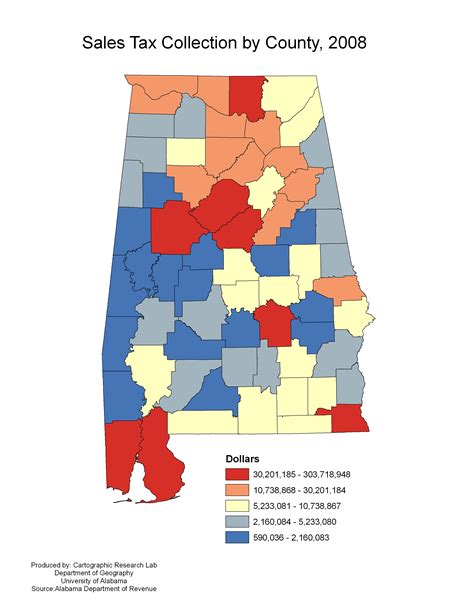

The property tax system in Iowa fundamentally differs from income tax regimes, primarily functioning as a locally assessed revenue source, with rates governed by county and municipal levies. The core monetary component is the mill rate—expressed as dollars per $1,000 of assessed property value—adjusted periodically according to statutory caps, valuation assessments, and local budget needs.

As of 2023, Iowa’s average effective property tax rate hovered around 1.5%, which, in comparison to national averages, positions it above many states known for lower property tax burdens. The burden’s distribution, however, varies notably among residential, commercial, and agricultural properties, with agricultural land often benefiting from somewhat lower effective rates due to specific valuation assessments and historic tax relief programs. Consequently, property taxes often constitute a significant shared cost for property owners, especially those in urbanized counties where municipal services demand higher funding.

Examining the economic impact, property taxes tend to favor stability, providing local governments with predictable revenue streams that directly link to local property values. Yet this linkage introduces volatility in periods of declining real estate values or recessionary conditions, as assessed property valuations decline or stagnate, constraining local revenue and possibly leading to service cuts or tax rate hikes. Conversely, exemptions, abatements, and relief programs—particularly aimed at seniors and agricultural landowners—serve to mitigate some of these effects but also introduce complexity in tax calculations and distributional fairness.

Analysis of Property Tax Burden and Public Services

Empirical studies demonstrate that property taxes in Iowa fund roughly 60-70% of local government revenue, including schools, roads, and emergency services. The reliance on property tax revenue underscores its significance in sustaining essential services but also raises questions about its efficiency and fairness. For example, disparities in property values across counties mean taxpayers in less affluent areas may shoulder proportionally higher burdens relative to their ability to pay, fueling debates over tax equity and the potential for redistribution mechanisms.

| Relevant Category | Substantive Data |

|---|---|

| Average Effective Property Tax Rate | Approx. 1.5% across Iowa counties in 2023 |

| Distribution of Revenue Sources | 60-70% from property taxes for local governments |

| Median Property Value | $165,000 (Iowa, 2023) |

| Tax Relief Programs | Homestead Exemption for seniors and disabled, agricultural land relief |

Understanding Iowa’s State Income Tax: Framework, Rates, and Behavioral Effects

The Iowa state income tax operates as a progressive tax system, with rates increasing with income levels. For 2023, the state’s income tax brackets ranged from 0.33% on the lowest incomes to 6.0% on incomes exceeding 74,000 for singles and 148,000 for joint filers. The structure mirrors many states’ efforts to balance revenue generation with redistribution, emphasizing vertical equity.

Tax deductions and credits, such as the Iowa Family Tax Credit and earned income tax credits, serve to offset liabilities for lower-income taxpayers. Notably, Iowa tax policy also incorporates a relatively broad federal deductibility, which influences taxpayer behavior and state revenue stability.

From an economic standpoint, state income taxes are frequently scrutinized for their influence on labor supply, income mobility, and investment decisions. Higher marginal rates are associated with increased tax avoidance and migration tendencies among affluent taxpayers, although empirical evidence indicates Iowa’s rates are moderate enough to prevent severe adverse effects. Moreover, progressive income taxation aims to ensure that higher earners contribute proportionally more, but it also raises concerns about potential disincentives to work or invest, especially at upper-income thresholds.

Impact of Income Tax on Economic Behavior and State Revenue

Research indicates that state income taxes directly influence individual location choices, with some high-income households considering migration to states with lower or no income taxes. However, Iowa’s overall tax competitiveness remains balanced, as factors such as quality of life, educational attainment, and infrastructure also significantly impact mobility decisions. The state’s revenue from income taxes accounts for approximately 30-40% of total state general fund collections, underscoring its importance in funding public education, healthcare, and transportation.

| Relevant Category | Substantive Data |

|---|---|

| Top Marginal Rate | 6.0% on incomes over 74,000 (single filers)</td></tr> <tr><td>Revenue Contribution</td><td>Approximately 35% of Iowa's total general fund revenues</td></tr> <tr><td>Tax Credits & Deductions</td><td>Multiple credits including earned income and family credits</td></tr> <tr><td>Taxable Income Thresholds</td><td>0 to over $74,000, with graduated rates |

Comparative Analysis: Cost-Effectiveness and Fiscal Implications

Altogether, the core question hinges on whether property taxes or income taxes impose a greater cost burden and which offers a more sustainable fiscal model. When evaluating cost-effectiveness, several dimensions—revenue stability, fairness, economic impact, and administrative complexity—must be integrated.

Property taxes, while providing a stable local revenue base, tend to be more regressive, disproportionately impacting fixed-income residents and agricultural landowners. Their dependence on local valuations ties revenue to real estate cycles, which introduces volatility. Conversely, the state income tax, being progressive, attempts to align taxpayer contribution with income capacity, fostering a perception of fairness but potentially encouraging tax avoidance or flight at higher rates.

From a public finance perspective, the ideal system would balance these considerations, leveraging the strengths of each while mitigating their weaknesses. Iowa’s hybrid structure exemplifies this, with the local property tax system providing essential funding, complemented by the state income tax’s redistribution and stabilization role.

Key Points

- Property taxes offer stable funding but tend toward regressivity and volatility tied to property valuation cycles.

- State income taxes are progressive and can better address income disparities but risk economic disincentives and mobility issues.

- Hybrid approach supports local autonomy while balancing equity and economic efficiency, but requires ongoing reform to optimize fiscal capacity.

- Strategic considerations include reform prospects such as property tax caps, income tax rate adjustments, and targeted relief programs.

- Overall comparison suggests that a mixed model, carefully calibrated, tends to offer greater overall cost-effectiveness than relying solely on one or the other.

Implications for Policy and Future Outlook

Given demographic shifts, economic transitions, and federal policy influences, Iowa’s fiscal pathway demands adaptability. Considering the evolving challenge of balancing revenue adequacy with taxpayer fairness, policymakers face choices around tax reform that could recalibrate the property-income tax mix. For example, implementing property tax reform such as valuation limits or expanding targeted relief could reduce regressivity while maintaining local fiscal autonomy. Meanwhile, moderating income tax rates or expanding credits could improve economic incentives without sacrificing revenue stability.

Furthermore, advancements in data analytics and taxpayer compliance monitoring promise more nuanced tax billing and collection, enhancing efficiency. As Iowa continues to navigate property tax burdens and income tax schedules, innovative governance—emphasizing transparency, equity, and economic resilience—will determine the sustainability of its fiscal model.

Which tax type historically imposes a heavier burden on Iowa residents?

+While property taxes are regressive and impact fixed-income residents disproportionately, income taxes’ progressivity makes them relatively more burdensome for higher earners, though generally viewed as fairer in distribution.

Can reforming property or income taxes improve Iowa’s fiscal sustainability?

+Yes, targeted reforms such as property tax caps or income tax rate adjustments, coupled with effective relief programs, can enhance sustainability, fairness, and economic vitality.

What are the main trade-offs in choosing between property and income taxes?

+Trade-offs include stability versus regressivity (property taxes), and progressivity versus potential economic disincentives (income taxes). Balancing these requires nuanced policy design.