How Much Is Overtime Taxed

Understanding the taxation of overtime pay is crucial for both employers and employees, especially when navigating the complex world of tax regulations. In this comprehensive guide, we delve into the intricacies of how overtime earnings are taxed, shedding light on the various factors that influence the final deductions. From federal and state tax laws to the impact of income brackets, we aim to provide a clear picture of what you can expect when it comes to overtime taxation.

Overtime Taxation: A Comprehensive Overview

When an employee works beyond their regular scheduled hours, the additional pay earned, known as overtime pay, is subject to various taxes. These taxes can significantly impact the take-home pay, making it essential to comprehend the underlying mechanisms.

Federal Income Tax Withholding

The federal income tax is a critical component of overtime pay taxation. The Internal Revenue Service (IRS) mandates that employers withhold a certain percentage of an employee’s earnings, including overtime pay, based on their filing status and the amount of income earned. This withholding ensures that the employee pays their fair share of federal taxes throughout the year.

The exact amount withheld depends on the employee's W-4 form, which outlines their personal allowances and tax deductions. A higher number of allowances can result in a lower tax withholding, but it's important to note that this may lead to a larger tax bill come tax season if the withholdings are insufficient.

| Filing Status | Single | Married | Head of Household |

|---|---|---|---|

| Tax Bracket | 10% | 12% | 22% |

| Overtime Withholding | 10% of Overtime Pay | 12% of Overtime Pay | 22% of Overtime Pay |

For instance, an employee in the 10% tax bracket would have 10% of their overtime pay withheld by their employer, ensuring compliance with federal income tax regulations.

State Income Tax Considerations

In addition to federal taxes, state income taxes also play a significant role in overtime pay deductions. The taxation rules vary from state to state, with some states having no income tax at all. For states that do impose income taxes, the rate and regulations can differ greatly.

States like California and New York, for example, have progressive tax systems, meaning that as income increases, so does the tax rate. On the other hand, states like Texas and Florida have no state income tax, resulting in a more straightforward tax calculation for overtime earnings.

FICA Taxes: Social Security and Medicare

Overtime pay is also subject to Federal Insurance Contributions Act (FICA) taxes, which fund social security and Medicare programs. These taxes are split between the employer and the employee, with each party contributing an equal share.

| FICA Taxes | Social Security | Medicare |

|---|---|---|

| Employee Contribution | 6.2% | 1.45% |

| Employer Contribution | 6.2% | 1.45% |

| Total FICA Taxes | 12.4% | 2.9% |

It's important to note that FICA taxes have wage limits, beyond which the employee is no longer required to pay. For instance, the social security tax only applies to earnings up to a certain threshold, after which no further deductions are made.

The Impact of Income Brackets

Understanding your income bracket is crucial when it comes to overtime taxation. The United States tax system operates on a progressive scale, meaning that as income increases, so does the tax rate. This means that higher earners may face a larger tax burden on their overtime pay compared to those in lower income brackets.

| Income Bracket | Tax Rate | Overtime Tax Impact |

|---|---|---|

| 10% Bracket | 10% | Lowest tax impact on overtime pay |

| 22% Bracket | 22% | Moderate tax impact |

| 32% Bracket | 32% | Significant tax impact on higher overtime earnings |

For example, an employee in the 32% income bracket may face a substantial tax deduction on their overtime pay, especially if their earnings push them into a higher tax bracket.

Other Deductions and Withholdings

Beyond income and FICA taxes, there may be additional deductions and withholdings from overtime pay. These can include contributions to retirement plans, health insurance premiums, and any outstanding debt or court-ordered garnishments.

It's crucial for employees to review their pay stubs regularly to understand the various deductions and ensure that their earnings and withholdings are accurate. Any discrepancies should be addressed promptly with the employer or payroll department.

Tax Implications for Employers

Employers also have a significant role in ensuring proper tax withholding for overtime pay. They must accurately calculate and withhold the appropriate taxes, including federal and state income taxes, as well as FICA taxes. Failure to do so can result in penalties and legal consequences.

Additionally, employers must ensure that their payroll systems are up-to-date and compliant with the latest tax regulations. This includes staying informed about any changes in tax laws and adjusting payroll processes accordingly.

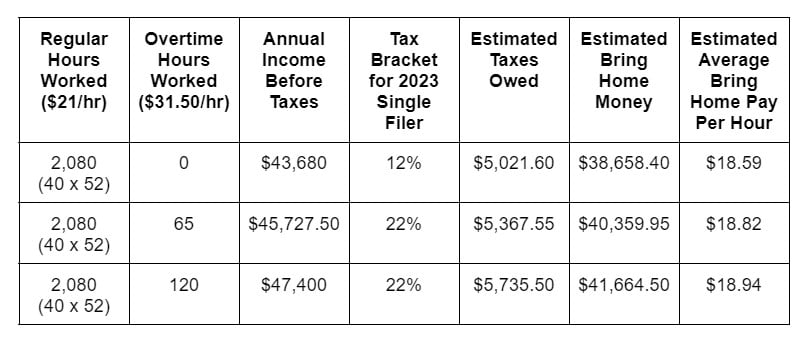

Case Study: Understanding Overtime Taxation in Practice

Let’s consider a practical example to illustrate the impact of overtime taxation. Imagine an employee, John, who works 10 hours of overtime in a week at a rate of $25 per hour. John is in the 22% income tax bracket and lives in a state with a 5% income tax rate.

| Overtime Earnings | $250 |

|---|---|

| Federal Income Tax | 22% of $250 = $55 |

| State Income Tax | 5% of $250 = $12.50 |

| FICA Taxes | 12.4% (Social Security) + 2.9% (Medicare) = $35.70 |

| Total Deductions | $103.20 |

| Net Overtime Pay | $146.80 |

In this case, John's overtime pay of $250 would result in a total deduction of $103.20, leaving him with a net overtime pay of $146.80. This example showcases the real-world impact of tax regulations on overtime earnings.

Future Implications and Strategies

As tax regulations continue to evolve, it’s essential for both employers and employees to stay informed about any changes that may impact overtime pay. Keeping up-to-date with tax laws can help individuals and businesses plan effectively and ensure compliance.

For employees, understanding the tax implications of overtime work can help them make informed decisions about accepting additional hours. It's crucial to consider the net pay after deductions to ensure that the extra work is worth the effort.

Employers, on the other hand, can benefit from implementing strategies to optimize overtime pay while remaining compliant with tax regulations. This may include offering flexible work arrangements or exploring alternative compensation methods to reduce the tax burden on employees.

FAQs

Are there any tax benefits for working overtime?

+

Overtime pay is subject to regular income taxes, and there are no specific tax benefits associated with working overtime. However, certain tax credits and deductions may be applicable based on individual circumstances.

Can I adjust my W-4 form to reduce tax withholding on overtime pay?

+

Yes, employees can adjust their W-4 form to increase or decrease the number of allowances, which can impact the tax withholding on overtime pay. However, it’s important to ensure that the withholdings align with your overall tax liability to avoid underpayment or overpayment of taxes.

Are there any tax deductions or credits specifically for overtime work?

+

There are no specific tax deductions or credits solely for overtime work. However, certain expenses related to employment, such as work-related travel or education, may be deductible. It’s advisable to consult a tax professional to understand your specific circumstances.