Capital Gains Tax On Inheritance

Understanding the intricacies of capital gains tax, particularly in the context of inheritance, is crucial for individuals navigating the complexities of estate planning and asset management. This article delves into the specific mechanisms and implications of capital gains tax on inherited assets, offering a comprehensive guide to help readers make informed financial decisions.

The Mechanics of Capital Gains Tax on Inheritance

Capital gains tax is a critical component of the tax landscape, impacting a wide range of financial transactions, including the inheritance of assets. When an individual inherits assets, such as stocks, real estate, or valuable collectibles, the question of capital gains tax often arises. This tax is levied on the profit or gain realized from the sale or disposal of an asset, and it plays a significant role in the overall tax liability of the recipient.

The capital gains tax on inheritance operates under a unique set of rules that differ from traditional capital gains taxation. In most jurisdictions, the capital gains tax on inherited assets is calculated based on the "stepped-up basis," which essentially means that the tax is assessed on the difference between the asset's fair market value at the time of inheritance and the price at which it is eventually sold.

Stepped-Up Basis: A Key Concept

The stepped-up basis is a fundamental concept in understanding capital gains tax on inheritance. It refers to the process where the asset’s basis, or cost, is adjusted to its fair market value at the time of the original owner’s death. This adjustment ensures that the capital gains tax is calculated based on the most recent and relevant value of the asset, providing a more accurate representation of the potential profit.

For instance, consider an individual who inherits a piece of real estate valued at $500,000 at the time of inheritance. If the original owner had purchased the property for $200,000, the stepped-up basis would adjust the cost basis to $500,000. Consequently, when the recipient decides to sell the property, the capital gains tax will be calculated on the difference between $500,000 and the sale price, rather than the original purchase price of $200,000.

| Asset Type | Original Cost | Fair Market Value at Inheritance | Stepped-Up Basis |

|---|---|---|---|

| Real Estate | $200,000 | $500,000 | $500,000 |

| Stocks | $150,000 | $300,000 | $300,000 |

| Art Collection | $75,000 | $120,000 | $120,000 |

Exclusions and Special Considerations

While the stepped-up basis is a standard practice for most inherited assets, there are certain exclusions and special considerations to be aware of. For instance, certain types of assets, such as qualified retirement accounts or life insurance policies, may not be subject to the stepped-up basis rule. Instead, they might follow different tax regulations upon inheritance.

Additionally, the tax treatment of inherited assets can vary based on the relationship between the deceased and the recipient. For example, in some jurisdictions, spouses or civil partners may receive more favorable tax treatment when inheriting assets, including potential exemptions from capital gains tax.

Navigating Capital Gains Tax on Inherited Assets

Effectively navigating the capital gains tax landscape for inherited assets requires a comprehensive understanding of the applicable regulations and strategies to minimize tax liability. Here are some key considerations and strategies to keep in mind:

Consult a Tax Professional

The intricacies of capital gains tax, especially in the context of inheritance, can be complex. Engaging a qualified tax professional or estate planning expert is crucial to ensure compliance with tax regulations and to develop a tailored strategy that maximizes the benefits of the stepped-up basis.

Understand the Fair Market Value

Accurately determining the fair market value of inherited assets is essential for calculating capital gains tax. This value can be influenced by various factors, including the asset’s condition, market trends, and appraisals. Seeking professional appraisals for valuable assets can provide an objective assessment of their worth.

Consider the Timing of Asset Disposal

The timing of when an inherited asset is sold or disposed of can significantly impact the capital gains tax liability. Strategically planning the sale to coincide with favorable market conditions or tax years can help optimize the tax outcome. For instance, selling assets during a year with lower income may result in a lower tax rate.

Explore Tax-Efficient Strategies

There are various tax-efficient strategies that can be employed to minimize the capital gains tax burden on inherited assets. These may include gifting assets to beneficiaries during the original owner’s lifetime, utilizing tax-efficient trusts, or even selling assets and reinvesting the proceeds in a tax-advantaged manner.

Keep Records and Documentation

Maintaining meticulous records and documentation of inherited assets is essential for tax purposes. This includes keeping track of purchase prices, appraisals, maintenance costs, and any other relevant information that can impact the asset’s value and, consequently, the capital gains tax calculation.

Case Study: Real-World Example

To illustrate the practical application of capital gains tax on inheritance, let’s consider a hypothetical scenario involving the inheritance of a portfolio of stocks.

John, a 55-year-old investor, inherits a portfolio of stocks from his father worth $1 million at the time of inheritance. The stocks were originally purchased by his father for $500,000 over the course of several years. John decides to hold onto the stocks for five years before selling them for $1.5 million.

In this scenario, John would benefit from the stepped-up basis, as the cost basis of the stocks would be adjusted to $1 million, the fair market value at the time of inheritance. Consequently, when he sells the stocks for $1.5 million, the capital gains tax would be calculated on the difference between $1.5 million and $1 million, resulting in a lower tax liability compared to calculating gains based on the original purchase price.

Future Implications and Tax Policy

The landscape of capital gains tax on inheritance is subject to change, influenced by evolving tax policies and legislative decisions. Staying informed about potential changes is crucial for individuals and estate planners to adapt their strategies accordingly.

In recent years, there has been a growing debate surrounding the fairness and efficacy of the stepped-up basis rule. Some proponents argue that it encourages the preservation of wealth and simplifies tax calculations, while critics suggest that it may lead to tax avoidance and perpetuate income inequality. As a result, there have been proposals to modify or eliminate the stepped-up basis rule, which could significantly impact the tax landscape for inherited assets.

Conclusion

Understanding the intricacies of capital gains tax on inheritance is essential for individuals managing their financial affairs and estate planning. The stepped-up basis rule provides a beneficial mechanism to minimize tax liability, but it is important to stay informed about potential changes in tax policy and consult with professionals to navigate these complexities effectively.

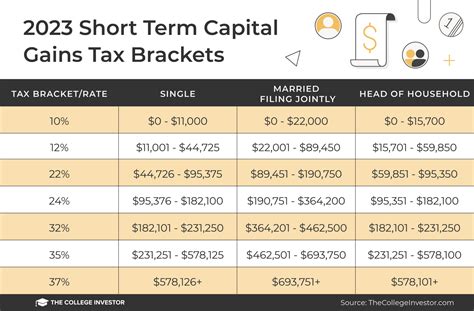

What is the capital gains tax rate on inherited assets?

+The capital gains tax rate on inherited assets can vary depending on the jurisdiction and the nature of the asset. In many countries, the rate is determined by the asset’s holding period and whether it is a long-term or short-term capital gain. It’s crucial to consult with a tax professional to understand the specific rates applicable to your situation.

Are there any exceptions to the stepped-up basis rule for inherited assets?

+Yes, there are certain exceptions to the stepped-up basis rule. For instance, assets held in qualified retirement accounts or life insurance policies may not benefit from the stepped-up basis. Additionally, some jurisdictions may have specific rules for certain types of assets, so it’s important to review the applicable regulations carefully.

How can I minimize capital gains tax on inherited assets?

+To minimize capital gains tax on inherited assets, consider consulting with a tax professional to explore strategies such as strategic asset disposition, utilizing tax-efficient trusts, or even gifting assets during the original owner’s lifetime. Planning and understanding the applicable tax laws can help optimize your tax outcomes.