How Is Restricted Stock Taxed

Restricted stock, a valuable form of employee compensation, is a type of equity-based incentive that companies offer to their employees, particularly in the tech industry. It provides employees with company shares that have certain restrictions or vesting conditions attached. Understanding the tax implications of restricted stock is crucial for both employers and employees to ensure compliance and optimize financial strategies.

The Basics of Restricted Stock Taxation

Restricted stock is taxed differently from traditional cash compensation and can have varying tax consequences depending on the specific terms of the grant and the company’s stock performance. Here’s a breakdown of the key aspects of restricted stock taxation.

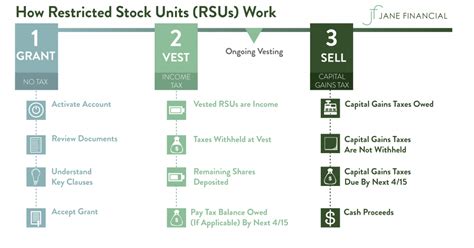

Taxation upon Vesting

When restricted stock vests, it becomes unrestricted, and the employee gains full ownership rights over the shares. This is when the tax liability arises. The fair market value (FMV) of the vested shares on the vesting date is considered ordinary income and is subject to income tax withholding.

| Tax Category | Applicable Tax Rate |

|---|---|

| Ordinary Income | Employee's regular income tax bracket |

| Payroll Taxes | Social Security and Medicare taxes |

Capital Gains Tax

Once the restricted stock vests, the employee can choose to hold onto the shares or sell them. If the shares are sold, the employee may be subject to capital gains tax. The tax treatment depends on the holding period:

- Short-Term Capital Gains: If the shares are sold within a year of vesting, any profit is taxed as ordinary income.

- Long-Term Capital Gains: If the shares are held for more than a year, the profit is taxed at the applicable long-term capital gains tax rate, which is generally lower than ordinary income tax rates.

Election under Section 83(b)

Employees with restricted stock grants have the option to make an election under Section 83(b) of the Internal Revenue Code. This election allows employees to pay taxes on the restricted stock at the time of grant, rather than waiting for vesting. It can be advantageous in certain scenarios, such as when the company’s stock is expected to appreciate significantly.

| Pros of 83(b) Election | Cons of 83(b) Election |

|---|---|

| Potentially lower capital gains tax | Requires immediate tax payment |

| Locks in a lower tax rate | Risk of overpaying if stock price drops |

| Avoids tax uncertainty | Complicates tax filing |

Employer’s Role in Restricted Stock Taxation

Employers play a critical role in guiding employees through the tax implications of restricted stock. They are responsible for providing clear and accurate information about the terms of the grant, including vesting schedules and tax consequences.

Tax Withholding

Upon vesting, employers are required to withhold income and payroll taxes from the employee’s compensation, including the value of vested restricted stock. The amount withheld depends on the employee’s tax withholding preferences and the applicable tax rates.

Tax Reporting

Employers must report the value of vested restricted stock to the Internal Revenue Service (IRS) and to the employee on their annual tax forms, such as Form W-2. This ensures that the employee’s tax liability is properly reported and that the IRS has accurate information about the compensation received.

Tax Strategies for Employees

Employees can employ various strategies to manage the tax implications of restricted stock. Here are some key considerations:

Tax Withholding Decisions

Employees can adjust their tax withholding preferences to ensure that enough tax is withheld to cover their liability. This can be particularly important when vesting a large number of shares.

Timing of Vesting

Employees may have some flexibility in the timing of vesting, especially with performance-based restricted stock. By coordinating vesting dates, employees can optimize their tax obligations, such as by vesting shares when their tax bracket is lower.

Selling Strategies

The decision to sell vested shares immediately or hold onto them can impact the tax treatment. Employees should consider their financial goals, risk tolerance, and the potential for capital gains or losses when deciding on a selling strategy.

Tax Planning with Financial Advisors

Given the complexity of restricted stock taxation, employees may benefit from seeking advice from financial advisors or tax professionals. They can provide personalized guidance based on the employee’s financial situation and help optimize tax strategies.

Future Implications and Considerations

The tax landscape for restricted stock is subject to change, and employees should stay informed about any updates or changes in tax laws. Additionally, the value of the company’s stock can be highly volatile, impacting the tax liability upon vesting and capital gains tax. Employees should regularly review their restricted stock holdings and consider their financial goals and risk tolerance when making decisions.

Conclusion

Understanding the tax implications of restricted stock is a critical aspect of financial planning for employees in the tech industry. By comprehending the taxation upon vesting, capital gains tax, and the option to make an 83(b) election, employees can make informed decisions and optimize their tax strategies. Employers, too, play a vital role in providing clear guidance and ensuring accurate tax reporting.

Frequently Asked Questions

Can I avoid taxes on restricted stock?

+No, you cannot avoid taxes on restricted stock. However, you can optimize your tax strategy by understanding the tax implications and making informed decisions. Strategies like adjusting tax withholding, timing vesting, and considering the 83(b) election can help manage tax obligations.

What happens if I don’t pay taxes on vested restricted stock?

+If you fail to pay taxes on vested restricted stock, you may face penalties and interest charges from the IRS. It’s crucial to ensure that you have sufficient funds to cover your tax obligations and consider seeking professional advice to navigate the tax implications.

Can I sell my vested restricted stock immediately?

+Yes, you can sell your vested restricted stock immediately. However, the decision to sell should be based on your financial goals and risk tolerance. Selling immediately may result in short-term capital gains tax, while holding onto the shares can provide potential long-term capital gains benefits.

What is the benefit of making an 83(b) election?

+Making an 83(b) election allows you to pay taxes on your restricted stock at the time of grant, rather than waiting for vesting. This can be advantageous if you expect the company’s stock to appreciate significantly. It locks in a potentially lower capital gains tax rate and avoids tax uncertainty.

Are there any drawbacks to the 83(b) election?

+Yes, the 83(b) election requires immediate tax payment, which can be a challenge if you don’t have sufficient funds. Additionally, if the company’s stock price drops, you may have overpaid taxes. It’s important to carefully consider your financial situation and seek professional advice before making this election.