What Is Sales Tax In Illinois

Sales tax in Illinois is a crucial component of the state's revenue generation and economic landscape. Understanding how sales tax works, its implications for businesses and consumers, and its role in supporting public services is essential for anyone operating within the state's borders.

Unraveling the Complexity of Illinois Sales Tax

Sales tax in Illinois is a vital revenue source for the state government, municipalities, and special tax districts. The tax is applied to the sale or rental of tangible personal property and certain services. The complexity arises from the fact that Illinois, unlike some other states, allows for local jurisdictions to impose their own sales tax rates on top of the state’s base rate, creating a unique tax landscape across different regions.

State Sales Tax Rate

As of [Current Year], the statewide sales tax rate in Illinois stands at 6.25%. This base rate is applied uniformly across the state and is a significant contributor to Illinois’ annual revenue.

Local Sales Tax Rates

In addition to the state sales tax, Illinois allows counties, municipalities, and special tax districts to levy their own sales taxes. These local rates can vary significantly, with some areas imposing rates as low as 0% and others as high as 3.75% or more. For instance, Chicago’s total sales tax rate is 10.25%, including the state and local components.

| County/Municipality | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Cook County | 1.25% | 7.5% |

| DuPage County | 1% | 7.25% |

| Lake County | 1.75% | 8% |

| Will County | 1.75% | 8% |

| McHenry County | 1.75% | 8% |

Taxable Goods and Services

The sales tax in Illinois applies to a broad range of goods and services, including but not limited to: clothing, electronics, furniture, groceries (with some exemptions for unprepared food), restaurant meals, hotel stays, and various services such as repair and installation.

Exemptions and Special Cases

Certain goods and services are exempt from sales tax in Illinois. These include most non-prepared food items, prescription drugs, and certain medical devices. Additionally, there are special provisions for certain industries, such as the sale of aircraft, which is exempt from sales tax if the aircraft is registered outside of Illinois and the sale takes place outside the state.

Impact on Businesses and Consumers

The sales tax structure in Illinois presents both opportunities and challenges for businesses and consumers alike.

Business Considerations

For businesses, especially those with a physical presence in multiple jurisdictions within the state, the complexity of managing different sales tax rates can be a significant administrative burden. Businesses must ensure compliance with both state and local tax laws, which can be a daunting task, especially for small businesses with limited resources.

Consumer Perspective

From a consumer standpoint, the varying sales tax rates can lead to price disparities across different regions. Consumers may find themselves comparing prices between stores in different counties or even traveling to areas with lower sales tax rates to make significant purchases, especially for high-value items like electronics or appliances.

Revenue Generation and Public Services

Sales tax revenue is a critical component of Illinois’ budget, funding a wide array of public services and infrastructure projects. The state’s Department of Revenue estimates that sales tax generates billions of dollars annually, which is then distributed to various state departments and local governments.

Funding Public Projects

The revenue from sales tax is used to fund essential services such as education, healthcare, transportation, and public safety. For instance, a portion of the sales tax revenue is dedicated to maintaining and improving the state’s infrastructure, including roads, bridges, and public transportation systems.

Economic Impact

The sales tax also plays a significant role in the state’s economy. By encouraging consumer spending, the tax helps drive economic growth and supports local businesses. Moreover, the varying tax rates across different regions can attract businesses to set up operations in certain areas, leading to job creation and economic development.

Conclusion: Navigating the Illinois Sales Tax Landscape

Understanding the intricacies of sales tax in Illinois is essential for businesses and consumers alike. The state’s unique tax structure, with its combination of state and local sales taxes, presents both challenges and opportunities. For businesses, effective tax management is crucial, while consumers may need to consider the impact of sales tax when making purchasing decisions.

As the state continues to rely on sales tax revenue to fund public services and drive economic growth, staying informed about the latest tax rates and regulations is essential for anyone doing business in or purchasing goods and services within the state of Illinois.

How often are sales tax rates updated in Illinois?

+Sales tax rates in Illinois can be updated annually or even more frequently, depending on local ordinances and special district needs. It’s essential to stay updated with the latest rates to ensure compliance.

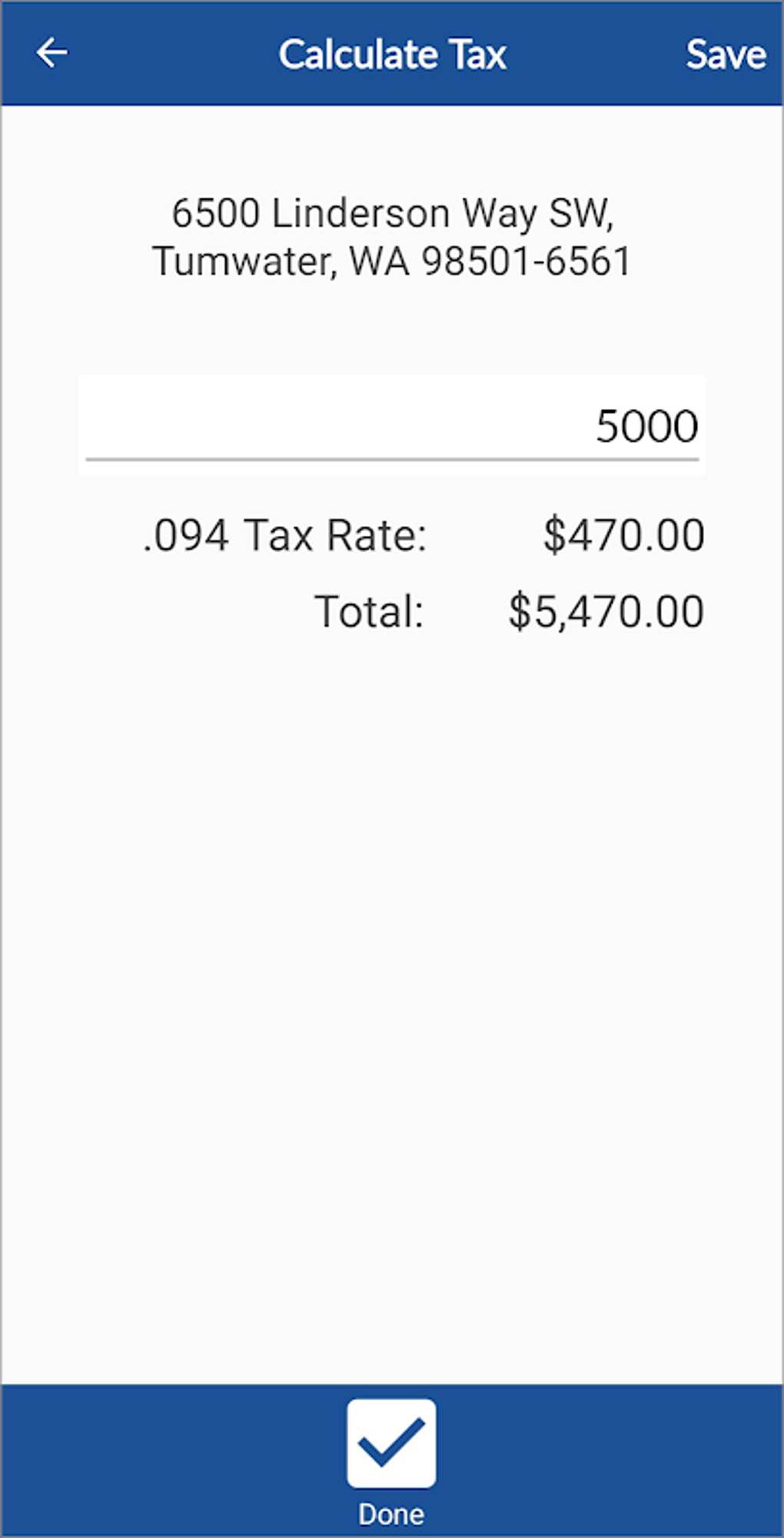

Are there any online resources to help calculate sales tax in Illinois?

+Yes, there are several online calculators and tools available that can help estimate the total sales tax based on your location and the type of purchase. These tools can be especially useful for businesses and consumers making large purchases.

How do businesses ensure they are collecting the correct sales tax?

+Businesses can utilize tax software and services that are specifically designed to handle complex tax calculations. These tools can help ensure compliance and reduce the risk of errors in sales tax collection.