Highlands County Tax Collector

The Highlands County Tax Collector's Office is an essential government entity in Highlands County, Florida, responsible for a range of vital financial and administrative services that impact the lives of local residents and businesses. This office, led by the elected Tax Collector, plays a pivotal role in ensuring the smooth functioning of the county's financial ecosystem.

A Vital Role in Community Finances

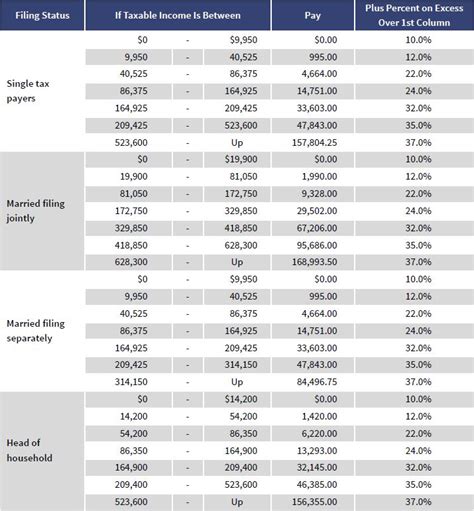

At the heart of the Tax Collector’s role is the collection and management of various taxes and fees. These include property taxes, which are a significant source of revenue for local governments, providing funding for essential services like education, infrastructure development, and public safety. The office also handles vehicle registration and titling, ensuring that vehicles are registered correctly and that owners comply with state regulations.

Additionally, the Tax Collector's Office administers the collection of various other fees and taxes, such as those related to driver's licenses, business taxes, and hunting and fishing licenses. These diverse revenue streams contribute significantly to the county's overall financial health and the provision of public services.

Efficient and Accessible Services

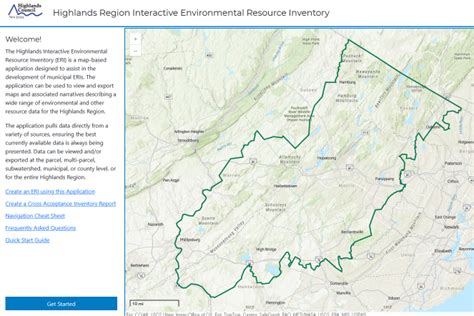

To cater to the diverse needs of the community, the Highlands County Tax Collector’s Office offers a wide range of services and convenient options. Residents can visit one of the office’s branches, located across the county, to access these services in person. These branches provide a physical space where individuals can receive assistance, ask questions, and complete their transactions.

For those who prefer digital interactions, the Tax Collector's Office has embraced modern technology to provide efficient online services. Through their website, residents can access a host of services, including paying property taxes, renewing vehicle registrations, and applying for various licenses and permits. This digital platform enhances convenience and efficiency, allowing individuals to complete their transactions from the comfort of their homes or offices.

Mobile Services and Outreach

Recognizing the importance of accessibility, the office also offers mobile services. This initiative brings the Tax Collector’s services directly to residents, particularly those in rural or less populated areas. By deploying mobile units, the office can reach individuals who may face challenges in accessing the physical branches, ensuring that all community members have equal access to the services they require.

Financial Management and Transparency

The Tax Collector’s Office is responsible for managing the substantial funds collected from various sources. This involves meticulous accounting practices to ensure accurate tracking of revenue, efficient allocation, and timely disbursement to the appropriate departments and agencies. The office also plays a crucial role in financial planning and budgeting for the county, providing valuable insights and data to inform decision-making processes.

In line with modern governance practices, the office prioritizes transparency in its financial operations. This includes providing detailed reports on revenue collection, expenditure, and budget allocations. These reports are often made publicly available, ensuring that taxpayers have access to information about how their contributions are being utilized. This level of transparency fosters trust and accountability in the community.

Payment Options and Convenience

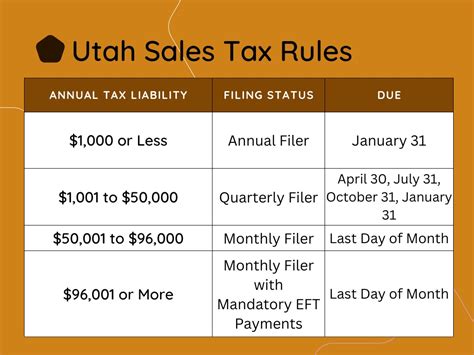

The Tax Collector’s Office understands the importance of offering flexible payment options to cater to the diverse financial needs and preferences of the community. In addition to traditional methods like cash and checks, the office accepts a variety of electronic payment methods, including credit and debit cards. These options provide convenience and flexibility, allowing taxpayers to choose the method that best suits their circumstances.

Furthermore, the office provides payment plans and installment options for taxpayers who may face financial challenges. These provisions demonstrate a commitment to ensuring that all community members can meet their financial obligations, even in difficult circumstances. By offering these flexible payment arrangements, the office helps maintain a healthy financial relationship between the government and its taxpayers.

Community Engagement and Outreach

Beyond its financial and administrative responsibilities, the Highlands County Tax Collector’s Office actively engages with the community. This engagement takes various forms, including educational initiatives to inform residents about their tax obligations and rights. The office also participates in community events, providing information and resources to residents and promoting financial literacy.

Through these outreach efforts, the office fosters a sense of community and strengthens the relationship between the government and its citizens. By being present and accessible, the Tax Collector's Office demonstrates its commitment to serving the community, not just as a revenue-collecting entity, but as a vital partner in the county's growth and development.

Assistance and Support

Recognizing that tax matters can sometimes be complex and challenging, the office provides dedicated support and assistance to taxpayers. This includes offering guidance on tax-related issues, explaining procedures, and providing resources to help individuals understand their rights and responsibilities. The office’s commitment to assistance ensures that taxpayers can navigate the sometimes intricate world of taxation with confidence and clarity.

Future Initiatives and Innovations

Looking ahead, the Highlands County Tax Collector’s Office is committed to continuous improvement and innovation. This includes exploring new technologies to enhance service delivery, such as implementing advanced digital platforms for more efficient and secure transactions. The office is also dedicated to staying abreast of changing regulations and best practices to ensure it remains an effective and responsive service provider.

Furthermore, the office is focused on developing strategies to further improve taxpayer experience. This includes simplifying processes, reducing wait times, and providing more personalized services. By continually evaluating and refining its practices, the Tax Collector's Office aims to meet the evolving needs of the community and ensure that its services remain relevant and accessible.

| Service | Description |

|---|---|

| Property Tax Collection | Responsible for collecting property taxes to fund essential services. |

| Vehicle Registration | Handles vehicle registration and titling, ensuring compliance with state laws. |

| Driver's License Services | Administers driver's license applications and renewals. |

| Business Tax Collection | Collects business taxes to support local businesses and the community. |

| Online Services | Provides a user-friendly website for online transactions, including tax payments and license renewals. |

| Financial Transparency | Commits to transparent financial practices, making revenue and expenditure reports publicly available. |

What is the role of the Highlands County Tax Collector’s Office?

+The Highlands County Tax Collector’s Office is responsible for collecting various taxes and fees, managing financial operations, and providing a range of services to the community, including property tax collection, vehicle registration, and driver’s license services.

How can I pay my property taxes in Highlands County?

+You can pay your property taxes online through the Tax Collector’s website, by visiting one of the physical branches, or by utilizing the mobile services provided by the office. The office offers various payment options, including cash, check, and electronic methods.

What happens if I miss the property tax payment deadline?

+Missing the property tax payment deadline can result in penalties and interest. The Tax Collector’s Office encourages taxpayers to stay informed about payment deadlines and offers assistance for those facing financial challenges. Contact the office for more information on late payment options and penalties.

How does the Tax Collector’s Office ensure financial transparency?

+The Tax Collector’s Office prioritizes financial transparency by providing detailed reports on revenue collection, expenditure, and budget allocations. These reports are often made publicly available, ensuring that taxpayers can access information about how their contributions are being utilized.

What community engagement initiatives does the Tax Collector’s Office offer?

+The Tax Collector’s Office engages with the community through educational initiatives, community events, and outreach programs. These initiatives aim to inform residents about their tax obligations, promote financial literacy, and strengthen the relationship between the government and its citizens.