Hernando County Property Taxes

Hernando County, located in the beautiful state of Florida, is known for its picturesque landscapes, charming small towns, and a vibrant community. One of the key aspects of living in Hernando County is understanding the property tax system and how it impacts residents. Property taxes are an essential revenue source for local governments, funding various public services and infrastructure. In this comprehensive guide, we will delve into the world of Hernando County property taxes, exploring the assessment process, tax rates, exemptions, and strategies to navigate this complex yet crucial aspect of homeownership.

Understanding Property Tax Assessments in Hernando County

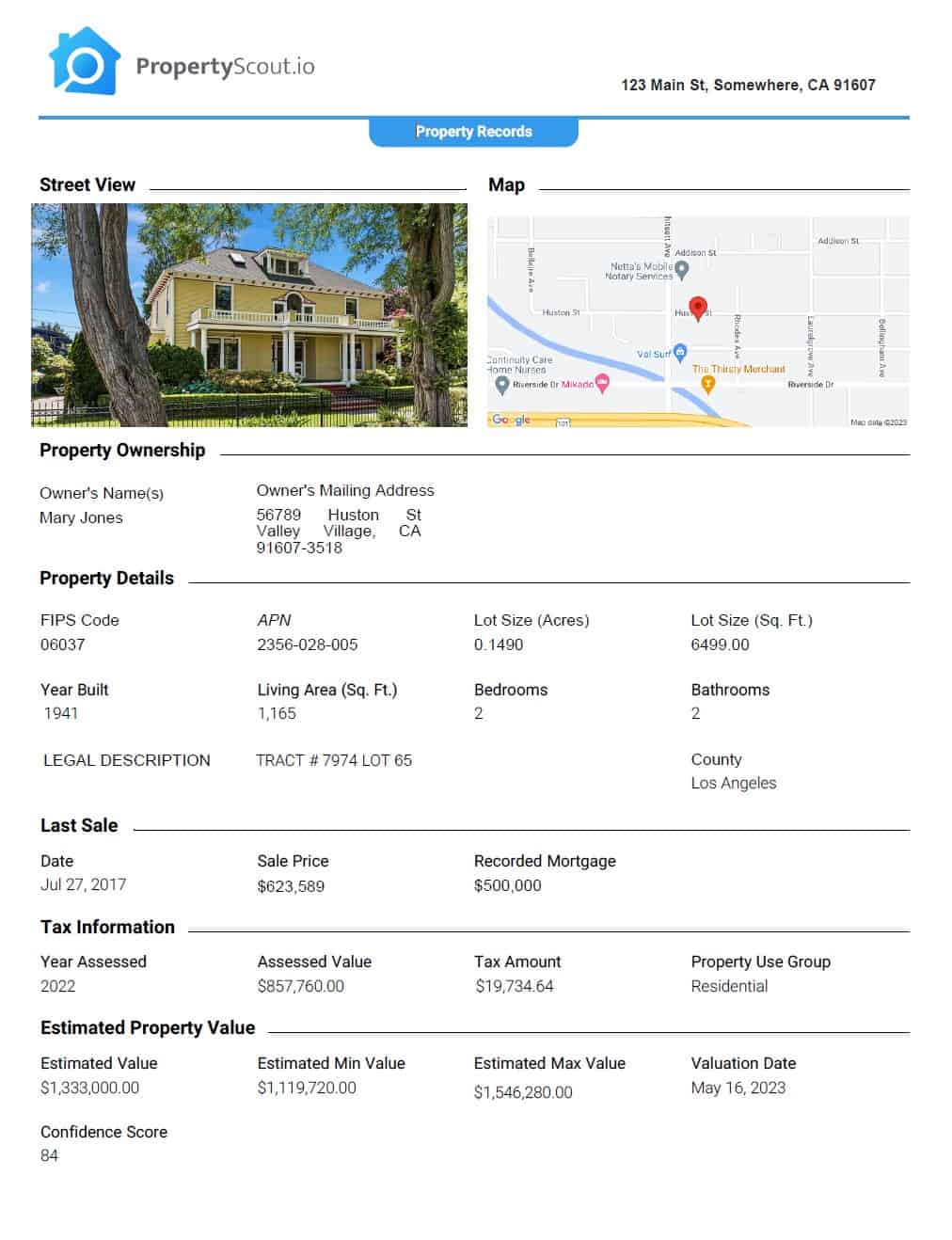

Property taxes in Hernando County are based on the assessed value of your property. The Hernando County Property Appraiser’s Office plays a vital role in this process. They are responsible for determining the just market value of each property within the county, ensuring fairness and accuracy in the assessment process. Here’s a step-by-step breakdown of how property taxes are assessed:

- Data Collection: The Property Appraiser's Office gathers information about properties, including recent sales, construction details, and other relevant factors. This data helps in establishing a property's market value.

- Market Analysis: Property appraisers analyze recent real estate transactions and market trends to determine the current value of properties. They consider factors like location, size, amenities, and any recent improvements.

- Assessment Notices: After the assessment process, property owners receive a notice of proposed property taxes. This notice includes the assessed value and the calculated tax amount. It is essential to review these notices carefully for accuracy.

- Appeal Process: If you believe your property's assessed value is incorrect, you have the right to appeal. The Property Appraiser's Office provides guidance on the appeal process, ensuring transparency and fairness.

By understanding the assessment process, property owners can actively participate in ensuring the accuracy of their property's value, which directly impacts the amount of taxes they owe.

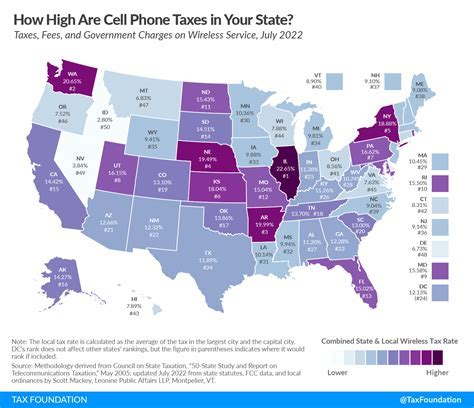

Hernando County’s Property Tax Rates

The property tax rate in Hernando County is determined by a combination of factors, including the millage rate and the assessed value of your property. The millage rate is set by local government bodies, such as the County Commission and various taxing authorities. Here’s a breakdown of how property tax rates are calculated:

| Taxing Authority | Millage Rate |

|---|---|

| County General Fund | 6.8366 |

| County Fire Rescue | 1.1446 |

| County Schools | 7.2306 |

| City of Brooksville | 5.0000 |

| City of Spring Hill | 4.7500 |

| Hernando County Water and Wastewater | 0.5905 |

| Special District - Port Authority | 0.1247 |

| Special District - Sheriff's Office | 0.8147 |

| Special District - Mosquito Control | 0.5467 |

The millage rate is expressed in mills, where one mill equals one dollar of tax for every $1,000 of assessed property value. For example, if your property has an assessed value of $200,000 and the County General Fund's millage rate is 6.8366, your property tax for this fund would be calculated as follows:

Assessed Value ($200,000) x Millage Rate (6.8366) / 1,000 = $1,367.32

It's important to note that the millage rates can vary from year to year, and they may differ between taxing authorities within Hernando County. Staying informed about these rates is crucial for budgeting and financial planning.

Property Tax Exemptions and Savings in Hernando County

Hernando County offers various property tax exemptions to eligible residents, providing significant savings on their annual tax bills. Understanding these exemptions can help homeowners maximize their tax benefits. Here are some of the key exemptions available:

Homestead Exemption

The Homestead Exemption is one of the most widely utilized exemptions in Florida. It provides a discount on the assessed value of your primary residence. To qualify for the Homestead Exemption, you must meet the following criteria:

- Be a legal resident of Florida.

- Own and occupy the property as your primary residence.

- Have resided in the property for at least six months of the year.

- File an application with the Hernando County Property Appraiser's Office.

The Homestead Exemption offers a $25,000 reduction in the assessed value of your property, resulting in lower property taxes. Additionally, Florida residents over the age of 65 or with certain disabilities may be eligible for an additional exemption of up to $50,000.

Additional Exemptions

Hernando County provides several other exemptions to eligible property owners. These include:

- Senior Citizen Exemption: Property owners aged 65 or older may qualify for an additional exemption, reducing their assessed value further.

- Widow/Widower Exemption: Spouses of deceased property owners may be eligible for an exemption, ensuring financial relief during difficult times.

- Veteran Exemptions: Active-duty military personnel, veterans, and their spouses can benefit from various exemptions, including the Homestead Exemption and additional discounts based on disability status.

- Low-Income Exemptions: Hernando County offers exemptions for low-income residents, helping them afford their property taxes.

It's crucial to review the specific requirements and application processes for each exemption to determine your eligibility. Taking advantage of these exemptions can significantly reduce your property tax burden.

Strategies for Navigating Hernando County Property Taxes

Understanding the assessment process, tax rates, and exemptions is just the first step in managing your Hernando County property taxes. Here are some additional strategies to consider:

Stay Informed

Keep yourself updated on any changes to tax rates, assessment procedures, and exemption requirements. The Hernando County Property Appraiser’s Office and local government websites are excellent resources for the latest information.

Review Your Assessment Notice

When you receive your assessment notice, carefully review it for accuracy. Ensure that the property details, such as square footage and improvements, are correct. If you identify any discrepancies, contact the Property Appraiser’s Office to rectify them.

Consider Hiring a Tax Professional

If you find the property tax system complex or have a unique situation, consulting a tax professional or accountant can provide valuable guidance. They can help optimize your tax savings and ensure compliance with regulations.

Appeal Your Assessment

If you believe your property’s assessed value is higher than its fair market value, you have the right to appeal. The Property Appraiser’s Office provides guidance on the appeal process, which typically involves submitting evidence and supporting documentation to support your case.

Utilize Online Tools

Hernando County offers online tools and resources to help property owners understand their tax obligations. These tools can provide estimated tax amounts, track assessment changes, and guide you through the exemption application process.

Conclusion: Navigating Hernando County Property Taxes with Confidence

Understanding the intricacies of Hernando County property taxes is crucial for every homeowner. By staying informed, actively participating in the assessment process, and taking advantage of available exemptions, you can effectively manage your property tax obligations. Remember, property taxes fund essential services and infrastructure, contributing to the overall well-being of the community. With the right strategies and knowledge, you can navigate the property tax system with confidence and ensure that your financial responsibilities are met.

How often are property assessments conducted in Hernando County?

+

Property assessments in Hernando County are conducted annually. The Property Appraiser’s Office works throughout the year to ensure accurate assessments for each property.

Can I appeal my property assessment if I disagree with the value assigned?

+

Yes, you have the right to appeal your property assessment if you believe it is incorrect. The Property Appraiser’s Office provides guidelines and procedures for filing an appeal. It’s essential to gather supporting evidence and follow the prescribed process.

Are there any online resources available to help me understand my property tax obligations?

+

Absolutely! Hernando County offers online tools and resources on its official website. These resources provide valuable information about property taxes, assessments, and exemption applications. They can guide you through the process and help you estimate your tax obligations.

What happens if I don’t pay my property taxes on time in Hernando County?

+

Unpaid property taxes can lead to penalties and interest charges. In severe cases, the county may place a tax lien on your property, which could eventually result in a tax deed sale. It’s crucial to stay current with your property tax payments to avoid these consequences.

Are there any programs or assistance available for low-income homeowners in Hernando County to help with property taxes?

+

Yes, Hernando County offers various programs and assistance to support low-income homeowners. These include the Low-Income Home Energy Assistance Program (LIHEAP) and the Homestead Exemption, which can provide significant relief for eligible residents. It’s recommended to explore these options to determine your eligibility.