Greenville County Sc Tax

In the heart of South Carolina, Greenville County stands as a bustling hub, renowned for its vibrant culture, thriving businesses, and, of course, its unique tax landscape. Navigating the intricacies of Greenville County, SC, taxes is a crucial aspect for both residents and businesses alike. From understanding the tax rates to exploring the various deductions and exemptions, there's a wealth of knowledge to uncover. In this comprehensive guide, we'll delve deep into the world of Greenville County taxes, offering a detailed breakdown of the essential information you need to know.

Unraveling the Greenville County Tax Structure

Greenville County’s tax system is a complex yet essential component of its economic framework. It plays a pivotal role in funding various public services and initiatives that contribute to the county’s overall growth and development. Understanding this system is key to ensuring compliance and optimizing financial strategies.

Tax Rates: A Detailed Breakdown

The tax rates in Greenville County are determined by a combination of factors, including property value, location, and the specific tax district. Here’s a closer look at the key components:

- Property Taxes: These are the primary source of revenue for the county. The tax rate is typically expressed as mills, where one mill represents 1 of tax for every 1,000 of assessed property value. The rates can vary significantly across the county, with urban areas often having higher rates than rural regions.

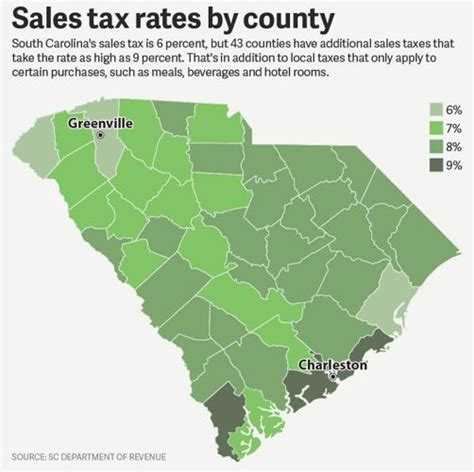

- Sales and Use Taxes: Greenville County, like the rest of South Carolina, imposes a state sales tax of 6%. Additionally, the county levies its own local sales tax, which can range from 1% to 2%, depending on the specific municipality. These taxes apply to most retail sales, certain services, and the use or consumption of tangible personal property.

- Income Taxes: Greenville County follows the state’s income tax structure. South Carolina has a progressive income tax system with six tax brackets, ranging from 0% to 7%. The tax rates and thresholds are subject to periodic adjustments.

It's important to note that tax rates are subject to change annually, so it's advisable to refer to the most recent tax tables provided by the Greenville County Treasurer's Office for accurate and up-to-date information.

Deductions and Exemptions: Maximizing Your Savings

Greenville County offers a range of deductions and exemptions that can significantly reduce your tax liability. Here are some key provisions:

- Homestead Exemption: Residents who own their primary residence can qualify for a homestead exemption, which reduces the assessed value of their property for tax purposes. The exemption amount varies based on income and age criteria.

- Senior Citizen Exemption: Greenville County provides an additional exemption for senior citizens aged 65 and above. This exemption further reduces the taxable value of their property, offering a significant tax relief for eligible homeowners.

- Military Exemption: Active-duty military personnel and veterans can qualify for property tax exemptions based on their service status and disability rating. The county’s Veterans Affairs Office provides guidance on the application process.

- Business Deductions: Businesses operating in Greenville County can take advantage of various deductions, such as depreciation, interest expenses, and business-related travel costs. These deductions can substantially lower taxable income and improve cash flow.

Tax Payment and Due Dates

Understanding the tax payment process and deadlines is crucial to avoid penalties and maintain a good standing with the county. Here’s a brief overview:

- Property Taxes: Property taxes are typically due in two installments. The first installment is due by January 15th, and the second installment is due by June 15th. Late payments are subject to interest and penalties.

- Sales and Use Taxes: Businesses are required to remit sales and use taxes on a monthly, quarterly, or annual basis, depending on their tax liability. The due dates align with the filing deadlines, which are typically the 20th of the month following the reporting period.

- Income Taxes: For individuals, the income tax filing deadline is April 15th, similar to the federal deadline. Businesses have varying due dates depending on their legal structure and tax year.

Navigating the Tax Landscape: Expert Tips

When it comes to managing your taxes in Greenville County, here are some expert tips to help you navigate the process efficiently:

Consider seeking professional guidance. Tax laws can be complex, and consulting a tax professional or accountant can ensure you're taking advantage of all eligible deductions and exemptions.

Online Resources and Tools

The Greenville County government website offers a wealth of resources to assist taxpayers. These include online tax calculators, payment portals, and downloadable forms. Utilizing these tools can simplify the tax preparation process and provide real-time information.

Understanding Tax Documents

Familiarize yourself with the various tax documents you’ll encounter. This includes tax bills, notices of assessment, and tax returns. Understanding the information contained within these documents is crucial for accurate record-keeping and tax planning.

Communication with Tax Authorities

If you have questions or concerns, don’t hesitate to reach out to the relevant tax authorities. The Greenville County Treasurer’s Office and the South Carolina Department of Revenue have dedicated staff who can provide guidance and support. Clear communication can prevent misunderstandings and potential penalties.

The Impact of Greenville County Taxes

The tax revenue generated in Greenville County plays a vital role in shaping the local economy and community. It funds essential services such as education, healthcare, infrastructure development, and public safety initiatives. Understanding the impact of taxes on these areas can provide valuable insights into the county’s overall well-being and future growth prospects.

Education Funding

A significant portion of tax revenue is allocated to supporting the county’s public education system. This funding ensures that schools have the resources needed to provide quality education, including teacher salaries, classroom materials, and infrastructure maintenance. By investing in education, Greenville County aims to foster a skilled workforce and a knowledgeable community.

Healthcare and Social Services

Tax revenue also contributes to the healthcare sector, funding public health initiatives, clinics, and social services. This support ensures that residents have access to essential healthcare services, especially those from underserved communities. Additionally, tax-funded social services provide assistance to vulnerable populations, promoting overall community well-being.

Infrastructure Development

Greenville County’s tax revenue plays a crucial role in financing infrastructure projects, including road construction and maintenance, public transportation systems, and utility improvements. Well-maintained infrastructure not only enhances the quality of life for residents but also attracts businesses and investments, driving economic growth.

Public Safety and Emergency Services

Taxes fund critical public safety initiatives, such as law enforcement, fire departments, and emergency response teams. These services ensure the safety and security of the community, responding swiftly to emergencies and maintaining a stable environment for residents and businesses alike.

Economic Growth and Business Incentives

Greenville County utilizes tax incentives and rebates to attract new businesses and support existing ones. These incentives, such as tax credits for job creation or investment, stimulate economic growth and create a competitive business environment. By offering these incentives, the county encourages entrepreneurship and fosters a diverse and robust local economy.

Conclusion

Navigating the tax landscape of Greenville County, SC, is a complex yet essential task. From understanding the tax rates and deductions to exploring the impact of taxes on the community, this comprehensive guide has provided a detailed overview. By staying informed, utilizing available resources, and seeking professional guidance when needed, residents and businesses can effectively manage their tax obligations while contributing to the vibrant and thriving community of Greenville County.

What is the current property tax rate in Greenville County, SC?

+The property tax rate in Greenville County can vary based on the specific tax district and property value. As of [current year], the millage rate ranges from [rate 1] to [rate 2] mills. It’s advisable to consult the Greenville County Treasurer’s Office for the most accurate and up-to-date information.

Are there any tax incentives for businesses in Greenville County?

+Yes, Greenville County offers various tax incentives to attract and support businesses. These incentives include tax credits for job creation, investment, and research and development. The Greenville County Economic Development Office provides detailed information on the available programs.

How can I estimate my tax liability for my property in Greenville County?

+The Greenville County Treasurer’s Office provides an online tax calculator that allows you to estimate your property tax liability. You’ll need to input your property’s assessed value and the applicable tax rate for your specific location. This tool provides a quick estimate to help with financial planning.

What happens if I miss a tax payment deadline in Greenville County?

+Missing a tax payment deadline can result in interest and penalties. It’s important to stay organized and plan your payments accordingly. If you encounter financial difficulties, it’s advisable to communicate with the Greenville County Treasurer’s Office to explore potential payment arrangements.

Are there any tax exemptions for green energy initiatives in Greenville County?

+Yes, Greenville County offers tax incentives for green energy initiatives. These incentives aim to promote sustainable practices and reduce the environmental impact of businesses and residents. The Greenville County Sustainability Office provides details on the available programs and eligibility criteria.