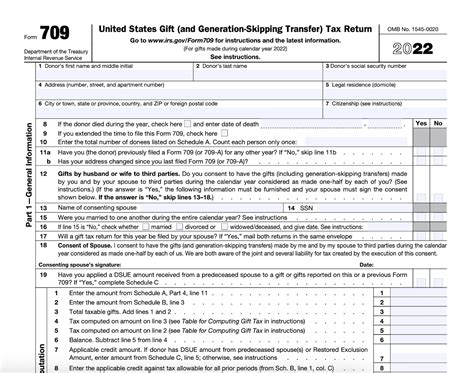

Gift Tax Return Form

When it comes to navigating the world of taxes, there are various forms and processes that individuals and businesses must familiarize themselves with. Among these, the Gift Tax Return Form is a crucial document that plays a significant role in the reporting and management of gifts that exceed certain thresholds. In this comprehensive guide, we will delve into the intricacies of the Gift Tax Return Form, exploring its purpose, key components, and the impact it has on individuals' financial obligations.

Understanding the Gift Tax Return Form

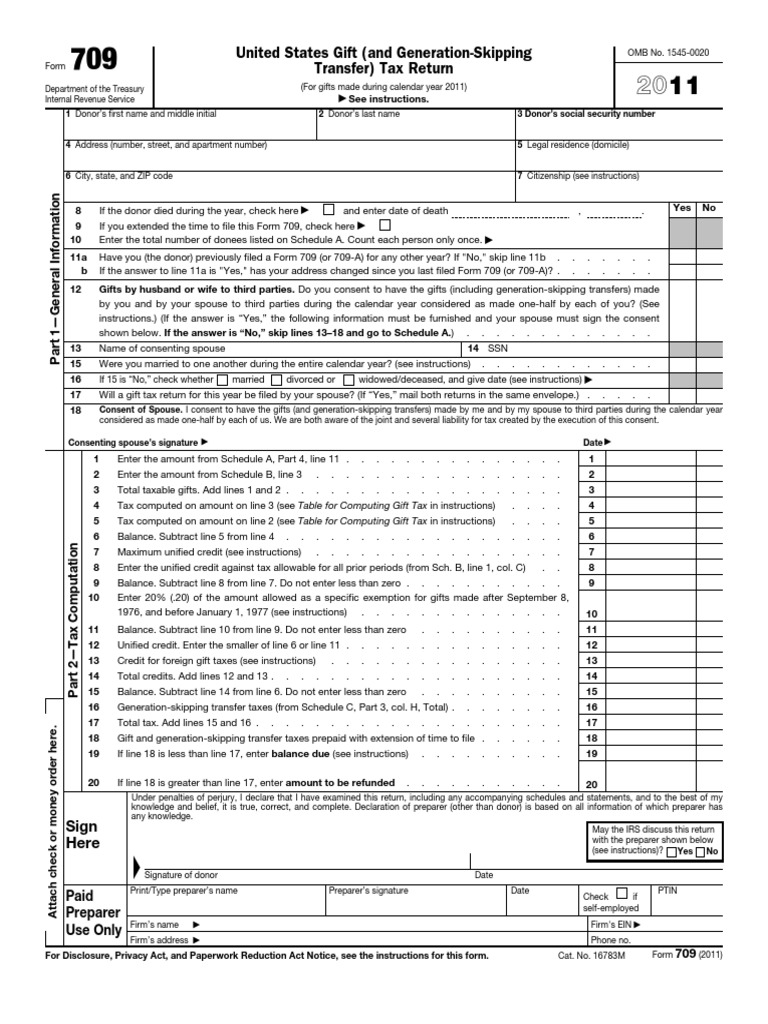

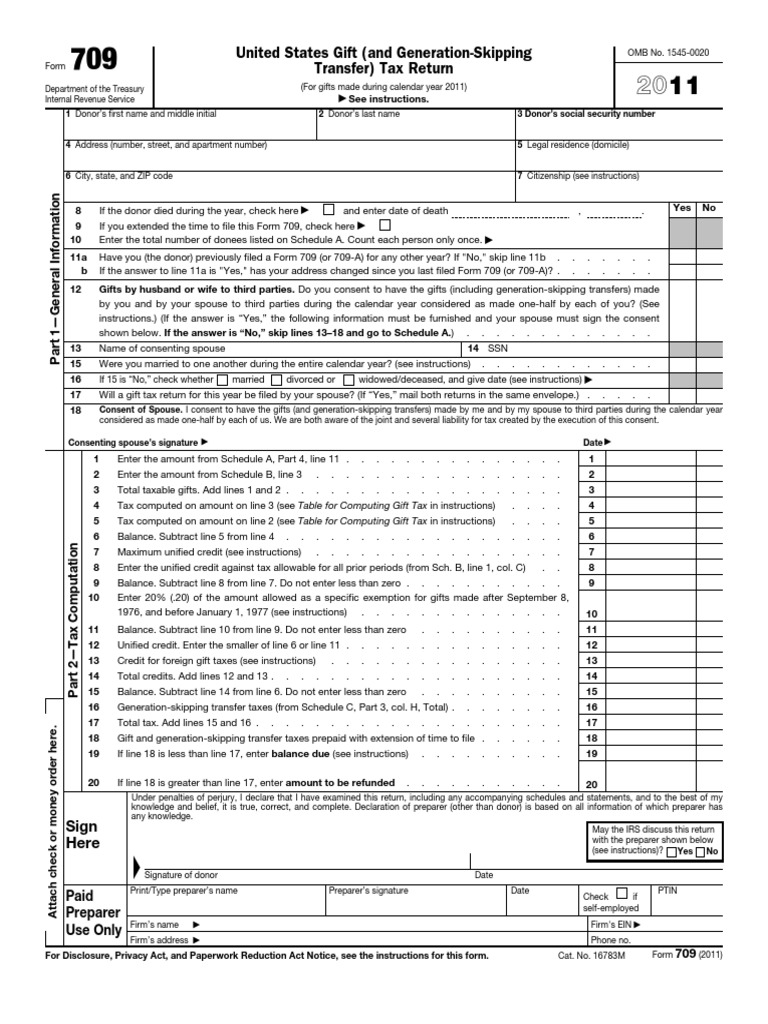

The Gift Tax Return Form, officially known as IRS Form 709, is a critical instrument in the United States’ tax system. It serves as a means for individuals to report and account for gifts they have made that surpass the annual exclusion limit set by the Internal Revenue Service (IRS). This form is a vital tool for ensuring compliance with tax laws and maintaining transparency in gift transactions.

The annual exclusion limit, which is adjusted periodically by the IRS, represents the maximum value of gifts an individual can give to another person without incurring gift tax. Gifts that exceed this limit must be reported on Form 709 to prevent potential tax liabilities. The form provides a structured way to declare these gifts and any applicable taxes.

Key Components of the Gift Tax Return Form

Form 709 is a comprehensive document that requires careful attention to detail. Here are some of the critical components that individuals need to be aware of when completing this form:

- Giver's Information: The form begins by collecting personal details about the individual making the gift, including name, address, and taxpayer identification number.

- Recipient's Details: Subsequently, the form requests information about the recipient of the gift, ensuring that the transaction is properly documented.

- Gift Description: This section requires a detailed description of the gift, including its nature, value, and any relevant dates.

- Annual Exclusion: Here, individuals must calculate and declare the annual exclusion amount, which is the value of gifts that can be given tax-free during the calendar year.

- Gift Tax Computation: The form guides individuals through the process of calculating the gift tax liability, if any, based on the value of the gift and applicable tax rates.

- Payment Information: If a gift tax is owed, the form provides space for individuals to include payment details, such as the method of payment and the amount.

- Signatures and Verification: Lastly, the form requires the individual's signature, affirming the accuracy of the information provided.

The complexity of Form 709 can vary depending on the nature and value of the gifts being reported. For instance, gifts of cash, property, or even certain types of investments may require additional documentation and calculations.

| Gift Type | Additional Requirements |

|---|---|

| Cash Gifts | Proof of transfer, such as bank statements or wire transfer records. |

| Property Gifts | Appraisals, titles, or other documents verifying the value and ownership of the property. |

| Investment Gifts | Statements or records from the investment institution, showing the value and terms of the investment. |

The Impact of Gift Tax Returns

Filing a Gift Tax Return has several significant implications for individuals, both financially and legally. Firstly, it ensures compliance with tax laws, preventing individuals from inadvertently incurring gift tax liabilities. By accurately reporting gifts that exceed the annual exclusion limit, individuals can avoid penalties and maintain a positive standing with the IRS.

Furthermore, Gift Tax Returns play a crucial role in the calculation of an individual's unified tax credit. This credit is a lifetime exemption that allows individuals to make substantial gifts or bequests without triggering estate tax. By reporting gifts on Form 709, individuals can keep track of their unified tax credit usage and ensure they do not exceed the limit, which could result in estate tax implications upon their passing.

From a strategic perspective, Gift Tax Returns offer individuals an opportunity to plan their estate and wealth transfer. By making thoughtful and well-timed gifts, individuals can minimize the impact of taxes on their beneficiaries and ensure their assets are distributed according to their wishes. Proper utilization of the annual exclusion and unified tax credit can significantly reduce the tax burden on heirs and beneficiaries.

Gift Tax Return for Married Couples

For married couples, the Gift Tax Return process can be particularly beneficial. The IRS allows couples to split gifts, which means that each spouse can utilize their annual exclusion limit separately. This strategy can double the amount of tax-free gifts a couple can make during a calendar year, providing more flexibility in estate planning.

Additionally, married couples can also take advantage of the gift-splitting election. This election allows one spouse to treat gifts made by the other spouse as if they were made by both spouses jointly. This strategy can be especially useful when one spouse has a larger estate or when the couple wishes to make substantial gifts to a single recipient.

Future Implications and Planning

The Gift Tax Return process is an essential component of long-term financial planning. By staying informed and proactive about gift-giving and tax obligations, individuals can make informed decisions that benefit both themselves and their loved ones. Here are some key considerations for future financial planning:

- Estate Planning: Gift Tax Returns can be a valuable tool in estate planning, helping individuals minimize taxes and ensure their assets are distributed according to their wishes.

- Generational Wealth Transfer: By making strategic gifts, individuals can transfer wealth to future generations while minimizing tax liabilities.

- Charitable Giving: Gifts to qualified charities can provide tax benefits and allow individuals to support causes they care about.

- Business Succession Planning: For business owners, Gift Tax Returns can play a role in planning for the transition of their business to the next generation.

It is essential to consult with tax professionals and financial advisors who can provide tailored advice based on individual circumstances. Each person's financial situation is unique, and a comprehensive understanding of the Gift Tax Return process can unlock opportunities for efficient wealth management.

FAQs

What is the annual exclusion limit for gift tax in 2023?

+The annual exclusion limit for 2023 is set at 16,000. This means individuals can give up to 16,000 to as many people as they wish without incurring gift tax.

Are there any exceptions to the gift tax rules for certain types of gifts?

+Yes, there are exceptions and exclusions for certain types of gifts. For instance, gifts to qualified charities, political organizations, and certain educational institutions are generally exempt from gift tax.

Can I split gifts with my spouse to maximize the annual exclusion limit?

+Absolutely! Married couples can split gifts, allowing each spouse to utilize their annual exclusion limit separately. This strategy can effectively double the tax-free gift amount for the couple.

What happens if I fail to file a Gift Tax Return for gifts that exceed the annual exclusion limit?

+Failing to file a Gift Tax Return for gifts that exceed the annual exclusion limit can result in penalties and interest charges. It is crucial to stay compliant with tax laws to avoid potential legal consequences.

How can I determine the value of non-cash gifts for Gift Tax Return purposes?

+For non-cash gifts, it is essential to obtain an accurate appraisal of the gift’s fair market value. This may involve engaging professional appraisers or using recognized valuation methods to determine the gift’s worth.