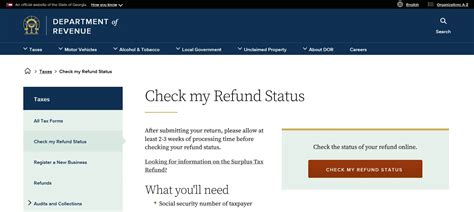

Georgia State Tax Refund Status

The Georgia State Tax Refund Status is a crucial aspect for taxpayers in the state of Georgia, USA. It refers to the process and steps individuals or businesses can take to check the status of their state tax refunds, ensuring timely and accurate information regarding their financial entitlements. This guide aims to provide an in-depth analysis of the process, highlighting the various methods, requirements, and timelines involved in tracking and receiving Georgia state tax refunds.

Understanding the Georgia State Tax Refund Process

The Georgia Department of Revenue handles the state’s tax refund process, aiming to provide efficient and transparent services to taxpayers. The refund process typically begins once the state receives and processes tax returns, which can take varying amounts of time depending on several factors.

It's important to note that the timing of tax refunds can be influenced by factors such as the method of filing (electronic vs. paper), the complexity of the return, and the overall volume of returns the department is processing during a given period.

Key Factors Affecting Refund Timing

-

Filing Method: Electronic filing, particularly through direct deposit, often results in faster refunds compared to traditional paper returns.

-

Return Complexity: Returns with simple structures and fewer adjustments tend to be processed quicker than those with complex deductions or credits.

-

Processing Periods: The Department of Revenue experiences peak periods, such as the post-April 15th rush, where processing times may be longer due to high volumes.

By understanding these factors, taxpayers can better estimate the timeline for their refund and plan their financial affairs accordingly.

Methods to Check Your Georgia State Tax Refund Status

Georgia offers several methods for taxpayers to inquire about their refund status, catering to various preferences and needs. These methods include online portals, phone inquiries, and traditional mail services.

Online Refund Status Check

The most efficient and widely used method is the online refund status check through the Georgia Department of Revenue’s official website. This service allows taxpayers to access their refund information 24⁄7, providing real-time updates on the status of their refund.

To use this service, taxpayers need to have their Social Security Number (SSN) and the exact amount of their expected refund. This ensures a secure and accurate process, protecting taxpayer information.

| Online Status Check Steps | Description |

|---|---|

| Step 1 | Visit the Georgia Department of Revenue website and navigate to the "Refund Status" section. |

| Step 2 | Enter your SSN and the exact refund amount. |

| Step 3 | Click "Submit" to view your refund status, including any processing updates or expected timelines. |

Phone Inquiries for Refund Status

For taxpayers who prefer a more personalized approach or encounter issues with the online system, the Georgia Department of Revenue offers a toll-free phone line for refund status inquiries.

| Phone Inquiry Details | Description |

|---|---|

| Phone Number | 1-877-352-8687 |

| Hours of Operation | Monday to Friday, 8 AM to 7 PM EST |

| Required Information | Taxpayers should have their SSN, the exact refund amount, and any relevant return details ready. |

While phone inquiries offer real-time assistance, they may have longer wait times during peak periods.

Traditional Mail Services

For those who prefer a more traditional approach or have concerns about online security, the Georgia Department of Revenue also provides mail-in refund status inquiries. Taxpayers can send a written request to the department, which will respond with an update on their refund status.

| Mail Inquiry Details | Description |

|---|---|

| Address | Georgia Department of Revenue Attention: Refund Inquiry P.O. Box 16110 Atlanta, GA 30321 |

| Required Information | Taxpayers should include their SSN, full name, address, and a clear request for their refund status. |

| Processing Time | Mail inquiries typically take 3-4 weeks for a response. |

Receiving Your Georgia State Tax Refund

Once the Georgia Department of Revenue processes your tax return and approves your refund, it’s important to understand the methods through which you can receive your refund.

Direct Deposit

The most efficient and secure method to receive your refund is through direct deposit. Taxpayers who provide their bank account details during filing can expect their refund to be deposited directly into their account, typically within 1-2 weeks of approval.

Check by Mail

For those who do not opt for direct deposit or have not provided their bank details, the Georgia Department of Revenue will issue a refund check by mail. This method may take slightly longer, with an average processing time of 2-3 weeks after refund approval.

It's important to note that refund checks are typically mailed to the address provided on the tax return. Taxpayers should ensure their address is accurate and up-to-date to avoid delays or misdelivery.

Troubleshooting Common Refund Issues

Despite the efficiency of the Georgia Department of Revenue’s refund system, taxpayers may occasionally encounter issues or delays with their refunds. Understanding common issues and their resolutions can help taxpayers navigate these challenges.

Common Refund Delays and Their Solutions

-

Error on Tax Return: If an error is detected on your tax return, the Department of Revenue may send a notice requesting additional information or documentation. Responding promptly to these notices is crucial to avoid further delays.

-

Missing Information: In some cases, taxpayers may have forgotten to include certain forms or schedules with their return. It’s important to ensure all required information is included to avoid refund processing delays.

-

Identity Verification: To prevent fraud, the Department of Revenue may request additional identity verification, especially for larger refunds. Responding promptly to these requests is essential to ensure timely refund processing.

Conclusion: A Transparent and Efficient Process

The Georgia State Tax Refund Status process is designed to be transparent and efficient, providing taxpayers with multiple methods to track and receive their refunds. By understanding the various methods, factors affecting refund timing, and potential issues, taxpayers can navigate the process with ease and ensure a smooth experience.

For more detailed information and updates, taxpayers are encouraged to visit the Georgia Department of Revenue website, which provides comprehensive resources and guides on tax refund status and other tax-related matters.

How long does it typically take to receive a Georgia state tax refund?

+The average processing time for a Georgia state tax refund is 6-8 weeks from the date the return is received. However, this timeline can vary based on factors like filing method, complexity of the return, and the overall volume of returns being processed.

What if my refund status shows “Pending” for an extended period?

+If your refund status remains “Pending” for more than 8 weeks, it’s recommended to contact the Georgia Department of Revenue through their toll-free phone line or mail-in inquiry service. Provide your SSN, full name, and any other relevant details to expedite the resolution process.

Can I track my refund status if I filed my return jointly with my spouse?

+Yes, both spouses can track the refund status using their individual SSNs and the exact refund amount. This applies whether the return was filed jointly or separately.