Ga Title Ad Valorem Tax

Welcome to a comprehensive exploration of the Ga Title Ad Valorem Tax, a unique tax system in the state of Georgia, United States. This article aims to delve into the intricacies of this tax, its historical context, how it impacts property owners, and its significance in Georgia's fiscal landscape. By the end of this journey, you'll have a deep understanding of this specific tax and its role in Georgia's economic framework.

Understanding the Ga Title Ad Valorem Tax

The Ga Title Ad Valorem Tax, often referred to as the Vehicle Title Tax, is a type of ad valorem tax imposed on the purchase of motor vehicles in the state of Georgia. This tax is distinct from other state taxes as it’s specifically targeted at the transfer of vehicle titles, making it a crucial consideration for anyone purchasing a new or used vehicle within the state.

The term ad valorem, derived from Latin, translates to "according to value." In the context of taxation, it signifies that the tax amount is directly proportional to the value of the property being taxed. In Georgia, this principle is applied to vehicle purchases, with the tax calculated based on the vehicle's assessed value.

This tax system has been in effect since 1997, when the Title Ad Valorem Tax Act was passed, aiming to provide a stable source of revenue for the state while ensuring fairness in taxation. The revenue generated from this tax is primarily allocated towards funding education, infrastructure development, and other essential public services.

How is the Ga Title Ad Valorem Tax Calculated?

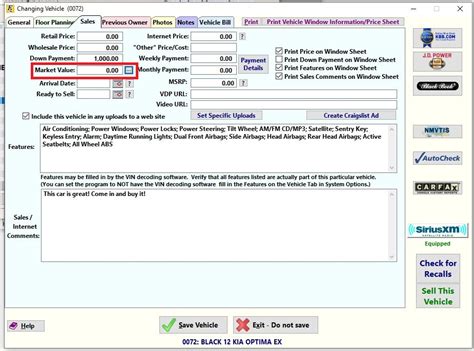

The calculation of the Ga Title Ad Valorem Tax involves a multi-step process. First, the assessed value of the vehicle is determined. This is typically done by considering the vehicle’s make, model, year, and condition. The assessed value is then multiplied by the tax rate, which can vary depending on the county where the vehicle is registered.

For instance, let's consider a scenario where a resident of Cobb County purchases a used car with an assessed value of $15,000. The tax rate in Cobb County is 6%. To calculate the Title Ad Valorem Tax, we'd multiply $15,000 by 0.06, resulting in a tax amount of $900.

However, it's important to note that this tax is subject to certain exemptions and limitations. For example, there's a trade-in allowance of up to $5,000 for the vehicle being traded in. Additionally, if the vehicle is purchased from a licensed Georgia dealer, the tax is calculated on the lower of the purchase price or the manufacturer's suggested retail price (MSRP), minus the trade-in allowance.

| County | Tax Rate |

|---|---|

| Cobb County | 6% |

| Fulton County | 7% |

| Gwinnett County | 5% |

| DeKalb County | 7.5% |

Historical Context and Evolution

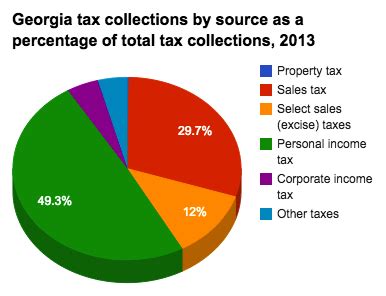

The Ga Title Ad Valorem Tax has its roots in the early 1990s, when Georgia’s legislature recognized the need for a more equitable and sustainable source of revenue to fund critical state services. Prior to its implementation, the state relied heavily on sales taxes, which were seen as regressive and disproportionately affected lower-income individuals.

In 1997, the Title Ad Valorem Tax Act was introduced as a means to shift the tax burden away from sales taxes and towards a more progressive system. The act aimed to ensure that those with higher-value assets contributed more to the state's revenue, while also providing a stable funding source for essential services.

Over the years, the Ga Title Ad Valorem Tax has undergone several amendments and adjustments. One significant change was the introduction of the Trade-In Allowance, which was implemented to incentivize vehicle trades and encourage consumers to consider their existing vehicles' value when purchasing new ones. This allowance not only benefited consumers but also helped promote a more sustainable approach to vehicle ownership.

Another notable evolution was the differentiation of tax rates based on county. This allowed local governments to have some autonomy in setting their own tax rates, taking into account the unique economic conditions and needs of their communities. While the state provided a framework, counties were given the flexibility to adjust tax rates as necessary, ensuring a balanced approach to taxation.

Impact on Georgia’s Economy

The Ga Title Ad Valorem Tax has had a profound impact on Georgia’s economy, serving as a reliable source of revenue for the state and its counties. The revenue generated from this tax has contributed significantly to the state’s fiscal stability, enabling the funding of critical services such as education, healthcare, and infrastructure development.

Furthermore, the tax has encouraged a more sustainable approach to vehicle ownership, promoting the consideration of trade-ins and the resale value of vehicles. This has not only benefited consumers financially but has also reduced the environmental impact associated with frequent vehicle purchases.

From an economic perspective, the Ga Title Ad Valorem Tax has fostered a more equitable distribution of tax burdens, ensuring that those with higher-value assets contribute proportionally more to the state's revenue. This progressive approach has helped reduce economic disparities and promote a more just society.

Comparative Analysis with Other States

When compared to other states, the Ga Title Ad Valorem Tax stands out as a unique and innovative approach to vehicle taxation. While many states impose sales taxes on vehicle purchases, Georgia’s focus on ad valorem taxation provides a more sustainable and equitable revenue stream.

For instance, in states like California, vehicle purchases are subject to a sales and use tax, which is a flat rate applied to the purchase price. This approach can lead to higher tax burdens for lower-income individuals, as the tax amount remains the same regardless of the vehicle's value. In contrast, Georgia's ad valorem tax ensures that the tax burden is proportional to the vehicle's value, providing a more progressive taxation system.

Additionally, the flexibility afforded to counties in setting their own tax rates is a unique feature of Georgia's system. This allows for a more localized approach to taxation, ensuring that counties can tailor their tax policies to meet their specific economic needs and conditions. This level of autonomy is rarely seen in other states, where tax rates are typically set at the state level.

Future Implications and Potential Changes

As with any tax system, the Ga Title Ad Valorem Tax is subject to potential changes and reforms. With evolving economic conditions and technological advancements, the state of Georgia may consider further amendments to ensure the tax remains fair, efficient, and relevant.

One potential area of focus could be the integration of electric vehicles (EVs) and their unique value considerations. As the market for EVs continues to grow, the state may need to adapt its assessment methods to accurately reflect the value of these vehicles, which can vary significantly from traditional combustion engine vehicles.

Furthermore, with the increasing popularity of ride-sharing and car-subscription services, the tax system may need to adapt to account for these new models of vehicle ownership. These services often involve frequent vehicle transfers, which could impact the calculation and collection of the Title Ad Valorem Tax. Addressing these emerging trends will be crucial to ensuring the tax system's long-term viability.

In conclusion, the Ga Title Ad Valorem Tax is a complex yet essential component of Georgia's fiscal framework. Its unique structure, progressive nature, and flexibility have made it a successful revenue-generating mechanism, contributing significantly to the state's economic stability and the funding of essential services. As Georgia continues to evolve, so too will its tax system, ensuring that it remains fair, efficient, and adaptable to the needs of its citizens.

What is the purpose of the Ga Title Ad Valorem Tax?

+The Ga Title Ad Valorem Tax is designed to provide a stable and equitable source of revenue for the state of Georgia. It aims to fund essential public services, such as education, infrastructure, and healthcare, while ensuring that the tax burden is proportional to the value of the vehicle being purchased.

How does the Ga Title Ad Valorem Tax differ from other state taxes on vehicle purchases?

+Unlike many states that impose a flat sales tax on vehicle purchases, Georgia’s Title Ad Valorem Tax is based on the vehicle’s assessed value. This means the tax amount is directly proportional to the value of the vehicle, making it a more progressive and equitable taxation system.

Are there any exemptions or limitations to the Ga Title Ad Valorem Tax?

+Yes, there are certain exemptions and limitations. For instance, there’s a trade-in allowance of up to $5,000 for vehicles being traded in. Additionally, if the vehicle is purchased from a licensed Georgia dealer, the tax is calculated on the lower of the purchase price or the manufacturer’s suggested retail price (MSRP), minus the trade-in allowance.