Fort Bend County Taxes

Fort Bend County, located in the vibrant state of Texas, is renowned for its diverse communities, thriving businesses, and dynamic culture. As one of the fastest-growing counties in the nation, it presents a unique landscape for residents and property owners alike. In this comprehensive guide, we delve into the intricacies of Fort Bend County Taxes, exploring the various aspects that contribute to the tax landscape of this dynamic region.

Understanding Fort Bend County’s Tax Structure

The tax system in Fort Bend County is a complex yet essential component of the local economy and governance. It is crucial for property owners and residents to grasp the fundamentals of this system to make informed decisions and ensure compliance with tax regulations.

Fort Bend County, like many other counties in Texas, operates on a property tax system. This means that the primary source of revenue for the county's operations and services comes from taxes levied on real estate properties within its jurisdiction. These properties include residential homes, commercial buildings, land, and other tangible assets.

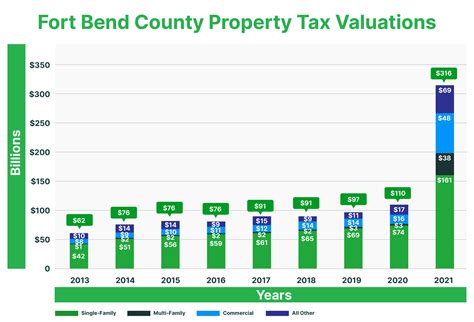

Tax Rates and Assessments

The tax rate in Fort Bend County is determined annually by the Fort Bend County Commissioners Court, which sets the tax rate based on the county’s budgetary needs and financial goals. This rate is expressed in dollars per $100 of assessed property value, a standard unit of measurement used across Texas.

The assessment process involves the Fort Bend Central Appraisal District (FCAD), an independent body responsible for determining the fair market value of each property in the county. FCAD conducts regular appraisals, taking into account factors such as location, size, improvements, and market conditions.

Once the appraised value is established, it is multiplied by the tax rate to calculate the total tax liability for each property owner. This calculation takes into account any applicable exemptions, such as the homestead exemption, which reduces the taxable value of a primary residence.

| Category | Tax Rate |

|---|---|

| Residential Property | 0.00079790 / $100 |

| Commercial Property | 0.00102490 / $100 |

| Agricultural Land | 0.00100000 / $100 |

It's important to note that tax rates can vary slightly from year to year, and they may differ for different types of properties. The above rates are provided as an example and may not reflect the most current tax rates.

Tax Collection and Payment

In Fort Bend County, the Fort Bend County Tax Assessor-Collector’s Office is responsible for collecting property taxes. This office sends out tax bills to property owners, which typically arrive in the fall of each year. Property owners have the option to pay their taxes in full or opt for a payment plan.

Late payments may incur penalties and interest, so it is advisable for property owners to stay informed about their tax due dates and make timely payments to avoid additional costs.

Tax Exemptions and Relief Programs

Fort Bend County offers various tax exemptions and relief programs to eligible property owners, helping to reduce their tax burden and provide financial assistance.

Homestead Exemption

One of the most significant tax relief programs in Fort Bend County is the homestead exemption. This exemption reduces the taxable value of a property owner’s primary residence, resulting in lower property taxes. To qualify for the homestead exemption, property owners must meet specific residency and ownership requirements and apply with the Fort Bend County Tax Assessor-Collector’s Office.

Other Exemptions and Relief

-

Over-65 Exemption: Property owners who are 65 years or older may qualify for an exemption that limits the increase in their property taxes. This exemption helps seniors retain their properties without facing significant tax increases due to rising property values.

-

Disabled Veteran Exemption: Qualified disabled veterans can receive an exemption from property taxes on their primary residence, offering financial relief to those who have served our country.

-

Agricultural Exemption: Property owners with agricultural land may be eligible for an exemption if their land is actively used for agricultural purposes. This exemption encourages and supports local farming and ranching.

Online Tax Services and Resources

Fort Bend County has embraced digital technology to enhance the tax experience for property owners. The Fort Bend County Tax Assessor-Collector’s Office provides a user-friendly online portal that allows residents to access a wealth of tax-related information and services.

Online Portal Features

-

Tax Bill Lookup: Property owners can easily look up their tax bills, including past and current assessments, online.

-

Online Payment: Residents have the convenience of paying their property taxes securely online, saving time and effort.

-

Exemption Applications: Many tax exemptions can be applied for directly through the online portal, simplifying the process and providing a more efficient experience.

-

Tax Calendar: The portal offers a comprehensive tax calendar, keeping residents informed about important dates, deadlines, and events related to property taxes.

-

Property Search: Residents and businesses can search for properties by address, owner name, or other identifying information, providing valuable insights for research and planning.

Community Engagement and Tax Transparency

Fort Bend County recognizes the importance of transparency and community involvement in tax matters. The county actively engages with residents through various initiatives and platforms.

Tax Transparency Initiatives

-

Public Meetings: The Fort Bend County Commissioners Court holds regular public meetings where residents can voice their concerns, ask questions, and stay informed about tax-related decisions and initiatives.

-

Community Workshops: Throughout the year, the county organizes workshops and seminars to educate residents about property taxes, exemptions, and other relevant topics. These events provide a platform for open dialogue and learning.

-

Online Resources: The Fort Bend County website offers a dedicated section for tax-related information, providing residents with easy access to resources, forms, and guidelines.

Future Outlook and Tax Considerations

As Fort Bend County continues to experience rapid growth and development, its tax landscape is expected to evolve. The county’s leadership and tax authorities are committed to maintaining a fair and efficient tax system that supports the community’s needs and fosters economic prosperity.

Key Considerations

-

Economic Development: Fort Bend County’s tax policies aim to attract and retain businesses, fostering economic growth and job creation. The county’s competitive tax rates and incentives contribute to its attractiveness as a business hub.

-

Infrastructure and Services: Tax revenues play a vital role in funding essential infrastructure projects and public services, ensuring that Fort Bend County remains a desirable place to live, work, and invest.

-

Community Engagement: The county’s commitment to transparency and community involvement in tax matters is expected to continue, ensuring that residents have a voice in shaping the tax landscape.

FAQ

When are Fort Bend County property taxes due?

+

Property taxes in Fort Bend County are typically due by January 31st of each year. However, taxpayers have the option to pay their taxes in two installments, with the first installment due by January 31st and the second installment due by July 31st.

How can I pay my Fort Bend County property taxes online?

+

To pay your Fort Bend County property taxes online, you can visit the Fort Bend County Tax Office website and navigate to the Online Payment Portal. You will need your account number or property details to make the payment securely.

What happens if I miss the deadline to pay my property taxes in Fort Bend County?

+

If you miss the deadline to pay your property taxes in Fort Bend County, penalties and interest will accrue on the outstanding balance. It’s important to stay informed about tax due dates and make timely payments to avoid additional costs.

How can I apply for a tax exemption in Fort Bend County?

+

To apply for a tax exemption in Fort Bend County, you can visit the Fort Bend County Tax Office website and download the appropriate exemption application form. The specific exemption you are seeking will determine the required documentation and eligibility criteria.

Where can I find more information about Fort Bend County’s tax rates and assessments?

+

For detailed information about Fort Bend County’s tax rates and assessments, you can visit the Fort Bend Central Appraisal District (FCAD) website. FCAD provides valuable resources, including tax rate information, appraisal data, and property search tools.