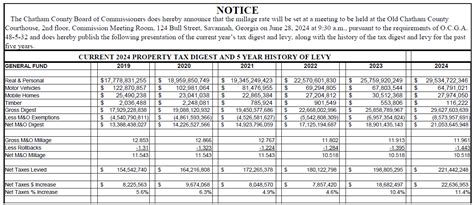

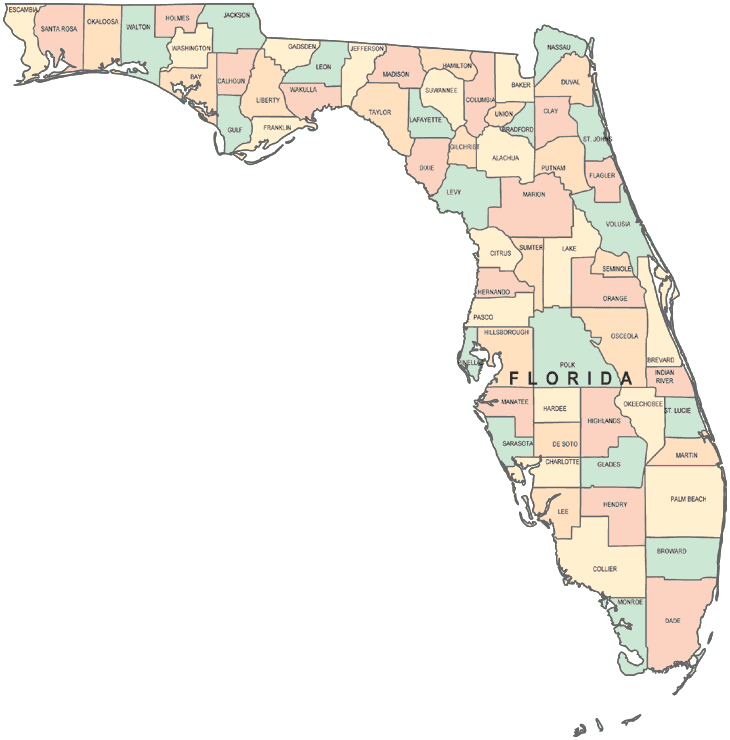

Florida Sales Tax By County

The Sunshine State, Florida, boasts a unique sales tax landscape, with tax rates varying across its 67 counties. Understanding this diversity is crucial for businesses and consumers alike, especially when considering the impact on pricing strategies and budgeting.

Florida’s County-Specific Sales Tax Structure

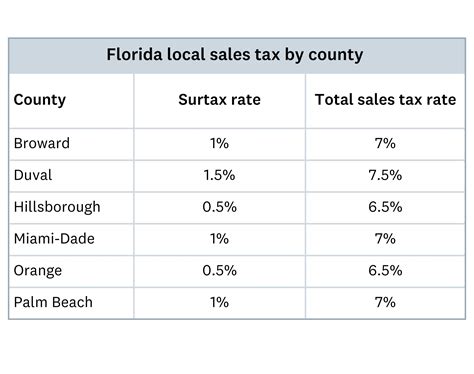

Florida’s sales tax system is a blend of state and local taxes, resulting in a range of rates. The state sales tax rate stands at 6%, but when combined with county surcharges, the total tax burden can vary significantly.

Regional Variations

Florida’s geography plays a pivotal role in its sales tax rates. For instance, in the densely populated South Florida region, counties like Miami-Dade and Broward have higher sales taxes to support their bustling economies and infrastructure needs. Conversely, rural counties often have lower rates.

Specific County Rates

| County | Sales Tax Rate |

|---|---|

| Alachua | 6.5% |

| Bay | 7% |

| Broward | 7.5% |

| Charlotte | 6.5% |

| Citrus | 6.5% |

| … | … |

This table provides a snapshot of sales tax rates across a few counties. The full list, detailing all 67 counties, can be found on the official Florida Department of Revenue website.

Impact on Business and Consumers

The county-specific sales tax structure in Florida has wide-ranging implications.

For Businesses

Businesses, especially those with an online presence, must ensure compliance with the relevant county’s tax rate. This can be a complex task, given the diverse rates across Florida. For instance, a business operating in Miami-Dade must account for the 7.5% sales tax, whereas a business in Alachua would apply a 6.5% rate.

For Consumers

Consumers, particularly those making significant purchases, should be aware of the sales tax variations. This knowledge can influence shopping decisions, especially when comparing prices across counties. For example, a consumer might opt to shop in a county with a lower sales tax rate to save money on a large purchase.

Sales Tax and Economic Development

The county-level sales tax system in Florida also has a role in economic development strategies.

Local Control and Investment

Counties with higher sales tax rates often invest these funds back into the local community. This can take the form of improved infrastructure, better public services, or even tax incentives for businesses, all of which can contribute to economic growth and development.

Attracting Businesses

Counties with lower sales tax rates might use this as a competitive advantage to attract new businesses. By offering a more favorable tax environment, these counties can stimulate economic activity and create new job opportunities.

Challenges and Future Outlook

While Florida’s county-specific sales tax system offers benefits, it also presents challenges.

Compliance and Administration

For businesses, managing compliance with varying sales tax rates can be complex and time-consuming. This is especially true for businesses with operations across multiple counties.

Potential for Reform

Given the complexities and administrative burdens, there have been calls for sales tax reform in Florida. Some experts advocate for a simplified, uniform sales tax rate across the state, which could streamline compliance and reduce administrative costs for businesses.

Conclusion

Florida’s county-specific sales tax system is a unique feature of the state’s tax landscape. It offers counties a degree of local control and the ability to invest in their communities. However, it also presents complexities for businesses and consumers, highlighting the need for efficient tax administration and potential reforms.

Frequently Asked Questions

How often are sales tax rates updated in Florida counties?

+Sales tax rates in Florida counties are generally updated annually, often to align with budgetary needs and infrastructure projects. However, some counties may experience more frequent changes, especially if there are special initiatives or projects requiring additional funding.

Do online retailers need to collect sales tax based on the buyer’s county in Florida?

+Yes, online retailers with a significant physical presence or nexus in Florida are required to collect sales tax based on the buyer’s county. This ensures that online purchases are subject to the same tax rates as in-person transactions, maintaining fairness in the retail landscape.

Are there any counties in Florida with no sales tax?

+No, Florida does not have any counties with a 0% sales tax rate. The state sales tax rate of 6% applies statewide, and counties can add their own surcharges, resulting in the varying rates seen across the state.

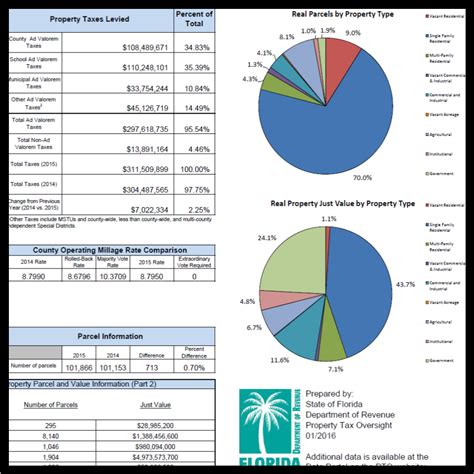

How do sales tax rates impact property values in Florida counties?

+Sales tax rates can indirectly impact property values in Florida counties. Counties with higher sales tax rates often have more funds available for infrastructure and public services, which can enhance the overall quality of life and potentially increase property values. Conversely, counties with lower rates might need to allocate more funds for these services, which could impact property taxes.

Can counties in Florida implement additional sales tax surcharges for specific purposes?

+Yes, Florida counties can implement additional sales tax surcharges for specific purposes, such as funding transportation projects or supporting local education initiatives. These surcharges are often subject to voter approval through referendums, allowing the public to have a say in how their sales tax dollars are allocated.