Fairfax Va Property Tax

Property taxes are an essential component of any community's revenue system, and Fairfax County, Virginia, is no exception. The Fairfax County Property Tax is a vital source of funding for various public services, infrastructure development, and community improvements. This article aims to delve into the intricacies of the Fairfax County property tax system, exploring its structure, calculation methods, payment processes, and implications for homeowners and businesses within the county.

Understanding Fairfax County Property Taxes

Fairfax County, located in Northern Virginia, is one of the most populous counties in the state. With a diverse population and a thriving economy, the county relies on a robust property tax system to support its extensive network of schools, public safety services, transportation infrastructure, and other essential community facilities.

The property tax in Fairfax County is an ad valorem tax, meaning it is levied based on the assessed value of the property. This value is determined by the Fairfax County Office of Real Estate Assessments, which conducts regular assessments to ensure fair and accurate property valuations. The assessed value is then used to calculate the property tax liability for each individual or business owning property within the county.

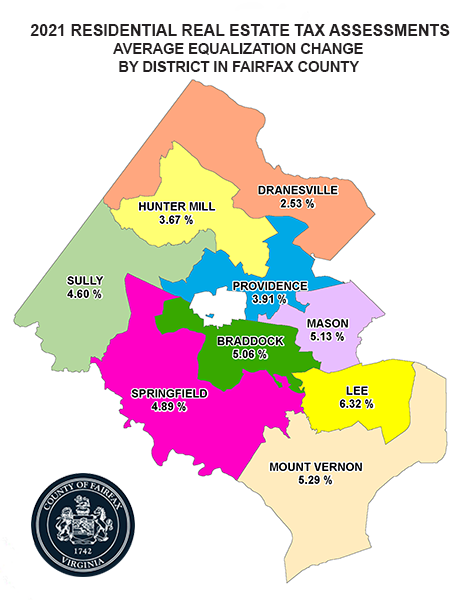

Assessed Value and Tax Rates

The assessed value of a property is not the same as its market value. Instead, it is a calculated value based on various factors, including:

- Fair Market Value: This is the estimated price for which a property would sell on the open market in its current condition.

- Assessment Ratio: Fairfax County applies an assessment ratio of 100% to all properties. This means the assessed value is equivalent to the fair market value.

- Property Class: Properties are classified into different categories, such as residential, commercial, or agricultural. Each class may have a different tax rate.

Once the assessed value is determined, it is multiplied by the applicable tax rate to calculate the property tax liability. The tax rates are set annually by the Fairfax County Board of Supervisors and can vary based on the property's location and class.

| Property Class | Tax Rate (per $100 of Assessed Value) |

|---|---|

| Residential | $1.1240 |

| Commercial | $1.4144 |

| Industrial | $1.4144 |

| Agricultural | $0.3566 |

For example, if a residential property has an assessed value of $500,000, the property tax calculation would be as follows:

Property Tax = Assessed Value x Tax Rate

Property Tax = $500,000 x $1.1240 = $562,000

Property Tax Payment Process

Fairfax County utilizes a streamlined and efficient payment process for property taxes. The county’s Treasurer’s Office handles the collection of property taxes and provides several payment options to accommodate different preferences and needs.

Payment Methods

- Online Payment: Homeowners and businesses can make secure online payments through the Fairfax County website. This method offers convenience and real-time confirmation of payment.

- Mail-in Payment: Property owners can also choose to pay their taxes by mailing a check or money order to the Treasurer’s Office. The payment should be accompanied by the appropriate coupon from the tax bill.

- In-Person Payment: For those who prefer face-to-face transactions, the Treasurer’s Office accepts payments in person at their office located at 12000 Government Center Parkway, Fairfax, VA 22035.

- Electronic Funds Transfer (EFT): EFT allows property owners to set up automatic payments from their bank account to the Treasurer’s Office. This option ensures timely payments and avoids late fees.

It is essential to note that Fairfax County offers a discount for early payments. Property owners who pay their taxes by a specified early payment deadline, usually in February or March, can receive a 10% discount on their tax bill. This incentive encourages timely payments and helps the county manage its cash flow effectively.

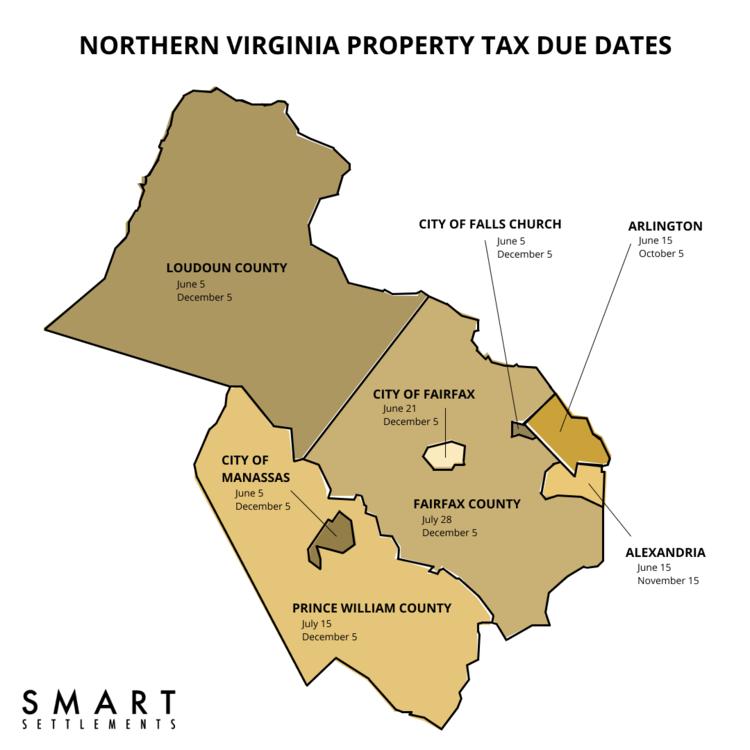

Tax Bill Distribution and Payment Due Dates

The Fairfax County Treasurer’s Office typically mails tax bills to property owners in late winter or early spring. These bills provide detailed information about the assessed value, tax rates, and the amount due for the current tax year. Property owners are responsible for ensuring that their mailing addresses are up-to-date to receive their tax bills promptly.

The tax bills also outline the payment due dates. Fairfax County generally divides the tax year into two installments, with each installment due on a specific date. Late payments are subject to interest and penalties, so it is crucial for property owners to stay informed about the payment deadlines.

Implications and Considerations for Property Owners

Understanding the Fairfax County property tax system is vital for homeowners and businesses within the county. Here are some key considerations and implications:

Budgeting and Planning

Property taxes are a significant expense for homeowners and businesses. It is essential to budget for these taxes annually to ensure timely payments and avoid financial strain. Property owners can estimate their tax liability based on the assessed value and tax rates to plan their finances accordingly.

Appeals and Assessments

If a property owner believes that their assessed value is inaccurate or unfair, they have the right to appeal the assessment. Fairfax County provides a comprehensive appeals process, allowing property owners to dispute their assessments and potentially reduce their tax liability. The appeals process involves submitting documentation and evidence to support the claim and may require a hearing before the Board of Equalization.

Impact on Real Estate Transactions

Property taxes are a crucial factor in real estate transactions. When buying or selling a property, the assessed value and associated tax liability can significantly impact the overall financial picture. Buyers should consider the property tax burden when evaluating the affordability of a home, and sellers should be transparent about the tax obligations associated with the property.

Community Benefits and Investments

Fairfax County property taxes are a critical source of revenue for the community. The funds generated through property taxes are invested in various public services and infrastructure projects that enhance the quality of life for residents. These investments include schools, parks, public safety, transportation, and other essential services. By paying their property taxes, residents directly contribute to the well-being and development of their community.

Conclusion: A Vital Community Investment

The Fairfax County property tax system is a vital component of the county’s fiscal framework. It ensures that the community’s needs are met while providing essential services and infrastructure. By understanding the assessment process, tax rates, and payment options, property owners can navigate the system effectively and contribute to the prosperity of Fairfax County.

How often are property assessments conducted in Fairfax County?

+Fairfax County conducts assessments every year. The Office of Real Estate Assessments reviews and updates property values annually to ensure accuracy and fairness.

Are there any tax relief programs for seniors or low-income homeowners in Fairfax County?

+Yes, Fairfax County offers several tax relief programs. These include the Homestead Exemption, which reduces taxable value, and the Senior Citizen Real Estate Tax Deferral Program, which allows eligible seniors to defer their property taxes until they sell or pass away.

What happens if I miss the tax payment deadline?

+Late payments are subject to interest and penalties. The Treasurer’s Office assesses a 10% penalty on the unpaid tax amount for each month the payment is late, up to a maximum of 10 months. It is crucial to make timely payments to avoid these additional charges.