Does New Hampshire Have Income Tax

Nestled in the heart of New England, the state of New Hampshire boasts a unique tax structure that has caught the attention of many. While some states heavily rely on income taxes to fund their operations, New Hampshire has taken a different approach. In this article, we will delve into the tax landscape of the Granite State, specifically addressing the question: Does New Hampshire have an income tax? We will explore the state's tax policies, their implications, and how this lack of income tax affects its residents and businesses.

The Absence of Income Tax in New Hampshire

New Hampshire stands as one of the few states in the United States that does not impose an income tax on its residents. This distinctive feature has shaped the state’s economic landscape and attracted various businesses and individuals seeking tax-friendly environments.

The state's decision to forego income taxation can be traced back to its long-standing commitment to limited government and low taxes. This philosophy is deeply rooted in the state's history and has influenced its tax policies for decades. As a result, New Hampshire has become a haven for those seeking to minimize their tax burdens.

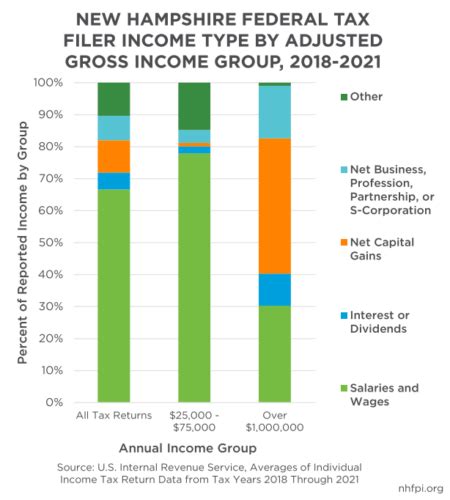

However, it is important to note that the absence of income tax does not mean that New Hampshire residents are completely exempt from taxation. The state still generates revenue through other means, primarily relying on taxes on dividends, interest, and capital gains, which are often referred to as "business profits tax."

Taxes in New Hampshire: A Comprehensive Overview

While income tax is notably absent, New Hampshire’s tax system encompasses a range of other taxes that contribute to its revenue stream. Here’s a breakdown of the key taxes in the state:

- Business Profits Tax: As mentioned earlier, this tax applies to dividends, interest, and capital gains, impacting businesses and investors. The rate for this tax is set at 8.5%.

- Sales and Use Tax: New Hampshire imposes a sales tax on retail sales, leases, and rentals of tangible personal property and certain services. The standard rate is 9%, with certain exemptions and reduced rates for specific items.

- Real Estate Taxes: Property taxes are a significant source of revenue for the state and local governments. These taxes are typically levied on real estate properties, including residential and commercial properties, with rates varying by municipality.

- Rooms and Meals Tax: A tax of 9% is applied to meals and rental of rooms in hotels, motels, and other lodging establishments. This tax contributes to the state's revenue from the tourism sector.

- Cigarette Tax: New Hampshire imposes a tax on the sale of cigarettes, with the rate set at $1.78 per pack. This tax aims to discourage smoking and generate revenue for public health initiatives.

- Excise Taxes: The state levies excise taxes on various products and services, including gasoline, alcoholic beverages, and telecommunications services. These taxes are often used to fund specific infrastructure projects or regulatory programs.

Despite the absence of income tax, New Hampshire's tax system still plays a crucial role in funding essential services, infrastructure development, and public programs. The state's approach to taxation reflects its commitment to maintaining a balanced budget and promoting economic growth.

| Tax Category | Rate |

|---|---|

| Business Profits Tax | 8.5% |

| Sales and Use Tax | 9% |

| Rooms and Meals Tax | 9% |

| Cigarette Tax | $1.78 per pack |

Economic Impact and Considerations

The absence of income tax in New Hampshire has had both positive and challenging implications for the state’s economy. Let’s explore some of the key aspects:

Attracting Businesses and Residents

New Hampshire’s no-income-tax policy has been a significant draw for businesses looking to reduce their tax liabilities. Companies, especially those with high-income employees, often find the state’s tax structure appealing. As a result, the state has witnessed a steady influx of businesses and entrepreneurs, contributing to economic growth and job creation.

Similarly, individuals seeking to minimize their tax burdens are often attracted to New Hampshire. The absence of income tax makes the state an attractive option for those with substantial earnings, as they can potentially save a significant amount in taxes compared to states with high income tax rates.

Revenue Generation and Challenges

While the lack of income tax brings in new businesses and residents, it also presents challenges in terms of revenue generation. The state relies heavily on other taxes, particularly the business profits tax and sales tax, to fund its operations. This reliance can make the state’s revenue stream more susceptible to economic fluctuations and changes in consumer behavior.

Furthermore, the absence of income tax means that New Hampshire may have less flexibility in responding to economic downturns or unexpected expenses. Income tax, being a progressive tax, can provide a more stable and adaptable revenue stream for states, which New Hampshire lacks.

Impact on Local Communities

The tax structure in New Hampshire can also have varying impacts on local communities. While the state as a whole benefits from the influx of businesses and residents, individual towns and cities may face unique challenges. For example, property taxes, which are a significant source of revenue for local governments, can become a burden for residents, especially in areas with high real estate values.

Additionally, the state's reliance on sales tax can disproportionately affect lower-income individuals and communities, as they may spend a larger portion of their income on taxable goods and services.

Comparison with Other States

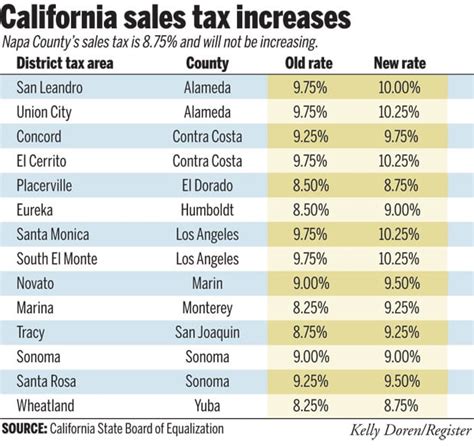

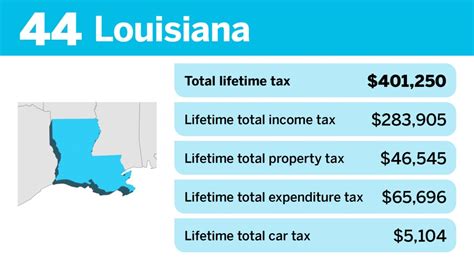

When comparing New Hampshire’s tax system to other states, it becomes evident that the Granite State takes a unique approach. While some states, like Florida and Texas, also have no income tax, they often make up for it with higher sales taxes or other forms of taxation. New Hampshire’s tax structure sets it apart, offering a different economic environment.

In contrast, states like California and New York have high income tax rates but often provide more extensive public services and infrastructure. The trade-off between tax rates and the level of public services is a key consideration for individuals and businesses when choosing where to reside or operate.

Future Outlook and Potential Changes

As with any tax system, there is always the possibility of future changes and reforms. New Hampshire’s tax landscape is no exception, and various factors could influence potential shifts in the state’s tax policies.

Economic Factors

Economic fluctuations and changes in the business environment can prompt the state to reconsider its tax policies. If the current tax structure proves insufficient to meet the state’s financial needs, especially during economic downturns, there may be calls for tax reforms.

Additionally, changes in federal tax policies can also impact the state's approach. For instance, if federal tax reforms lead to reduced revenue for the state, New Hampshire may need to reevaluate its tax structure to maintain a balanced budget.

Political Landscape

The political climate in New Hampshire plays a significant role in shaping tax policies. The state’s commitment to limited government and low taxes is deeply ingrained in its political culture. However, as political dynamics shift, there could be proposals for tax reforms, especially if there is a perceived need for additional revenue or a desire to redistribute tax burdens more equitably.

Public Opinion and Initiatives

Public opinion and citizen initiatives can also drive changes in tax policies. If there is a growing concern about the state’s tax structure, especially regarding the impact on specific communities or industries, there may be efforts to propose alternative tax systems or adjustments to existing taxes.

Furthermore, the state's commitment to direct democracy, with its tradition of town meetings and citizen-led initiatives, means that residents have a direct say in shaping tax policies. This unique aspect of New Hampshire's governance can lead to unexpected shifts in tax laws.

Regional and National Context

New Hampshire’s tax policies are also influenced by regional and national contexts. The state’s proximity to other New England states with different tax structures can impact its competitiveness in attracting businesses and residents. Additionally, national economic trends and tax policies can shape the state’s approach, especially if there are significant changes in federal tax laws.

Conclusion: Navigating New Hampshire’s Tax Landscape

New Hampshire’s decision to forego income tax has created a unique tax environment that has both advantages and challenges. The state’s tax system, while attracting businesses and individuals seeking tax efficiency, also presents considerations in terms of revenue generation and the distribution of tax burdens.

As New Hampshire continues to navigate its economic journey, the state's tax policies will remain a topic of discussion and debate. Understanding the nuances of the Granite State's tax landscape is essential for individuals, businesses, and policymakers alike, as it shapes the economic trajectory of one of America's most distinctive states.

Does New Hampshire have any tax incentives for businesses?

+Yes, New Hampshire offers various tax incentives to attract and support businesses. These incentives include tax credits for research and development, job creation, and investment in certain industries. The state also provides tax exemptions for specific sectors, such as manufacturing and high-tech businesses.

How does New Hampshire compare to neighboring states in terms of tax rates?

+New Hampshire’s tax rates, particularly its absence of income tax, make it a competitive option compared to neighboring states. While some states like Massachusetts and Vermont have higher income tax rates, they often offer more extensive public services. New Hampshire’s tax structure can be attractive to those seeking lower tax burdens.

Are there any drawbacks to New Hampshire’s tax system for residents?

+While the absence of income tax can be beneficial, New Hampshire’s tax system may present challenges for certain groups. Lower-income individuals may face higher effective tax rates due to the reliance on sales tax. Additionally, property taxes can be a burden for homeowners, especially in areas with high real estate values.

How does New Hampshire fund public services without an income tax?

+New Hampshire funds public services through a combination of taxes, including the business profits tax, sales tax, and property taxes. The state also receives federal funding and has a history of prudent fiscal management, ensuring a balanced budget.

Are there any ongoing debates or proposals for tax reforms in New Hampshire?

+Yes, tax reform proposals are periodically discussed in New Hampshire. Some advocate for the introduction of an income tax to provide more stable revenue, while others propose adjustments to existing taxes to address revenue gaps or redistribute tax burdens more equitably. The ongoing debate reflects the state’s commitment to continuous improvement and its unique tax landscape.