Delinquent Property Tax List

The Impact of Delinquent Property Taxes: Navigating the Complexities of Property Ownership

Property taxes are an essential component of local government funding, supporting vital services and infrastructure. However, when property owners fail to pay these taxes, it can lead to a cascade of legal and financial repercussions. This article delves into the intricacies of delinquent property tax lists, exploring their implications, the legal processes involved, and strategies for homeowners to navigate this challenging situation.

Understanding Delinquent Property Taxes

Delinquent property taxes refer to unpaid property tax obligations, which can accrue interest and penalties over time. These taxes are typically levied annually by local governments, and failure to pay them can result in severe consequences for property owners.

The impact of delinquent property taxes extends beyond individual homeowners. Local governments rely on these taxes to fund essential services such as schools, public safety, and infrastructure maintenance. When a significant portion of the tax base goes unpaid, it can strain the financial stability of the community and affect the overall quality of life.

The Delinquent Property Tax List: A Comprehensive Overview

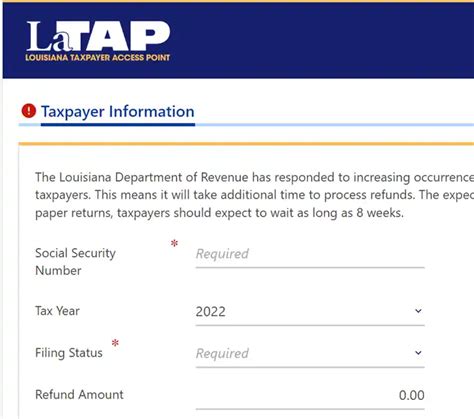

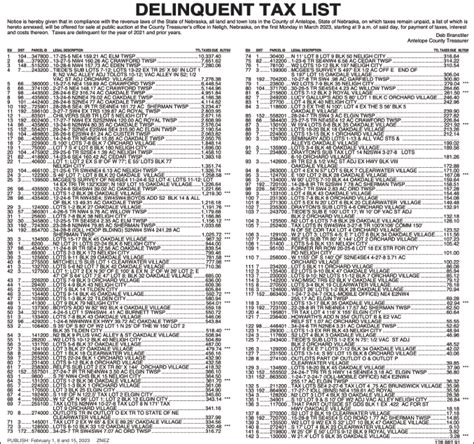

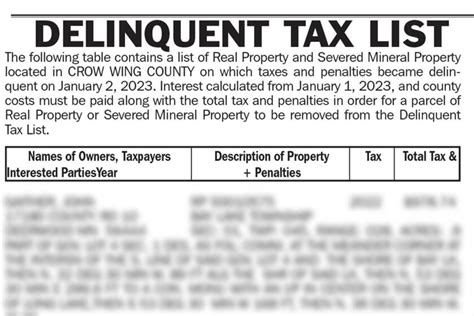

The delinquent property tax list is a public record maintained by the local tax authority. It contains detailed information on properties with outstanding tax liabilities, including the property owner's name, address, parcel number, and the amount owed. This list serves as a formal notification to property owners and is a crucial step in the legal process to recover unpaid taxes.

Here's a breakdown of the key elements typically found on a delinquent property tax list:

- Property Owner Information: The list includes the legal name of the property owner, often accompanied by their mailing address. This information is crucial for tax authorities to communicate the outstanding debt and potential legal actions.

- Property Details: Each entry on the list provides specific details about the property, such as its location, parcel number, and legal description. This ensures that the tax liability is accurately attributed to the correct property.

- Amount Owed: The delinquent tax list clearly states the total amount of unpaid property taxes, including any accrued interest and penalties. This information helps property owners understand the magnitude of their financial obligation.

- Payment Due Dates: The list often includes a timeline of payment due dates, highlighting when the taxes were originally due and any subsequent deadlines for avoiding further penalties or legal actions.

- Legal Notices: In some cases, the list may include legal notices or warnings, informing property owners of the potential consequences of non-payment, such as tax liens, property seizures, or foreclosure proceedings.

It's important to note that the delinquent property tax list is a public record, and anyone can access it to check for outstanding tax liabilities. This transparency aims to encourage property owners to fulfill their tax obligations and ensure fair tax collection practices.

The Legal Consequences of Delinquent Property Taxes

The legal implications of delinquent property taxes can be severe and far-reaching. When property owners fail to pay their taxes, local governments have the authority to take legal action to recover the outstanding debt.

Tax Liens and Foreclosure

One of the initial steps taken by tax authorities is to place a tax lien on the delinquent property. A tax lien is a legal claim against the property, which gives the government priority over other creditors in the event of a sale or transfer of ownership. This lien serves as a warning to potential buyers that there are outstanding tax obligations associated with the property.

If the property owner fails to resolve the delinquent taxes, the local government may initiate foreclosure proceedings. Foreclosure allows the government to seize the property and sell it at a public auction to recoup the unpaid taxes. This process can be financially devastating for homeowners and often results in the loss of their property.

Interest and Penalty Accumulation

Delinquent property taxes accrue interest and penalties over time. The interest rates and penalty structures vary depending on the jurisdiction, but they can quickly add up, significantly increasing the amount owed. These additional charges serve as an incentive for property owners to resolve their tax obligations promptly.

For example, let's consider a scenario where a homeowner owes $5,000 in property taxes. If the interest rate is 10% per annum and the penalty is 5% of the outstanding amount, the total debt would accumulate as follows:

| Year | Interest | Penalty | Total Debt |

|---|---|---|---|

| Year 1 | $500 | $250 | $5,750 |

| Year 2 | $575 | $287.50 | $6,612.50 |

| Year 3 | $661.25 | $330.63 | $7,604.38 |

| ... | ... | ... | ... |

As this example illustrates, the financial burden of delinquent property taxes can escalate rapidly, making it increasingly challenging for homeowners to resolve their tax obligations.

Impact on Credit Score and Financial Standing

Delinquent property taxes can also have a detrimental effect on a homeowner's credit score and overall financial standing. When taxes go unpaid, the local government may report the delinquency to credit bureaus, resulting in a negative mark on the homeowner's credit report. This can impact their ability to secure loans, mortgages, or other forms of credit in the future.

Additionally, the financial strain of delinquent property taxes can lead to missed payments on other obligations, such as mortgage loans or credit card debts. This further exacerbates the homeowner's financial situation and may trigger additional fees, late payment penalties, or even legal actions from creditors.

Strategies for Homeowners to Address Delinquent Taxes

For homeowners facing delinquent property taxes, there are several strategies they can employ to resolve the situation and avoid legal consequences.

Payment Plans and Settlement Agreements

Local tax authorities often offer payment plans to help homeowners manage their delinquent tax obligations. These plans allow homeowners to pay off their taxes over an extended period, reducing the financial burden and providing a structured approach to resolution.

In some cases, tax authorities may also consider settlement agreements. These agreements involve negotiating a reduced tax amount or a compromise on interest and penalties. However, it's important to note that settlement agreements are typically reserved for homeowners facing financial hardship or extenuating circumstances.

Seeking Professional Assistance

Navigating the complexities of delinquent property taxes can be overwhelming, especially for homeowners who are already facing financial challenges. Seeking professional assistance from tax advisors, accountants, or legal experts can provide valuable guidance and support.

Tax professionals can help homeowners understand their rights and obligations, negotiate with tax authorities, and explore potential tax relief programs or incentives. They can also assist in preparing accurate tax returns, ensuring that homeowners avoid future delinquencies and potential legal issues.

Exploring Tax Relief Programs

Many jurisdictions offer tax relief programs to assist homeowners who are struggling to pay their property taxes. These programs may provide temporary reductions in tax assessments, deferrals, or waivers for eligible individuals facing financial hardship.

For instance, some states have programs specifically designed to assist elderly or disabled homeowners with their property taxes. These programs often have eligibility criteria based on income, age, or disability status. By researching and applying for such programs, homeowners may be able to alleviate some of the financial strain associated with delinquent taxes.

Prevention and Awareness: Key Takeaways

While addressing delinquent property taxes is crucial, prevention and awareness are equally important. Here are some key takeaways to help homeowners avoid delinquent tax situations:

- Stay Informed: Keep track of property tax due dates and amounts. Local tax authorities often provide online resources or mailers to inform homeowners of their tax obligations. Staying informed helps homeowners plan their finances and avoid missing payment deadlines.

- Budgeting and Financial Planning: Incorporate property taxes into your annual budget. Allocate funds specifically for tax payments to ensure you have the necessary funds available when they are due. Consider setting aside a portion of your income each month to cover property taxes, reducing the financial strain during tax season.

- Seek Assistance Early: If you anticipate financial difficulties in paying your property taxes, don't wait until you receive a delinquent tax notice. Reach out to tax authorities or seek professional advice as soon as possible. Many jurisdictions offer payment plans or relief programs that can help alleviate the burden and prevent further complications.

- Understand Tax Laws and Incentives: Stay updated on local tax laws and any incentives or exemptions that may apply to your property. Some jurisdictions offer tax breaks for certain property improvements, energy-efficient upgrades, or historic preservation efforts. Understanding these incentives can help you optimize your tax obligations and potentially reduce your tax liability.

By being proactive and taking these preventive measures, homeowners can minimize the risk of delinquent property taxes and avoid the associated legal and financial consequences.

Conclusion: Navigating a Complex Legal Landscape

Delinquent property taxes present a complex and challenging situation for both homeowners and local governments. The legal consequences can be severe, impacting a homeowner's financial stability, credit score, and even their property ownership. However, by understanding the intricacies of delinquent property taxes, exploring available options, and seeking professional guidance, homeowners can navigate this complex landscape and find a resolution.

Local governments, too, play a crucial role in managing delinquent taxes. By providing transparent communication, offering payment plans, and exploring tax relief options, they can encourage voluntary compliance and maintain a fair and sustainable tax collection system.

In the end, the goal is to ensure that property taxes are paid, supporting the vital services and infrastructure that benefit the entire community. By addressing delinquent taxes promptly and collaboratively, we can maintain a stable and prosperous society.

What happens if I ignore a delinquent property tax notice?

+

Ignoring a delinquent property tax notice can have severe consequences. Tax authorities may place a tax lien on your property, impacting its value and marketability. If the taxes remain unpaid, the government may initiate foreclosure proceedings, resulting in the loss of your property. It’s crucial to address delinquent taxes promptly to avoid these legal actions.

Can I negotiate my delinquent property taxes?

+

Yes, in many cases, tax authorities are open to negotiating delinquent property taxes. They may offer payment plans, reduced interest rates, or even settlement agreements. It’s essential to communicate with the tax office and explain your circumstances to explore potential options for resolving the debt.

Are there any tax relief programs available for homeowners facing financial hardship?

+

Yes, several jurisdictions offer tax relief programs to assist homeowners in financial distress. These programs may provide temporary tax relief, deferrals, or waivers based on eligibility criteria such as income, age, or disability. Researching and applying for these programs can help alleviate the burden of delinquent property taxes.

What are the potential long-term effects of delinquent property taxes on my credit score?

+

Delinquent property taxes can have a significant impact on your credit score. When taxes go unpaid, the local government may report the delinquency to credit bureaus, resulting in a negative mark on your credit report. This can affect your ability to obtain loans, mortgages, or other forms of credit in the future. It’s crucial to address delinquent taxes promptly to minimize the impact on your creditworthiness.