Crypto.com Tax

Welcome to a comprehensive guide on Crypto.com Tax, an essential aspect of managing your cryptocurrency portfolio. In an era where digital assets are gaining mainstream acceptance, understanding the tax implications becomes crucial for every investor. This article aims to delve into the intricacies of Crypto.com Tax, offering expert insights and practical advice to help you navigate this complex landscape.

Unraveling Crypto.com Tax: A Comprehensive Guide

As the world of cryptocurrencies continues to evolve, so do the tax regulations governing these digital assets. Crypto.com, a leading platform in the crypto space, has its own set of tax considerations that every user should be aware of. In this section, we will explore the fundamentals of Crypto.com Tax, providing a solid foundation for investors to build their tax strategies.

Understanding Crypto.com’s Tax Structure

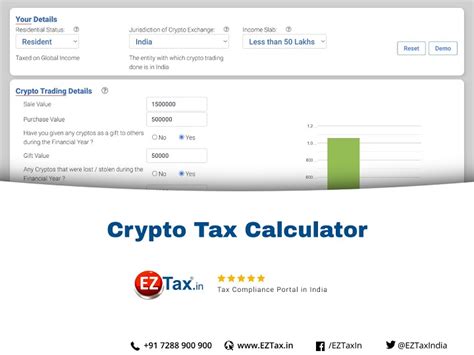

Crypto.com operates in multiple jurisdictions, and its tax structure varies depending on the user’s location. Generally, the platform follows the tax guidelines set by the country or region where the user resides. This means that Crypto.com users are subject to their local tax laws, which can range from capital gains taxes to income tax obligations.

For instance, in countries like the United States, crypto transactions are treated as property sales, and any gains or losses are taxed accordingly. In contrast, some European countries classify cryptocurrencies as financial instruments, resulting in different tax treatments.

It's crucial for Crypto.com users to understand their specific tax obligations based on their residence. This knowledge forms the basis for effective tax planning and compliance.

| Jurisdiction | Tax Classification |

|---|---|

| United States | Property Sales |

| European Union | Financial Instruments |

| Singapore | Commodities or Securities |

| Australia | Capital Gains Tax |

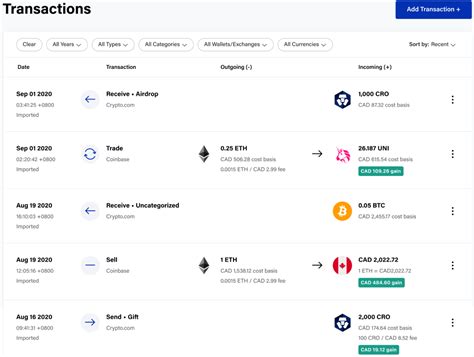

Taxable Events on Crypto.com

Crypto.com users engage in various activities that can trigger taxable events. Here’s an overview of some common scenarios:

- Trading Cryptocurrencies: Every buy, sell, or swap of cryptocurrencies on Crypto.com's exchange platform results in a taxable event. The gain or loss from these transactions is subject to tax.

- Staking Rewards: Crypto.com offers staking services for certain cryptocurrencies. When users receive staking rewards, they must report these as taxable income.

- Crypto-to-Fiat Transactions: Converting cryptocurrencies to fiat currencies (e.g., USD, EUR) is a taxable event, as it triggers a realization of gains or losses.

- Airdrops and Forks: If users receive airdrops or fork tokens from Crypto.com, these must be valued and reported as income or capital gains.

- Interest and Dividends: Crypto.com's Earn program offers interest and dividend-like earnings. These earnings are considered taxable income and must be declared.

Reporting Crypto.com Transactions

Accurate reporting of Crypto.com transactions is essential for tax compliance. Here’s a step-by-step guide to help users navigate this process:

- Gather Transaction Data: Users should keep a record of all their Crypto.com transactions, including the date, type of transaction (buy, sell, swap), cryptocurrency involved, and the associated fiat value.

- Calculate Gains or Losses: For each transaction, calculate the gain or loss by subtracting the cost basis (purchase price) from the selling price. This determines whether the transaction results in a taxable gain or a deductible loss.

- Report on Tax Returns: Depending on the jurisdiction, users must report their crypto transactions on the appropriate tax forms. In the United States, this often involves completing Schedule D and Form 8949.

- Consider Tax Software: To simplify the reporting process, users can utilize tax software specifically designed for cryptocurrency transactions. These tools can automate the calculation and reporting of gains and losses.

Advanced Tax Strategies for Crypto.com Users

Beyond the fundamentals, Crypto.com users can employ advanced tax strategies to optimize their crypto investments. These strategies aim to minimize tax liabilities while ensuring compliance with tax regulations.

Tax-Efficient Trading Strategies

Trading cryptocurrencies can lead to substantial tax obligations. However, by implementing tax-efficient strategies, users can reduce their tax burden. Here are some approaches to consider:

- Long-Term Holding: Holding cryptocurrencies for more than one year before selling can qualify for more favorable long-term capital gains tax rates. This strategy is particularly beneficial in jurisdictions with lower long-term capital gains tax rates.

- Tax Loss Harvesting: If a cryptocurrency investment declines in value, users can sell it to realize a loss. This loss can be used to offset gains from other investments or carried forward to future tax years.

- Tax-Efficient Portfolio Management: Strategically managing your crypto portfolio can help minimize taxes. For instance, users can consider tax-loss harvesting to rebalance their portfolio while offsetting gains.

Utilizing Crypto Tax Software

Navigating the complex world of crypto taxes can be made easier with the help of specialized tax software. These tools automate the process of tracking and reporting crypto transactions, making it simpler for users to comply with tax regulations.

Some popular crypto tax software options include:

- CoinTracker: This platform integrates with Crypto.com and other exchanges, automatically importing transaction data and generating tax reports.

- CryptoTrader.Tax: A user-friendly software that supports multiple exchanges, including Crypto.com. It offers advanced tax strategies and real-time tax insights.

- ZenLedger: Beyond tax reporting, ZenLedger provides portfolio tracking and tax loss harvesting tools, helping users optimize their crypto investments.

Tax Planning with Crypto-Friendly Accountants

For complex crypto tax situations or when seeking personalized advice, engaging a crypto-friendly accountant can be invaluable. These professionals have expertise in cryptocurrency tax regulations and can offer tailored solutions.

When choosing an accountant, consider the following:

- Experience: Look for an accountant who has worked with crypto clients and understands the unique tax challenges of digital assets.

- Licensing: Ensure the accountant is licensed and registered in your jurisdiction.

- Specialization: Choose an accountant who specializes in cryptocurrency tax, as they will have the most up-to-date knowledge and expertise.

The Future of Crypto.com Tax

As the cryptocurrency industry matures, so too will the tax regulations governing it. Crypto.com, being a prominent player in the space, will likely continue to adapt its tax strategies and offerings to align with evolving tax laws.

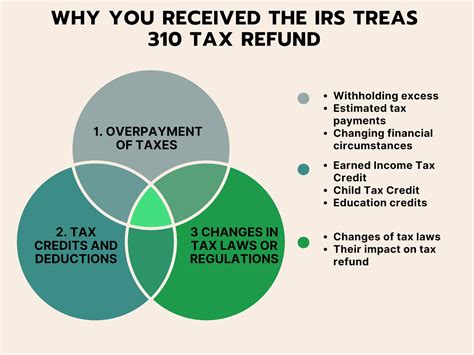

Regulatory Changes and Their Impact

Tax regulations surrounding cryptocurrencies are subject to frequent changes. Governments around the world are increasingly recognizing the importance of crypto assets and are working to establish clear guidelines. Here’s a glimpse into some potential future developments:

- Global Tax Standards: With the rise of cryptocurrencies, there may be a push for global tax standards to ensure consistent treatment of crypto assets across borders.

- Enhanced Tax Reporting: Governments may implement stricter reporting requirements for crypto transactions, potentially integrating blockchain technology into tax systems.

- Regulatory Clarifications: As the industry matures, governments may provide clearer guidance on the tax treatment of specific crypto activities, such as staking, airdrops, and decentralized finance (DeFi) participation.

Crypto.com’s Response to Regulatory Changes

Crypto.com has a track record of adapting to regulatory changes. The platform is likely to continue its commitment to compliance, offering users tools and resources to navigate the evolving tax landscape.

Potential future initiatives could include:

- Enhanced Tax Reporting Tools: Crypto.com might introduce more sophisticated tax reporting features, making it easier for users to comply with changing regulations.

- Educational Resources: The platform could expand its educational content, providing users with guidance on how to navigate tax obligations effectively.

- Partnerships with Tax Authorities: Crypto.com may explore partnerships with tax authorities to streamline tax reporting and ensure compliance.

Conclusion

Understanding and managing Crypto.com Tax is a critical aspect of being a responsible crypto investor. By staying informed about tax regulations, utilizing advanced tax strategies, and seeking expert advice when needed, users can navigate the complex world of crypto taxes with confidence. As the industry evolves, Crypto.com is poised to lead the way in offering tax-compliant solutions for its users.

What is Crypto.com’s tax structure for US residents?

+

For US residents, Crypto.com treats crypto transactions as property sales, and any gains or losses are taxed accordingly. Users must report their crypto transactions on Schedule D and Form 8949.

How can I minimize my tax liabilities on Crypto.com?

+

To minimize tax liabilities, consider long-term holding strategies, tax loss harvesting, and utilizing tax-efficient portfolio management techniques. Consulting a crypto-friendly accountant can also provide personalized advice.

Are there any tax advantages to using Crypto.com’s staking services?

+

Staking on Crypto.com can provide tax advantages in the form of reduced tax obligations. However, the specific tax treatment depends on the jurisdiction and the nature of the staking rewards.

What are the potential future developments in crypto tax regulations?

+

Potential future developments include global tax standards, enhanced tax reporting requirements, and clearer regulatory guidance on specific crypto activities like staking and DeFi.