Connecticut Car Sales Tax

Connecticut, known as the "Constitution State," is a vibrant hub of automotive activity, with a thriving car market and a diverse range of vehicles on offer. The state's car sales tax is an essential aspect of its automotive industry, impacting both dealers and consumers. This article delves into the intricacies of Connecticut's car sales tax, providing a comprehensive guide for anyone interested in understanding the financial aspects of purchasing a vehicle in this beautiful state.

Understanding Connecticut’s Car Sales Tax

Connecticut imposes a sales and use tax on the sale or lease of motor vehicles. This tax is applicable to both new and used cars, and it is an important revenue source for the state government. The tax rate and collection process are designed to ensure a fair and transparent transaction for both buyers and sellers.

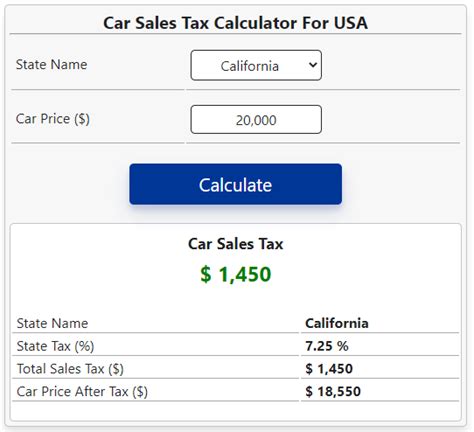

The car sales tax in Connecticut is levied as a percentage of the vehicle's purchase price, including any additional fees and options. The tax is calculated on the total cost of the vehicle, excluding any trade-in allowances or rebates. This means that the tax amount varies depending on the price of the car and the specific details of the transaction.

The Current Tax Rate

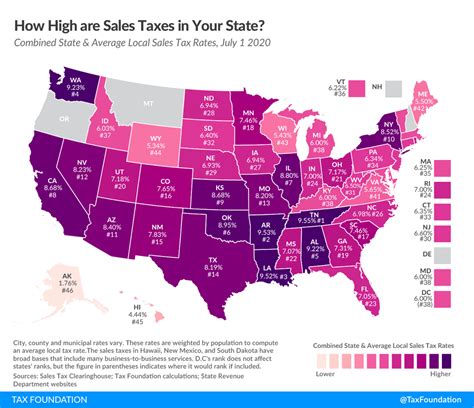

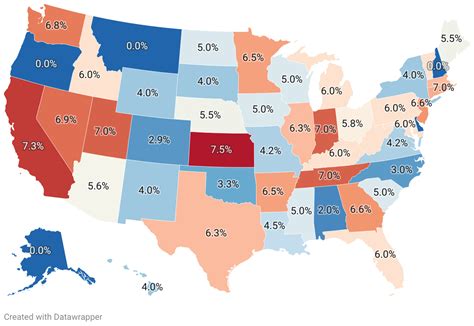

As of my last update in January 2023, the car sales tax rate in Connecticut stands at 6.35%. This rate is uniform across the state and is applied to all vehicle purchases, ensuring consistency and fairness. The tax rate is subject to change, and it is advisable to verify the current rate with official sources or a trusted tax professional before finalizing a vehicle purchase.

| Tax Rate Category | Connecticut Sales Tax Rate |

|---|---|

| Vehicle Sales Tax | 6.35% |

It's worth noting that the tax rate can vary depending on the type of vehicle being purchased. For instance, electric vehicles may be subject to different tax rates or exemptions due to state incentives aimed at promoting environmentally friendly transportation.

Tax Calculation and Payment

When purchasing a car in Connecticut, the sales tax is typically calculated by the dealership or seller and added to the total cost of the vehicle. The buyer then pays the full amount, including the tax, at the time of purchase. It is important to review the final invoice carefully to ensure that the tax calculation is accurate and in line with the current rate.

For those purchasing a used car from a private seller, the sales tax is typically paid when registering the vehicle. This process involves submitting the necessary paperwork and paying the tax amount to the Department of Motor Vehicles (DMV). It is essential to understand the registration process and any associated fees to ensure a smooth transition of ownership.

Exemptions and Special Considerations

Connecticut offers certain exemptions and special considerations when it comes to car sales tax. These exemptions are designed to support specific groups or promote certain types of vehicles.

- Military Personnel: Active-duty military members may be eligible for a sales tax exemption on vehicle purchases. This exemption is part of the state's commitment to supporting those who serve our country.

- Alternative Fuel Vehicles: To encourage the adoption of environmentally friendly vehicles, Connecticut offers a sales tax exemption for the purchase of certain alternative fuel vehicles, such as electric or hybrid cars. This initiative aims to reduce carbon emissions and promote sustainable transportation.

- Trade-Ins: When trading in a vehicle as part of a purchase, the trade-in allowance is typically subtracted from the purchase price before calculating the sales tax. This ensures that the tax is only applied to the net cost of the new vehicle.

The Impact of Car Sales Tax on Consumers

Understanding the car sales tax is crucial for consumers as it directly affects the overall cost of purchasing a vehicle. The tax can significantly impact the final price, especially for high-value vehicles. It is essential for buyers to factor in the tax when budgeting for a new car purchase.

When comparing vehicle prices, it is advisable to consider the total cost, including the sales tax. This ensures a more accurate comparison and helps buyers make informed decisions. Additionally, understanding the tax implications can assist consumers in negotiating better deals with dealerships, as they can demonstrate awareness of the financial aspects of the transaction.

Tips for Managing Car Sales Tax

- Research and Compare: Before making a purchase, research and compare prices from multiple dealerships or sellers. This allows you to negotiate a better deal and potentially save on sales tax by choosing a more affordable option.

- Consider Financing Options: Financing a car purchase can provide flexibility and potentially reduce the overall cost. Explore different financing options and calculate the total cost, including the sales tax, to determine the most suitable choice.

- Take Advantage of Exemptions: If you are eligible for any tax exemptions, such as those for military personnel or alternative fuel vehicles, be sure to claim them. This can result in significant savings and make your vehicle purchase more affordable.

- Understand Registration Fees: In addition to the sales tax, there may be other fees associated with registering your vehicle. Familiarize yourself with these fees to avoid any surprises during the registration process.

Dealer Perspectives and Responsibilities

For car dealerships in Connecticut, understanding and managing the sales tax is a critical aspect of their business operations. Dealers play a crucial role in ensuring a transparent and compliant transaction process for their customers.

Dealer Responsibilities

- Accurate Tax Calculation: Dealerships are responsible for accurately calculating the sales tax on each vehicle sale. This includes staying updated with any changes in tax rates or regulations to ensure compliance.

- Transparent Pricing: Providing clear and transparent pricing information to customers is essential. Dealers should ensure that the sales tax is clearly communicated and included in the total cost, allowing buyers to make informed choices.

- Assisting with Exemptions: Dealerships should be knowledgeable about any applicable tax exemptions and assist customers in claiming these exemptions when eligible. This demonstrates a commitment to customer satisfaction and compliance with state regulations.

Strategies for Dealers

To maximize sales and maintain a competitive edge, dealerships can employ various strategies related to car sales tax.

- Tax-Inclusive Pricing: Some dealerships choose to include the sales tax in their advertised prices. This simplifies the buying process for customers and can make the dealership appear more affordable. However, it's essential to ensure that the tax rate is clearly disclosed to avoid any confusion.

- Bundled Services: Dealers can offer bundled services or packages that include the sales tax and other fees. This approach can provide convenience for customers and simplify the transaction process.

- Incentives and Promotions: Offering incentives or promotions that offset the sales tax can be an effective strategy to attract customers. For example, dealerships may offer to cover a portion of the tax or provide additional discounts on certain models.

Future Implications and Changes

The car sales tax landscape in Connecticut, like in many other states, is subject to potential changes and developments. It is essential to stay informed about any proposed amendments or adjustments to the tax rate or regulations.

The state government may consider tax reforms to support specific initiatives or address budgetary needs. Additionally, changes in the automotive industry, such as the growing popularity of electric vehicles, may prompt revisions to tax policies to encourage their adoption.

Staying abreast of these potential changes is crucial for both consumers and dealerships to ensure they can adapt to any new regulations or tax structures. Regularly checking official sources, such as the Connecticut Department of Revenue Services, can provide valuable insights into any upcoming tax-related developments.

Conclusion

Understanding Connecticut’s car sales tax is an essential aspect of the vehicle purchasing process. With a moderate tax rate and various exemptions, the state provides a balanced approach to vehicle taxation. Both consumers and dealerships play crucial roles in ensuring a transparent and compliant transaction process.

By staying informed about the tax rate, exemptions, and strategies for managing the sales tax, buyers and sellers can navigate the car sales tax landscape effectively. This knowledge empowers individuals to make informed decisions, negotiate better deals, and contribute to a thriving automotive industry in Connecticut.

What is the current car sales tax rate in Connecticut?

+

The current car sales tax rate in Connecticut is 6.35% as of January 2023.

Are there any exemptions from the car sales tax in Connecticut?

+

Yes, Connecticut offers exemptions for active-duty military personnel and the purchase of certain alternative fuel vehicles.

How is the sales tax calculated on a car purchase in Connecticut?

+

The sales tax is calculated as a percentage of the vehicle’s purchase price, including any additional fees and options. The tax is applied to the total cost, excluding trade-in allowances or rebates.

When is the sales tax paid for a used car purchase in Connecticut?

+

For used car purchases from private sellers, the sales tax is typically paid when registering the vehicle with the Department of Motor Vehicles (DMV).

Are there any strategies dealerships use to manage car sales tax in Connecticut?

+

Yes, dealerships may employ strategies such as tax-inclusive pricing, bundled services, or offering incentives to offset the sales tax, providing convenience and potential savings for customers.