Commonwealth Of Ma Taxes

The Commonwealth of Massachusetts, often referred to as "Taxachusetts," has a reputation for its complex and sometimes challenging tax system. With a rich history dating back to the early days of American taxation, Massachusetts has evolved its tax policies to meet the needs of its diverse population and economy. Understanding the nuances of Commonwealth of Massachusetts taxes is essential for residents, businesses, and investors alike. This comprehensive guide will delve into the various aspects of Massachusetts' tax system, offering a detailed analysis and insights to help navigate this intricate landscape.

A Historical Perspective on Massachusetts Taxation

Massachusetts has a long and fascinating history with taxation, dating back to its colonial days. The state’s early tax policies were heavily influenced by its role in the American Revolution and the subsequent struggle for independence. One of the key moments in this history was the famous Boston Tea Party, an iconic act of rebellion against the British tax on tea.

As the years progressed, Massachusetts' tax system evolved to support its growing industries, including shipping, manufacturing, and, more recently, technology and finance. The state's unique blend of historical landmarks and innovative startups has presented a complex tax environment, with a mix of traditional and modern tax policies.

Over the years, Massachusetts has implemented a range of taxes to fund its public services and infrastructure. These include income taxes, sales taxes, property taxes, and various excise taxes. Each of these tax categories has its own set of rules and regulations, making it crucial for taxpayers to stay informed and compliant.

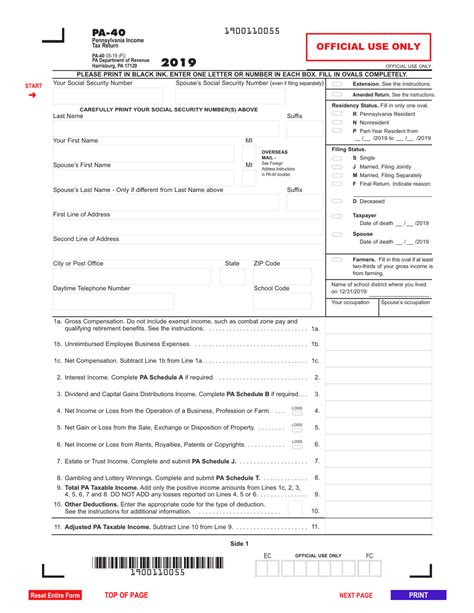

Income Taxes: A Comprehensive Overview

Massachusetts imposes an income tax on both residents and non-residents earning income within the state. The income tax rate varies depending on the taxpayer’s income bracket. As of the latest tax year, the income tax rates in Massachusetts are as follows:

| Income Bracket | Tax Rate |

|---|---|

| $0 - $9,750 | 5.05% |

| $9,751 - $24,450 | 5.50% |

| $24,451 - $54,900 | 5.95% |

| $54,901 - $165,000 | 7.05% |

| Over $165,000 | 12.00% |

It's important to note that these rates are subject to change, and taxpayers should refer to the official Massachusetts Department of Revenue website for the most up-to-date information. Additionally, there are various deductions and credits available to reduce the taxable income, such as the Personal Exemption Deduction and the Massachusetts Earned Income Tax Credit.

Resident vs. Non-Resident Taxation

Massachusetts differentiates between resident and non-resident taxpayers when it comes to income tax. A resident is someone who maintains a permanent home in the state or spends more than 183 days in Massachusetts during a calendar year. Non-residents, on the other hand, are taxed only on income earned within the state.

For non-residents, Massachusetts has a reciprocal agreement with several other states, which means that income earned in those states may be taxed at the resident rate of the home state instead of Massachusetts' higher non-resident rate. This agreement helps prevent double taxation for individuals who work in one state but live in another.

Taxable Income Sources

Massachusetts taxes a wide range of income sources, including wages, salaries, tips, commissions, bonuses, and investment income. However, certain types of income, such as municipal bond interest, are exempt from state income tax. Understanding which income sources are taxable is crucial for accurate reporting and compliance.

Sales and Use Taxes: A Guide for Consumers and Businesses

Massachusetts imposes a sales tax on the sale of tangible personal property and certain services. As of the latest tax year, the state sales tax rate is 6.25%. However, it’s important to note that some cities and towns in Massachusetts also levy local option taxes, which can increase the total sales tax rate to as high as 7%.

Exemptions and Special Taxes

Not all goods and services are subject to the standard sales tax rate. Massachusetts offers various exemptions, such as for food, clothing, and certain medical devices. Additionally, there are special taxes on specific items, such as the Meals Tax (which applies to restaurant meals) and the Hotel/Motel Room Occupancy Tax.

Use Tax: What You Need to Know

In addition to sales tax, Massachusetts also imposes a use tax on the storage, use, or consumption of tangible personal property purchased from out-of-state vendors. This tax is meant to ensure that all purchases, regardless of where they are made, are subject to taxation. The use tax rate is the same as the sales tax rate, i.e., 6.25%.

Businesses that sell goods to Massachusetts residents but do not collect sales tax must notify their customers of their use tax obligation. Failure to comply with use tax regulations can result in penalties and interest.

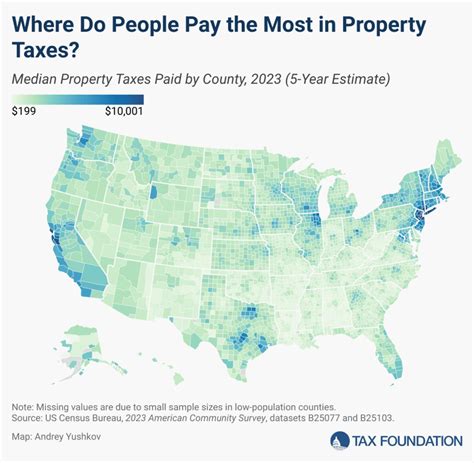

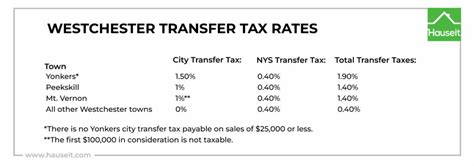

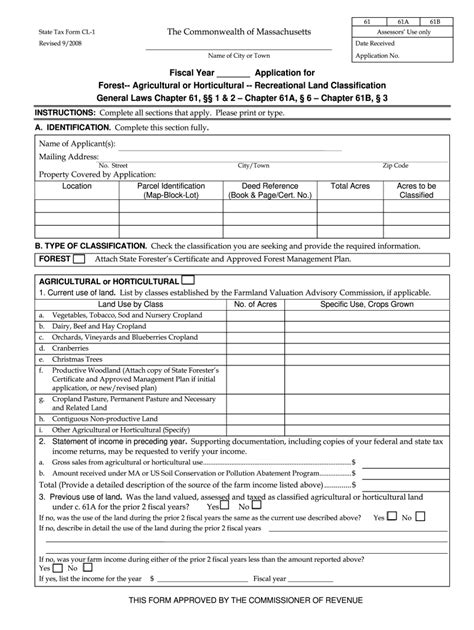

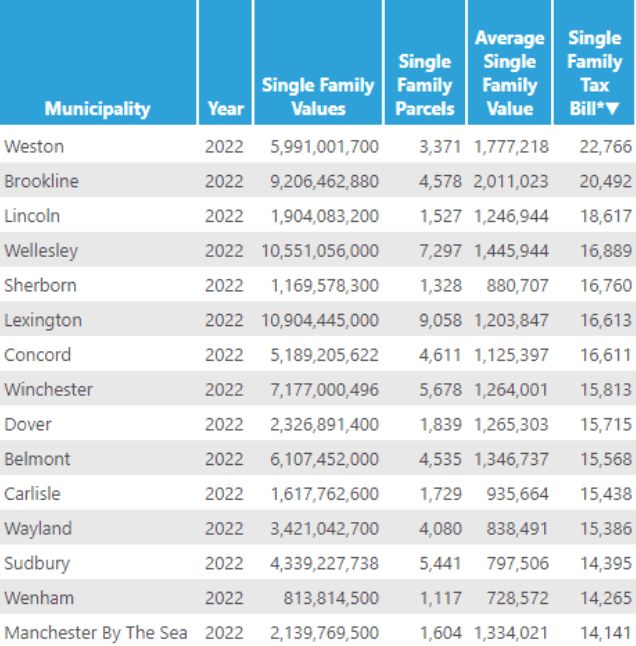

Property Taxes: Understanding the Assessments and Rates

Property taxes are a significant source of revenue for local governments in Massachusetts. The state has a unique property tax system where the responsibility for assessing and collecting taxes lies with the individual cities and towns.

Assessment Process

Each city and town is responsible for assessing the value of all taxable property within its boundaries. This includes real estate (land and buildings) and personal property (tangible property owned by individuals and businesses). The assessment process typically involves physical inspections, research on recent sales, and other valuation methods.

Tax Rates and Valuation

Once the property is assessed, the local government sets a tax rate, often referred to as the “tax levy,” to fund its budget. The tax rate is expressed in “mills,” with one mill being equal to one dollar of tax for every 1,000 of assessed property value. For example, if a property is valued at 500,000 and the tax rate is 20 mills, the property tax would be $10,000.

It's important to note that property tax rates can vary significantly from one town to another, even within the same county.

Tax Relief and Exemptions

Massachusetts offers various tax relief programs and exemptions to eligible taxpayers. These include exemptions for senior citizens, veterans, and certain types of property used for religious or charitable purposes. Additionally, the state provides a Circuit Breaker program, which offers a tax credit to low- and moderate-income homeowners and renters who pay a high percentage of their income in property taxes.

Excise Taxes: A Look at Vehicle and Other Excise Taxes

Massachusetts levies excise taxes on various goods and activities, including vehicles, boats, and certain business activities.

Vehicle Excise Tax

Vehicle owners in Massachusetts are subject to an annual excise tax, which is based on the vehicle’s value and weight. The tax rate varies depending on the vehicle’s type and use. For passenger vehicles, the tax rate is typically 25 for the first 1,000 pounds and 20 for each additional 1,000 pounds or fraction thereof.

Motorcycles, mopeds, and trailers have different tax rates, and there are additional taxes for commercial vehicles and vehicles used for hire.

Boat Excise Tax

Massachusetts also imposes an excise tax on boats and personal watercraft. The tax rate is based on the boat’s length and type. For example, a pleasure boat under 14 feet in length is exempt from the tax, while a boat over 65 feet in length is taxed at a higher rate.

Other Excise Taxes

Massachusetts has various other excise taxes, including taxes on tobacco products, alcohol, and telecommunications services. These taxes are often imposed to fund specific programs or to deter certain behaviors, such as smoking or excessive alcohol consumption.

Tax Incentives and Credits: Supporting Businesses and Residents

Massachusetts offers a range of tax incentives and credits to attract and support businesses and residents. These incentives are designed to encourage economic growth, job creation, and investment in the state.

Business Tax Incentives

The state provides various tax incentives for businesses, including tax credits for research and development, film and digital media production, and renewable energy projects. Additionally, Massachusetts offers tax incentives for businesses that locate or expand in certain designated economic development areas.

Personal Tax Credits

Massachusetts residents can benefit from a variety of personal tax credits, such as the Massachusetts Earned Income Tax Credit (EITC), which provides a refundable tax credit to low- and moderate-income working individuals and families. Other personal tax credits include the Solar Energy Credit, the Residential Renewable Energy Credit, and the Child and Dependent Care Credit.

Compliance and Enforcement: Ensuring Fair Taxation

The Massachusetts Department of Revenue (DOR) is responsible for enforcing tax laws and ensuring compliance. The DOR has a range of tools and resources to assist taxpayers, including online filing systems, tax guides, and educational materials. The department also conducts audits and investigations to ensure that taxpayers are accurately reporting their income and paying the correct amount of tax.

For taxpayers who face difficulty in meeting their tax obligations, the DOR offers various payment plans and settlement options. These programs aim to provide relief to taxpayers while also ensuring that the state collects the revenue it is due.

Penalties and Interest

Taxpayers who fail to comply with Massachusetts tax laws may face penalties and interest charges. The severity of the penalty depends on the nature and extent of the violation. For example, taxpayers who fail to file a tax return may be subject to a penalty of 5% of the tax due for each month the return is late, up to a maximum of 25%.

Additionally, taxpayers who underreport their income or make errors on their tax returns may be subject to accuracy-related penalties, which can be up to 20% of the underpayment.

Conclusion: Navigating the Commonwealth’s Tax Landscape

The Commonwealth of Massachusetts’ tax system is a complex web of income, sales, property, and excise taxes, each with its own set of rules and regulations. Understanding these taxes is crucial for individuals and businesses operating within the state. By staying informed about the latest tax laws, taxpayers can ensure compliance and take advantage of any available tax incentives and credits.

As Massachusetts continues to evolve and adapt to changing economic conditions, its tax system will also undergo revisions and updates. Keeping abreast of these changes is essential for effective tax planning and management. Whether you're a long-time resident or a new business, understanding and navigating the Commonwealth's tax landscape is a key aspect of financial success and stability.

What is the tax filing deadline in Massachusetts?

+The tax filing deadline in Massachusetts is typically April 15th for individual income tax returns. However, this deadline can be extended to October 15th under certain circumstances. It’s important to note that the deadline may vary for different types of tax returns, so it’s best to check the official Massachusetts DOR website for the most accurate and up-to-date information.

Are there any tax breaks for first-time homebuyers in Massachusetts?

+Yes, Massachusetts offers a first-time homebuyer tax credit. This credit provides a reduction in the state income tax for eligible first-time homebuyers. The credit is equal to 5% of the purchase price of the home, up to a maximum of $2,500. To qualify, the home must be the buyer’s primary residence, and there are income and purchase price limitations.

How often are property taxes assessed in Massachusetts?

+Property taxes in Massachusetts are typically assessed annually. However, some cities and towns may reassess properties more frequently, such as every 3 years, to ensure that property values and tax assessments remain accurate. It’s important for property owners to stay informed about their town’s assessment schedule and any changes that may impact their property tax bill.