City Of Milwaukee Taxes

Welcome to an in-depth exploration of the tax landscape in the vibrant city of Milwaukee. This article aims to shed light on the various taxes levied within the city, their implications, and how they contribute to the overall economic and social fabric of this thriving metropolitan area. Milwaukee, with its rich history and diverse community, has a unique tax structure that plays a pivotal role in shaping its future. Let's delve into the intricacies of City of Milwaukee Taxes and uncover the facts that underpin this essential aspect of urban life.

Understanding Milwaukee’s Tax Ecosystem

Milwaukee, the largest city in the state of Wisconsin, boasts a robust tax system that funds essential services, infrastructure development, and community initiatives. The city’s tax framework is designed to support its residents, businesses, and visitors, ensuring a balanced approach to revenue generation and public expenditure. Understanding this ecosystem is crucial for individuals and entities operating within Milwaukee’s borders, as it directly impacts their financial obligations and, subsequently, their overall experience in the city.

Property Taxes: A Pillar of Milwaukee’s Revenue

Property taxes are a significant component of Milwaukee’s tax landscape. These taxes are levied on real estate properties, including residential homes, commercial buildings, and land. The Milwaukee County Treasurer’s Office is responsible for assessing and collecting property taxes, with rates varying based on property value and location within the city. Property taxes contribute substantially to the city’s revenue, funding vital services like education, public safety, and municipal maintenance.

Here's a breakdown of the key aspects of Milwaukee's property tax system:

| Assessment Period | Tax Rate |

|---|---|

| Property assessments are conducted every two years. | The tax rate is determined by the city's budget and is subject to annual adjustments. |

| Property owners receive a Notice of Assessment, detailing the assessed value of their property. | The tax rate is typically expressed as a mill rate, with one mill representing $1 of tax per $1,000 of assessed value. |

For instance, a residential property with an assessed value of $200,000 and a mill rate of 15.20 would incur a property tax of $3,040 for the year.

Income Taxes: Personal and Business Contributions

Milwaukee, like many other cities, levies income taxes on both personal and business incomes. These taxes are a critical source of revenue, enabling the city to invest in economic development, social programs, and infrastructure improvements.

Key points to consider regarding Milwaukee's income tax structure:

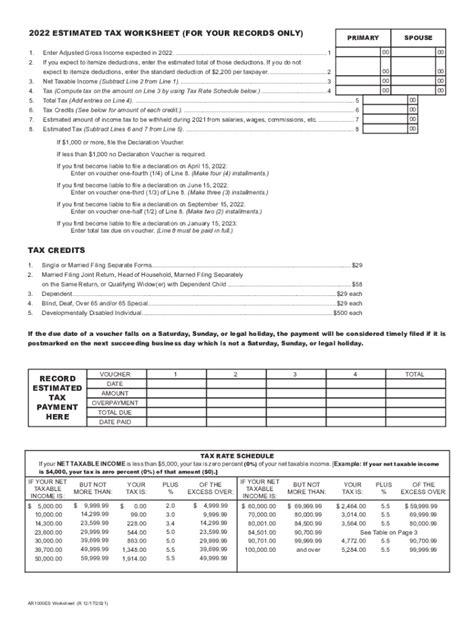

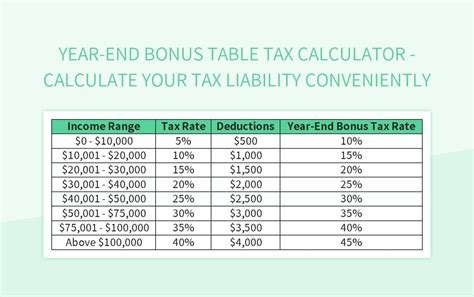

- Personal Income Tax: Milwaukee residents are subject to a personal income tax, with rates varying based on income brackets. The city's income tax rates are generally progressive, meaning higher incomes are taxed at higher rates.

- Business Income Tax: Businesses operating within Milwaukee's boundaries are required to pay a municipal income tax, in addition to state and federal taxes. The city's business tax rates are designed to support local entrepreneurship and economic growth.

- Tax Credits and Incentives: Milwaukee offers a range of tax credits and incentives to attract and retain businesses. These initiatives often include tax breaks for job creation, investment in certain industries, and development in designated areas.

Sales and Use Taxes: Supporting Local Businesses and Services

Sales and use taxes are another essential component of Milwaukee’s tax system. These taxes are applied to the sale of goods and services within the city, with the revenue generated used to support various public services and infrastructure projects.

Here are some key details about Milwaukee's sales and use tax structure:

- Sales Tax: Milwaukee imposes a sales tax on most retail transactions, with the rate determined by the combined state and local tax rates. As of the latest data, the combined sales tax rate in Milwaukee is 5.5%, which includes the state sales tax of 5% and a local sales tax rate of 0.5%.

- Use Tax: The city also levies a use tax on the storage, use, or consumption of tangible personal property purchased from out-of-state vendors. This tax ensures that businesses and individuals pay taxes on goods acquired from online or out-of-state sources, leveling the playing field for local businesses.

- Exemptions and Discounts: Certain items, such as groceries, prescription drugs, and clothing, are exempt from sales tax in Milwaukee. Additionally, senior citizens and individuals with disabilities may be eligible for discounts on certain purchases, further reducing the tax burden on specific demographics.

Special Assessments and Other Taxes

In addition to the aforementioned taxes, Milwaukee employs a range of special assessments and other tax mechanisms to fund specific projects and initiatives.

- Special Assessments: These are charges levied on property owners to fund improvements or services that specifically benefit their properties or neighborhoods. Examples include street lighting, sidewalk repairs, or the installation of stormwater management systems.

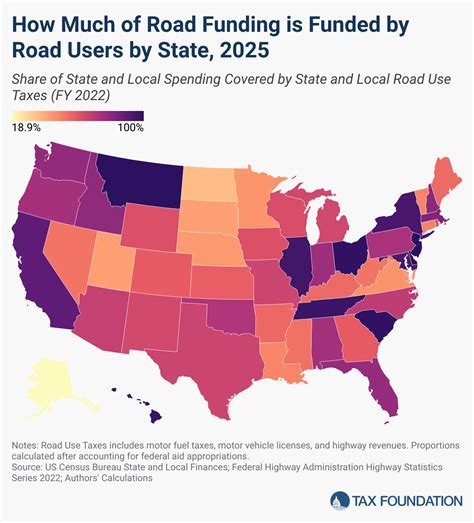

- Vehicle Registration Tax: Milwaukee imposes a tax on the registration of motor vehicles, with the revenue generated used to support transportation infrastructure and public transit systems.

- Hotel/Motel Tax: A tax is applied to the rental of hotel and motel rooms within the city, with the proceeds often allocated to tourism promotion and development.

- Utility Taxes: Taxes are levied on utility services such as water, sewer, and electricity, contributing to the city's revenue stream and helping to maintain these essential services.

Impact and Implications of Milwaukee’s Tax System

The tax system in Milwaukee plays a critical role in shaping the city’s economic, social, and environmental landscape. It influences investment decisions, business growth, and the overall quality of life for residents.

Economic Development and Job Creation

Milwaukee’s tax policies, particularly its incentives for businesses, have a direct impact on economic development and job creation. By offering tax breaks and credits, the city encourages businesses to establish or expand their operations within its boundaries, leading to increased employment opportunities and a more robust local economy.

For instance, the Milwaukee Business Improvement District (BID) program provides tax incentives for businesses to invest in specific areas of the city, fostering economic growth and revitalizing underdeveloped neighborhoods.

Equity and Social Justice

Milwaukee’s tax system also plays a role in addressing issues of equity and social justice. Through targeted tax exemptions, credits, and initiatives, the city aims to reduce the tax burden on low-income residents and vulnerable populations. This approach helps to promote financial stability and social mobility for these groups, contributing to a more equitable society.

One notable example is the Earned Income Tax Credit (EITC), a refundable tax credit for low- to moderate-income working individuals and families. This credit, coupled with other initiatives like the Property Tax Relief Program, helps alleviate the financial strain on Milwaukee's most vulnerable residents.

Infrastructure and Public Services

Tax revenue is a primary driver of infrastructure development and the provision of public services in Milwaukee. The city’s taxes fund essential services such as education, public safety, healthcare, and transportation, ensuring the well-being and prosperity of its residents.

For instance, property taxes contribute significantly to the funding of Milwaukee Public Schools, one of the largest school districts in the state, providing quality education to thousands of students.

Community Engagement and Investment

Milwaukee’s tax system encourages community engagement and investment. Through various tax initiatives and programs, the city empowers residents and businesses to actively participate in the development and improvement of their neighborhoods. This fosters a sense of ownership and pride in the community, leading to a more vibrant and resilient city.

One such initiative is the Neighborhood Improvement District (NID) program, which allows residents and businesses to come together and invest in local improvements, such as beautification projects, security enhancements, and economic development initiatives.

Future Outlook and Innovations

As Milwaukee continues to evolve and adapt to changing economic, social, and environmental landscapes, its tax system will likely undergo transformations to remain effective and equitable. Here are some potential future developments and innovations in Milwaukee’s tax ecosystem:

- Sustainable Taxation: With a growing focus on environmental sustainability, Milwaukee may explore innovative tax mechanisms to encourage eco-friendly practices and investments. This could include incentives for renewable energy adoption, green building initiatives, and sustainable transportation options.

- Digital Taxation: As the digital economy continues to expand, Milwaukee may need to adapt its tax system to accommodate online transactions and digital businesses. This could involve implementing taxes on digital services, e-commerce platforms, and digital advertising, ensuring a fair revenue stream from these emerging sectors.

- Tax Simplification and Transparency: To enhance compliance and reduce administrative burdens, Milwaukee could consider simplifying its tax system, making it more transparent and user-friendly. This could involve streamlining tax forms, providing clearer guidelines, and offering online tools for tax calculation and filing.

- Community-Driven Taxation: Milwaukee could further empower its residents by involving them in the tax decision-making process. This could take the form of community forums, online platforms, or advisory committees, where residents can provide input on tax policies and priorities, fostering a sense of ownership and trust in the tax system.

- Tax Innovation and Technology: The city may explore technological advancements to improve tax collection, administration, and enforcement. This could include the use of blockchain technology for secure and transparent tax transactions, or the implementation of artificial intelligence for more efficient tax auditing and fraud detection.

Conclusion

The tax system in Milwaukee is a dynamic and intricate component of the city’s infrastructure, playing a vital role in shaping its future. From property taxes to income, sales, and special assessments, each tax mechanism contributes to the city’s revenue stream, supporting essential services and initiatives. As Milwaukee continues to evolve, its tax system will need to adapt to changing circumstances, ensuring a balanced approach that fosters economic growth, social equity, and environmental sustainability.

By understanding the intricacies of Milwaukee's tax landscape, residents, businesses, and stakeholders can make informed decisions, contribute to the city's prosperity, and actively participate in its future development. The city's tax policies, when well-managed and equitable, have the potential to drive positive change, enhance quality of life, and position Milwaukee as a thriving urban center for generations to come.

What is the current sales tax rate in Milwaukee?

+The current combined sales tax rate in Milwaukee is 5.5%, including a state sales tax of 5% and a local sales tax rate of 0.5%.

Are there any property tax exemptions available in Milwaukee for senior citizens?

+Yes, Milwaukee offers a Senior Citizen Property Tax Deferral Program, which allows eligible senior citizens to defer a portion of their property taxes until the property is sold or transferred.

How does Milwaukee support small businesses through its tax system?

+Milwaukee provides tax incentives and credits to small businesses, including tax breaks for job creation, investment in certain industries, and development in designated areas. These initiatives aim to foster entrepreneurship and economic growth.

Are there any environmental initiatives funded by Milwaukee’s tax revenue?

+Yes, Milwaukee’s tax revenue supports various environmental initiatives, such as the Milwaukee Shoreline Industrial Cleanup, which aims to remediate contaminated sites along the city’s industrial shoreline, and the Urban Forestry Program, which promotes tree planting and maintenance to enhance the city’s green spaces.