City Of Columbus Tax

Welcome to our comprehensive guide on the City of Columbus Tax, a critical aspect of doing business and residing in this vibrant metropolis. As one of the largest cities in the United States, Columbus boasts a diverse economy, a thriving cultural scene, and a unique tax landscape that every business owner and resident should understand.

In this in-depth article, we will delve into the intricacies of the City of Columbus Tax, exploring its various components, rates, and implications. By the end, you will have a clear understanding of the tax obligations and opportunities within this dynamic city, empowering you to make informed financial decisions.

Unraveling the City of Columbus Tax Landscape

The City of Columbus, Ohio, operates under a comprehensive tax system designed to fund essential services and support the city's growth and development. This system encompasses various taxes, each with its own purpose and rate structure.

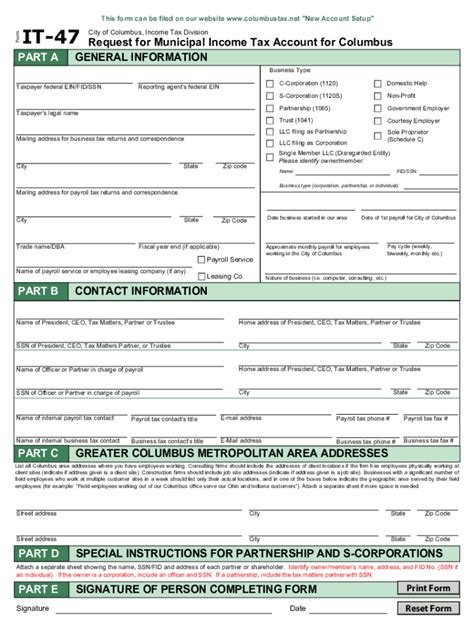

Income Tax: A Key Component

One of the primary taxes in Columbus is the Income Tax, applicable to both individuals and businesses. This tax is levied on income earned within the city limits, whether through employment, business operations, or other sources. The Income Tax rate in Columbus is 2%, which is relatively competitive compared to other major cities.

For individuals, the Income Tax is calculated based on their earnings, with certain deductions and credits available to reduce the tax burden. Businesses, on the other hand, may be subject to additional taxes depending on their industry and size. The city offers resources and guidelines to help businesses navigate their tax obligations accurately.

Sales and Use Tax: Understanding Consumer Taxes

The Sales and Use Tax is another crucial component of the Columbus tax landscape. This tax is applied to the sale of goods and certain services within the city. The current rate for Sales Tax in Columbus is 7.25%, which includes both the state and local tax components.

Businesses operating in Columbus must collect and remit Sales Tax on eligible transactions. Failure to comply can result in penalties and legal consequences. The city provides detailed guidelines and resources to assist businesses in understanding their Sales Tax obligations and ensuring compliance.

Property Tax: Owning Property in Columbus

Property owners in Columbus are subject to Property Tax, which is based on the assessed value of their real estate holdings. The Property Tax rate in Columbus varies depending on the type of property and its location within the city. On average, the rate is around 2.5% of the property's assessed value.

Property Tax assessments are conducted periodically, and property owners have the right to appeal their assessments if they believe the value assigned is inaccurate. The city provides resources and guidance to help property owners understand the assessment process and their rights.

Other Taxes and Fees: A Comprehensive Overview

In addition to the aforementioned taxes, Columbus imposes various other taxes and fees to fund specific initiatives and services. These include:

- Excise Taxes: Applied to certain goods and services, such as telecommunications and electricity, to fund specific city programs.

- Hotel/Motel Taxes: Levied on accommodations within the city, with proceeds often allocated to tourism and convention center initiatives.

- License and Permit Fees: Required for various business activities, such as construction, professional services, and entertainment venues.

- Special Assessment Taxes: Assessed on properties benefiting from specific city improvements, such as street lighting or road repairs.

It's important for businesses and individuals to be aware of these additional taxes and fees to ensure compliance and avoid penalties.

Navigating the Columbus Tax System: Strategies and Insights

Understanding the Columbus tax landscape is just the first step. To optimize your financial strategy, it's crucial to explore strategies that can help you navigate the tax system effectively.

Tax Planning and Compliance: A Proactive Approach

Proactive tax planning is essential for individuals and businesses alike. By staying informed about tax laws, regulations, and deadlines, you can ensure timely compliance and avoid costly mistakes.

Consider working with tax professionals who specialize in Columbus taxes. They can provide valuable insights, help you maximize deductions and credits, and ensure you're taking advantage of any applicable tax incentives.

Tax Incentives and Credits: Unleashing Opportunities

Columbus offers various tax incentives and credits aimed at encouraging economic growth, job creation, and investment. These incentives can significantly reduce your tax burden and provide a competitive edge for your business.

For instance, the city may offer tax abatements for businesses investing in certain industries or locating in specific areas. Additionally, there may be tax credits available for research and development, renewable energy initiatives, and historic preservation projects.

Tax Efficiency: Streamlining Your Operations

Efficient tax management is key to optimizing your financial health. This involves implementing robust accounting systems, regularly reviewing your tax obligations, and staying updated on tax law changes.

Consider investing in tax software or outsourcing your tax management to experts who can ensure accuracy and efficiency. By streamlining your tax processes, you can free up time and resources for other critical business operations.

The Future of Columbus Taxes: Trends and Projections

As Columbus continues to thrive and evolve, its tax landscape is likely to experience changes and adjustments. Understanding these potential shifts can help you prepare for the future and make informed financial decisions.

Economic Growth and Tax Revenue

The city's economic growth is expected to drive increased tax revenue, particularly from Income and Sales Taxes. As more businesses and individuals relocate to Columbus, the tax base will expand, providing additional funding for city initiatives and services.

| Tax Type | Projected Growth |

|---|---|

| Income Tax | 5-7% increase over the next 5 years |

| Sales Tax | Steady growth, aligned with economic expansion |

| Property Tax | Moderate growth, influenced by real estate market dynamics |

Potential Tax Reform: A Focus on Equity

City leaders and policymakers are increasingly discussing tax reform initiatives aimed at promoting equity and fairness. This may involve reevaluating tax rates, exploring new revenue streams, and adjusting tax policies to better support low- and moderate-income residents and businesses.

Technological Advancements: Streamlining Tax Processes

Advancements in technology are expected to play a significant role in streamlining tax processes in Columbus. The city may invest in digital platforms and online tools to enhance tax filing, payment, and compliance, making it easier for taxpayers to meet their obligations.

Conclusion: Embracing the Columbus Tax Landscape

Understanding and navigating the City of Columbus Tax system is essential for individuals and businesses operating within this dynamic city. By staying informed, proactive, and adaptable, you can optimize your financial strategies, maximize tax benefits, and contribute to the growth and prosperity of Columbus.

Remember, the tax landscape is constantly evolving, and staying ahead of the curve is crucial. Continue to educate yourself, seek professional guidance when needed, and embrace the opportunities that Columbus's tax system presents.

What are the current tax rates for individuals and businesses in Columbus, Ohio?

+For individuals, the Income Tax rate is 2%. Businesses operating in Columbus are subject to a 2% Income Tax rate as well, along with other applicable taxes such as Sales Tax (7.25%) and Property Tax (varies based on property type and location).

How can I stay updated on tax law changes in Columbus?

+Stay informed by regularly checking the official city websites, subscribing to tax-related newsletters, and following reputable tax blogs or forums. Additionally, consider working with tax professionals who specialize in Columbus taxes to receive timely updates and guidance.

Are there any tax incentives or credits available for businesses in Columbus?

+Yes, Columbus offers various tax incentives and credits to encourage economic growth and investment. These may include tax abatements, research and development credits, renewable energy incentives, and more. It’s important to consult with tax professionals or city officials to understand the specific incentives available and how to qualify.