Canopy Tax Login

Welcome to the comprehensive guide on the Canopy Tax Login process, an essential tool for tax professionals and businesses alike. In today's digital age, online tax platforms have revolutionized the way we manage our financial obligations. Canopy Tax, a leading provider of cloud-based tax software, offers a seamless and secure login experience, empowering users to access their tax data and streamline their workflows.

This article will delve into the intricacies of the Canopy Tax Login, exploring its features, benefits, and step-by-step instructions. By the end, you'll have a clear understanding of how to navigate the platform, maximize its capabilities, and enhance your tax management processes.

The Importance of Canopy Tax Login

In the fast-paced world of taxation, having a reliable and efficient login system is crucial. Canopy Tax Login serves as the gateway to a comprehensive suite of tax preparation and compliance tools. With its user-friendly interface and robust security measures, the platform ensures that professionals and businesses can confidently manage their tax obligations, regardless of their scale or complexity.

Canopy Tax Login provides a centralized hub for tax data, offering real-time access to critical information. This accessibility enables users to make informed decisions, collaborate seamlessly with colleagues or clients, and stay updated on the latest tax regulations and updates.

Key Features of Canopy Tax Login

The Canopy Tax Login platform boasts an array of features designed to streamline tax management and enhance productivity. Let’s explore some of the key aspects that make it a preferred choice among tax professionals:

Secure Access and Data Protection

Canopy Tax prioritizes the security of user data. The login process employs advanced encryption protocols to safeguard sensitive information, ensuring that tax data remains confidential and protected from unauthorized access.

Additionally, the platform offers multi-factor authentication options, adding an extra layer of security. Users can choose to enable features like biometric authentication or one-time passcodes, providing an additional safeguard for their accounts.

Customizable User Experience

Canopy Tax understands that every tax professional and business has unique needs. The login platform allows users to personalize their experience, tailoring the dashboard to their preferences. Users can organize and prioritize their workflows, ensuring a streamlined and efficient tax management process.

The customizable nature of the platform extends to role-based access control. Administrators can assign specific permissions to team members, ensuring that only authorized individuals have access to sensitive data or critical functions.

Real-Time Collaboration and Communication

Canopy Tax Login facilitates seamless collaboration among team members and clients. The platform enables real-time communication, allowing users to share documents, provide feedback, and collaborate on tax projects efficiently.

With built-in messaging and commenting features, users can stay connected and ensure that everyone is on the same page. This collaborative environment enhances productivity and fosters better client relationships.

Intuitive Tax Preparation Tools

At the heart of Canopy Tax Login is a suite of powerful tax preparation tools. These tools simplify the tax filing process, guiding users through each step with intuitive interfaces and comprehensive guidance.

The platform offers automated calculations, form generation, and e-filing capabilities, reducing the risk of errors and streamlining the entire tax preparation journey. Whether it's individual tax returns or complex business filings, Canopy Tax provides the necessary tools to get the job done efficiently.

Step-by-Step Guide: Canopy Tax Login Process

Now that we’ve explored the key features of Canopy Tax Login, let’s walk through the login process step by step. This guide will ensure a smooth and hassle-free experience for users, regardless of their technical expertise.

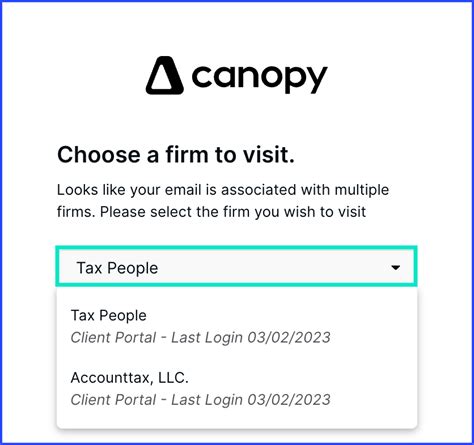

Step 1: Accessing the Canopy Tax Login Portal

To begin, users can access the Canopy Tax Login portal by visiting the official website. The login page is designed with a user-friendly interface, making it easy to navigate even for first-time users.

The portal displays clear prompts for existing users to enter their credentials and for new users to create an account. This streamlined approach ensures a quick and efficient login process.

Step 2: Creating a New Account

For new users, creating an account is a straightforward process. The platform guides users through a simple registration process, requesting essential information such as name, email address, and contact details.

Users can choose a secure password and select their preferred authentication method, ensuring a personalized and secure login experience from the outset.

Step 3: Logging In to Canopy Tax

Once an account is created, logging in is a breeze. Users can access their Canopy Tax dashboard by entering their credentials on the login page.

The platform employs a secure SSL connection, ensuring that all data transmitted during the login process is encrypted and protected.

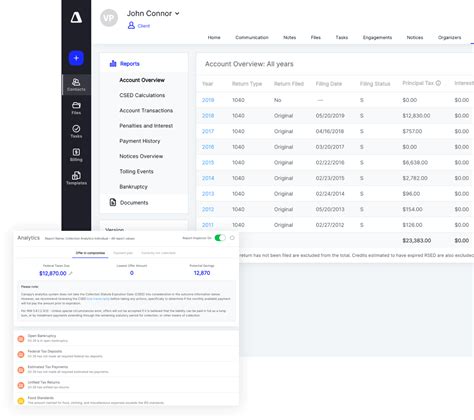

Step 4: Navigating the Dashboard

Upon successful login, users are greeted with a customizable dashboard. The dashboard provides a snapshot of their tax-related activities, allowing quick access to critical information and tools.

Users can navigate through various sections, such as tax returns, client management, and reporting, with ease. The intuitive design ensures that users can locate the necessary features and functions without any hassle.

Step 5: Utilizing Canopy Tax Tools

The true power of Canopy Tax Login lies in its robust suite of tax preparation and compliance tools. Users can leverage these tools to streamline their tax workflows and enhance productivity.

Some of the key tools available within the platform include:

- Tax Return Preparation: Canopy Tax offers an intuitive tax return preparation wizard, guiding users through the process step by step. It supports various tax forms and provides real-time calculations, ensuring accuracy.

- E-Filing: With Canopy Tax, users can electronically file their tax returns with ease. The platform integrates with tax authorities, simplifying the filing process and reducing the risk of errors.

- Client Management: The platform enables efficient client management, allowing users to organize and track client information, documents, and communication in one place.

- Reporting and Analytics: Canopy Tax provides advanced reporting capabilities, generating insightful tax reports and analytics. Users can gain valuable insights into their tax obligations and performance.

Maximizing Your Canopy Tax Login Experience

To get the most out of your Canopy Tax Login, here are some tips and best practices to consider:

Personalize Your Dashboard

Take advantage of the customizable dashboard feature to create a personalized workspace. Organize your widgets, shortcuts, and sections to suit your workflow, ensuring quick access to the tools and information you need most.

Leverage Collaboration Features

Canopy Tax’s collaboration tools are a powerful asset. Utilize the messaging and commenting features to communicate with team members and clients efficiently. Share documents, provide feedback, and work together seamlessly to deliver exceptional tax services.

Stay Updated with Training and Support

Canopy Tax provides comprehensive training resources and support to ensure that users can make the most of the platform. Take advantage of tutorials, webinars, and knowledge base articles to enhance your skills and stay updated with the latest features and enhancements.

Explore Advanced Features

As you become more familiar with Canopy Tax Login, explore the advanced features and functionalities offered by the platform. From automated tax planning to advanced analytics, these features can further streamline your tax management processes and enhance your overall efficiency.

Future of Canopy Tax Login

Canopy Tax is committed to continuous innovation and improvement. The platform is constantly evolving to meet the changing needs of tax professionals and businesses. Here’s a glimpse into the future of Canopy Tax Login and some exciting developments on the horizon:

Enhanced Security Measures

As cybersecurity threats evolve, Canopy Tax is dedicated to strengthening its security infrastructure. Expect to see enhanced encryption protocols, advanced threat detection systems, and improved authentication methods to ensure the utmost protection for user data.

AI-Powered Tax Assistance

Artificial Intelligence (AI) is transforming the tax industry, and Canopy Tax is at the forefront of this revolution. The platform is exploring ways to integrate AI-powered tax assistance, offering intelligent suggestions, error detection, and real-time guidance to users, further enhancing the accuracy and efficiency of tax preparation.

Mobile Accessibility

In today’s mobile-centric world, Canopy Tax recognizes the importance of providing a seamless login experience across devices. Expect future updates to include a fully optimized mobile app, ensuring that users can access their tax data and manage their workflows on the go.

Integration with Emerging Technologies

Canopy Tax is committed to staying at the forefront of technological advancements. The platform is exploring integrations with emerging technologies such as blockchain and machine learning, enabling even more secure and efficient tax management processes.

Conclusion

The Canopy Tax Login platform is a powerful tool that empowers tax professionals and businesses to manage their tax obligations with ease and efficiency. With its secure access, customizable features, and robust suite of tax preparation tools, Canopy Tax Login is a game-changer in the world of tax management.

By following the step-by-step guide and maximizing your login experience, you can unlock the full potential of Canopy Tax and take control of your tax processes. As the platform continues to innovate and evolve, the future of tax management looks brighter than ever, thanks to the capabilities offered by Canopy Tax Login.

How do I reset my Canopy Tax Login password if I forget it?

+If you forget your Canopy Tax Login password, you can easily reset it by following these steps: Visit the login page and click on the “Forgot Password” link. Enter your registered email address, and Canopy Tax will send you a password reset link. Follow the instructions in the email to create a new password and regain access to your account.

Can I access Canopy Tax on my mobile device?

+Yes, Canopy Tax offers a mobile-optimized version of its platform, ensuring that you can access your tax data and manage your workflows on the go. Simply visit the Canopy Tax website on your mobile browser, and you’ll be directed to the mobile-friendly interface.

What security measures does Canopy Tax have in place to protect my data?

+Canopy Tax takes data security extremely seriously. The platform employs advanced encryption protocols, multi-factor authentication options, and robust cybersecurity measures to protect your tax data. Additionally, Canopy Tax regularly undergoes independent security audits to ensure compliance with industry standards.

Can I collaborate with my clients using Canopy Tax Login?

+Absolutely! Canopy Tax Login facilitates seamless collaboration between tax professionals and their clients. The platform offers secure document sharing, messaging, and commenting features, allowing you to work together efficiently and provide exceptional tax services.

Is Canopy Tax Login suitable for small businesses and startups?

+Yes, Canopy Tax Login is designed to cater to businesses of all sizes, including small businesses and startups. The platform offers scalable pricing plans and a user-friendly interface, making it an ideal choice for businesses looking to streamline their tax management processes and stay compliant.