California Tax On Car Sales

The Golden State, California, is renowned for its sunny weather, diverse landscapes, and, of course, its bustling automotive market. When it comes to buying a car, one of the key considerations for prospective buyers is the tax they will need to pay. Understanding the intricacies of California's tax on car sales is essential for anyone looking to make an informed purchase decision. In this comprehensive guide, we will delve into the specifics of how California taxes car sales, providing you with the knowledge you need to navigate this important aspect of the buying process.

Unraveling California’s Tax Structure for Car Sales

![Solved: What Is The 8.5 % Sales Tax Of A $12, 000 Car Bought In California? A. $1, 020 B. $120 C. [Business] Solved: What Is The 8.5 % Sales Tax Of A $12, 000 Car Bought In California? A. $1, 020 B. $120 C. [Business]](https://nacdashboard.nara.gov/assets/img/solved-what-is-the-8-5-sales-tax-of-a-12-000-car-bought-in-california-a-1-020-b-120-c-business.jpeg)

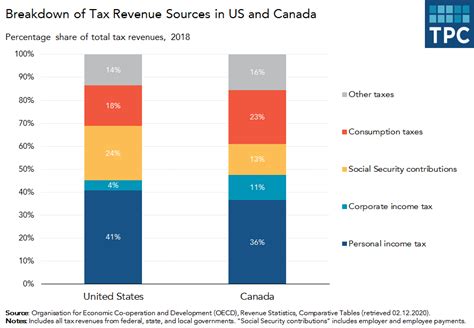

California’s tax system for car sales is designed to generate revenue for the state while ensuring fairness and transparency for buyers and sellers. The state imposes a sales and use tax on the purchase of vehicles, which is collected by the California Department of Motor Vehicles (DMV) and the California State Board of Equalization (BOE). This tax applies to both new and used vehicles, and it is an essential part of the overall cost of buying a car in the state.

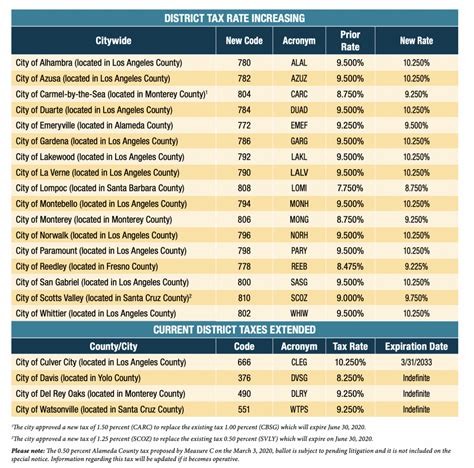

The tax rate for car sales in California is not a one-size-fits-all figure. Instead, it varies depending on the location of the purchase. California is divided into various tax jurisdictions, each with its own tax rate. This means that the tax you pay on your car purchase can differ significantly depending on the county or city where the sale takes place.

To provide a clearer picture, let's take a look at some specific tax rates across different regions in California:

| Tax Jurisdiction | Sales and Use Tax Rate |

|---|---|

| Los Angeles County | 9.50% |

| Orange County | 7.75% |

| San Diego County | 7.75% |

| San Francisco County | 8.75% |

| Sacramento County | 8.25% |

As you can see, the tax rate can vary quite significantly from one region to another. This is why it's crucial to be aware of the tax jurisdiction where you plan to purchase your vehicle. It can make a substantial difference in the overall cost.

Calculating Your Car Purchase Tax

To calculate the tax you will owe on your car purchase, you’ll need to consider not just the sales and use tax rate but also any applicable local taxes or fees. These additional charges can include county taxes, city taxes, and various registration fees. It’s essential to factor these into your calculation to get an accurate estimate of the total tax you’ll pay.

Let's walk through an example to illustrate how this works. Imagine you're buying a new car in Los Angeles County, where the sales and use tax rate is 9.50%. The price of the car is $30,000, and there is an additional local tax of 1.50% and a registration fee of $80. To calculate the total tax due, we would follow these steps:

- Calculate the sales and use tax: $30,000 x 9.50% = $2,850.

- Add the local tax: $30,000 x 1.50% = $450.

- Include the registration fee: $80.

- Total tax due: $2,850 + $450 + $80 = $3,380.

So, in this scenario, the total tax due on the purchase of the $30,000 car would be $3,380. This amount would be added to the purchase price, making the total cost of the car $33,380.

Understanding the Registration Process and Its Costs

In addition to the sales and use tax, there are other fees and costs associated with registering your vehicle in California. These fees are collected by the DMV and cover various administrative processes and services.

The primary registration fee in California is based on the vehicle's weight. This fee can range from around $20 to several hundred dollars, depending on the weight of the vehicle. For example, a standard passenger car weighing around 4,000 pounds would typically have a registration fee of approximately $80.

Additionally, there are other fees and costs to consider, such as:

- Title transfer fee: A fee charged for transferring the title of ownership when purchasing a used vehicle.

- Smog abatement fee: A fee imposed to support air quality programs and help reduce smog emissions.

- Registration renewal fee: A periodic fee paid when renewing your vehicle registration.

- Environmental fee: A fee aimed at funding environmental protection programs.

The exact fees and their amounts can vary depending on the type of vehicle, its age, and the specific county or city where it is registered. It's crucial to obtain a detailed breakdown of these fees from your local DMV office or a reputable online resource to ensure you have an accurate understanding of the total costs associated with registering your vehicle.

Registration Fee Examples

To provide some real-world examples, let’s look at the registration fees for a few common vehicle types in California:

| Vehicle Type | Registration Fee |

|---|---|

| Standard Passenger Car (4,000 lbs) | $80 |

| Pickup Truck (6,000 lbs) | $120 |

| Motorcycle (under 500 lbs) | $20 |

| Electric Vehicle (3,000 lbs) | $80 |

These fees are subject to change, so it's always best to refer to official sources for the most up-to-date information. The DMV's website is a valuable resource for understanding the registration process and the associated costs.

The Impact of California’s Car Sales Tax on Buyers

The tax on car sales in California can significantly impact buyers, especially when purchasing high-value vehicles. The varying tax rates across different regions can make a substantial difference in the overall cost of a car, which is why it’s crucial for buyers to be well-informed about the tax landscape.

Let's consider a practical example to illustrate this impact. Imagine two individuals, Alice and Bob, both looking to purchase a new luxury car priced at $100,000. Alice lives in San Diego County, where the sales and use tax rate is 7.75%, while Bob resides in Los Angeles County, where the rate is 9.50%.

- Alice's tax calculation: $100,000 x 7.75% = $7,750.

- Bob's tax calculation: $100,000 x 9.50% = $9,500.

As a result, Alice would pay a total of $7,750 in tax on her car purchase, while Bob would pay $9,500. This difference of $1,750 is solely due to the varying tax rates in their respective counties. It's a substantial amount that can influence buying decisions and budget considerations.

Moreover, the impact of the tax extends beyond the initial purchase. California's car sales tax is not a one-time expense. It is an ongoing cost that affects the resale value of vehicles and influences the overall cost of ownership. When selling a car, the tax paid initially is often factored into the selling price, making it an essential consideration for both buyers and sellers.

The Future of Car Sales Tax in California

As the automotive industry continues to evolve, so too does the tax landscape surrounding car sales in California. The state’s commitment to environmental sustainability and its efforts to promote electric and alternative-fuel vehicles have led to the introduction of various incentives and tax breaks. These initiatives aim to encourage the adoption of cleaner transportation options and reduce the environmental impact of vehicles.

One notable development is the growing emphasis on incentivizing the purchase of electric vehicles (EVs). California has implemented a range of tax credits and rebates to make EVs more affordable and attractive to buyers. These incentives can significantly reduce the overall cost of purchasing an EV, making them a more feasible option for environmentally conscious consumers.

Additionally, the state is exploring innovative approaches to tax collection and administration. The introduction of digital platforms and online services has streamlined the registration and tax payment processes, making it more convenient for buyers and sellers. These digital solutions not only enhance efficiency but also reduce the administrative burden associated with car sales and registration.

Looking ahead, the future of car sales tax in California is likely to be shaped by several key factors. The state's ongoing commitment to environmental sustainability and its goal of reducing greenhouse gas emissions will continue to influence tax policies. As the electric vehicle market expands, we can expect further incentives and tax breaks to encourage their adoption.

Furthermore, technological advancements and the integration of smart mobility solutions are expected to play a significant role. The rise of autonomous vehicles and connected car technologies may lead to new tax models and revenue streams. California's policymakers will need to adapt tax regulations to accommodate these emerging trends while ensuring fairness and transparency.

In conclusion, understanding California's tax on car sales is a crucial aspect of making informed decisions as a buyer or seller. The varying tax rates, registration fees, and incentives all contribute to the overall cost of purchasing and owning a vehicle in the Golden State. By staying informed about these tax considerations, you can navigate the car-buying process with confidence and make choices that align with your financial goals and environmental values.

How often do I need to renew my vehicle registration in California?

+Vehicle registration renewal in California is typically required annually. However, the specific renewal date can vary based on the month your vehicle was initially registered. It’s important to stay updated on your renewal date to avoid late fees and ensure continuous registration.

Are there any exemptions or credits available for car sales tax in California?

+Yes, California offers several exemptions and credits for car sales tax. These include incentives for purchasing electric or hybrid vehicles, as well as tax breaks for certain types of vehicles used for business purposes. It’s worth exploring these options to potentially reduce your tax liability.

How can I find the sales and use tax rate for my specific county in California?

+You can easily find the sales and use tax rate for your county by visiting the California State Board of Equalization’s website. They provide a comprehensive list of tax rates for all counties in the state. Alternatively, you can contact your local DMV office for this information.