Broward Property Tax Payment

Property taxes are an essential aspect of local government funding, contributing to vital services such as education, infrastructure, and public safety. In Broward County, Florida, understanding the payment process for property taxes is crucial for residents and property owners alike. This article aims to provide a comprehensive guide to the Broward Property Tax Payment process, covering everything from assessment to payment methods, with an emphasis on clarity and expert insight.

Understanding Property Tax Assessments in Broward County

The property tax assessment process in Broward County is a meticulous and transparent system designed to ensure fair taxation for all property owners. The process begins with an appraisal, where the Property Appraiser’s Office determines the just market value of each property based on recent sales data and other factors. This value serves as the basis for calculating the property tax.

Once the market value is established, it is subjected to exemptions and adjustments as applicable. Broward County offers various exemptions, including homestead exemptions for primary residences, which can significantly reduce the taxable value of a property. These exemptions are a vital component of the county's tax policy, aiming to provide relief to homeowners and encourage homeownership.

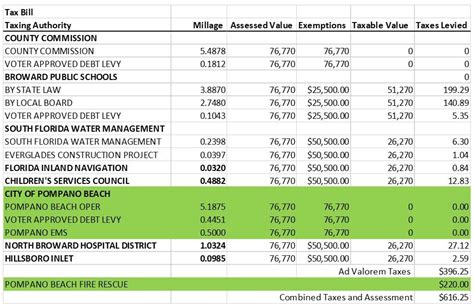

The resulting taxable value is then multiplied by the millage rate, which is the tax rate per thousand dollars of assessed value. The millage rate is set annually by the Broward County Board of County Commissioners, taking into account the funding needs of various county services. This calculation results in the total property tax liability for the property owner.

Online Property Tax Assessment Tools

For property owners in Broward County, the Property Appraiser’s Office provides an online property search tool that allows them to access detailed information about their property’s assessment. This tool offers a convenient way to view the property’s current and previous market values, taxable values, and any applicable exemptions. It also provides a breakdown of the millage rate, showing how the tax rate is distributed among different taxing authorities.

| Property Tax Assessment Categories | Description |

|---|---|

| Market Value | The estimated value of the property based on recent sales and other factors. |

| Taxable Value | The assessed value after applying exemptions and adjustments. |

| Millage Rate | The tax rate per thousand dollars of assessed value, set by the County Commissioners. |

Payment Methods and Due Dates

Broward County offers a range of convenient payment methods for property taxes, ensuring flexibility for taxpayers. The primary payment methods include:

- Online Payment: Property owners can make secure online payments through the Broward County Property Appraiser's official website. This method allows for real-time payment tracking and provides an electronic receipt for records.

- Mail-in Payment: Property owners can mail their tax payments to the designated address, ensuring they reach the Broward County Tax Collector's Office before the due date.

- In-Person Payment: For those who prefer a more traditional approach, payments can be made in person at the Tax Collector's Office or any of its branch locations. This method offers immediate confirmation of payment.

- Electronic Funds Transfer (EFT): This method allows for automatic payment transfers from a taxpayer's bank account on the due date. It provides a convenient, paperless way to ensure timely payment.

It's important to note that property taxes in Broward County are typically due twice a year, with payment deadlines usually falling in March and November. However, the exact due dates can vary slightly from year to year, so it's advisable to check the official Broward County Tax Collector's website for the most up-to-date information.

Payment Discounts and Penalties

Broward County offers a discount for early payment of property taxes. Property owners who pay their taxes in full by the early payment deadline (usually in late March) are eligible for a discount, typically around 4%. This incentive encourages timely payment and helps the county with its cash flow management.

On the other hand, late payments are subject to interest and penalties. The penalty for late payment is 3% of the tax amount, and interest accrues daily at a rate of 1.5% per month until the tax is paid in full. These measures are in place to ensure the timely collection of taxes and to deter delinquent payments.

| Payment Method | Description |

|---|---|

| Online Payment | Secure payment through the official website with real-time tracking. |

| Mail-in Payment | Payment sent by mail to the designated address. |

| In-Person Payment | Payment made directly at the Tax Collector's Office or its branches. |

| Electronic Funds Transfer (EFT) | Automatic payment transfer from a taxpayer's bank account on the due date. |

Property Tax Relief Programs

Broward County recognizes the financial burden that property taxes can impose on certain groups of taxpayers. As such, the county offers several property tax relief programs to provide assistance and support.

Homestead Exemption

The homestead exemption is a significant tax relief program in Broward County. It allows eligible homeowners to reduce the taxable value of their primary residence, resulting in lower property taxes. To qualify for the homestead exemption, a property must be the owner’s permanent residence, and the owner must apply for the exemption by a specified deadline each year.

Senior Exemption

The senior exemption is designed to provide tax relief to Broward County’s senior citizens. This exemption reduces the taxable value of the property for homeowners aged 65 or older. Similar to the homestead exemption, property owners must apply for the senior exemption by the designated deadline to be eligible.

Other Relief Programs

In addition to the homestead and senior exemptions, Broward County offers several other property tax relief programs. These include:

- Widow/Widower Exemption: Provides tax relief to surviving spouses of deceased property owners.

- Disability Exemption: Offers tax relief to homeowners with certain disabilities.

- Total and Permanent Disability Exemption: Provides full exemption from property taxes for homeowners who are totally and permanently disabled.

- Low-Income Senior Citizen Exemption: Offers additional tax relief to low-income senior citizens.

Each of these programs has specific eligibility criteria and application procedures. Property owners are encouraged to visit the Property Appraiser's Office website or contact their office for detailed information and guidance on applying for these relief programs.

Conclusion

Understanding the Broward Property Tax Payment process is crucial for property owners in the county. From the initial assessment to the various payment methods and relief programs, this comprehensive guide aims to provide clarity and expert insight. By staying informed and taking advantage of the resources and programs available, property owners can ensure they meet their tax obligations efficiently and take advantage of the opportunities for tax relief.

Frequently Asked Questions

When is the property tax due in Broward County?

+Property taxes in Broward County are typically due twice a year, with payment deadlines usually falling in March and November. However, the exact due dates can vary slightly from year to year.

How can I pay my property taxes in Broward County?

+Broward County offers various payment methods, including online payment, mail-in payment, in-person payment, and Electronic Funds Transfer (EFT). You can choose the method that best suits your preferences and needs.

Are there any discounts or penalties for property tax payments in Broward County?

+Yes, Broward County offers a discount for early payment of property taxes. If you pay your taxes in full by the early payment deadline, you are eligible for a discount, typically around 4%. Late payments, on the other hand, are subject to interest and penalties.

What is the homestead exemption, and how can I apply for it in Broward County?

+The homestead exemption is a tax relief program that reduces the taxable value of your primary residence. To apply for the homestead exemption in Broward County, you must complete and submit the required application form by the designated deadline each year. You can find more information and the application form on the Property Appraiser’s Office website.

Are there any other property tax relief programs available in Broward County?

+Yes, Broward County offers several other property tax relief programs, including the senior exemption, widow/widower exemption, disability exemption, total and permanent disability exemption, and low-income senior citizen exemption. Each program has specific eligibility criteria and application procedures. Visit the Property Appraiser’s Office website or contact their office for detailed information and guidance.