Are Attorney Fees Tax Deductible

When it comes to managing your finances and navigating the intricate world of taxation, understanding the deductibility of attorney fees is crucial. In the United States, the Internal Revenue Service (IRS) has specific guidelines regarding the tax treatment of legal expenses. This article aims to provide a comprehensive guide to help you determine whether attorney fees are tax-deductible, offering insights into the relevant tax laws and real-world examples to illustrate the application of these rules.

Understanding Tax Deductibility of Attorney Fees

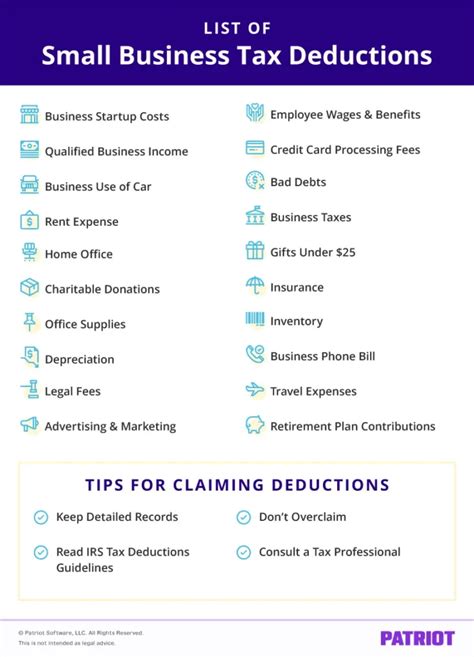

The deductibility of attorney fees depends on the nature of the legal services rendered and the purpose for which the fees were incurred. In general, attorney fees are tax-deductible if they meet specific criteria outlined by the IRS. These criteria primarily revolve around the purpose of the legal services and whether they are directly related to generating income or maintaining your existing income.

The IRS classifies attorney fees as business expenses or personal expenses, and the tax treatment differs for each category. Business expenses are generally tax-deductible, while personal expenses are typically not deductible unless they fall under specific exceptions.

Business-Related Attorney Fees

Attorney fees incurred for business-related matters are often tax-deductible. This includes legal services related to:

- Starting or operating a business

- Contract negotiations and disputes

- Intellectual property protection

- Employment law matters

- Tax planning and compliance

- Real estate transactions for investment purposes

For example, if you own a small business and hire an attorney to draft contracts, negotiate business deals, or handle tax-related matters, the fees paid for these services are typically deductible as business expenses. Similarly, if you're an independent contractor and pay an attorney to resolve a contract dispute with a client, those fees are likely deductible.

| Business-Related Fees | Deductible |

|---|---|

| Contract Drafting | ✓ |

| Business Dispute Resolution | ✓ |

| Employment Law Consultations | ✓ |

| Tax Audit Representation | ✓ |

Personal-Related Attorney Fees

Personal attorney fees are generally not tax-deductible. These include legal services for personal matters such as:

- Divorce proceedings

- Personal injury claims

- Will drafting and estate planning

- Family law matters

- Traffic violations

However, there are exceptions to this rule. Certain personal attorney fees may be deductible if they are directly related to generating or preserving income. For instance, if you are an artist and incur legal fees to protect your intellectual property rights, those fees could be deductible as a business expense.

| Personal Fees | Deductible |

|---|---|

| Divorce Legal Fees | X |

| Personal Injury Attorney Costs | X |

| Estate Planning Attorney Fees | X |

| Intellectual Property Protection (Personal Work) | ✓ |

Tax Deductibility for Different Filing Statuses

The tax deductibility of attorney fees can vary depending on your filing status. Here's a breakdown for the most common filing statuses:

Individual Filers

For individuals filing as single, head of household, or qualifying widow(er), business-related attorney fees are deductible as a business expense on Schedule C (Form 1040). Personal attorney fees are generally not deductible unless they fall under specific exceptions mentioned earlier.

Married Filing Jointly or Separately

Married couples filing jointly or separately can deduct business-related attorney fees in the same manner as individual filers. However, the deductibility of personal attorney fees is subject to the same rules and exceptions. It's essential to maintain proper documentation and separate business and personal expenses clearly.

Partnerships and S Corporations

For business entities like partnerships and S corporations, business-related attorney fees are deductible as ordinary and necessary business expenses. These expenses are typically reported on the business tax return (Form 1065 for partnerships and Form 1120S for S corporations) and allocated to the individual partners or shareholders accordingly.

Record-Keeping and Documentation

Proper record-keeping is crucial when claiming attorney fees as tax deductions. The IRS may request supporting documentation, so it's essential to maintain records such as:

- Attorney invoices or bills

- Receipts for legal services

- Contracts or agreements related to the legal work

- Correspondence with the attorney detailing the nature of the services

- Any relevant tax forms or documents filed with the IRS

Organize these documents carefully and keep them accessible for future reference, as they may be needed during tax audits or for substantiating your deductions.

Conclusion: Navigating Tax Deductibility of Attorney Fees

Understanding the tax deductibility of attorney fees is a complex but essential aspect of financial management. By distinguishing between business and personal expenses and staying informed about IRS guidelines, you can maximize your tax deductions and minimize your tax liability. Always consult with a tax professional or CPA to ensure compliance with the latest tax laws and to tailor your deductions to your specific circumstances.

Can I deduct attorney fees for starting a new business?

+Yes, attorney fees incurred for setting up a new business, such as drafting legal documents, registering the business, and handling initial tax matters, are generally deductible as business expenses.

Are legal fees for a divorce deductible?

+No, legal fees related to a divorce are typically not deductible as personal expenses. However, if the divorce settlement involves the division of business assets, some legal fees may be deductible as a business expense.

Can I deduct attorney fees for tax audit representation?

+Yes, attorney fees incurred for representing you during a tax audit are generally deductible as a business expense. These fees help preserve your existing income and are necessary for compliance with tax laws.

How do I claim attorney fees as a deduction on my tax return?

+The process for claiming attorney fees as a deduction depends on your filing status and the nature of the fees. Business-related fees are typically reported on Schedule C (Form 1040) for individuals or on the appropriate business tax return for partnerships and corporations. Personal attorney fees may require separate documentation and may be deductible as a medical expense under certain circumstances.