Alameda County Sales Tax

Alameda County, nestled in the heart of the San Francisco Bay Area, is a vibrant region known for its diverse communities, bustling cities, and thriving businesses. As a key economic hub, the county relies on a variety of revenue sources to fund essential public services and infrastructure projects. Among these, the sales tax stands out as a crucial component of the county's financial ecosystem, impacting both residents and businesses alike.

The sales tax in Alameda County is a levy imposed on the sale of goods and certain services within the county's borders. It is an essential tool for generating revenue, contributing significantly to the county's budget and shaping the local economy. In this comprehensive article, we will delve into the intricacies of the Alameda County sales tax, exploring its history, current rates, exemptions, and the impact it has on the county's financial landscape.

A Historical Perspective

The origins of the sales tax in Alameda County can be traced back to the early 20th century, when the concept of a sales tax began to gain traction across the United States. In California, the first sales tax was introduced in 1933, during the depths of the Great Depression, as a means to generate much-needed revenue for the state. Initially, the sales tax was a flat rate applied to all transactions, but over time, it evolved to become more nuanced and tailored to the needs of individual counties.

Alameda County, being one of the most populous and economically diverse counties in California, has played a significant role in shaping the state's sales tax landscape. In the 1960s, the county was at the forefront of advocating for local control over sales tax rates, leading to the establishment of a system where counties could set their own rates within certain parameters. This allowed Alameda County to tailor its tax policies to suit the unique needs of its communities and local businesses.

Current Sales Tax Rates

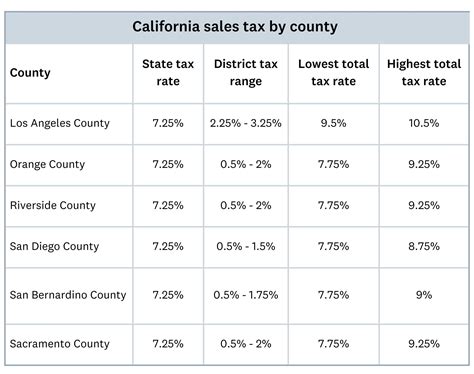

As of [current year], the sales tax rate in Alameda County is composed of a combination of state, county, and city/district taxes. The state of California imposes a base sales tax rate of 7.25%, which is applied uniformly across the state. On top of this, Alameda County adds a 0.5% county-wide tax, bringing the total to 7.75% for most areas within the county.

However, the story doesn't end there. Many cities and special districts within Alameda County have their own additional sales taxes, often earmarked for specific purposes such as transportation improvements, public safety, or cultural programs. These local taxes can vary significantly, ranging from 0% to 1.5%, depending on the municipality.

For example, the city of Berkeley imposes a 1% municipal tax, bringing the total sales tax rate in Berkeley to 8.75%. On the other hand, the city of Hayward has a lower local tax rate of 0.5%, resulting in a total sales tax of 8.25% in that area. These variations in local taxes create a complex landscape, with sales tax rates differing from one city to another within the county.

| City/District | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Berkeley | 1% | 8.75% |

| Hayward | 0.5% | 8.25% |

| Oakland | 1% | 8.75% |

| Union City | 0.5% | 8.25% |

| Livermore | 1% | 8.75% |

| Pleasanton | 1% | 8.75% |

| Fremont | 0.5% | 8.25% |

| San Leandro | 1% | 8.75% |

| Dublin | 0.5% | 8.25% |

| Albany | 1% | 8.75% |

Sales Tax Exemptions

While the sales tax is applied to a wide range of goods and services, there are certain exemptions and exclusions that are worth noting. These exemptions are designed to alleviate the tax burden on specific sectors or to promote certain social or economic goals.

- Food and Beverages: Many staple food items, such as unprocessed groceries, are exempt from sales tax. This exemption is aimed at reducing the tax burden on essential food items and ensuring that basic necessities remain affordable for all residents.

- Prescription Drugs: Sales tax is not applied to prescription medications, allowing residents to access necessary healthcare without additional financial strain.

- Manufacturing Equipment: Sales tax is waived for the purchase of certain manufacturing equipment, encouraging investment in the local manufacturing sector and promoting economic growth.

- Educational Materials: Books, textbooks, and other educational materials are exempt from sales tax, supporting the county's commitment to education and knowledge dissemination.

- Medical Devices: Sales tax is not imposed on the purchase of medical devices, including durable medical equipment, to ensure equal access to healthcare for all residents.

Impact on Local Businesses

The sales tax in Alameda County has a profound impact on local businesses, shaping their strategies and operations. For brick-and-mortar retailers, the sales tax is a direct cost passed on to consumers, influencing their pricing and competitive positioning. Online retailers, on the other hand, navigate a more complex landscape, often required to collect and remit sales tax based on the location of their customers.

The varying sales tax rates across different cities within the county create opportunities for businesses to strategically locate their operations. For instance, a business might choose to establish its headquarters in a city with a lower sales tax rate to reduce its tax burden, while still being able to serve customers across the county.

Additionally, the sales tax provides an incentive for businesses to explore tax-exempt options or seek out tax breaks and incentives offered by the county or specific cities. This can lead to innovative solutions, such as investing in green technologies or supporting local charities, to qualify for tax exemptions or credits.

Case Study: The Impact of Sales Tax on Small Businesses

To illustrate the impact of sales tax on local businesses, let’s consider the example of a small, independent bookstore located in Oakland, known as “Page Turner’s Paradise.”

Page Turner's Paradise, a beloved fixture in the Oakland community, faces the challenge of competing with online retailers and larger chains. The sales tax, while necessary for the county's revenue, adds a layer of complexity to the bookstore's pricing strategy. The store must carefully calculate its pricing to remain competitive while also accounting for the 8.75% sales tax rate in Oakland.

To mitigate the impact of the sales tax, the bookstore owner, Sarah, has implemented several strategies. She offers free local delivery for orders above a certain amount, encouraging customers to support their neighborhood bookstore. Additionally, Sarah actively engages with the community, sponsoring local events and initiatives, which helps build loyalty and attracts new customers.

Furthermore, Sarah has explored the possibility of expanding her business online, recognizing the potential to reach a wider audience. However, this presents its own challenges, as she would need to navigate the complexities of sales tax collection and compliance for online sales, ensuring compliance with the varying tax rates across the county.

Despite these challenges, Page Turner's Paradise continues to thrive, thanks to its dedicated customer base and the support of the local community. The sales tax, while an added cost, is seen as a necessary contribution to the county's development and a small price to pay for the benefits it brings to the local economy and public services.

Revenue Generation and Public Services

The revenue generated through the sales tax is a critical component of Alameda County’s budget, funding a wide range of essential public services and infrastructure projects. These funds are distributed across various sectors, ensuring the county’s continued growth and development.

Public Safety and Law Enforcement

A significant portion of the sales tax revenue is allocated to public safety initiatives, including law enforcement, emergency services, and crime prevention programs. This funding enhances the county’s ability to maintain a safe and secure environment for its residents and businesses.

For instance, the Alameda County Sheriff's Office benefits from sales tax revenue, allowing it to maintain an adequate workforce and invest in modern equipment and technologies to combat crime effectively.

Transportation Infrastructure

Alameda County’s transportation network, comprising roads, bridges, and public transit systems, relies heavily on sales tax revenue for maintenance and improvements. This ensures that residents and businesses can commute efficiently and that the county’s transportation infrastructure remains resilient and sustainable.

One notable project funded by sales tax revenue is the expansion of the Bay Area Rapid Transit (BART) system, which connects various cities within the county and beyond. The sales tax provides a stable source of funding for BART's ongoing maintenance and expansion plans, improving connectivity and reducing traffic congestion.

Education and Youth Programs

Education is a top priority for Alameda County, and sales tax revenue plays a vital role in supporting the county’s schools and educational initiatives. This funding enhances the quality of education, provides resources for extracurricular activities, and ensures that all students have access to a high-quality learning environment.

Additionally, sales tax revenue is directed towards youth programs and recreational activities, offering opportunities for personal growth, sports participation, and creative pursuits for the county's youth population.

Future Implications and Considerations

As Alameda County continues to evolve and adapt to changing economic and social landscapes, the sales tax will remain a key component of its financial strategy. However, several factors and considerations will shape the future of the sales tax in the county.

Economic Growth and Diversification

Alameda County’s economy is diverse and dynamic, with a mix of industries ranging from technology and healthcare to manufacturing and hospitality. As the county continues to attract new businesses and foster economic growth, the sales tax will play a crucial role in generating revenue to support this expansion.

Additionally, the county may explore opportunities to diversify its revenue streams, reducing its reliance on sales tax and mitigating the impact of economic downturns or shifts in consumer behavior.

Technological Advancements and Online Sales

The rise of e-commerce and online sales presents both opportunities and challenges for the sales tax. While online retailers can contribute to the county’s revenue by collecting and remitting sales tax, the complexity of determining the appropriate tax rate based on the customer’s location can be a hurdle.

Alameda County, in collaboration with state and local authorities, will need to adapt its sales tax policies and enforcement mechanisms to ensure fair and accurate tax collection from online retailers, without imposing undue burdens on businesses or consumers.

Community Engagement and Tax Reform

The sales tax, as a critical revenue source, has a direct impact on the lives of Alameda County’s residents and businesses. As such, community engagement and transparency in tax policies are essential. The county can benefit from ongoing dialogue with residents, businesses, and stakeholders to gather feedback, address concerns, and ensure that the sales tax remains fair and equitable.

Additionally, tax reform initiatives may be explored to streamline the sales tax system, simplify compliance, and reduce administrative burdens on businesses. Such reforms could include simplifying the tax rates, harmonizing local taxes, or implementing new technologies for efficient tax collection and management.

How often are sales tax rates updated in Alameda County?

+

Sales tax rates in Alameda County are typically updated annually, often in response to changes in state or local policies, economic conditions, or community needs. The county board of supervisors plays a key role in setting the local tax rate, ensuring that it aligns with the county’s financial goals and priorities.

Are there any efforts to simplify the sales tax system in the county?

+

Yes, there have been ongoing discussions and initiatives aimed at simplifying the sales tax system in Alameda County. These efforts focus on harmonizing local tax rates, reducing the administrative burden on businesses, and improving compliance. The county is committed to making the sales tax system more efficient and user-friendly for all stakeholders.

How does the sales tax impact small businesses in the county?

+

The sales tax can pose challenges for small businesses, especially those with thin profit margins. However, it also provides an incentive for small businesses to explore tax-exempt options, seek out tax breaks, and engage with the community. Many small businesses find creative ways to navigate the sales tax landscape and contribute to the county’s economy.

What happens to the revenue generated from sales tax?

+

The revenue generated from sales tax in Alameda County is distributed across various sectors, including public safety, transportation, education, and social services. This funding ensures that the county can provide essential services and infrastructure to its residents and support the local economy.

Are there any sales tax holidays in Alameda County?

+

Alameda County, like many other counties in California, does not observe specific sales tax holidays. However, the county may participate in state-wide initiatives or offer temporary tax breaks for certain sectors or products to stimulate the economy or support specific industries.