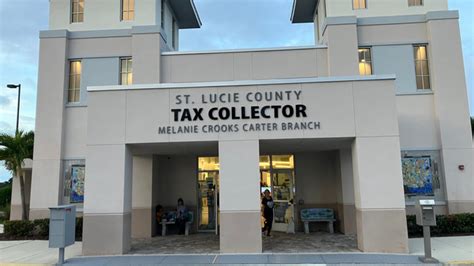

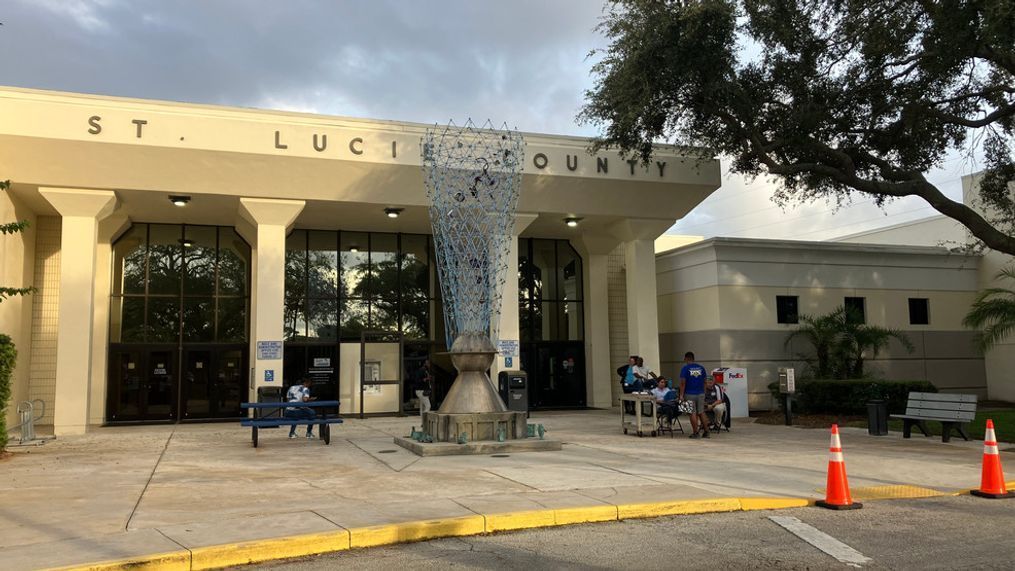

Port St Lucie Tax Collector

Welcome to the comprehensive guide to the Port St. Lucie Tax Collector's Office, a vital administrative body within the beautiful city of Port St. Lucie, Florida. This article aims to provide an in-depth understanding of the role and services offered by the Tax Collector's Office, shedding light on its significance to the community and the residents it serves.

The Port St. Lucie Tax Collector's Office is an essential institution, responsible for a wide array of financial and administrative tasks that impact the daily lives of its citizens. From vehicle registration and title transfers to collecting property taxes and offering various other tax-related services, this office plays a pivotal role in the smooth functioning of the city's economy and infrastructure.

As an expert in local government operations and tax administration, I aim to provide you with an insightful look into the workings of this office, its historical context, and its impact on the community. We will explore the services provided, the processes involved, and the future directions the office might take to better serve the evolving needs of the city.

The Role and Responsibilities of the Port St. Lucie Tax Collector

The Tax Collector’s Office in Port St. Lucie holds a position of considerable responsibility and public trust. Their primary duty is to collect various taxes, fees, and other revenue streams mandated by the state and local governments, ensuring the financial stability and growth of the city.

Tax Collection and Administration

At the heart of their operations, the Tax Collector’s Office is responsible for the efficient and effective collection of taxes. This includes property taxes, which form a significant portion of the city’s revenue, as well as specialized taxes like the Tangible Personal Property Tax, which is levied on certain business assets.

| Tax Type | Description |

|---|---|

| Property Tax | Tax levied on real estate properties based on their assessed value. |

| Tangible Personal Property Tax | Tax applied to certain business assets like equipment, inventory, and furniture. |

In addition to tax collection, the office also provides a range of administrative services. These include issuing driver licenses, ID cards, and vehicle tags, as well as facilitating vehicle title transfers and registrations. They also play a crucial role in the state's motor vehicle recall program, ensuring the safety and compliance of vehicles on the road.

Customer Service and Public Engagement

The Tax Collector’s Office prides itself on delivering exceptional customer service. Their team is trained to provide clear, concise, and friendly assistance to the public, ensuring that residents understand their tax obligations and the services available to them.

Public engagement is a key aspect of their role. They regularly interact with the community through various outreach programs, public meetings, and educational initiatives. This not only fosters a sense of transparency but also allows them to gather valuable feedback and insights to improve their services.

Services Offered by the Port St. Lucie Tax Collector’s Office

The range of services provided by the Tax Collector’s Office is extensive and diverse, catering to the varied needs of the city’s residents and businesses. Here, we delve into some of the key services and the impact they have on the community.

Property Tax Assessment and Collection

Property taxes are a critical source of revenue for the city, funding essential services like schools, fire and police departments, and public infrastructure. The Tax Collector’s Office plays a crucial role in this process, ensuring accurate assessment and timely collection of these taxes.

The office maintains detailed records of all property transactions, ensuring that the correct taxes are levied and collected. They also provide resources and guidance to homeowners, helping them understand their tax obligations and potential exemptions or discounts they may be eligible for.

For businesses, the office offers assistance with the Tangible Personal Property Tax, providing clear guidelines and resources to ensure compliance. They also offer a streamlined online payment system, making it convenient for businesses to manage their tax obligations.

Vehicle Registration and Title Transfers

The Tax Collector’s Office is the primary point of contact for vehicle-related services in Port St. Lucie. They handle vehicle registrations, title transfers, and the issuance of vehicle tags. This service is crucial for ensuring the safety and legality of vehicles on the road, as well as providing a reliable revenue stream for the city.

Their efficient processing of vehicle registrations and titles helps maintain accurate records, which is essential for law enforcement and public safety. The office also ensures that residents are aware of their responsibilities when it comes to vehicle ownership, including timely registration renewals and compliance with vehicle safety standards.

Driver License and ID Card Services

In addition to vehicle-related services, the Tax Collector’s Office is also responsible for issuing driver licenses and ID cards. This service is vital for the personal identification and mobility of residents, allowing them to drive legally and access various services and opportunities.

The office provides a seamless process for license and ID card applications, renewals, and replacements. They also offer road tests for those applying for their first driver license, ensuring that new drivers meet the state's requirements for safe driving.

Other Tax-Related Services

Beyond the aforementioned services, the Tax Collector’s Office provides a range of other tax-related assistance. This includes offering information and resources on tax exemptions, discounts, and credits, helping residents and businesses save on their tax obligations.

They also assist with the collection of various other taxes, such as the Local Business Tax, which is levied on businesses operating within the city limits. By providing clear guidelines and efficient collection methods, the office ensures that businesses comply with their tax obligations, contributing to the financial health of the city.

Future Directions and Innovations

As the city of Port St. Lucie continues to grow and evolve, so too must the services provided by the Tax Collector’s Office. The office is committed to staying at the forefront of innovation and technological advancements to better serve the community.

Digital Transformation and Online Services

One of the key areas of focus for the Tax Collector’s Office is the expansion of their online services. They aim to provide a user-friendly, secure, and efficient online platform for residents and businesses to access a wide range of services, from tax payments to vehicle registration renewals.

By investing in digital transformation, the office hopes to improve the overall customer experience, reduce wait times, and increase accessibility. This is particularly beneficial for those with busy schedules or limited mobility, as they can conduct their tax-related business from the comfort of their homes.

Community Outreach and Education

The Tax Collector’s Office recognizes the importance of community engagement and education in ensuring the success of their services. They plan to continue and expand their outreach initiatives, providing valuable resources and information to the public.

This includes hosting workshops and seminars on various tax-related topics, such as understanding property tax assessments, navigating the vehicle registration process, and maximizing tax savings. By empowering residents with knowledge, the office aims to build a more informed and engaged community.

Sustainable and Green Initiatives

In line with the city’s commitment to sustainability, the Tax Collector’s Office is exploring ways to reduce their environmental footprint. This includes implementing paperless processes where possible, encouraging digital transactions, and adopting energy-efficient practices in their operations.

By embracing sustainable practices, the office aims to contribute to the city's environmental goals while also reducing operational costs and increasing efficiency. This commitment to sustainability is not just beneficial for the environment but also demonstrates the office's dedication to responsible governance.

Conclusion: A Commitment to Excellence

The Port St. Lucie Tax Collector’s Office is a pillar of the community, dedicated to providing exceptional service and contributing to the city’s prosperity. Through their diverse range of services, from tax collection to vehicle registration and driver licensing, they play a crucial role in the daily lives of residents and the overall well-being of the city.

With a commitment to innovation, community engagement, and sustainability, the office is well-positioned to meet the evolving needs of Port St. Lucie. Their dedication to excellence ensures that they will continue to provide efficient, effective, and friendly services to the community for years to come.

What are the office hours for the Port St. Lucie Tax Collector’s Office?

+The Tax Collector’s Office is open Monday to Friday from 8:30 AM to 4:30 PM, excluding public holidays. For specific service hours and availability, it’s recommended to check their official website or contact their customer service.

How can I pay my property taxes in Port St. Lucie?

+There are several convenient ways to pay your property taxes. You can pay online through the Tax Collector’s secure payment portal, by mail, or in person at the Tax Collector’s Office. They also offer a convenient drop box for after-hours payments.

What documents do I need to register my vehicle in Port St. Lucie?

+To register your vehicle, you’ll need a valid title, proof of insurance, and a completed Vehicle Registration Application (HSMV 82041). If you’re a new resident to Florida, you’ll also need to provide proof of residency. For more details, it’s recommended to visit the Tax Collector’s website or contact their office.