Wisconsin Tax Returns

Welcome to a comprehensive guide on Wisconsin tax returns, designed to provide an expert-level understanding of the state's tax system. This article will delve into the intricacies of Wisconsin's tax laws, offering valuable insights and practical information for both residents and businesses navigating the state's tax landscape. By the end of this guide, you'll have a clear understanding of Wisconsin's tax obligations, strategies for efficient compliance, and the potential opportunities for tax savings.

Understanding Wisconsin’s Tax System

Wisconsin, known for its diverse economy and vibrant communities, has a comprehensive tax system that encompasses a range of taxes, including income tax, sales and use tax, property tax, and various other levies. This section will provide an overview of Wisconsin’s tax structure, shedding light on the types of taxes imposed, their rates, and how they impact individuals and businesses.

The state's income tax system is progressive, with rates ranging from 3.54% to 7.65% for individuals and 4.85% for businesses. Sales tax, on the other hand, stands at a standard rate of 5%, with certain items like groceries and prescription drugs being exempt. Additionally, Wisconsin imposes a property tax, which is primarily administered by local governments, and a variety of other taxes such as franchise taxes, estate taxes, and excise taxes on specific goods and services.

Key Tax Rates and Brackets

Wisconsin’s income tax brackets are designed to ensure a fair distribution of tax obligations across different income levels. For the 2023 tax year, the state’s income tax brackets are as follows:

| Tax Rate | Single Filers | Married Filing Jointly |

|---|---|---|

| 3.54% | Up to $12,300 | Up to $16,400 |

| 4.33% | $12,301 - $25,000 | $16,401 - $35,000 |

| 5.56% | $25,001 - $85,000 | $35,001 - $120,000 |

| 6.27% | $85,001 - $135,000 | $120,001 - $185,000 |

| 6.9% | $135,001 - $250,000 | $185,001 - $325,000 |

| 7.65% | Over $250,000 | Over $325,000 |

It's important to note that these rates and brackets are subject to periodic adjustments to maintain their effectiveness and fairness. Additionally, Wisconsin offers various tax credits and deductions, such as the Homestead Credit and the Earned Income Tax Credit, which can reduce the tax burden for eligible taxpayers.

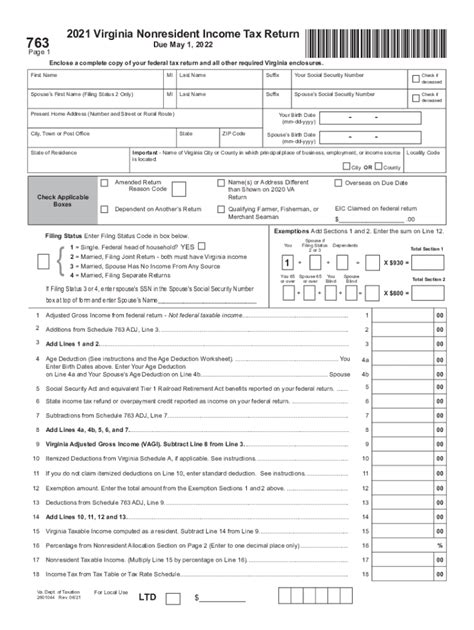

Filing Wisconsin Tax Returns

Filing tax returns in Wisconsin involves a systematic process, ensuring compliance with state regulations. This section will guide you through the essential steps, providing a clear roadmap for individuals and businesses to navigate the filing process efficiently.

Gathering Necessary Documents

The first step in preparing your Wisconsin tax return is gathering all the relevant documents. This includes:

- W-2 forms from all employers

- 1099 forms for any income, including interest, dividends, and retirement distributions

- Records of deductions, such as charitable contributions, medical expenses, and mortgage interest

- Records of any income from self-employment or business activities

- Proof of any credits or deductions claimed, such as the Homestead Credit or Earned Income Tax Credit

Organizing these documents is crucial to ensure an accurate and complete tax return.

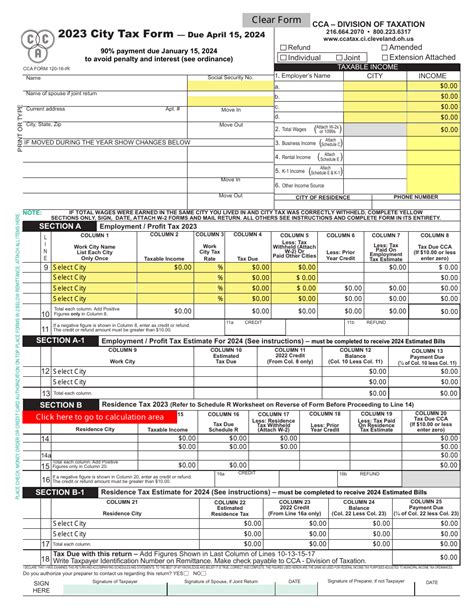

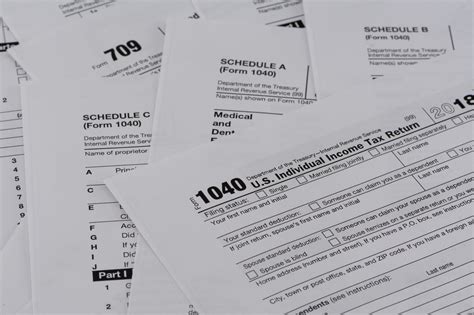

Selecting the Right Form

Wisconsin offers several tax forms, each tailored to specific situations. The most common forms include:

- Form 1 - Individual Income Tax Return: For most individuals, this form is used to report income, deductions, and credits.

- Form 1065 - Wisconsin Partnership Return: Partnerships use this form to report business income and losses.

- Form 1120 - Wisconsin Corporate Income Tax Return: Corporations use this form to report their income and expenses.

- Form 1040 - Wisconsin Fiduciary Income Tax Return: Used by estates and trusts to report income and deductions.

Choosing the correct form is essential to ensure compliance and avoid penalties.

Preparing and Filing the Return

Once you have gathered your documents and selected the appropriate form, it’s time to prepare your tax return. This process involves entering your income, deductions, and credits into the form, calculating your tax liability, and ensuring all information is accurate and complete.

Wisconsin offers several options for filing tax returns, including:

- Online Filing: The Wisconsin Department of Revenue provides an online filing system, making it convenient and efficient to submit your return electronically.

- Paper Filing: For those who prefer traditional methods, Wisconsin accepts paper tax returns, which can be mailed to the Department of Revenue.

- Tax Preparers: Engaging the services of a tax professional can ensure a thorough and accurate filing, especially for complex tax situations.

Tax Strategies and Savings

Navigating Wisconsin’s tax system presents opportunities for strategic planning and potential savings. This section will explore various strategies and considerations to help taxpayers optimize their tax positions and reduce their overall tax burden.

Maximizing Deductions and Credits

Wisconsin offers a range of deductions and credits that can significantly reduce your tax liability. Some of the key deductions and credits to consider include:

- Homestead Credit: This credit provides a refund or reduction in property taxes for eligible homeowners and renters.

- Earned Income Tax Credit: A refundable tax credit for low- to moderate-income workers, helping to offset the burden of social security and Medicare taxes.

- Property Tax Deduction: Wisconsin allows taxpayers to deduct a portion of their property taxes from their state income tax.

- Education Credits and Deductions: Wisconsin offers various credits and deductions for education-related expenses, such as the American Opportunity Tax Credit and the Lifetime Learning Credit.

Understanding and utilizing these deductions and credits can lead to substantial tax savings.

Strategic Business Tax Planning

For businesses operating in Wisconsin, strategic tax planning can yield significant benefits. Here are some key considerations:

- Tax Incentives: Wisconsin offers various tax incentives for businesses, including tax credits for research and development, job creation, and investments in renewable energy. Understanding these incentives can lead to substantial savings.

- Entity Choice: Choosing the right business entity can impact tax obligations. For instance, LLCs and S-corporations offer pass-through taxation, which can reduce the overall tax burden.

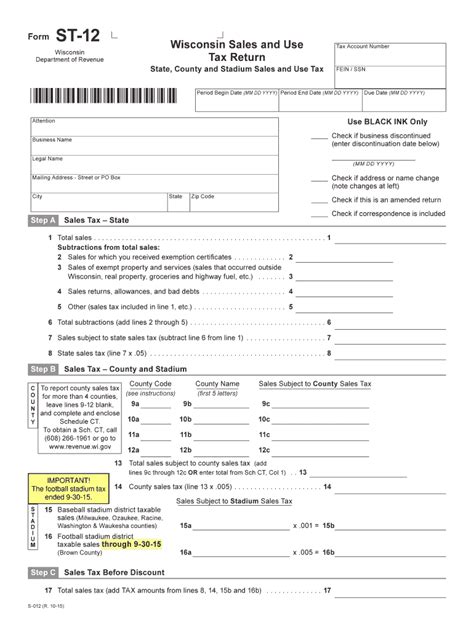

- Sales and Use Tax: Properly understanding and managing sales and use tax obligations can help businesses avoid penalties and maximize their tax savings.

Navigating Tax Challenges

While Wisconsin’s tax system is designed to be fair and efficient, taxpayers may encounter challenges and complexities. This section will address common tax issues and provide guidance on resolving them effectively.

Addressing Audit Concerns

Tax audits can be a source of concern for taxpayers. However, understanding the audit process and being prepared can help alleviate anxiety and ensure a smooth resolution. Here are some key points to consider:

- Audit Selection: Audits are typically selected based on risk factors, such as high deductions, complex tax situations, or inconsistencies in reporting.

- Preparing for an Audit: Gather all relevant documentation and be prepared to provide detailed explanations for any deductions or credits claimed. Having a clear understanding of your tax return can help you address any auditor queries effectively.

- Representing Yourself or Engaging a Professional: While you can represent yourself during an audit, engaging a tax professional can provide valuable expertise and support.

Resolving Tax Disputes

Tax disputes can arise for various reasons, including disagreements over tax liability, penalties, or the application of tax laws. Here’s how to navigate these situations:

- Understanding the Dispute: Clearly identify the issue and understand the reasons behind the dispute. This can help you develop a strategic approach to resolving the matter.

- Communication: Maintain open and honest communication with the taxing authority. Explain your position clearly and provide supporting documentation to strengthen your case.

- Negotiation: In some cases, negotiation can lead to a mutually acceptable resolution. Be prepared to offer reasonable alternatives or concessions to reach an agreement.

Managing Tax Penalties and Interest

Failing to comply with Wisconsin’s tax laws can result in penalties and interest. Here’s how to handle these situations:

- Understanding the Penalty: Penalties can vary based on the nature of the violation, such as late filing, underpayment of taxes, or negligence. Understanding the specific penalty can help you address the issue effectively.

- Requesting Penalty Abatement: In certain circumstances, penalties can be reduced or waived. Provide a detailed explanation and supporting documentation to make a strong case for penalty abatement.

- Payment Plans: If you're unable to pay the full amount owed, Wisconsin offers payment plans to help taxpayers manage their tax liabilities over time.

The Future of Wisconsin’s Tax System

As Wisconsin’s economy and tax landscape continue to evolve, so too will the state’s tax system. This section will explore potential future developments and their implications for taxpayers.

Tax Reform and Modernization

Wisconsin, like many states, is considering tax reform initiatives to simplify the tax system, improve fairness, and boost economic growth. Potential reforms may include:

- Flattening Income Tax Rates: Simplifying the tax structure by reducing the number of tax brackets and lowering rates can make the system more transparent and easier to navigate.

- Expanding Tax Credits: Increasing the availability and value of tax credits, especially for low- and middle-income taxpayers, can provide much-needed relief and boost economic activity.

- Streamlining Tax Administration: Implementing digital technologies and modernizing tax administration processes can enhance efficiency, reduce compliance burdens, and improve taxpayer experiences.

Impact on Taxpayers

Tax reform efforts in Wisconsin can have both positive and negative impacts on taxpayers. Here are some potential outcomes:

- Lower Tax Burdens: Simplifying the tax system and expanding tax credits can reduce the overall tax burden for many taxpayers, providing financial relief and boosting disposable income.

- Enhanced Economic Growth: Reform efforts focused on business tax incentives and simplification can attract new businesses and investment, creating jobs and stimulating economic growth.

- Increased Compliance: Modernizing tax administration processes can make it easier for taxpayers to comply with tax laws, reducing the risk of errors and penalties.

Conclusion

Wisconsin’s tax system, while comprehensive and complex, offers a range of opportunities for taxpayers to optimize their tax positions and navigate the state’s economic landscape successfully. By understanding the tax laws, utilizing strategic planning, and staying informed about potential reforms, taxpayers can ensure compliance, maximize savings, and contribute to Wisconsin’s vibrant economy.

This guide has provided an in-depth look at Wisconsin's tax system, offering valuable insights and practical guidance. For more information and expert assistance, be sure to consult tax professionals and stay updated with the latest developments in Wisconsin's tax landscape.

What is the deadline for filing Wisconsin tax returns?

+The deadline for filing Wisconsin tax returns is typically aligned with the federal tax deadline, which is typically April 15th. However, it’s important to note that this deadline may be extended in certain circumstances, such as during tax law changes or natural disasters.

Are there any online resources for filing Wisconsin tax returns?

+Yes, Wisconsin offers an online filing system called e-file, which is a convenient and secure way to file your tax return electronically. This system is available through the Wisconsin Department of Revenue’s website.

Can I file an amended Wisconsin tax return if I made a mistake?

+Absolutely! If you discover an error or need to make changes to a previously filed tax return, you can file an amended return using Form 1X - Amended Individual Income Tax Return. This form allows you to correct any mistakes and adjust your tax liability accordingly.

Are there any tax preparation services available in Wisconsin?

+Yes, Wisconsin has a network of tax professionals and tax preparation services that can assist individuals and businesses with their tax obligations. These professionals can provide guidance, prepare tax returns, and offer strategic tax planning advice.

How can I stay updated with Wisconsin’s tax laws and changes?

+Staying informed is crucial for effective tax planning. The Wisconsin Department of Revenue provides a wealth of resources, including tax publications, updates on tax laws and regulations, and news releases. Additionally, subscribing to tax newsletters or following reputable tax blogs can keep you informed about the latest developments.