Cleveland Tax

In the realm of financial planning and tax management, navigating the complex landscape of tax regulations can be a daunting task for individuals and businesses alike. This is especially true when it comes to understanding the unique tax environment of specific regions, such as the city of Cleveland, Ohio. With its rich history, diverse economy, and ever-evolving tax policies, Cleveland presents a multifaceted challenge for taxpayers seeking to optimize their financial strategies. This comprehensive guide aims to demystify the world of Cleveland Tax, offering an in-depth analysis of its intricacies and providing valuable insights for effective tax planning.

Understanding Cleveland’s Tax Landscape

Cleveland, known for its vibrant cultural scene and thriving industries, has a tax system that reflects its economic diversity. The city’s tax structure is a blend of federal, state, and local regulations, each with its own set of rules and exemptions. This complexity requires a nuanced understanding to ensure compliance and optimize financial outcomes.

Federal and State Tax Obligations

At the federal level, Cleveland residents and businesses adhere to the Internal Revenue Code (IRC), which sets forth comprehensive guidelines for income, employment, and excise taxes. The IRC, along with the associated tax forms and regulations, forms the backbone of the U.S. tax system. However, the state of Ohio adds its own layer of complexity with unique tax laws and rates.

Ohio’s tax system includes a progressive income tax structure, with rates ranging from 0.477% to 4.797% based on taxable income. Additionally, Ohio levies a Commercial Activity Tax (CAT) on businesses with a taxable gross receipts threshold of $150,000. These state-level taxes significantly impact the financial strategies of Cleveland taxpayers.

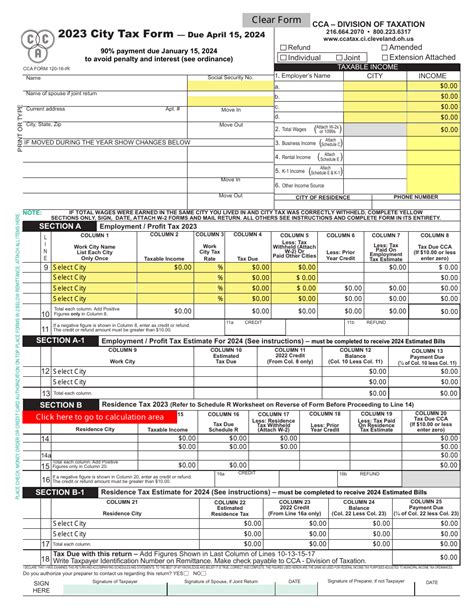

Local Tax Considerations

Within Cleveland’s city limits, taxpayers encounter further nuances. The city imposes its own income tax, with a rate of 2% on wages, salaries, and other compensation earned within the city. This tax applies to both residents and non-residents working in Cleveland. Additionally, Cleveland’s tax code includes provisions for various deductions and credits, which can significantly reduce tax liabilities for eligible taxpayers.

| Tax Type | Rate |

|---|---|

| Cleveland Income Tax | 2% |

| Ohio Income Tax (Progressive) | 0.477% - 4.797% |

| Ohio Commercial Activity Tax (CAT) | Varies based on gross receipts |

Tax Exemptions and Incentives

Navigating the tax landscape of Cleveland is not just about understanding the rates and regulations; it’s also about identifying opportunities for tax savings. Cleveland, like many other cities, offers a range of tax exemptions and incentives aimed at stimulating economic growth and supporting its residents.

For instance, Cleveland's tax code includes provisions for homestead exemptions, which reduce property taxes for eligible homeowners. This exemption can provide significant savings for long-term residents. Additionally, the city offers tax credits for various initiatives, such as energy-efficient home improvements and job creation.

Tax Planning Strategies

Effective tax planning in Cleveland requires a strategic approach. Taxpayers can benefit from analyzing their income sources, deductions, and credits to minimize their overall tax burden. For instance, understanding the city’s earned income tax credit and personal exemptions can significantly reduce tax liabilities for eligible individuals.

Furthermore, businesses operating in Cleveland can explore tax incentives for research and development, job creation, and capital investments. These incentives, often offered at the state and local levels, can provide substantial savings and support the growth of local businesses.

The Role of Tax Professionals

Given the complexity of Cleveland’s tax system, the role of tax professionals cannot be overstated. Tax advisors, accountants, and attorneys play a crucial role in guiding taxpayers through the intricate web of tax laws and regulations.

Tax Preparation and Compliance

Tax professionals are well-versed in the intricacies of Cleveland’s tax code, ensuring that taxpayers meet their compliance obligations. They assist with tax return preparation, identifying relevant deductions and credits, and ensuring accurate reporting of income and expenses. This expertise is particularly valuable for individuals and businesses with complex financial structures.

Tax Planning and Strategy

Beyond compliance, tax professionals are essential for strategic tax planning. They can analyze a taxpayer’s unique financial situation and provide tailored advice to optimize tax outcomes. This may involve structuring business transactions to maximize tax savings, advising on investment strategies, or guiding individuals through the complexities of estate planning and inheritance taxes.

Staying Informed on Tax Updates

The tax landscape is dynamic, with frequent updates and changes in regulations. Tax professionals are dedicated to staying abreast of these changes, ensuring that their clients are aware of any new tax laws, incentives, or exemptions that may impact their financial strategies. This proactive approach is crucial for avoiding penalties and ensuring compliance with the latest tax requirements.

Case Study: Effective Tax Planning in Cleveland

Consider the case of a small business owner, Ms. Taylor, who recently relocated her company to Cleveland. Ms. Taylor, a savvy entrepreneur, sought the guidance of a local tax professional to navigate the city’s tax environment.

With the help of her tax advisor, Ms. Taylor was able to identify several tax incentives available to her business. She qualified for a research and development tax credit, which provided a significant refund on her tax liabilities. Additionally, by restructuring her business entity, she was able to take advantage of pass-through taxation, reducing her personal tax burden.

Furthermore, Ms. Taylor's tax advisor guided her through the complexities of Cleveland's income tax. By understanding the city's residency rules and commuting exemptions, Ms. Taylor was able to optimize her tax payments and avoid unnecessary liabilities. This comprehensive approach to tax planning not only saved Ms. Taylor money but also provided her with peace of mind, knowing she was in compliance with all relevant tax laws.

Future Outlook and Tax Trends

As Cleveland continues to evolve and grow, its tax landscape is likely to see further changes and developments. Staying informed about these shifts is crucial for effective tax planning.

Potential Tax Reform

At the federal level, there is ongoing discussion about tax reform, which could impact Cleveland taxpayers. Proposed changes include revisions to tax brackets, adjustments to the standard deduction, and potential alterations to the tax treatment of pass-through entities. These reforms, if implemented, would have a significant impact on the financial strategies of Cleveland residents and businesses.

Local Tax Initiatives

Cleveland’s local government is also active in exploring tax initiatives to support economic development and community growth. For instance, there have been proposals for tax increment financing (TIF) districts, which would redirect tax revenues to fund specific development projects. Additionally, the city may explore new tax incentives to attract businesses and stimulate job growth.

Digital Tax Initiatives

With the increasing digital transformation of tax systems, Cleveland is likely to adopt more advanced technologies for tax administration. This includes the use of digital platforms for tax filing, payment, and compliance, as well as the exploration of blockchain and cryptocurrency tax regulations.

Environmental Tax Policies

Cleveland, like many cities, is also focused on sustainable development and environmental initiatives. This may lead to the implementation of green taxes or incentives for businesses and individuals adopting eco-friendly practices. These policies could provide opportunities for tax savings while promoting environmental stewardship.

Conclusion

Navigating the world of Cleveland Tax is a complex yet rewarding endeavor. With a deep understanding of the city’s tax landscape, taxpayers can optimize their financial strategies, minimize their tax liabilities, and contribute to the vibrant economic ecosystem of Cleveland. Whether it’s through strategic tax planning, leveraging available incentives, or staying informed about emerging tax trends, the key to success lies in proactive financial management.

As Cleveland continues to evolve, its tax system will remain a dynamic and integral part of the city's economic fabric. By staying informed and seeking expert guidance, taxpayers can ensure they are making the most of their financial opportunities while remaining compliant with the ever-changing tax regulations.

What are the key tax rates and regulations in Cleveland, Ohio?

+

Cleveland, Ohio, has a diverse tax landscape. At the city level, there’s a 2% income tax on wages earned within the city limits. Ohio’s state income tax is progressive, ranging from 0.477% to 4.797%. Additionally, Ohio levies a Commercial Activity Tax (CAT) on businesses with a threshold of $150,000 in gross receipts. These rates and regulations can impact tax planning strategies for individuals and businesses.

Are there any tax incentives or exemptions available in Cleveland?

+

Yes, Cleveland offers various tax incentives and exemptions. For instance, there are homestead exemptions for property taxes, tax credits for energy-efficient home improvements, and incentives for businesses engaging in research and development, job creation, and capital investments. These incentives can significantly reduce tax liabilities for eligible taxpayers.

How can I optimize my tax strategy in Cleveland?

+

Effective tax planning in Cleveland involves understanding your income sources, deductions, and credits. It’s beneficial to analyze your specific financial situation and explore opportunities for tax savings. This may include taking advantage of available tax incentives, optimizing business transactions, and seeking guidance from tax professionals who can provide tailored advice.

What role do tax professionals play in navigating Cleveland’s tax landscape?

+

Tax professionals are crucial for ensuring compliance and optimizing tax outcomes. They assist with tax preparation, identifying relevant deductions and credits, and providing strategic tax planning advice. With their expertise in Cleveland’s tax code, they can guide individuals and businesses through the complexities of tax regulations and help maximize financial opportunities.

What are some potential future tax trends in Cleveland?

+

Cleveland’s tax landscape is likely to see changes and developments in the future. Potential trends include tax reform at the federal level, local initiatives like tax increment financing (TIF) districts, the adoption of digital tax platforms, and the implementation of green taxes or incentives. Staying informed about these trends is essential for proactive tax planning.