Washoe County Tax

Welcome to a comprehensive guide on the ins and outs of Washoe County taxes. In this article, we will delve into the world of tax obligations and regulations specific to Washoe County, Nevada. Whether you're a resident, a business owner, or simply curious about the tax landscape in this vibrant county, we've got you covered. Get ready to explore the intricacies of tax laws, understand your responsibilities, and navigate the tax system with confidence.

Understanding the Basics: Washoe County Tax Landscape

Washoe County, nestled in the heart of Nevada, boasts a diverse and thriving economy. From the bustling streets of Reno to the picturesque communities in the surrounding areas, this county is a hub of economic activity. As such, understanding the tax structure and requirements is essential for individuals and businesses alike.

The tax landscape in Washoe County is shaped by a combination of federal, state, and local regulations. While the federal government sets the overarching tax framework, Nevada, and subsequently Washoe County, have their own unique tax policies and rates. This interplay of different tax jurisdictions creates a complex yet fascinating system that we will unravel throughout this article.

Key Tax Types in Washoe County

To provide a comprehensive overview, let’s break down the primary tax types applicable in Washoe County:

- Property Tax: One of the most significant tax obligations for Washoe County residents and businesses is property tax. This tax is levied on real estate properties, including residential homes, commercial buildings, and land. The assessment and collection of property taxes are vital for funding local services and infrastructure.

- Sales and Use Tax: Washoe County, like many other counties in Nevada, imposes a sales tax on retail transactions. This tax is added to the purchase price of goods and services and is collected by businesses, which then remit the tax to the county. Additionally, there are specific regulations regarding the use tax, which applies to certain transactions conducted outside of the traditional retail setting.

- Income Tax: While Nevada is known for its lack of a state income tax, Washoe County still plays a role in income tax obligations. Residents and businesses with Nevada-sourced income may have federal and state income tax liabilities. It's important to understand the residency requirements and reporting obligations associated with income tax.

- Business Taxes: For businesses operating in Washoe County, there are various tax obligations to consider. These may include business license fees, occupational taxes, and gross receipts taxes. The specific requirements can vary based on the nature of the business and its operations.

- Special Taxes and Assessments: Washoe County, like many counties, may impose additional taxes or assessments to fund specific projects or services. These can include transportation taxes, tourism taxes, or even special district assessments. Understanding these special taxes is crucial for businesses and residents alike.

By familiarizing ourselves with these key tax types, we can begin to navigate the complex web of tax obligations in Washoe County. In the following sections, we will delve deeper into each of these tax categories, providing practical insights, real-world examples, and expert advice to help you stay compliant and make informed tax decisions.

Property Tax: Navigating the Assessment and Payment Process

Property tax is a cornerstone of the tax system in Washoe County, and understanding its intricacies is essential for homeowners, landlords, and business owners alike. This section will guide you through the property tax journey, from assessment to payment, ensuring you’re equipped with the knowledge to navigate this crucial tax obligation.

The Assessment Process: How Property Values are Determined

The property tax assessment process is a critical component of the tax system. In Washoe County, the Assessor’s Office is responsible for determining the assessed value of each property. This value serves as the basis for calculating property tax liabilities.

The assessment process typically involves the following steps:

- Data Collection: The Assessor's Office gathers information about properties, including their physical characteristics, such as square footage, number of rooms, and amenities. This data is crucial for determining the property's value.

- Market Analysis: Assessors conduct thorough research on the local real estate market. They analyze recent sales of similar properties to establish a fair market value for each property in the county.

- Assessment Calculation: Using the collected data and market analysis, assessors calculate the assessed value of each property. This value is typically a percentage of the fair market value, as determined by state and local regulations.

- Notice of Assessment: Once the assessment is complete, property owners receive a Notice of Assessment. This document outlines the assessed value of their property and provides information on how to appeal if the owner believes the assessment is inaccurate.

It's important for property owners to review their assessment carefully and understand the factors that contribute to their property's value. This awareness can help identify potential errors or discrepancies, ensuring fair and accurate assessments.

Understanding Tax Rates and Calculations

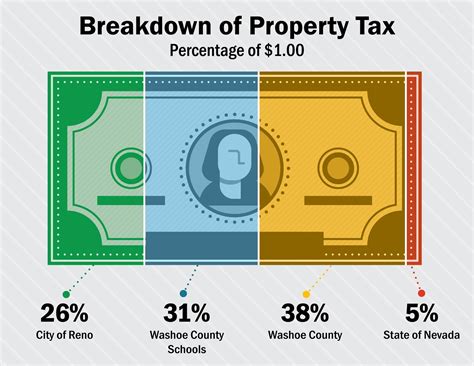

Once the assessed value of a property is determined, the tax rate comes into play. Tax rates in Washoe County are established by various taxing authorities, including the county itself, school districts, and special districts.

The tax rate is expressed as a percentage and is applied to the assessed value of the property. For example, if a property has an assessed value of $200,000 and the tax rate is 2%, the annual property tax liability would be $4,000. This calculation is straightforward but can vary based on the specific tax rates set by different taxing authorities.

| Taxing Authority | Tax Rate |

|---|---|

| Washoe County | 1.5% |

| School District | 1.2% |

| Special District (e.g., Fire Protection) | 0.3% |

In the above example, the total tax rate would be the sum of these individual rates, resulting in an effective tax rate of 2.5% for this property.

Payment Options and Deadlines

Property tax payments in Washoe County are typically due twice a year, with specific deadlines set by the county. Property owners receive a tax bill outlining the amount due and the payment deadlines. It’s crucial to make timely payments to avoid penalties and interest.

Washoe County offers various payment options, including online payment portals, mail-in payments, and in-person payments at designated locations. Property owners can choose the method that best suits their preferences and convenience.

Staying informed about payment deadlines and taking advantage of early payment discounts, if available, can help property owners manage their tax obligations effectively. Additionally, understanding the consequences of late payments, such as penalties and potential liens, is essential for maintaining good financial standing.

Sales and Use Tax: A Guide to Compliance

Sales and use tax is a critical component of the tax system in Washoe County, impacting both businesses and consumers. In this section, we will explore the ins and outs of sales and use tax, providing a comprehensive guide to help businesses and individuals navigate their tax obligations and ensure compliance.

Understanding Sales Tax: A Business Perspective

Sales tax is a transaction-based tax imposed on the sale of goods and certain services. In Washoe County, businesses play a vital role in collecting and remitting sales tax to the county. Understanding the sales tax obligations is crucial for businesses to maintain compliance and avoid penalties.

Key considerations for businesses include:

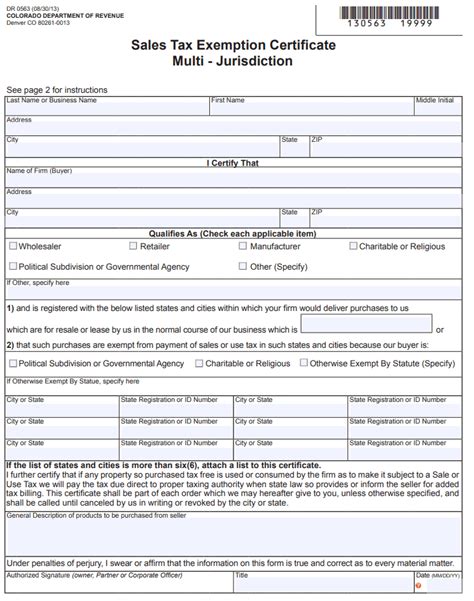

- Registration and Permits: Businesses operating in Washoe County must obtain the necessary permits and register with the county to collect and remit sales tax. This process ensures that businesses are officially recognized and compliant with tax regulations.

- Sales Tax Rate: The sales tax rate in Washoe County is determined by the county and may vary based on the location of the business and the type of goods or services being sold. It's essential for businesses to understand the applicable sales tax rate and apply it accurately to their transactions.

- Taxable Transactions: Not all transactions are subject to sales tax. Businesses must understand which goods and services are taxable and which are exempt. This knowledge helps businesses accurately calculate and collect sales tax, ensuring compliance.

- Record-Keeping: Proper record-keeping is vital for sales tax compliance. Businesses should maintain accurate records of taxable transactions, including sales receipts, invoices, and other relevant documents. These records serve as evidence of compliance and can be crucial during audits.

- Remittance Process: Sales tax collected by businesses must be remitted to the county within specified deadlines. The remittance process typically involves filing sales tax returns and paying the calculated tax amount. Businesses should stay informed about the deadlines and ensure timely remittance to avoid penalties.

Use Tax: The Consumer Perspective

While sales tax is primarily a business obligation, consumers also play a role in the sales and use tax system. Use tax applies to certain transactions where sales tax was not collected at the point of sale, such as online purchases or out-of-state purchases brought into Washoe County.

Key considerations for consumers include:

- Understanding Use Tax: Consumers should be aware of their use tax obligations when purchasing goods or services that are not subject to sales tax at the time of purchase. Use tax is often self-assessed and must be paid directly to the county.

- Self-Assessment: Consumers are responsible for calculating and remitting use tax on applicable transactions. This process typically involves filing a use tax return and paying the calculated tax amount. Staying informed about use tax regulations and deadlines is crucial for compliance.

- Exemptions and Discounts: Certain purchases may be exempt from use tax, such as certain types of food, prescription drugs, or educational materials. Consumers should understand these exemptions and take advantage of any available discounts or credits.

Compliance and Enforcement

Both businesses and consumers have a responsibility to comply with sales and use tax regulations. The Washoe County tax authorities have systems in place to enforce compliance and ensure fair tax collection.

Businesses should be aware of potential audits and the importance of maintaining accurate records. During an audit, tax authorities may review sales records, tax returns, and other documents to verify compliance. Non-compliance can result in penalties, interest, and even legal consequences.

Consumers, on the other hand, should understand that use tax is a self-assessed obligation. Failure to pay use tax on applicable transactions can lead to penalties and interest. It's essential for consumers to stay informed and take responsibility for their tax obligations.

Income Tax: Navigating Residency and Reporting

Income tax is a complex topic, especially when it comes to understanding residency requirements and reporting obligations. In Washoe County, the interplay of federal, state, and local tax laws creates a unique landscape for income tax. This section will guide you through the key considerations and help you navigate your income tax responsibilities.

Residency and Tax Obligations

Determining residency is a critical step in understanding your income tax obligations. In Washoe County, residency is typically established based on the number of days spent in the county and the intention to make it your primary residence. This determination is crucial because it dictates whether you are considered a resident for tax purposes.

For residents of Washoe County, income tax obligations may include:

- Federal Income Tax: As a resident, you are subject to federal income tax on your worldwide income. This includes wages, salaries, investments, and other forms of income. The Internal Revenue Service (IRS) sets the guidelines and rates for federal income tax.

- State Income Tax: While Nevada does not have a state income tax, Washoe County residents may still have state tax obligations if they have income sourced from other states. It's important to understand the tax laws of those states and report income accordingly.

- Local Income Tax: Washoe County, like many counties, may have its own local income tax. This tax is typically levied on residents' income and is used to fund local services and initiatives. Understanding the local income tax rate and filing requirements is essential for compliance.

Reporting and Filing Requirements

Once you have determined your residency status and income tax obligations, the next step is understanding the reporting and filing requirements. This process involves:

- Federal Tax Returns: As a resident, you are required to file a federal tax return each year. The IRS provides guidelines and forms for reporting your income, deductions, and credits. It's crucial to meet the filing deadlines and ensure accurate reporting to avoid penalties.

- State and Local Tax Returns: Depending on your residency and income sources, you may need to file state and local tax returns. These returns are typically separate from federal tax returns and have their own filing deadlines and requirements. Staying informed about these obligations is essential for compliance.

- Record-Keeping: Proper record-keeping is vital for income tax compliance. This includes maintaining records of income, expenses, deductions, and any other relevant financial information. These records serve as evidence during tax audits and can help support your tax position.

Tax Planning and Strategies

Income tax planning is an essential aspect of financial management. By understanding your income tax obligations and exploring tax-efficient strategies, you can optimize your tax position and potentially reduce your tax liability.

Key considerations for tax planning include:

- Deductions and Credits: Explore the available deductions and credits that may apply to your situation. These can include deductions for mortgage interest, charitable contributions, and certain expenses. Understanding these deductions can help reduce your taxable income and lower your tax liability.

- Retirement Planning: Contributions to retirement accounts, such as 401(k)s or IRAs, can provide tax benefits. By maximizing your contributions within the allowed limits, you can reduce your taxable income and potentially enjoy tax-deferred or tax-free growth on your retirement savings.

- Business Tax Strategies: If you own a business, there are various tax strategies to consider. These may include optimizing business deductions, utilizing tax-efficient business structures, and exploring tax incentives for business investments.

Business Taxes: A Comprehensive Overview

For businesses operating in Washoe County, understanding the various tax obligations is crucial for financial success and compliance. In this section, we will provide a comprehensive overview of the business taxes that apply in Washoe County, offering practical insights and expert guidance to help businesses navigate their tax responsibilities.

Business License Fees and Permits

One of the first steps for businesses in Washoe County is obtaining the necessary licenses and permits. These requirements ensure that businesses operate within the legal framework and comply with local regulations.

Key considerations include:

- Business License: Most businesses in Washoe County are required to obtain a business license. This license serves as official recognition of the business and its operations. The process typically involves submitting an application, paying a fee, and complying with any additional requirements set by the county.

- Occupational Licenses: Depending on the nature of the business, certain occupations may require specific licenses or permits. For example, professions like cosmetology, plumbing, or electrical work often have licensing requirements. It's essential for businesses to understand these occupational license requirements and obtain the necessary permits.

- Zoning and Land Use Permits: Businesses operating in specific locations or engaging in certain activities may require zoning or land use permits. These permits ensure that the business complies with local land use regulations and planning guidelines.

Gross Receipts Taxes and Other Business Taxes

In addition to license fees and permits, businesses in Washoe County may be subject to various taxes based on their operations and revenue.

- Gross Receipts Tax: Some businesses in Washoe County may be required to pay a gross receipts tax. This tax is based on the total revenue generated by the business, regardless of profitability. It’s important for businesses to understand if they are subject to this tax and how it is calculated.

- Occupation Taxes: Certain occupations or industries may be subject to specific occupation taxes. These taxes are typically levied on businesses engaged in activities like gaming, liquor sales, or specific services. Businesses should be aware of these occupation-specific taxes and ensure compliance.

- Payroll Taxes: If a business has employees, it is responsible for withholding and remitting payroll