Amend The Tax Return

Welcome to this comprehensive guide on the often daunting task of amending a tax return. Filing taxes is a necessary part of financial life, but sometimes errors or changes in circumstances require an amendment. This article will delve into the intricacies of the process, providing expert insights and step-by-step guidance to ensure you navigate this complex terrain with confidence and precision.

Understanding the Need for Amendment

An amended tax return is a formal document used to correct errors or make changes to a previously filed tax return. This could be due to a variety of reasons, such as overlooked deductions, changes in marital status, or adjustments to income figures. It’s important to note that an amendment is not a redo of the entire return; rather, it’s a targeted correction to specific sections.

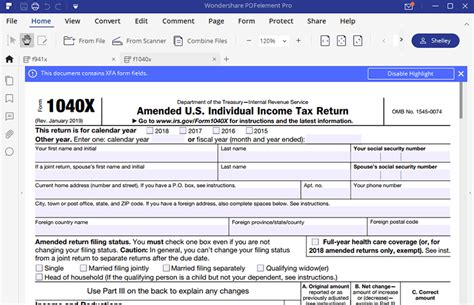

The Internal Revenue Service (IRS) allows taxpayers to file an amended return using Form 1040X, the Amended U.S. Individual Income Tax Return. This form is used to rectify mistakes made on previously filed tax returns for personal income taxes. The process involves recalculating the tax liability, interest, and any penalties that might apply due to the amendments.

Identifying Common Reasons for Amending

There are several scenarios that may warrant an amended tax return. Some of the most common reasons include:

- Overlooked deductions or credits: This could include missing out on deductions for medical expenses, educational costs, or charitable donations. It's essential to review all potential deductions and ensure none are overlooked.

- Changes in income: If you receive additional income after filing your return, such as from a side gig or a part-time job, this could impact your tax liability and may require an amendment.

- Mistakes in calculations: Simple arithmetic errors or incorrect calculations can lead to an inaccurate tax return. Double-checking your calculations and using reliable tax software can help minimize this risk.

- Dependency changes: Changes in your dependent status, such as the birth of a child or a change in custody arrangements, can impact your tax liability and may require an amendment.

- Tax law changes: If there are changes in tax laws that affect your return, you may need to amend your taxes to take advantage of new deductions or credits.

The Amending Process: A Step-by-Step Guide

Amending a tax return involves a series of precise steps to ensure accuracy and compliance. Here’s a detailed breakdown of the process:

Step 1: Identify the Error or Change

The first step is to identify the specific error or change that necessitates an amendment. This could be as simple as realizing you forgot to include a deduction or as complex as discovering a miscalculation that affects your entire return.

It's important to thoroughly review your original return and compare it with any relevant documents, such as pay stubs, investment statements, or receipts. This will help you pinpoint the exact area that needs correction.

Step 2: Gather Necessary Documents

Once you’ve identified the error, gather all the documents and information needed to support the amendment. This may include additional tax forms, receipts, or statements that back up the changes you’re making.

For example, if you're claiming a new deduction for medical expenses, ensure you have all the necessary receipts and documentation to support the claim. Similarly, if you're adjusting your income, gather the appropriate tax forms or statements to back up the change.

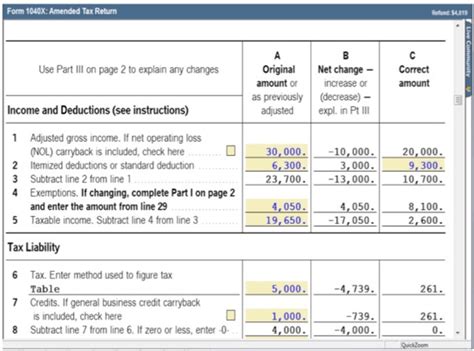

Step 3: Complete Form 1040X

The next step is to complete Form 1040X, the Amended U.S. Individual Income Tax Return. This form is specifically designed for amending previously filed tax returns.

The form consists of three columns: Column A, where you enter the original information from your previously filed return; Column B, where you enter the corrected information; and Column C, which calculates the difference between the two. This allows the IRS to easily identify the changes you're making.

Fill out the form carefully, ensuring all the information is accurate and up-to-date. If you're using tax software, many programs have the ability to guide you through the amendment process and even generate the necessary forms.

Step 4: Calculate the Adjusted Tax Liability

After completing Form 1040X, you’ll need to calculate your adjusted tax liability. This involves recomputing your tax based on the changes you’ve made.

If your amendments result in a higher tax liability, you'll need to include any additional tax due with your amended return. Conversely, if your amendments lead to a lower tax liability, you may be entitled to a refund. In this case, ensure you provide your correct banking information so the IRS can process the refund accordingly.

Step 5: Attach Supporting Documents

Once you’ve completed Form 1040X and calculated your adjusted tax liability, it’s time to attach any supporting documents. These documents should back up the changes you’ve made on the amended return.

For instance, if you're claiming additional deductions, attach the relevant receipts or statements. If you're adjusting your income, include the appropriate tax forms or pay stubs. Ensure all documents are clear and legible.

Step 6: Sign and Submit the Amended Return

The final step is to sign and submit your amended return to the IRS. This can be done either by mail or, in some cases, electronically.

If you're mailing your amended return, ensure you use the appropriate mailing address for your state and the type of return you're filing. The IRS website provides a comprehensive list of mailing addresses for different scenarios.

If you're filing electronically, you'll need to use tax software that supports amended returns. Ensure you follow the instructions provided by the software to ensure a smooth filing process.

| Tip | Stay Organized |

|---|---|

|

Keep all your tax-related documents organized and easily accessible. This will make the amendment process smoother and faster. |

Potential Challenges and Considerations

While amending a tax return is generally straightforward, there are some challenges and considerations to keep in mind:

Timeframe for Amendments

The IRS generally allows taxpayers to amend their returns within three years from the date the original return was filed or within two years from the date the tax was paid, whichever is later. However, certain scenarios, such as claims for a refund due to a carryback of a net operating loss, have different time limits.

It's important to be mindful of these time limits to ensure your amendment is accepted and processed without delays.

Interest and Penalties

If your amendment results in additional tax due, the IRS may charge interest on the unpaid amount. Additionally, if the amendment is due to negligence or intentional disregard of the tax rules, the IRS may impose penalties.

To avoid interest and penalties, it's crucial to file your amended return promptly and ensure all the information is accurate. If you're unsure about any aspect of the process, consider seeking professional advice from a tax advisor or accountant.

Complex Amendments

Some amendments can be complex, especially if they involve multiple years or significant changes in your financial situation. In such cases, it’s highly recommended to seek the assistance of a tax professional who can guide you through the process and ensure compliance with the relevant tax laws.

A tax professional can also help you identify potential deductions or credits you may have overlooked, maximizing your tax savings.

Expert Insights and Tips

Amending a tax return can be a complex and time-consuming process, but with the right approach and resources, it can be successfully navigated. Here are some expert insights and tips to make the process smoother:

Use Reliable Tax Software

Tax software can be a valuable tool when amending your return. Many reputable software programs offer features specifically designed for amending tax returns, guiding you through the process and ensuring accuracy.

These programs can help calculate your adjusted tax liability, generate the necessary forms, and provide a step-by-step guide to the amendment process.

Seek Professional Advice

If you’re unsure about any aspect of the amendment process or have a complex financial situation, it’s always best to seek the advice of a tax professional. Certified Public Accountants (CPAs) or Enrolled Agents (EAs) are licensed tax professionals who can provide expert guidance and ensure compliance with tax laws.

They can review your original return, identify potential errors or omissions, and help you navigate the amendment process with confidence.

Keep Detailed Records

Maintaining detailed records of your financial transactions and tax-related documents is crucial when amending your return. This ensures you have the necessary information to support your amendments and simplifies the process.

Organize your records in a way that makes it easy to locate specific documents when needed. This could involve using a filing system or digital storage solutions.

Stay Updated on Tax Laws

Tax laws can change frequently, so it’s important to stay updated on any relevant changes that may impact your tax situation. This includes changes in deductions, credits, or tax rates.

The IRS website and reputable tax resources provide up-to-date information on tax law changes. Staying informed can help you take advantage of new deductions or credits and ensure your amended return is compliant with the latest regulations.

Future Implications and Planning

Amending a tax return not only rectifies past errors but also provides an opportunity to improve your future tax planning. Here’s how:

Learn from Your Mistakes

Identifying and correcting errors on your tax return can be an educational experience. It allows you to learn from your mistakes and take steps to prevent similar errors in the future.

Review your amended return carefully and understand the reasons for the amendments. This knowledge can help you prepare more accurate returns in the future and maximize your tax savings.

Optimize Your Tax Strategy

Amending your return can also highlight areas where you may be missing out on deductions or credits. Use this as an opportunity to optimize your tax strategy and ensure you’re taking advantage of all the tax benefits available to you.

Review your deductions, credits, and tax withholdings to ensure they align with your financial situation. Consider seeking professional advice to develop a comprehensive tax strategy that minimizes your tax liability while remaining compliant with tax laws.

Stay Informed on Tax Changes

Tax laws are subject to change, and staying informed can help you adapt your tax planning accordingly. Keep an eye on tax law changes and updates, especially those that may impact your specific financial situation.

Subscribe to reputable tax resources or follow tax news to stay up-to-date. This proactive approach can help you make informed decisions and ensure your tax planning remains effective and compliant.

Conclusion: A Precise Approach to Amending

Amending a tax return is a precise and detailed process, but with the right knowledge and resources, it can be successfully managed. By understanding the reasons for amendment, following a step-by-step guide, and seeking expert advice when needed, you can navigate this complex terrain with confidence.

Remember, an amended tax return is not a sign of failure but an opportunity to correct errors and optimize your tax strategy. By learning from your mistakes and staying informed on tax laws, you can ensure a more accurate and beneficial tax filing experience in the future.

How long does it take for the IRS to process an amended return?

+The IRS typically takes 16 weeks to process an amended return. However, this timeframe can vary based on the complexity of the amendment and the workload of the IRS at the time of filing. It’s important to note that this processing time starts from the date the IRS receives your amended return, so ensure you submit it promptly.

Can I amend multiple years of tax returns at once?

+Yes, you can amend multiple years of tax returns simultaneously. However, you’ll need to file a separate Form 1040X for each tax year you’re amending. Ensure you use the correct form for the specific tax year you’re amending, as the forms may vary slightly from year to year.

What if I realize I made a mistake on my amended return after submitting it?

+If you discover an error on your amended return after submitting it, you’ll need to file another amended return to correct the mistake. Follow the same process as you did for the initial amendment, ensuring you correct the specific error. Remember to use the appropriate form and submit it promptly.