Taxes In New Haven Ct

Taxes are an integral part of any community's financial structure, and in New Haven, Connecticut, they play a significant role in shaping the city's economy and the lives of its residents. This comprehensive guide will delve into the intricacies of taxes in New Haven, offering an in-depth analysis of the various tax systems, their implications, and their impact on the city's development.

The Complex Web of Taxes in New Haven

New Haven, a vibrant city nestled in the heart of Connecticut, boasts a unique tax landscape that contributes to its economic vitality. The city’s tax system is a complex interplay of state, local, and federal regulations, each with its own set of rules and rates.

Understanding the Local Tax Structure

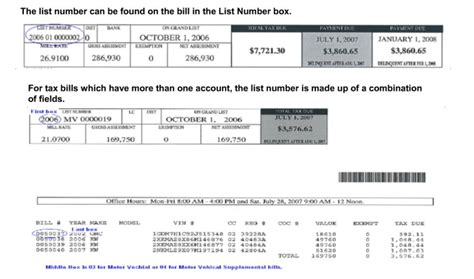

At the heart of New Haven’s tax system lies the local tax, which forms the backbone of the city’s revenue generation. The local tax is primarily composed of the property tax, a levy based on the assessed value of real estate properties within the city limits. This tax is a significant contributor to the city’s budget, funding essential services like public education, infrastructure development, and public safety.

The property tax rate in New Haven is set annually by the Board of Alders, the city's legislative body. The rate is expressed in mills, where one mill represents a tax liability of $1 for every $1,000 of assessed property value. For instance, a property assessed at $200,000 with a tax rate of 25 mills would have a tax liability of $5,000 (25 mills x $200,000/1000). The assessed value of properties is determined through a comprehensive assessment process, ensuring fairness and accuracy in tax collection.

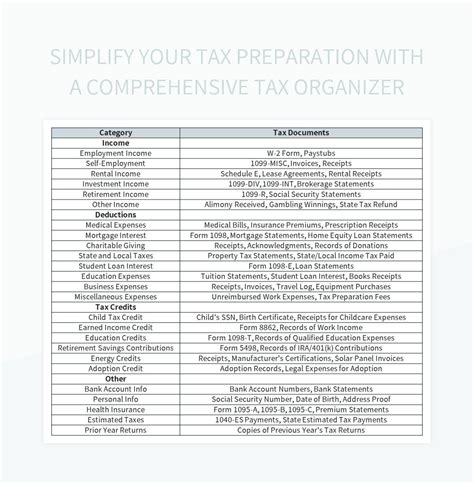

| Tax Type | Rate (in mills) |

|---|---|

| Property Tax | 25.00 |

| Sales Tax | 6.35% |

| Income Tax | Varies based on income bracket |

State and Federal Taxes: A Complex Overlay

Superimposed on the local tax structure are the state and federal taxes, each with its own set of complexities. The state of Connecticut levies an income tax, a sales tax, and various other taxes, which contribute to the state’s revenue and fund state-wide initiatives.

The Connecticut income tax is a progressive tax, meaning the tax rate increases as income rises. The state has multiple income tax brackets, ranging from 3% to 6.99%, depending on the taxable income. Residents of New Haven are required to file state income tax returns annually, and the city's income tax department plays a crucial role in ensuring compliance and collecting the appropriate taxes.

The Connecticut sales tax, on the other hand, is a flat rate tax applied to most goods and services sold within the state. The current sales tax rate is 6.35%, with certain items, such as groceries, being exempt. This tax is collected by businesses at the point of sale and remitted to the state, providing a significant portion of the state's revenue.

At the federal level, the Internal Revenue Service (IRS) administers a wide range of taxes, including the federal income tax, social security tax, and medicare tax, among others. These taxes are integral to the nation's fiscal policy and fund a myriad of federal programs and initiatives.

Tax Incentives and Abatements: Shaping New Haven’s Future

In its efforts to promote economic development and attract businesses, New Haven offers a range of tax incentives and abatements. These measures are designed to stimulate investment, create jobs, and enhance the city’s economic competitiveness.

Tax Incentives for Businesses

New Haven provides a variety of tax incentives for businesses, especially those involved in specific sectors like technology, healthcare, and renewable energy. These incentives can take the form of tax credits, deductions, or even full or partial tax exemptions for a defined period.

For instance, the New Haven Small Business Tax Credit offers a credit of up to $2,000 for businesses that create new jobs or increase their payroll. This credit is available for a period of up to five years, providing a significant boost to small businesses in the city.

Additionally, the city offers tax increment financing (TIF), a mechanism that allows for the redirection of future property tax revenue increases to fund infrastructure improvements and other development costs. This incentive is particularly attractive to businesses considering major investments or expansions in New Haven.

Residential Tax Abatements

New Haven also recognizes the importance of homeownership and its contribution to the city’s economic health. As such, the city offers a range of tax abatement programs aimed at encouraging homeownership and stabilizing neighborhoods.

The Homeowner's Tax Abatement Program provides a 50% tax abatement for up to five years for new homebuyers in targeted areas of the city. This program is designed to stimulate homeownership in areas that have experienced a decline in property values, helping to revitalize these neighborhoods and encourage community investment.

Furthermore, the city offers a Senior Citizen Tax Abatement, providing eligible seniors with a tax abatement of up to $500. This program is aimed at reducing the tax burden on senior citizens, many of whom are on fixed incomes, and encouraging them to remain in their homes and contribute to the city's community fabric.

The Impact of Taxes on New Haven’s Economy

The tax system in New Haven plays a pivotal role in shaping the city’s economic landscape. It influences investment decisions, impacts the cost of living, and affects the city’s competitiveness in attracting businesses and residents.

Attracting Investment and Businesses

New Haven’s tax incentives and abatements have been instrumental in attracting businesses and investment to the city. By offering competitive tax rates and targeted incentives, the city has been able to create a business-friendly environment that encourages growth and innovation.

For instance, the city's technology sector has seen significant growth in recent years, with numerous startups and established tech companies setting up shop in New Haven. This growth can be partly attributed to the city's New Haven Digital Drive initiative, which offers a range of tax incentives and support for digital businesses, making the city an attractive hub for tech-related investment.

Cost of Living and Residential Considerations

The tax structure in New Haven also influences the cost of living for residents. While the city’s tax rates are competitive, the cost of living can still be a consideration for prospective residents.

The city's property tax, while offering a stable source of revenue for essential services, can also be a significant expense for homeowners. However, the tax abatement programs, such as the Homeowner's Tax Abatement Program, help to mitigate this cost, making homeownership more affordable and attractive.

Additionally, the city's sales tax can impact the cost of goods and services for residents. While the rate is competitive compared to other cities in the state, it can still be a factor in residents' financial planning and budgeting.

Future Implications and Tax Policy Considerations

As New Haven continues to evolve and adapt to changing economic and social landscapes, its tax policy will play a crucial role in shaping its future. The city’s tax system must strike a delicate balance between generating sufficient revenue for essential services and fostering an environment that encourages economic growth and investment.

Sustainable Revenue Generation

New Haven’s tax system must be designed to generate sustainable revenue, ensuring the city can fund its essential services and infrastructure needs. This involves a careful analysis of the tax base, identifying areas for growth, and implementing measures to enhance tax collection efficiency.

Encouraging Economic Development

The city’s tax policy should continue to prioritize measures that encourage economic development and investment. This includes maintaining a competitive tax environment, especially for businesses, and expanding tax incentives and abatements to attract new industries and support existing ones.

Social Equity and Tax Policy

Tax policy in New Haven should also consider social equity, ensuring that the tax burden is distributed fairly across different income groups and that no segment of the population is disproportionately affected. This involves regular reviews of the tax system, identifying potential disparities, and implementing measures to address them.

For instance, the city's tax policy should aim to protect low-income residents from excessive tax burdens, while also ensuring that high-income earners and businesses contribute fairly to the city's revenue.

Conclusion

The tax system in New Haven is a complex yet vital component of the city’s economic ecosystem. It influences investment decisions, shapes the cost of living, and contributes to the city’s overall development and prosperity. By understanding the intricacies of this system, residents and businesses can make informed decisions and contribute to the continued growth and success of New Haven.

What is the current property tax rate in New Haven, CT?

+The current property tax rate in New Haven is 25 mills, which means for every 1,000 of assessed property value, the tax liability is 25.

Are there any tax incentives for businesses in New Haven?

+Yes, New Haven offers a range of tax incentives for businesses, including tax credits, deductions, and abatements. These incentives are aimed at encouraging business growth and investment in the city.

How does the state income tax work in Connecticut?

+The Connecticut state income tax is a progressive tax, meaning the tax rate increases as income rises. There are multiple income tax brackets, ranging from 3% to 6.99%, depending on the taxable income.

What is the sales tax rate in New Haven, CT?

+The sales tax rate in New Haven, CT, is 6.35%, which is the standard rate for the state of Connecticut. Certain items, like groceries, are exempt from this tax.

Are there any tax abatement programs for homeowners in New Haven?

+Yes, New Haven offers tax abatement programs for homeowners, including the Homeowner’s Tax Abatement Program, which provides a 50% tax abatement for up to five years for new homebuyers in targeted areas.